PDF attached

Private exporters report sales of:

• 1,844,040 metric tons of corn for delivery to Mexico. Of the total, 1,089,660 metric tons is for delivery during the 2021/2022 marketing year and 754,380 metric tons is for delivery during the 2022/2023 marketing year

• 130,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year

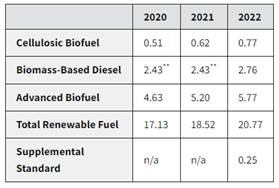

EPA released proposed biofuel mandates. https://www.epa.gov/renewable-fuel-standard-program/proposed-volume-standards-2020-2021-and-2022

World Weather Inc.

WORLD WEATHER HIGHLIGHTS FOR DECEMBER 8, 2021

- Eastern Argentina and far southern Brazil are still advertised to receive restricted rainfall during the next ten days.

- However, other parts of Brazil will continue in very good condition with high yield potentials expected.

- Lost production in the south, if there is any, will not likely have a big impacted unless the dryness expands farther to the north.

- With that said, western Parana and immediate neighboring areas are still too dry today but expected to get moisture late this weekend into next week.

- Australia weather still looks better through the next ten days

- China’s weather will remain favorable and India is expecting relatively good weather for this time of year after too much rain last month.

- Less precipitation in eastern Ukraine and Russia’s middle and lower Volga River Basin should have a minimal impact because of warm temperatures and winter crop dormancy.

- North Africa is still too dry in Morocco and northwestern Algeria.

- West-central Africa is drying out as it should at this time of year.

- South Africa will see a good mix of rain and sunshine.

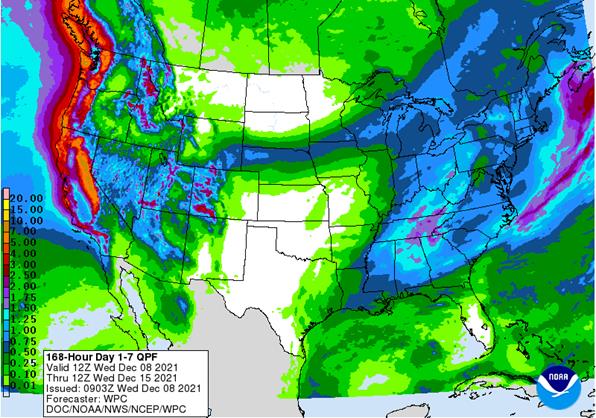

- In the United States, a more active weather pattern in the western states will bring significant mountain snow and valley rainfall to California and the Great Basin as well as the Rocky Mountain region this weekend and next week.

- U.S. hard red winter wheat production areas will be dry for the next week and then southeastern areas may get some rain in the second week of the outlook.

- The lower U.S. Delta, Tennessee River Basin lower and eastern Midwest and interior southeastern states will experience periodic precipitation during the next ten days.

Wednesday, Dec. 8:

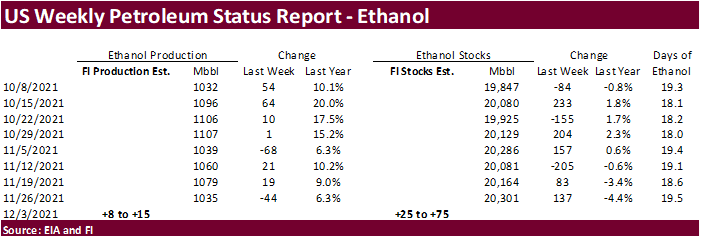

- EIA weekly U.S. ethanol inventories, production

- Fitch ESG Outlook Conference Asia Pacific, day 1

- FranceAgriMer’s monthly grains report

Thursday, Dec. 9:

- USDA’s monthly World Agricultural Supply and Demand (WASDE) report, noon

- USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- China farm ministry’s monthly crop supply-demand report (CASDE)

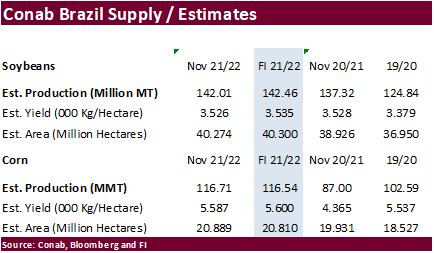

- Brazil’s Conab report on yield, area and output of corn and soybeans

- Fitch ESG Outlook Conference Asia Pacific, day 2

- Port of Rouen data on French grain exports

Friday, Dec. 10:

- ICE Futures Europe weekly commitments of traders report (6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

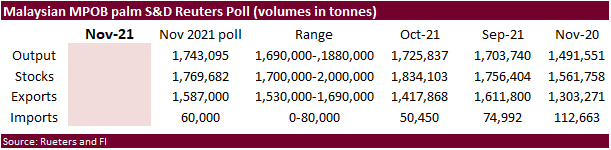

- Malaysian Palm Oil Board’s data on November palm oil reserves, output and exports

- Malaysia’s Dec. 1-10 palm oil exports

- HOLIDAY: Thailand

Macros

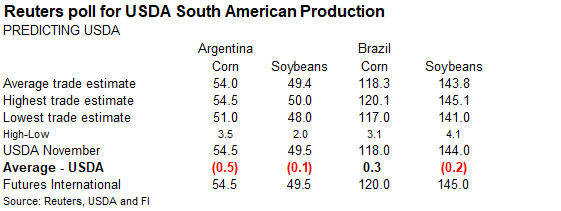

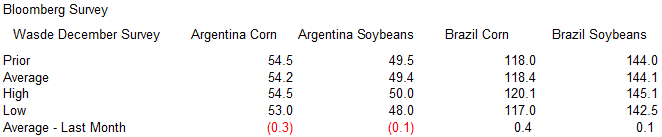

· CBOT corn is lower tracking wheat and soybeans. News is light. Southern Brazil could use some rain and rest of the country is in good shape. Argentina’s weather is good.

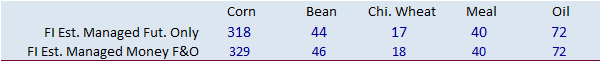

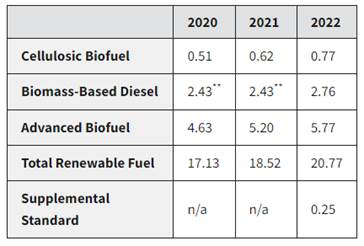

· EPA proposed retroactively to set total renewable fuel volumes at 17.13 billion gallons for 2020, 18.52 billion for 2021 and 20.77 billion for 2022. The 2020 and 2021 volumes are down from the final set in 2019, while the 2022 indicates an increase.

· The EPA denied 65 small refinery applications for biofuel waivers.

· USDA announced they will provide $700 million in new biofuel grants to help companies that were impacted by the Covid-19 pandemic (USDA Pandemic Assistance for Producers initiative). Some traders thought this announcement was a smokescreen as the EPA was expected to come out with disappointing ethanol blend biofuel mandate.

· Some company subsidies of a major Chinese hog breeder delayed payments on commercial bills, triggering selling in the market, with $3.5 billion wiped in just two days. (Bloomberg)

· A Bloomberg poll looks for weekly US ethanol production to be up 11,000 barrels to 1.046 million (1025-1071 range) from the previous week and stocks up 130,000 barrels to 20.431 million.

Export developments.

· Private exporters report sales of:

1,844,040 metric tons of corn for delivery to Mexico. Of the total, 1,089,660 metric tons is for delivery during the 2021/2022 marketing year and 754,380 metric tons is for delivery during the 2022/2023 marketing year

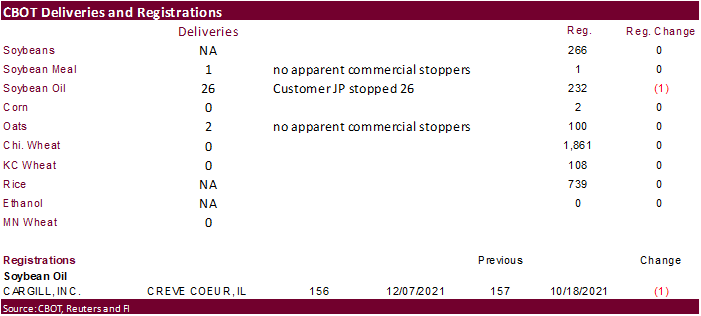

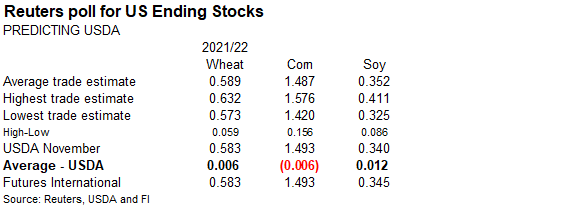

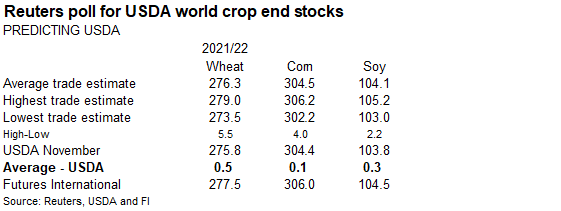

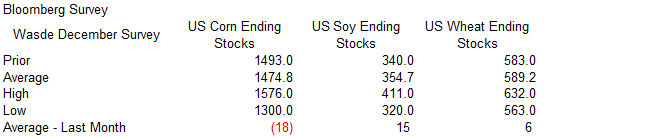

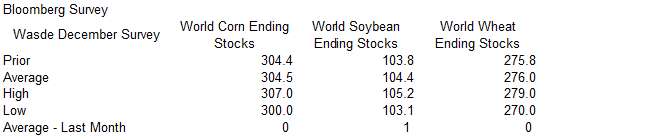

· Led by soybean oil, the soybean complex is lower. Look for positioning ahead of the USDA report. Analysts are looking for global soybean and wheat ending stocks to increase.

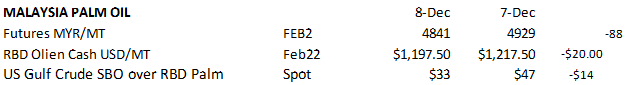

· Malaysian palm oil futures gave up 88 ringgit and cash is off $20/ton.

· Keep an eye on global soybean oil demand which is increasing. The product is still favored by India over palm oil imports and earlier this week we heard Argentina offers are drying up. Separately, Argentina soybean oil premiums dropped about $15/ton to $1308/ton from the past day.

· D6 RINs bounced back late yesterday to 95cts.

· EPA proposed advanced biofuel at 5.2 billion for 2021 and 5.77 billion for 2022 (a new high). Some traders were looking for a higher 2022 RVO. The 2020 & 2021 is more in line with actual blending volumes. They rejected all small refinery exemptions.

· USDA announced they will provide $700 million in new biofuel grants to help companies that were impacted by the Covid-19 pandemic.

· USDA also announced they will provide $100 million in new biofuel infrastructure aid to help companies that were impacted by the Covid-19 pandemic.

· Offshore values are leading soybean oil 55 points higher and meal $1.10 short ton higher.

· Rotterdam meal values were 1-3 euros lower from yesterday morning and Rotterdam oil mixed.

· Malaysia

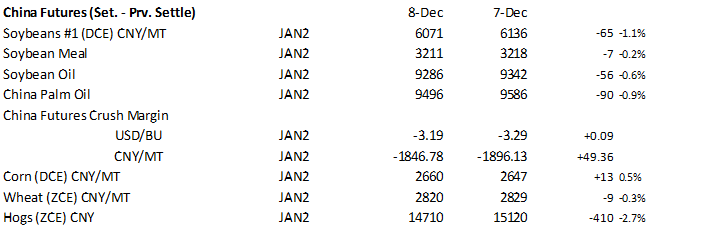

· China crush margins on our analysis was last $1.95 ($1.94 previous) versus $2.22 at the end of last week and compares to $0.93 a year ago.

· China futures were down 1.1% for soybeans, down 0.2% for meal, down 0.6% for SBO and palm was down 0.9%.

Export Developments

· Private exporters report sales of:

130,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year

November MPOB estimates via Reuters

· US wheat is lower in a risk off trade ahead of the USDA report due out on Thursday. Traders are looking for an increase in global ending stocks after Australia’s government projected a record wheat crop.

· The US will see light precipitation across the central Great Plains over the coming week. Snow recently fell across the far western Great Plains, improving conditions. With a warmup across the US over the next week, that may improve winter wheat conditions ahead of dormancy.

· We hear China resumed buying of western coast Canadian wheat, which is firming up the wheat spreads.

· Australia weather looks good through the next ten days.

· March Matif Paris wheat was 3.00 euros lower at 288.75.

· Farm office FranceAgriMer lowered its non-EU French soft wheat exports from 9.4 to 9.2 million tons, still 24% above the volume last season. Soft wheat shipments within the EU were projected at 7.8 million tons, unchanged last month.

· Syria closed coastal ports due to bad weather.

Export Developments.

· Bangladesh’s lowest offer for wheat was $404.11/ton CIF.

· Jordan bought 60,000 tons of barley at $303.70/ton c&f for FH July 2022 shipment.

· Japan in a SBS import tender seeks 80,000 tons of feed wheat and 100,000 tons of barley on December 15 for arrival by March 10.

· South Korean flour mills bought 50,000 tons of milling wheat from the US and another 50,000 tons from Australia, for February and April shipment, respectively.

U.S. wheat

- soft white wheat 11% protein bought low $390s a ton

- soft white wheat of 9% protein bought in the low $540s a ton

- hard red winter wheat of 11.5% protein bought in the mid $380s a ton

- northern spring/dark northern spring wheat of 14% protein bought in the mid $420s a ton

Australian wheat

- Australian standard white (ASW) bought in the mid $360s

- Australian hard wheat grade AH2 in the low $390s (Reuters)

· The Philippines seeks 125,000 tons of feed barley and 300,000 tons of feed wheat on December 9 for Feb-Jun arrival.

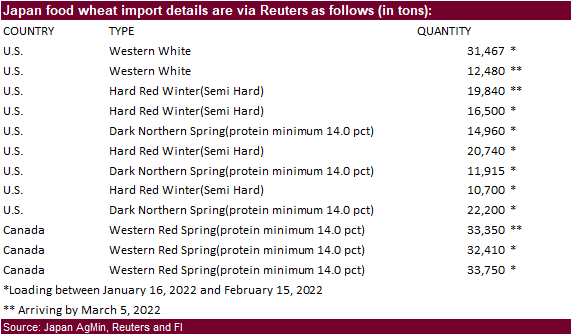

· Japan seeks 260,312 tons of food wheat from the US and Canada.

· Jordan seeks another 120,000 tons of wheat on Dec 9 and seeks 120,000 tons of barley on Dec 8.

Rice/Other

· South Korea seeks 22,000 tons of rice from the US on December 9 for arrival in South Korea from May 2022 and from August 2022.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.