Opening Calls:

Soybeans 6-10 higher

Soybean meal $1.50-3.50 higher

Soybean oil 30-60 points higher

Corn 4-6 cents higher

Chicago Wheat 2-5 higher

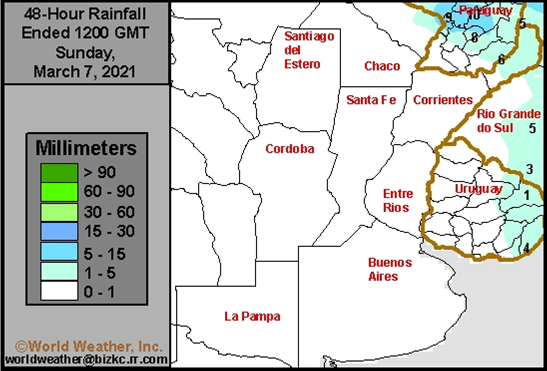

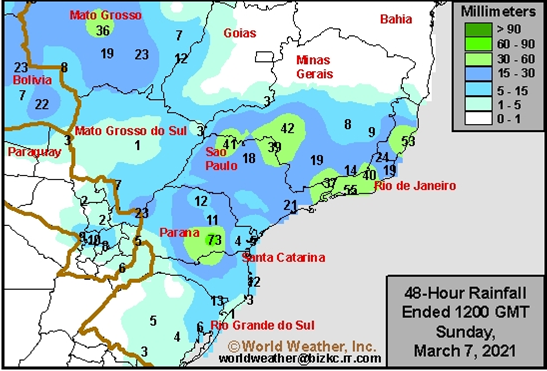

Argentina appeared to be completely dry over the weekend while Brazil’s waterlogged Mato Grosso saw additional rain. It was also wet across Parana, Sao Paulo and surrounding areas. Brazil will see drier weather across the southern areas this week while concerns over the quality of the soybean crop and corn plantings should continue across the central and northern areas from additional rain in the forecast. The rain will not be as heavy as previous weeks but are still unwelcome. Argentina will see a couple weak fronts this week, but amounts could vary and overall, the country will continue to dry down, causing additional crop stress.

[MAPS BELOW]

US precipitation was minimal across wheat country over the weekend. Mixed precipitation and rain will develop across the upper Great Plains and upper WCB by Wednesday. Heaviest rainfall will occur across Missouri, Illinois and Indiana over the next 5 days.

Along with expectations for a US economic rebound as states relax on restrictions, inflation could support majority of commodity markets this week. Energy markets are expected to trade higher led by mineral oil after one of Saudi Arabia’s top producing locations came under fire by Houthi rebels the weekend. China also imported a large amount of oil during the Jan-Feb period.

The US Senate passed the $1.9 trillion coronavirus relief package and it now goes to the House for a vote.

Other news was light.

Algeria is in for more wheat. They seek 50,000 tons of wheat on Tuesday, valid until Wednesday for March or April shipment, depending on origin.

China January through February soybean imports were 13.41 million tons, down 0.8% from 13.51 million tons a year earlier. China’s imports of edible vegetable oils imports during the two-month period increased a large 48 percent from the same period in 2020 to 2.04 million tons. On a macro level China’s exports surged from a rebound in global demand amid Covid-19 recovery.

Switzerland voted and approved a free trade agreement with Indonesia that will gradually lower tariffs on palm oil by about 20%-40% for up to 12,500 tons per year, but only if sustainability standards are met.

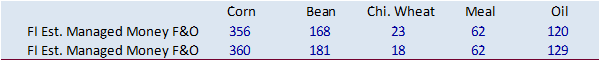

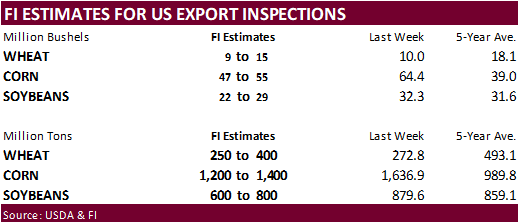

Following the overnight trade, it will be a busy week. Traders will be watching to see if the CBOT soybean complex can sustain their current rally this week and if corn will find support from rumors over a large US purchase late last week. Wheat prices could be influenced over changes in US selected state crop conditions, fluctuations in the USD, and global export developments Managed money are still very long corn and soybeans. We look for very good corn inspections to be reported by USDA on Monday, at or below average soybeans and below average all-wheat shipments. Tuesday USDA will update their S&D’s, followed by MPOB palm data Wednesday and Conab Thursday. Later this week traders will also get February US CPI inflation data (Wed), projected to increase 0.4% from the previous month and up 1.7% from year ago (1.4% rise in Jan.).

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.