PDF attached

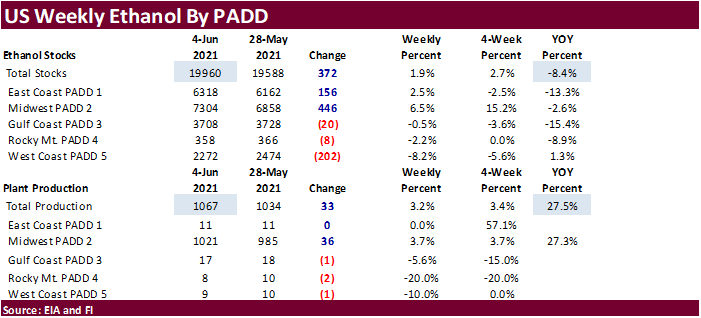

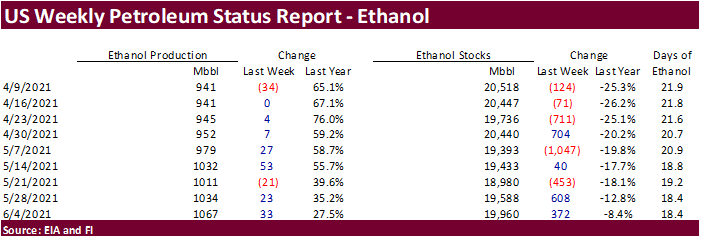

Weekly US ethanol production was up a large 33,000 barrels to 1.067 million (trade looking for up 2,000) and stocks increased 372,000 barrels to 19.960 million (trade +110k). For the week ending June 6, ethanol output of 1.067 million barrels is highest since 2/28/20, and more interestingly only 41,000 barrels below the weekly record set early December 2017 of 1.108 million barrels. Production is up about 9% from around this time last month. Last week’s production came in above the comparable 2017 & 2018 periods but was just short what was produced in week 40 in 2019. Ethanol stocks are off 8.4% from around this time year ago. US gasoline demand fell 666,000 barrels from the previous week, but lagging demand for this time of year in 2019.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.