PDF attached

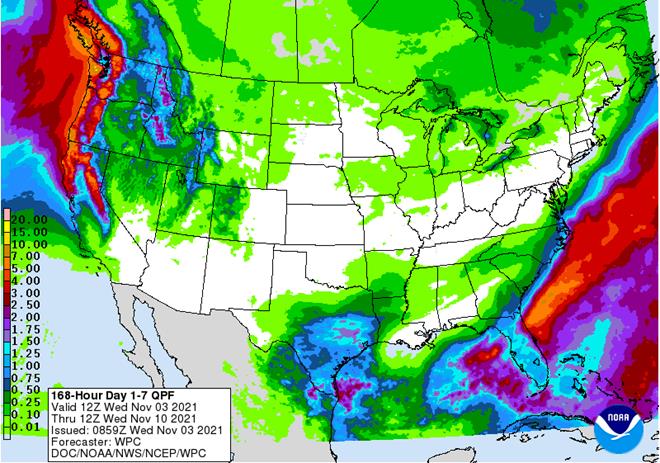

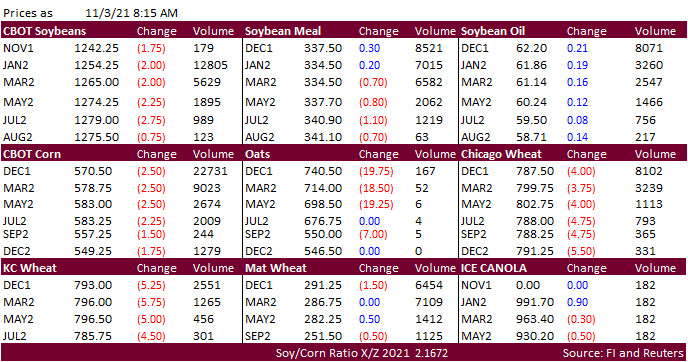

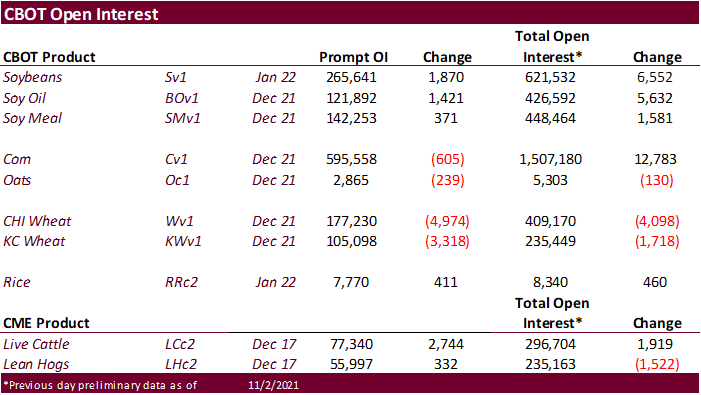

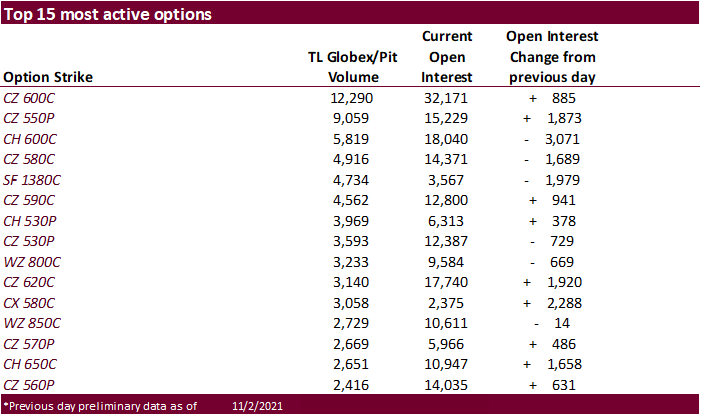

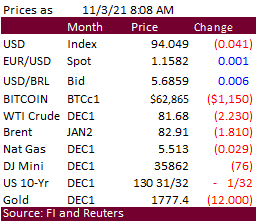

Sharply lower WTI crude oil may weigh on corn and eventually soybean oil today. US equities are mixed the USD slightly lower. US agriculture markets are mostly lower (soybean oil and nearby meal higher). Offshore values are favoring soybean oil over soybean meal. Grains are consolidating but look for limited losses in wheat from recent strong demand. US ethanol production may influence corn prices when the report is released mid-morning. The US weather outlook over the short term appears to have improved a touch for the Midwest and Brazil.

![]()

World Weather Inc.

Wednesday, Nov. 3:

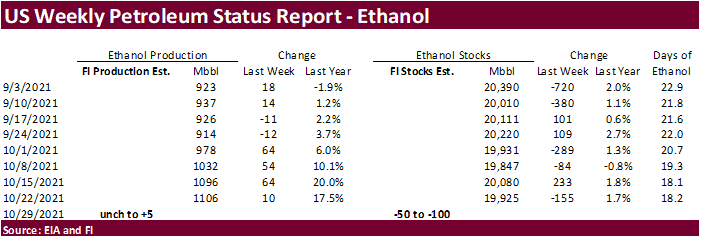

- EIA weekly U.S. ethanol inventories, production

- HOLIDAY: Japan

Thursday, Nov. 4:

- FAO World Food Price Index

- USDA weekly crop net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- New Zealand Commodity Price, 8pm Wednesday ET time

- Port of Rouen data on French grain exports

- HOLIDAY: India, Malaysia, Singapore

Friday, Nov. 5:

- ICE Futures Europe weekly commitments of traders report (6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- China’s CNGOIC to publish demand-supply reports on corn, soy and other commodities

- FranceAgriMer weekly update on crop conditions

- Malaysia Nov. 1-5 palm oil exports

- HOLIDAY: India

Source: Bloomberg and FI

US ADP Employment Change Oct: 571K (est 400K; prev 568K)

· Corn futures are lower on light consolidation and lower bias in the outside markets. US weather suggests good corn harvest progress, at least for the WCB as producers are still concentrated on soybeans in the ECB. US ethanol production may give some direction little later this morning.

· This morning we are seeing a mixed trade in equities, sharply lower trade in WTI crude oil (down $2.70) and USD is slightly lower.

· Stone X pegged the Brazil 2021-22 second corn crop at 87.53 million tons.

· China said it will guarantee supplies of daily necessities, including meat and vegetable oils.

· A Bloomberg poll looks for weekly US ethanol production to be up 2,000 barrels (1035-1139 range) from the previous week and stocks up 106,000 barrels to 20.031 million.

· Baltic Dry Index fell 9.3% to 2,892 points.

University of Illinois – Planting Decisions

Schnitkey, G., N. Paulson, K. Swanson and C. Zulauf. “Planting and Acreage Decisions in 2022.” farmdoc daily (11):150, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 2, 2021.

Export developments.

- None reported

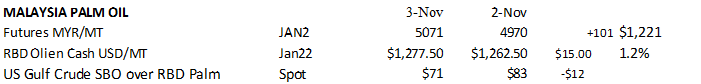

· CBOT soybeans are lower by 0.75-2.25 cents with losses limited from mixed trade in meal and higher soybean oil. Offshore values are favoring soybean oil over soybean meal. Palm futures were up 101 ringgit to 5071 and cash was up $15/ton to $1277.50/ton.

· The slow harvest pace across the ECB over the past few weeks and good demand for soybean meal continues to underpin the meal basis and support CBOT contracts. US harvest progress is expected to increase across the ECB for the balance of the week and SA plantings are running full steam.

· CBOT lowered their soybean futures margins by 14.5% to $2650/ton from $3100 and initial margin rates will be 110% of maintenance margin rates, effective close of business day (Nov 3).

· Brazil is on holiday today. The Brazilian Real yesterday hit a new low against the US Dollar.

· Brazil soybeans are now competitive with US.

· StoneX sees the 2021-22 Brazil soybean crop at 144.73 million tons versus 144.26 previous. Stone X pegged the Brazil 2021-22 second corn crop at 87.53 million tons.

· Argentina has a chance for showers, but precipitation amounts will remain well below normal.

· Argentine producers sold 33.1 million tons of soybeans from the 2020-21 season, according to the AgMin, below 34.4 million tons year ago. 2021-22 soybean commitments are running at 2.6 million tons.

· Malaysian palm oil futures:

· Rotterdam meal values were mostly 2-6 euros higher and vegetable oils unchanged to mixed.

· Offshore values are leading soybean oil 28 points higher and meal $6.00 short ton lower.

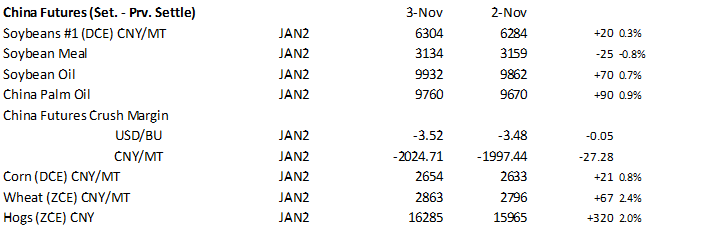

· China crush margins on our analysis was last $2.34/bu ($2.21 previous), compared to $2.32 at the end of last week and compares to $1.15 a year ago.

· China

Export Developments

· Egypt’s GASC received offers for vegetable oils and lowest offer was $1445/ton for sunflower oil and $1517/ton for soybean oil. They seek 30,000 tons of soybean oil and 10,000 tons of sunflower oil for arrival between Dec. 25 and Jan. 15 from Dec. 20 to Jan. 10, with 180-day letters of credit and/or at sight.

· US wheat futures are lower on light profit taking. Import announcements have been quiet since last weekend and some traders are eying another week of poor US all-wheat export inspections when updated Monday. Thursday, we get export sales and see commitments around average for this time of year (250-350k).

· Losses in wheat are expected on recent strong global demand.

· Paris December wheat was down 1.50 euros by around 7:45 am CT at 291.25, down from an all-time high made on Tuesday.

Export Developments.

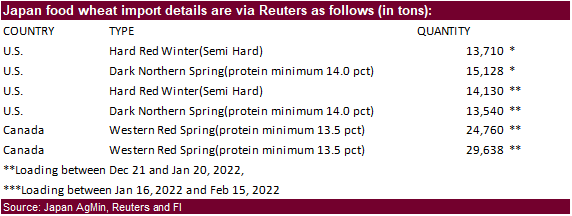

· Japan seeks 143,396 tons of food wheat.

· Pakistan issued an import tender for 90,000 tons of wheat set to close Nov. 4 for Jan through April shipment.

· Ethiopia seeks 300,000 tons of milling wheat on November 9.

· Ethiopia seeks 400,000 tons of wheat on November 30.

Rice/Other

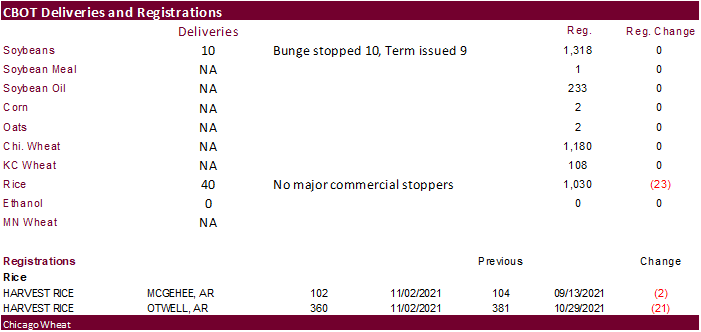

· There were 57 rice deliveries and registrations fell 14.

· Results awaited: Maldives seeks 25,000 tons of parboiled rice with offers due by October 28.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.