PDF attached

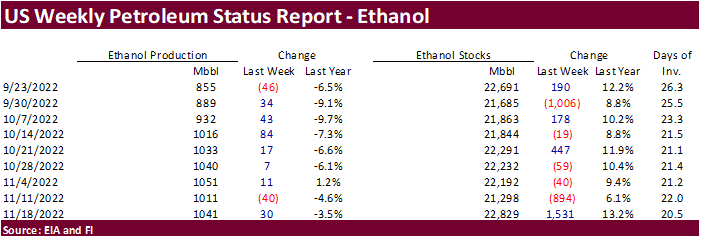

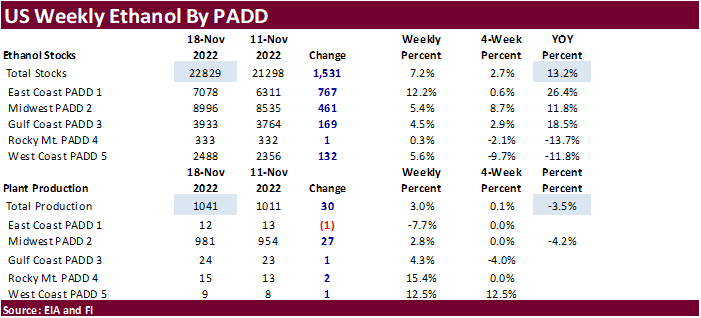

EIA reported weekly ethanol production up a large 30,000 barrels per day to 1.041 million and stocks up 1.531 million barrels to 22.829 million. We like watching the 4-week average change, which is up 2,000 barrels for production and up 135,000 barrels for stocks. Back to the weekly changes, for comparison, a Bloomberg poll looked for weekly US ethanol production to be up 11,000 thousand and stocks up 6,000 barrels to 21.304 million. Early September to November 18 US ethanol production is still running 4.8% below same period year ago and 1.9% below pre pandemic 2019. US gasoline stocks rose for the second consecutive week, by 3.058 million barrels to 211 million and demand for gasoline dropped 415,000 barrels to 8.327 million barrels. US gasoline demand is down about 10 percent from this time year ago. We left corn for ethanol use unchanged, currently 25 million bushels below USDA’s 2022-23 estimate.

US DoE Crude Oil Inventories (W/W) 18-Nov: -3.691M (est -2.614M; prev -5.400M)

– Distillate: +1.718M (est +650K; prev +1.120M)

– Cushing: (prev -1.624M)

– Gasoline: +3.058M (est +1.150M; prev +2.207M)

– Refinery Utilization: +1.0% (est 0.35%; prev +0.8%)

RFA’s daily email update has several articles circulating around on higher US ethanol blending. This is not new as it was reported earlier this week, but several media outlets are analyzing the potential impact. Below is a recap from one article.

Energy and ag groups seek permanent year-round E15 fix

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.