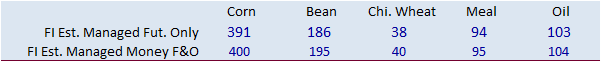

File(s) attached include daily estimate of funds and FI export sales estimates

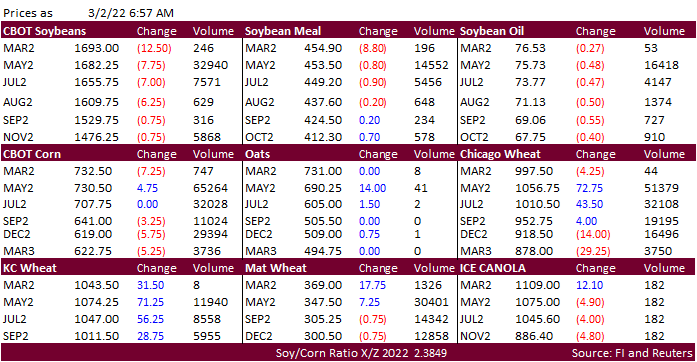

CBOT May soybeans are lower in a risk off session. Products also fell. While no Ukraine/Russia cease fire in sight, look for the soybean complex to see a choppy trade for the remainder of this week. Palm oil traded 102 points lower to 6,660 MYR and cash was up $10/ton. China agriculture futures rallied. USDA NASS reported the January US soybean crush at 194.3 million bushels, 0.6 above a Bloomberg trade guess and below 198.2 million for December. Soybean oil stocks came in at 2.500 billion pounds, 51 million pounds above a trade guess and highest since April 20th.

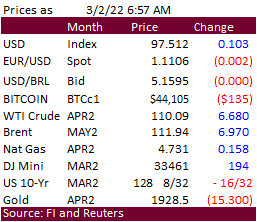

Despite sharply higher WTI crude oil, CBOT corn futures are mostly lower from lower soybeans and some risk off. May futures rallied above $7.45 overnight. Traders will be watching out for China grain import announcements. China was rumored yesterday to be looking around for US corn. Russia and Ukraine provide about a fifth of the world’s corn supplies for the export market. WTI over $110/barrel early Wednesday. 3 major oil companies ceased operations in Russia this week. A Bloomberg poll looks for weekly US ethanol production to be up 18,000 barrels to 1.027 million (1010-1041 range) from the previous week and stocks up 61,000 barrels to 25.544 million.

Chicago wheat futures rose above $10.50 a bushel for the first time since March 2008, extending a rally as Russia’s invasion continues. More and more countries are taking steps to ensure food security. Chicago SRW wheat is back near a 14-year high. Around 5 am CT, that contract saw a wild swing, a reminder how volatile and easy one could get blown out of a position. May EU wheat futures were up 6.00 euros at 346.25 euros at the time this was written. MGEX spring wheat stocks are down 10.4% from year ago.

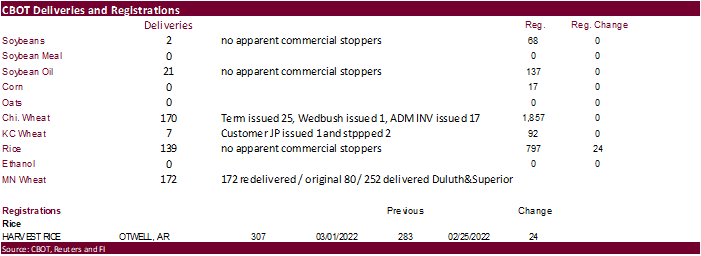

SK’s KFA bought 134,000 tons of corn at around $413.23/ton c&f. Tunisia’s state grains agency bought about 100,000 tons of durum wheat. Japan started buying milling wheat from the US. Turkey started buying wheat for their import tender for up to 435,000 tons of soft wheat.

Wheat, butter & milk limits expand

https://www.cmegroup.com/trading/price-limits.html

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.