PDF attached

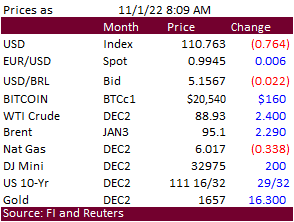

USD

is 75 points lower, WTI crude oil $2.59 higher and US equities pointing towards a higher open. US wheat futures are mostly lower on technical selling after rallying Monday on Black Sea shipping concerns. Prices rallied into the electronic session. Look for

a two-sided trade. Corn is slightly lower. The soybean complex is higher from another rally in global vegetable oil prices. US winter wheat conditions were only 28 percent good and excellent, down from 45 year ago. The initial fall rating was lowest since

at least 1987 when USDA started reporting. Malaysia January palm oil futures was up 179 Ringgit to 4,233 and cash was up $32.50/ton to $970.00/ton. Offshore values this morning were leading soybean oil 51 points lower earlier this morning and meal $3.80 short

ton lower.

Weather

Western

NE will see rain Thursday. NE, KS, western OK, and western TX will see rain Friday. The Midwest will see light rain today and again Thursday through Friday bias northwestern areas. Northeastern areas of Brazil will see rain this week. Argentina will see net

drying over the next 5 days.

WORLD

WEATHER HIGHLIGHTS FOR NOVEMBER 1, 2022

- Frost

was reported in portions of Argentina and in a few pockets in far southern Brazil this morning, but no serious crop damage was suspected - A

few light freezes were noted in southeastern Buenos Aires – the impact of which should have been very low - Argentina

will be dry for the next ten days - Brazil’s

center west and southern crop areas will be dry biased for the next ten days - Rain

is likely in northeastern Brazil over the next few days offering some relief from seasonal dryness - U.S.

rainfall will be greatest this weekend and early next week from Oklahoma and north-central Texas to Wisconsin - Eastern

U.S. Midwest and southeastern states will receive below normal precipitation over the next ten days - Tropical

Storm Lisa will intensify while moving west northwesterly toward Belize where landfall is expected late Wednesday night and early Thursday - The

storm could reach land as a weak hurricane, but its main threat will be heavy rainfall from Belize to Chiapas, Mexico including northern Guatemala

- Not

much change was noted in Europe, CIS, China or India - Eastern

Australia will experience restricted rainfall in the next ten days which may improve crop and field conditions in many areas - South

Africa is still expecting rain of significance in the coming ten days to improve spring and summer crop planting and emergence conditions - Typhoon

Nalgae will weaken today while approaching the Hong Kong area - The

storm will produce heavy rain in Guangdong and lighter rain in neighboring areas - Some

of the drought stricken southeastern corner of China will benefit from this storm’s moisture, although much more rain will still be needed

Source:

World Weather INC

Tuesday,

Nov. 1:

-

Australia

commodity index -

EU

weekly grain, oilseed import and export data -

New

Zealand global dairy trade auction -

Purdue

Agriculture Sentiment. 9:30am -

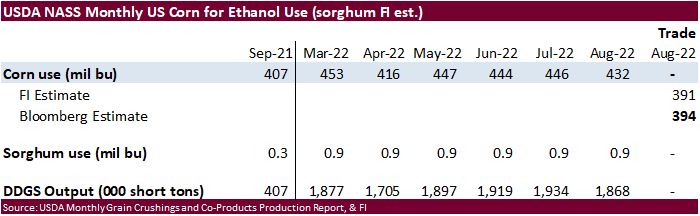

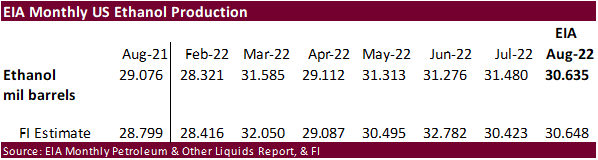

USDA

soybean crush, DDGS production, corn for ethanol, 3pm -

US

winter wheat condition, 4pm -

Honduras,

Costa Rica monthly coffee exports -

International

Cotton Advisory Committee releases monthly outlook -

HOLIDAY:

France, Chile

Wednesday,

Nov. 2:

-

Indonesian

Palm Oil Conference in Bali, day 1

-

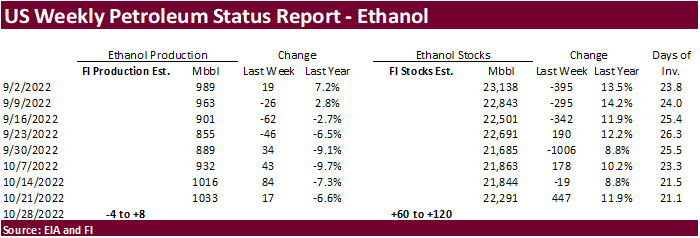

EIA

weekly US ethanol inventories, production, 10:30am -

HOLIDAY:

Brazil

Thursday,

Nov. 3:

-

Indonesian

Palm Oil Conference in Bali, day 2

-

USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am -

HOLIDAY:

Japan

Friday,

Nov. 4:

-

Indonesian

Palm Oil Conference in Bali, day 3

-

FAO

World Food Price Index -

FranceAgriMer

weekly update on crop conditions -

ICE

Futures Europe weekly commitments of traders report -

CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm

Source:

Bloomberg and FI

USDA

inspections versus Reuters trade range

Wheat

137,082 versus 100000-500000 range

Corn

422,288 versus 225000-650000 range

Soybeans

2,574,060 versus 1200000-2650000 range

Macros

·

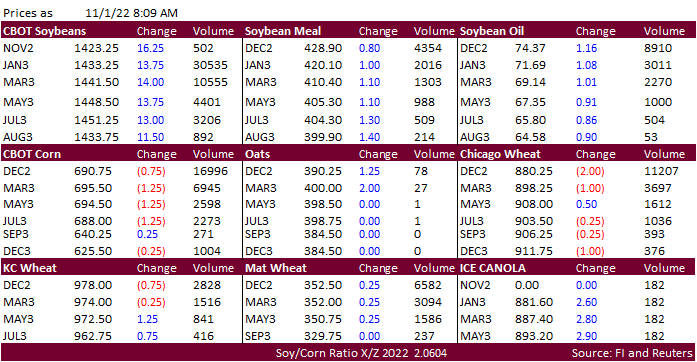

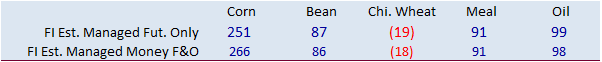

Corn prices are mostly lower follow wheat but losses are limited from a rally in soybeans and new month/new money.

·

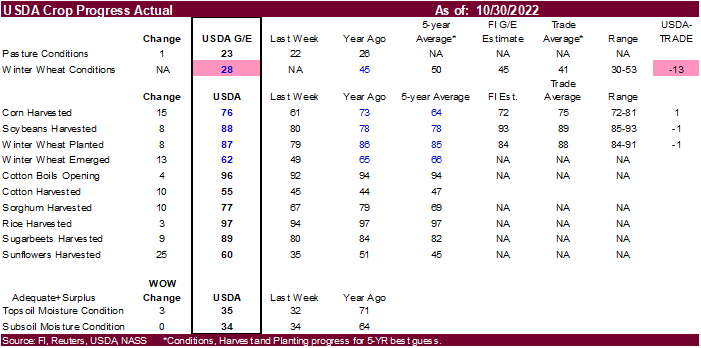

US corn harvest progress of 76 percent was 1 point above expectations and above 64 percent average.

·

USDA US corn export inspections as of October 27, 2022 were 422,288 tons, within a range of trade expectations, below 472,594 tons previous week and compares to 671,085 tons year ago. Major countries included China for 144,283

tons, Mexico for 121,649 tons, and Japan for 97,421 tons.

·

South Korea’s KFA group bought 65,000 tons of corn from South America or South Africa for arrival around February 5.

·

South Korea’s MFG group rejected offers for 58,000 tons of corn and 8,000 tons of soybean meal from South America for December/January arrival.

·

CBOT

soybeans are higher on strength in the global vegetable oil markets. Soybean meal is also trading higher. US harvest progress is moving along nicely. Despite US barge river problems, USDA export inspections for soybeans were robust.

·

Renewed concerns over covid-19 lockdowns in China could hinder upside movement in soybeans.

·

Many Brazil truckers that supported outgoing President Jair Bolsonaro are staging a strike, blocking roads in 16 states. Today the Brazil Supreme Court ordered police to remove the roadblocks set up by the protesters. 271 points

were blocked in 23 of Brazil’s 26 states.

·

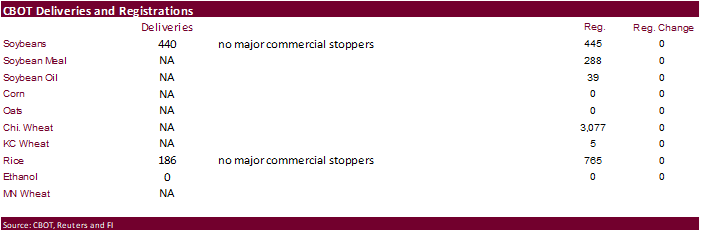

CBOT deliveries for November soybeans were (another) 440 contracts with no major commercial stoppers.

·

US soybean harvest progress of 88 percent was 1 point below expectations and above 78 percent average.

·

Cargo surveyor SGS reported October Malaysian palm exports at 1,477,713 tons, 77,568 tons above month ago or up 5.5%, and 1,068 tons above October 2021 or up 0.1%.

·

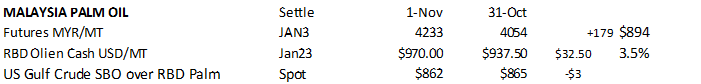

Malaysia January palm oil futures was up 179 Ringgit to 4,233 and cash was up $32.50/ton to $970.00/ton.

·

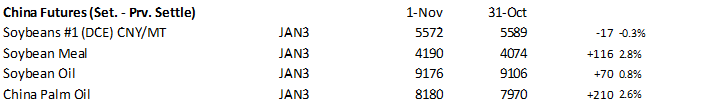

China November soybeans were down 0.3%, meal up 2.8%, soybean oil 0.8% higher and palm oil 2.6% higher.

·

Rotterdam vegetable oils were unchanged (no quotes) for soybean oil and sharply higher for rapeseed oil, from this time yesterday morning. SA meal was 0.50-2.00 euros higher.

·

Offshore values this morning were leading soybean oil 51 points lower earlier this morning and meal $3.80 short ton lower.

·

China plans to auction off 500,000 tons of soybeans from reserves on November 11.

·

USDA US soybean export inspections as of October 27, 2022 were 2,574,060 tons, within a range of trade expectations, below 2,918,705 tons previous week and compares to 2,675,334 tons year ago. Major countries included China for

2,076,606 tons, Mexico for 141,886 tons, and Taiwan for 88,606 tons.

·

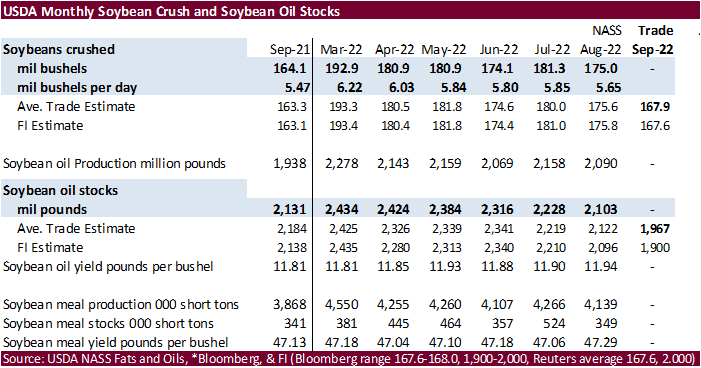

We look for US soybean crush for the month of September to average 5.59 million bushels per day versus 5.65 million during August and 5.47 million September 2021.

·

US wheat futures are

mostly lower on technical selling after rallying Monday on Black Sea shipping concerns. Prices rallied into the electronic session. Look for a two-sided trade.

·

Argentina saw additional frosts on Tuesday and there was some damage to the wheat crop.

·

US winter wheat conditions for the combined good and excellent categories were only 28 percent (worst since at least 1987), well below an average trade guess of 41 percent, below 45 percent year ago and 50 average.

·

Only 9 percent of OK’s topsoil moisture was rated adequate/surplus, and Texas stands at only 26 percent.

·

Paris December wheat was unchanged earlier at 352.25 euros a ton.

·

US soft wheat exports, from July 1 to October 30 reached 11.54 million tons, compared with 11.44 million tons by the same week in 2021-22.

·

China plans to auction off 40,000 tons of wheat from state reserves on November 2.

·

USDA US all-wheat export inspections as of October 27, 2022 were 137,082 tons, within a range of trade expectations, above 133,319 tons previous week and compares to 130,721 tons year ago. Major countries included Mexico for 29,539

tons, Taiwan for 26,355 tons, and Korea Rep for 26,322 tons.

·

Jordan passed on 120,000 tons of hard milling wheat for March/April shipment.

·

Jordan issued an import tender for 120,000 tons of hard milling wheat set to close November 15 for March/April shipment.

·

South Korea’s NOFI group bought 63,000 tons of feed wheat at $396/ton c&f for arrival around December 30, 2022.

·

Result awaited: Iraq seeks 50,000 tons of wheat on October 30, nearly one week later than their original close date.

·

Jordan is back in for 120,000 tons of barley on November 2 for March/April shipment.

Rice/Other

·

South Korea’s Agro-Fisheries & Food Trade Corp. seeks 50,500 tons of rice from the US and/or EU on November 9 for arrival between February and June.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.