PDF attached

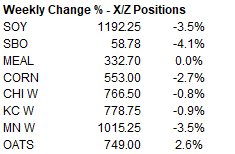

Lower

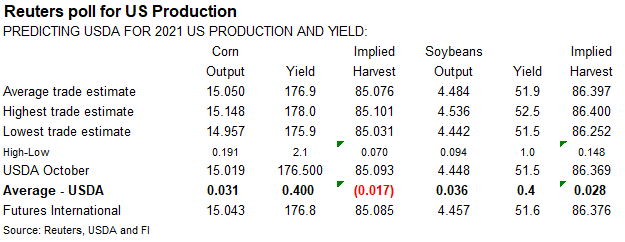

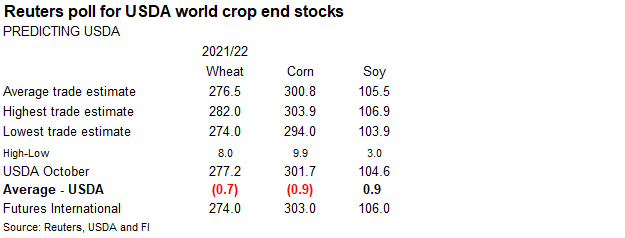

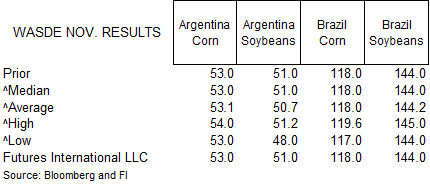

trade to end the week in CBOT agriculture futures with exception to oats and rice. The bearish sentiment was tied to improving US weather and prospects for large South American crops amid rapid planting progress. USDA will update its November S&D’s on Tuesday

and consensus is for the US corn and soybean yields to be upward revised.

![]()

World

Weather Inc.

MOST

IMPORTANT WEATHER AROUND THE WORLD

- Eastern

Argentina, Uruguay, southern Paraguay and far southern Brazil continue to see an evolving forecast pattern of limited rainfall - This

fits well with the increasing La Nina influence and from the 22-year and 18-year cycles - Expect

dryness in these areas to be a festering feature this month and in December with a few breaks possible - Frequent

Brazil rain of significance will occur in the next ten days from eastern Mato Grosso, Tocantins and parts of northeastern Goias into Minas Gerais and Bahia - Some

of these areas will get greater than usual rainfall and local flooding may evolve next week - No

crop damage is expected, although some planting delay is expected - Brazil’s

best weather is expected from western and southern Mato Grosso through northern and eastern Mato Grosso do Sul where a good mix of rain and sunshine is expected over the next two weeks - Net

drying in Sao Paulo and parts northern Parana, Brazil will be closely monitored during the next ten days; the region could become a little too dry in time - China

snowstorm this weekend into Monday to have big impact - A

major snowstorm is expected to impact northeastern China as cold air comes into the region beginning today in Inner Mongolia and spreading southeast into the Northeast Provinces during the weekend. The storm will last through Monday in northeastern China - Snowfall

of 8-20 inches is possible in a part of northeastern China and blizzard or near blizzard conditions will be possible - Cold

rain and sleet are also expected - Travel

disruptions, power outages and some death to livestock and people will be possible - The

advertised storm in the forecast model data may be overdone and some moderation is possible over the next couple of days

- The

biggest concern will be to transportation and livestock health - The

coldest air should remain over eastern Russia and only a part of it will reach into northeastern China – just enough to induce the snowstorm - U.S.

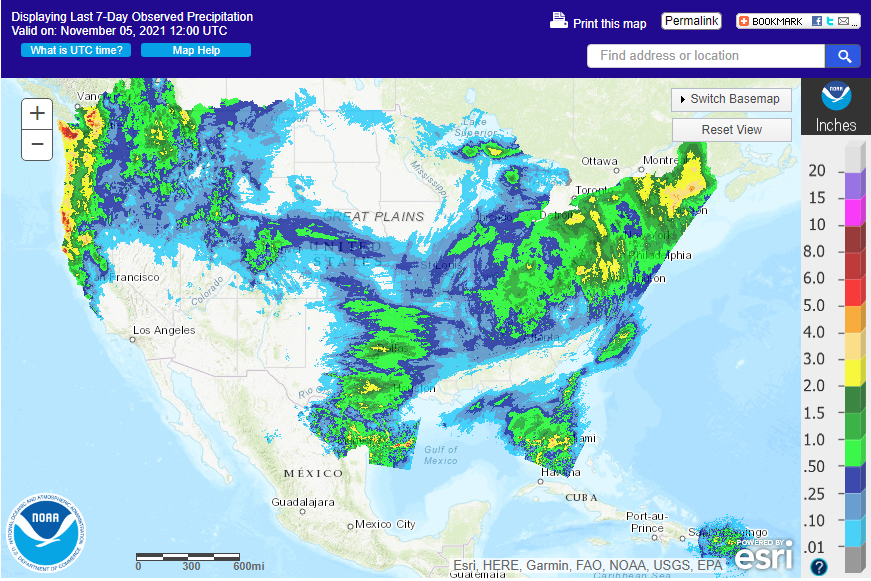

harvest weather will be nearly ideal through Tuesday of next week, although some showers will develop in the central parts of the nation on Tuesday - The

next more generalized precipitation event will be in the Midwest Wednesday through Friday of next week and rain from the same storm will also impact parts of the Delta and southeastern states briefly late in the week - Snow

will accumulate in the upper Midwest from this event with Minnesota getting multiple inches of snow while only lighter bouts of accumulation occur in the eastern Dakotas, Iowa and Wisconsin

- Dry

weather will resume for many of these areas after Nov. 13, although there will still be frequent disturbances in the northern Plains and Great Lakes region - West

Texas will be mostly dry over the next two weeks favoring cotton and other late season crop harvest progress - West-central

and southwestern parts of the U.S. Plains are expecting little to no rain for much of the next ten days to two weeks which is to be expected with intensifying La Nina conditions - Limited

precipitation is still expected in the northwestern U.S. Plains and central parts of Canada’s Prairies through early next week, but these areas will eventually have some potential for rain and snow as La Nina becomes more significant - The

precipitation potentials should begin to improve in the second half of next week in a part of this region - Waves

of rain will occur frequently from northern California through the Cascade Mountains and coastal areas of Washington and Oregon during the next ten days to two weeks - Limited

precipitation will impact the San Joaquin Valley, southwestern desert region and southern U.S. Rocky Mountains during the next two weeks - Some

snow and rain will impact the southern Sierra Nevada, but resulting moisture will be lighter than usual - Temperatures

in central and interior western parts of North America will rise well above average briefly late this week into early next week followed by some cooling late next week - Southern

California and the southwestern desert region will continue dry biased for the next two weeks - Australia’s

rain frequency will be rising in the south and eastern parts of the nation during the next two weeks

- The

moisture boost will be great for summer crop planting, emergence and establishment, but the moisture will slow winter crop maturation and harvest progress - No

crop quality concerns are expected for a while, but a close watch on the harvest and rainfall will be warranted until wheat, barley and canola harvesting is complete - Southern

India will turn wetter over the next week to ten days - The

precipitation will slow summer crop maturation and harvest progress and could raise a little cotton, rice and oilseed quality concern - The

wettest areas will include Andhra Pradesh, Tamil Nadu Kerala and Karnataka, although rain will fall in Maharashtra as well - Sugarcane

and coffee will benefit from the moisture - A

tropical cyclone may evolve in the eastern Arabian Sea later this weekend to the west of India.

- The

storm should stay over open water in the Arabian Sea, although it will spin a few waves of rain into the west coast of India through next week.

- The

storm’s movement is very questionable in today’s forecast models meaning there is still potential for the system to more significantly impact India, Pakistan, Oman or other areas in the Arabian Sea coastal areas

- Another

tropical cyclone is advertised to form in the Bay of Bengal early next week that is advertised to reach the lower east coast of India late next week and if this storm verifies it may produce some heavy rain in Andhra Pradesh, Telangana and/or Odisha - A

more active weather pattern in Russia during the coming two weeks will lead to a boost in snow cover for many areas in the north and central parts of the nation - Locally

heavy snow is possible in northern and eastern parts of Russia’s crop region and in most of the Ural Mountains - Ukraine

and southern Russia grain areas will receive some periods of rain during the week next week and into the following weekend - The

moisture will be good for use in the spring - Southern

wheat areas of Russia and Ukraine will receive “some” shower activity next week to moisten the topsoil - Europe

weather will be favorable for fieldwork of all kinds, although it will have to advance around brief bouts of light rainfall - The

Balkan Countries will be wettest starting next week - Italy

will continue to receive some periodic shower activity - South

Africa will start receiving some needed rain in the central and eastern summer crop areas this weekend and next week that will eventually bring on a soil moisture boost - The

moisture will improve planting, germination and emergence conditions, although the distribution will not be uniform and many western crop areas will stay dry biased - Temperatures

will be warmer than usual in the northeast and slightly below average in the southwest through the next week - Indonesia

and Malaysia weather will be wet biased over the next two weeks with frequent rain expected over saturated or nearly saturated soil causing some flooding - Coastal

areas of southern Vietnam will likely trend wetter than usual next week, but restricted rainfall is expected until then - Some

of the heavy rain may eventually push into the Central Highlands of Vietnam, but confidence is low

- Philippines

weather will remain favorably mixed with rain and sunshine through the next two weeks - Portions

of North Africa will get some needed rain late this week through the weekend - Algeria

will be wettest with the central coastal region getting excessive rain and possibly some flooding - Tunisia

will also receive some light rainfall - Southwestern

Morocco remains in a multi-year drought with little rain of significance expected over the next couple of weeks - West-central

Africa will experience a good mix of weather during the next ten days to two weeks - Less

frequent rain in cotton areas will translate into better crop maturation conditions - Coffee,

cocoa, sugarcane and rice will also benefit from less frequent and less significant rainfall, although completely dry weather is not likely for a while - East-central

Africa weather will be favorably mixed for a while supporting coffee, rice, cocoa and a host of tropical crops - Tanzania

will not receive much rain and portions of central Ethiopia coffee areas may also be a little drier biased - Mexico’s

weather will drier biased for the next ten days except along the lower east coast where periodic rainfall is expected - Central

America rainfall will be erratic over the next two weeks with the greatest rain expected in Costa Rica and Panama - Western

and northern Colombia, Ecuador and Peru agricultural areas will be closely monitored over the next few weeks as the potential for flooding increases.

- The

risk may be greatest starting in the second week of the forecast and continuing into mid-November.

- Coffee,

sugarcane, corn and a host of other crops may eventually impacted by too much rain in Colombia

- Western

Venezuela may also be involved with the excessive moisture - Central

Asia cotton and other crop harvesting will advance swiftly as dry and warm conditions prevail - Today’s

Southern Oscillational Index was +6.41 and it was expected to drift a little higher over the coming week - New

Zealand weather is expected to be drier than usual during the coming week - Temperatures

will be seasonable. - Nov.

12-18 will trend wetter in western parts of South Island - Tropical

Storm Wanda was 640 miles west northwest of the Azores and expected to move closer to the islands this weekend - The

storm poses no threat to North America and will merge with a mid-latitude cold front next week while bringing rain to northwestern Europe next week

Friday,

Nov. 5:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China’s

CNGOIC to publish demand-supply reports on corn, soy and other commodities - FranceAgriMer

weekly update on crop conditions - Malaysia

Nov. 1-5 palm oil exports - HOLIDAY:

India

Sunday,

Nov. 7:

- China’s

first batch of October trade data, including soybean, edible oil and meat imports

Monday,

Nov. 8:

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

cotton condition; corn, soy and cotton harvesting; winter wheat planting, 4pm - Ivory

Coast cocoa arrivals

Tuesday,

Nov. 9:

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, noon - China

farm ministry’s CASDE outlook report - EU

weekly grain, oilseed import and export data - France

agriculture ministry crop production estimates - U.S.

Purdue Agriculture Sentiment, 9:30am

Wednesday,

Nov. 10:

- EIA

weekly U.S. ethanol inventories, production - Vietnam’s

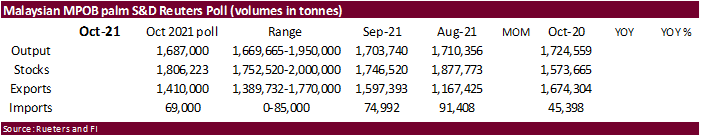

customs department publishes October commodity trade data - Malaysian

Palm Oil Board’s data on October output, exports and stockpiles, 12:30pm Kuala Lumpur - Malaysia’s

Nov. 1-10 palm oil export numbers by cargo surveyors - FranceAgriMer

monthly grains report

Thursday,

Nov. 11:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - Brazil’s

Conab releases data on yield, area and output of corn and soybeans (tentative) - New

Zealand Food Prices - HOLIDAY:

France

Friday,

Nov. 12:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

US

Change In Nonfarm Payrolls Oct: 531K (est 450K; prev 194K; prevR 312K)

–

Unemployment Rate Oct: 4.6% (est 4.7%; prev 4.8%)

–

Avg Hourly Earnings (M/M) Oct: 0.4% (est 0.4%; prev 0.6%)

–

Avg Hourly Earnings (Y/Y) Oct: 4.9% (est 4.9%; prev 4.6%)

US

Change In Private Payrolls Oct: 604K (est 420K; prev 317K; prevR 365K)

–

Change In Manufactur

ing

Oct: 60K (est 30K; prev 26K; prevR 31K)

US

Labour Force Participation Rate Oct: 61.6% (est 61.7%; prev 61.6%)

US

Payroll Employment Rises By 531,000 In October; Unemployment Rate Edges Down To 4.6%

Canadian

Net Change In Employment Oct: 31.2% (est 41.6%; prev 157.1%)

–

Unemployment Rate Oct: 6.7% (est 6.8%; prev 6.9%)

–

Hourly Wage Rate Permanent Employees Oct: 2.1% (est 2.1%; prev 1.7%)

Canadian

Full Time Employment Change Oct: 36.4K (prev 193.6K)

–

Part Time Employment Change Oct: -5.2K (prev -36.5K)

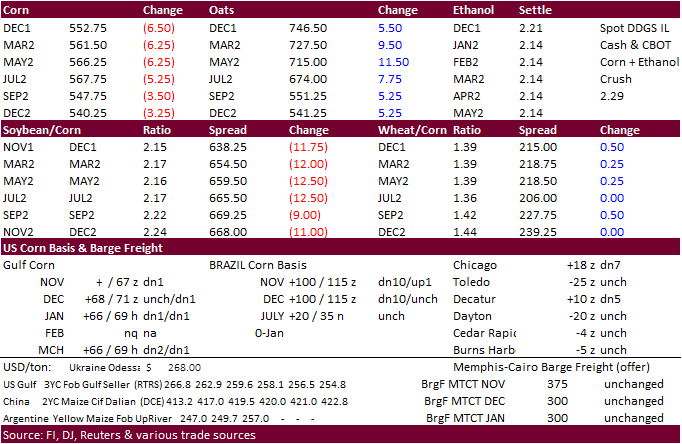

Corn

·

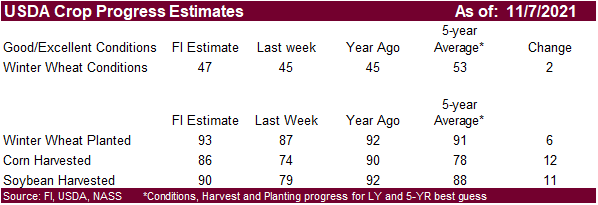

Corn futures ended 2.75-6.25 cents lower on weakness in soybeans. Higher wheat initially limited losses until that market turned lower. US weather looks very good, especially for the ECB, this weekend fieldwork. We look for

harvest progress to be up 12 points this week to 86 percent after dry weather occurred across the heart of the Midwest.

·

Goldman roll for December contacts started today. The only thing we can note for today was bear spreading in soybeans, soybean oil, corn and wheat.

·

The US EPA rejected so far at least one petition from an oil refiner to be exempt from RSF blending laws for the 2019 compliance year. 32 more are pending for 2019. For 2020 there are 28 and only three for 2021.

·

France harvested 73 percent of their corn crop as of November 1, up from 54 percent week earlier and 11 days below average. Last year the corn crop was 93 percent harvested.

·

France raised their alert status on bird flu disease after 130 bid flu cases have been reported across Europe since August.

Export

developments.

-

None

reported

Updated

11/01/21

December

corn is seen in a $5.30-$6.10 range

March

corn is seen in a $5.25-$6.25 range

·

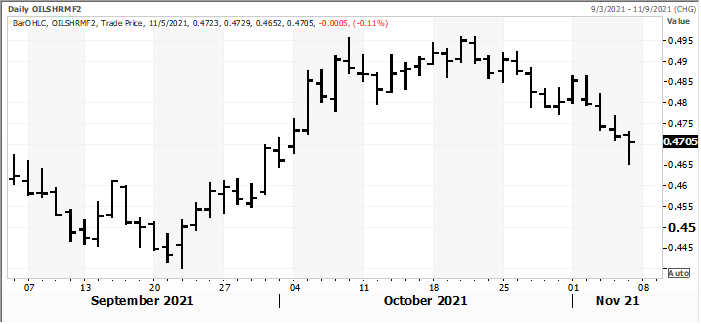

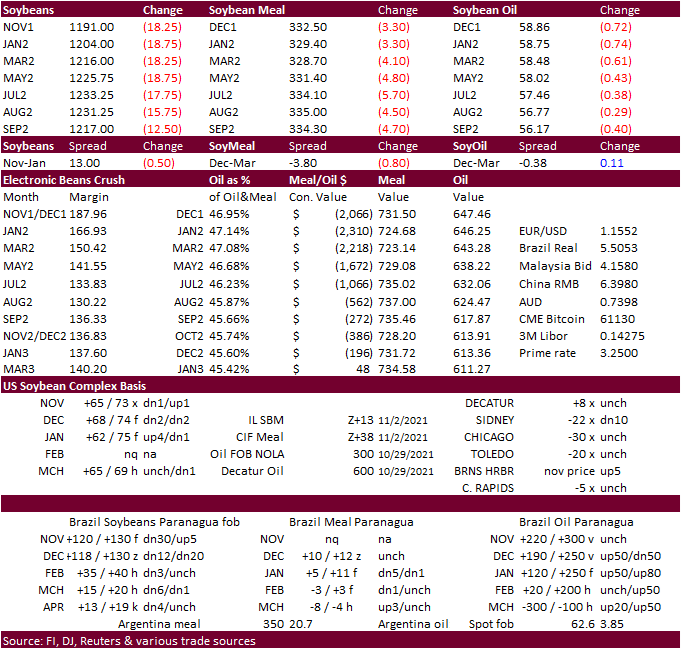

CBOT soybeans traded

14.25-17.25 cents lower and was down for the third consecutive day. Weakness in soybean oil initially pulled soybeans lower. December soybean oil is starting to look like a short-term bear market, at least when eying the chart. It settled at 58.78, 80 lower.

We would not rule out 55.25. Soybean meal finished $3.10-$4.60 lower. Meal was one of the few markets that escaped bear spreading.

·

China was quiet this week. Without explosive US export announcements, it will be hard for CBOT soybeans to sustain a rally for more than a few days. Our sentiment is starting to turn negative for these markets. Weather for

US and SA looks good, US exports are running behind year ago levels, and wheat is overbought in our opinion.

·

The US Midwest will see light rain for the northern areas over the weekend. Rain returns to the north central areas Tuesday. Brazil will see rain across Mato Grosso, Goias, Minas Gerais, MGDS, south Parana, and Santa Catarina

through Tuesday. Argentina will see precipitation across the northern Cordoba, Santa Fe, and Entre Rios today, and central La Pampa through Tuesday.

·

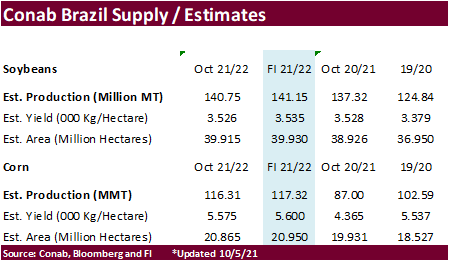

Safras & Mercado estimated Brazil’s 2021-22 soybean crop at 144.7 million tons versus 142.2 million tons previously.

·

A Reuters poll calls for Brazil soybean production to end up near 144 million tons, a record. Note Conab is due out next week and we should see trade estimates out on Monday.

·

Argentina’s government ended a brief oilseed worker strike on Thursday. The strike was over taxes. Argentina will hold general elections on November 14 (mid-term).

·

Argentina has a chance for showers, but precipitation amounts will remain well below normal.

·

China crush margins on our analysis was last $2.30/bu ($2.42 previous), compared to $2.32 at the end of last week and compares to $1.15 a year ago.

January

oil share

Export

Developments

·

None reported

USDA

Attaché on China oilseeds

“China’s

soybean imports in marketing year (MY) 20/21 hit a record 99.8 million metric tons (MMT) on high feed demand in the swine and poultry sectors. Soybean imports are expected to reach 101 MMT in MY 21/22 on increasing demand for soybean meal and soybean oil and

lower imports of rapeseed year-over-year. U.S. share of China’s soybean imports reached 37.2 percent in MY 20/21.”

Updated

11/4/21

Soybeans

– January $11.80-$13.25 range, March $11.50-$13.50

Soybean

meal – December $315-$360, March $310-$360

Soybean

oil – December 58.25-62.50 cent range, March 56-65

·

US Chicago and Minneapolis wheat futures started higher on technical buying but turned lower after buying dried. Lack of direction was noted. The USD was higher but turned lower and it seemed to have little influence on wheat

prices today. Pakistan passed on 90,000 tons of wheat this week.

·

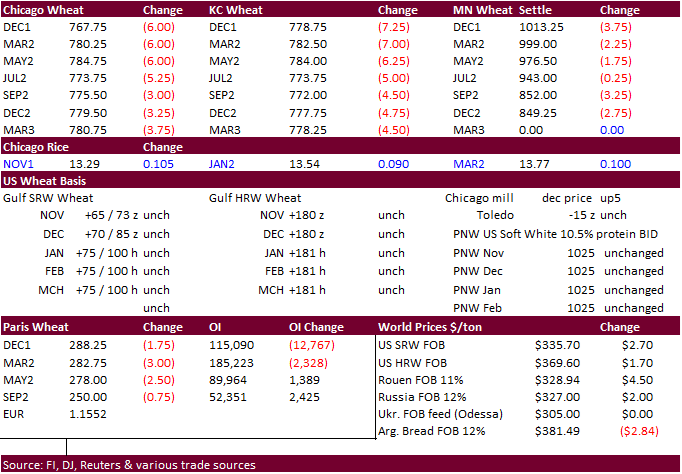

Paris December wheat was down 1.75 euros at 287.75/ton.

·

France had planted 80 percent of their soft wheat crop as of November 1, up from 61 percent week earlier.

·

Ukraine harvested 87% of their grain crop or 67.8 million tons of the expected area according to the AgMin.

·

Russia’s SovEcon estimated wheat exports for 2021-22 at 34 million tons, down 300,000 tons from previous. India is on holiday.

·

The US Great Plains weather forecast is unchanged this morning and net drying will prevail for the western and southern wheat areas through next week.

·

Easter Australia has been battered by rains over the past week, causing quality declines for grains and oilseeds. More rain is expected across the southeast.

USDA

Attaché on India wheat

“Official

MY 2021/2022 trade figures for wheat exports through August 2021 at 1.99 MMT, are up significantly from 218,000 MT last year. Market sources report that 250,000-300,000 MT were shipped in September and that 700,000 to 800,000 MT will be exported in October

2021. Exports are destined for Nepal, Sri Lanka, Bangladesh, Indonesia, and Middle East and African countries. Sources inform that Indian wheat trades at $310-$315/MT freight-on-board (FOB), enjoying a $15-$20/MT advantage in these markets after accounting

for the freight costs.”

Export

Developments.

·

Pakistan passed on 90,000 tons of wheat this week.

·

Ethiopia seeks 300,000 tons of milling wheat on November 9.

·

Ethiopia seeks 400,000 tons of wheat on November 30.

·

None reported

Updated

11/01/21

December

Chicago wheat is seen in a $7.30‐$8.25 range, March $7.25-$8.40

December

KC wheat is seen in a $7.35‐$8.35, March $7.00-$8.50

December

MN wheat is seen in a $9.70‐$11.50, March $9.00-$11.75

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.