PDF attached

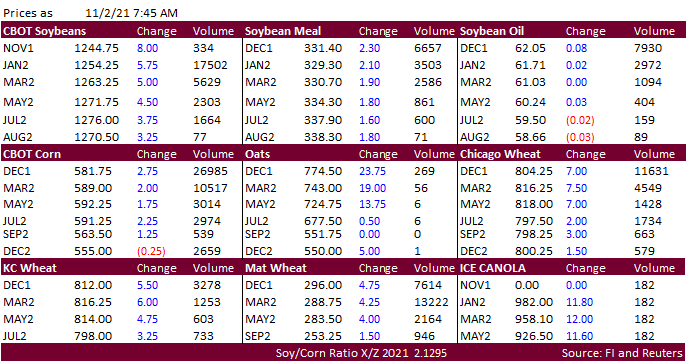

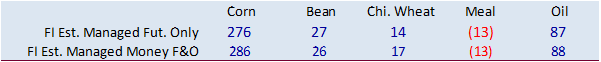

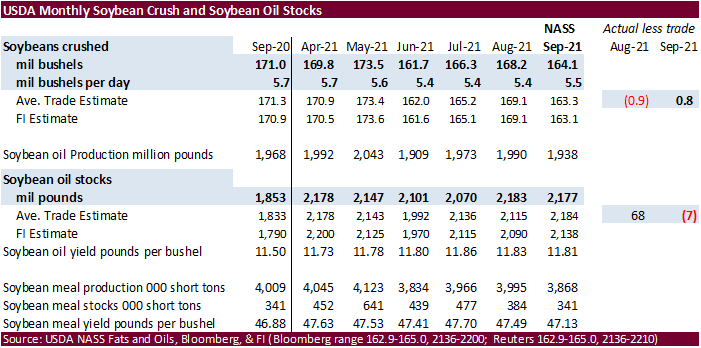

Higher trade in soybeans, meal and corn. SBO was mixed. Offshore values are suggesting meal should gain on soybean oil. US and Paris wheat futures are higher. Chicago wheat rallied to a December 2012 high overnight. KC wheat is sitting at a May 2014 high and Minneapolis at a June 2011 high. Global food security concerns, rising fertilizer prices, good ethanol margins, and strong global demand for wheat/vegetable oils continue to support prices. China overnight recommended people to stock up on food (they issued the same recommendation a year ago). The USDA NASS crush/soybean oil stocks report was seen neutral for prices. US winter wheat crop ratings dropped an unexpected 1 point last week (trade was looking for 2 point increase) and corn and soybean harvesting was slightly less than expected. Only fresh import tender we see is Japan in for 114,396 tons of food wheat this week. Egypt is in for vegetable oils on Wednesday. We may see some profit taking today if the USD rallies. WTI is selling off ahead of the weekly US inventory report due out Wednesday. US equities are suggesting a weaker open. FOMC meeting starts today. Trade estimates for the USDA report should be out Wednesday, Tuesday overnight at earliest.

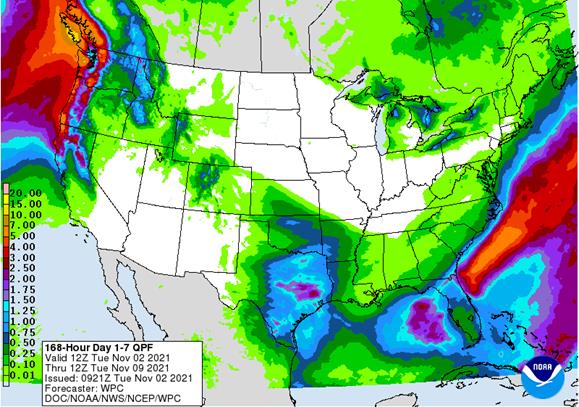

Per 7-day US map below, the Midwest will dry down this week while the southern Great Plains should see precipitation. For Brazil, rains this week will fall across Mato Grosso, Goias, Minas Gerais, southern Parana, Santa Catarina, and RGDS. For Argentina, rain is expected across most of the growing areas, favoring Cordoba, Santa Fe, northern Entre Rios.

StoneX

US soybean crop 4.490 billion, up from 4.436 previous. Yield 51.9 vs. 51.3 previous.

US corn crop 15.119 billion, up from 15.022 previous. Yield 177.7 vs. 176.6 previous.

World Weather Inc.

WORLD WEATHER HIGHLIGHTS FOR NOVEMBER 2, 2021

- Keep an eye on Australia during the next few weeks for signs of increasing rainfall.

- The nation’s wheat, barley and canola looks fantastic, but a rainy harvest could ruin that.

- Three rain events are expected over the next ten days as a more active weather pattern begins.

- No serious issues are expected right away, but drier weather will be needed in time.

- South America weather will continue well diversified with most areas in Argentina and Brazil getting enough rain to support crops during the next ten days.

- A drying bias may evolve later this month in eastern Argentina and southern Brazil as well as in southern Paraguay and Uruguay.

- U.S. weather over the next week will be great for promoting summer crop harvest progress, although a little rain in the southern Plains and Delta during mid-week will slow that process briefly.

- Not much significant rain will fall in the U.S. high Plains region leaving Montana and areas from Colorado to the Texas Panhandle a little drier than desired.

- Week two of the Russia and Ukraine forecast has more rain in the forecast relative to earlier this week and that will help add some moisture to the topsoil for use in the spring.

- The season’s first bitter cold air was noted in northern parts of Russia’s eastern New Lands this morning with extremes slipping to -15 Fahrenheit or -26C, although the impact was minimal since no winter crops are grown in the region.

- India is still expecting an active weather pattern over the next ten days in the southern half of the nation while China’s weather and Europe’s weather is well mixed.

- South Africa needs a boost in rainfall for spring planting.

- No extreme weather was noted for coffee, citrus or sugarcane production areas around the world

- Malaysia and Indonesia weather will continue active for a while generating frequent rain and keeping the soil saturated or nearly Saturated in many areas

Tuesday, Nov. 2:

- New Zealand global dairy trade auction

- EU weekly grain, oilseed import and export data

- HOLIDAY: Brazil

Wednesday, Nov. 3:

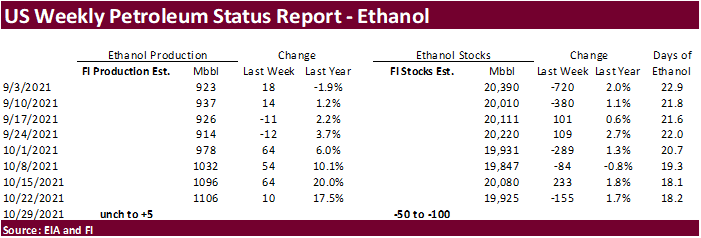

- EIA weekly U.S. ethanol inventories, production

- HOLIDAY: Japan

Thursday, Nov. 4:

- FAO World Food Price Index

- USDA weekly crop net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- New Zealand Commodity Price, 8pm Wednesday ET time

- Port of Rouen data on French grain exports

- HOLIDAY: India, Malaysia, Singapore

Friday, Nov. 5:

- ICE Futures Europe weekly commitments of traders report (6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- China’s CNGOIC to publish demand-supply reports on corn, soy and other commodities

- FranceAgriMer weekly update on crop conditions

- Malaysia Nov. 1-5 palm oil exports

- HOLIDAY: India

Source: Bloomberg and FI

USDA inspections versus Reuters trade range

Wheat 115,341 versus 150000-500000 range

Corn 619,340 versus 475000-900000 range

Soybeans 2,272,003 versus 1850000-2300000 range

StoneX

US soybean crop 4.490 billion, up from 4.436 previous. Yield 51.9 vs. 51.3 previous.

US corn crop 15.119 billion, up from 15.022 previous. Yield 177.7 vs. 176.6 previous.

Canada Building Permits (M/M) Sep: 4.3% (est 3.0% prev -2.1%; prevR -2.0%)

· Corn futures are higher on strength in wheat. Don’t discount a two-sided trade. Already we are seeing some private groups calling for an increase in the US corn yield when updated early next week. Oats surged yesterday and are again higher today. OZ is about a 28 discount to WZ and are near a $2.24 premium over corn.

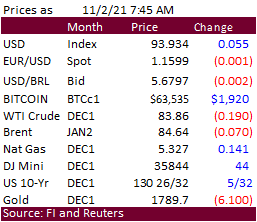

· The USD up 6 points. Look for fluctuations in that currency on upcoming US FOMC comments.

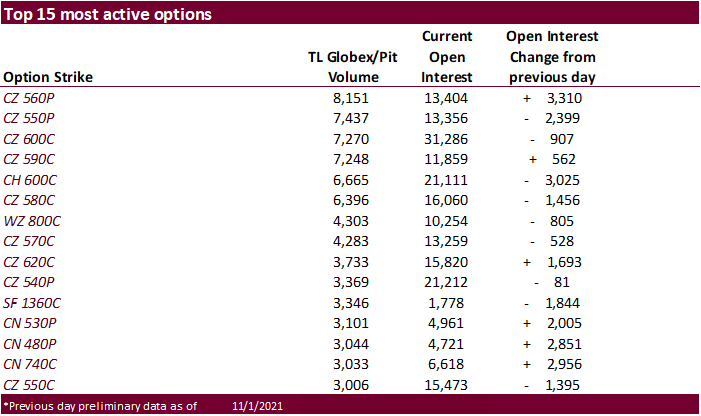

· Yesterday there were 4500 CZ560/550PS that traded rolled into the open interest to the 560’s.

· The Chinese government urged people to stock up on food ahead of the winter in case of emergencies, such as supply shortages. They have already seen some people stock up on rice, cooking oil and salt. The government issued a similar warning about a year ago.

· CME feeder cattle futures on Monday hit a 5-month low. Slaughter rates are running near last year’s level.

· Reuters ran a story on China pig production and the recent expansion has been more robust than planned. They noted prices “hover below the cost of production and the government urges them to cull their herds,”, despite government recommendations for producers to scale back on herds. They went onto say “surging output and COVID-linked demand interruptions have driven down prices by 70% this year, causing heavy producer losses over the past three months.”

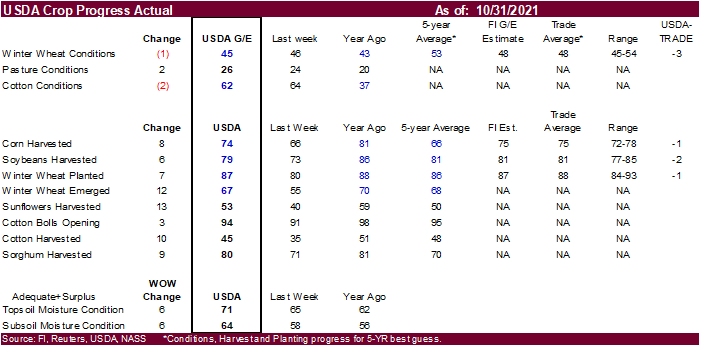

· US corn harvested was reported at 74 percent, up 8 points and compares to 81 year ago and 66 average. The 74 percent was one point below a trade average.

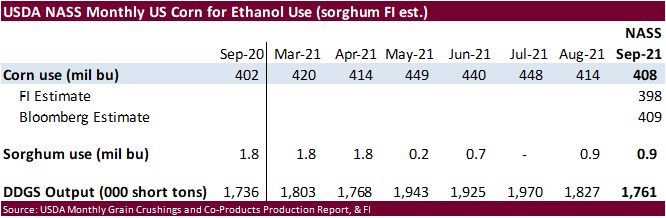

· USDA reported 408 million bushels of US corn was used during the month of September, one bushel below a Bloomberg estimate, down from 414 million from August 21 and up from 402 million during September 2020. We are currently using 5.300 billion bushels for corn use for the current crop year (up 50 from previous), 100 million above USDA, and have a bias to lift our estimate higher if production holds above 1.75 million barrels per day over the next month or two.

· USDA US corn export inspections as of October 28, 2021 were 619,340 tons, within a range of trade expectations, below 634,864 tons previous week and compares to 740,612 tons year ago. Major countries included Mexico for 312,229 tons, Japan for 162,891 tons, and Colombia for 84,894 tons.

· AgRural: Brazil 2021-22 corn plantings reached 63 percent compared to 53% previous week and 54 percent year ago.

Export developments.

- None reported

· CBOT soybeans caught a bid this morning in part to higher meal, that help lift nearby soybean oil. Offshore values are suggesting meal over soybean oil. The trade is looking for additional commitments of US soybeans by China.

· US soybeans harvested was reported at 79 percent, up 6 points and compares to 86 year ago and 81 average. The 79 percent was 2 points below a trade average.

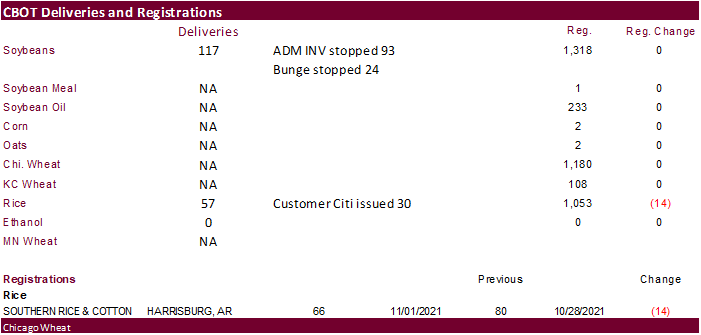

· CBOT soybean deliveries were 117 contracts that included some commercial activity, lighter than the previous two delivery days. Registrations were unchanged.

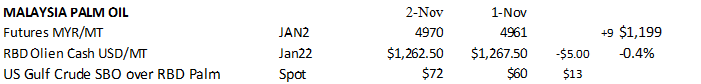

· Malaysian palm oil futures:

· Rotterdam meal values were mostly 1-2 euros lower and vegetable oils 1-15 euros higher led by RSO.

· Offshore values are leading soybean oil 41 points lower and meal $0.30 short ton higher.

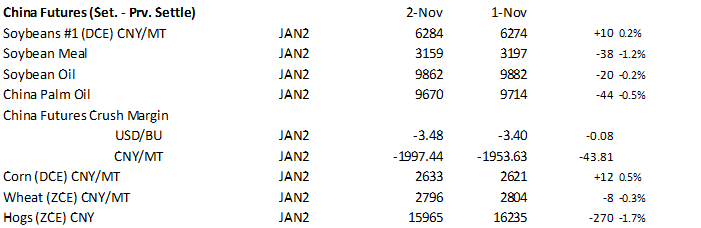

· China crush margins on our analysis was last $2.21/bu ($2.27 previous), compared to $2.32 at the end of last week and compares to $1.15 a year ago.

· China

· USDA US soybean export inspections as of October 28, 2021 were 2,272,003 tons, within a range of trade expectations, below 2,565,929 tons previous week and compares to 2,390,548 tons year ago. Major countries included China for 1,431,732 tons, Mexico for 199,178 tons, and Italy for 134,283 tons.

· AgRural: Brazil 2021-22 soybean crop plantings reached 52% of the estimated area as of Oct. 28 (second-fastest pace ever for this time of year), up 14 percentage points from the previous week and higher than the 42% for the same period of 2020-21.

Export Developments

· Egypt’s GASC seeks 30,000 tons of soybean oil and 10,000 tons of sunflower oil on Wednesday for arrival Dec. 20 – Jan. 10, with 180-day letters of credit and/or at sight.

· Results awaited: The USDA seeks 20 tons of vegetable oil in 4-liter cans for Dec 1-13 shipment on November 2.

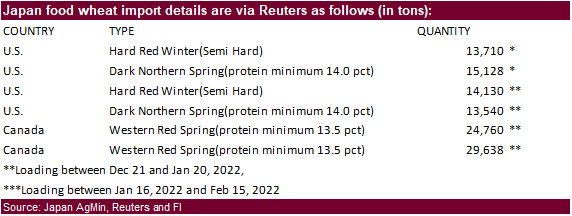

· US wheat futures are higher on follow through strong global demand. Japan is in for food wheat which is routine. EU wheat demand is robust. Prices are expected to get volatile during the balance of the week unless additional fresh import demand continues to sustain this rally in wheat. Yesterday’s USDA export inspections were poor.

· Paris December wheat was up 5.00 euros by around 6:40 am CT at 296.25, an all-time high.

· Heavy Matif wheat option volume occurred yesterday of nearly 39,000 lots.

· Ukraine 2022 winter wheat plantings reached 91 percent of the intended area or 6.1 million hectares as of November 1. 6.68 million hectares is what the AgMin expects for plantings.

· US Great Plains weather improves this week with some showers early to mid-week across the southern Great Plains.

· US winter wheat conditions fell one point to 45 percent from the previous week, above 43 year ago and compares to 53 percent 5-year average. This was 3 points below an average trade guess.

· By class, HRW wheat conditions fell 0.9% using our adjusted calculation, SRW increased 0.3% from the previous week and the winter white increased 1.5% from last week after the PNW and related states saw heavy rains.

· US planting progress increased 7 points from the previous week to 87 percent and compares to 88 percent year ago and 86 average. The 87 points was 1 point below an average trade guess.

· USDA US all-wheat export inspections as of October 28, 2021 were 115,341 tons, below a range of trade expectations, below 197,479 tons previous week and compares to 313,355 tons year ago. Major countries included Mexico for 30,537 tons, Honduras for 23,401 tons, and Jamaica for 22,482 tons.

December Paris wheat

Export Developments.

· Japan seeks 143,396 tons of food wheat.

· Yesterday Egypt’s GASC bought 180,000 tons of Russian wheat.

· Pakistan issued an import tender for 90,000 tons of wheat set to close Nov. 4 for Jan through April shipment.

· Ethiopia seeks 300,000 tons of milling wheat on November 9.

· Ethiopia seeks 400,000 tons of wheat on November 30.

Rice/Other

· There were 57 rice deliveries and registrations fell 14.

· Results awaited: Maldives seeks 25,000 tons of parboiled rice with offers due by October 28.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.