File(s) attached include daily estimate of funds

Good morning.

Wheat and WTI crude oil prices have been widely talked about over the past day after futures surged to fresh multi-year highs. The soybean complex is rebounding in part to stronger outside vegetable oil markets. Corn traded two-sided on lack of direction. Importers are starting to turn to corn over wheat. Wheat is seeing another wild trade with nearby Chicago and KC May wheat sharply higher.

Taiwan’s MFIG bought about 130,000 tons of corn sourced from the United States and Argentina, Some 65,000 tons of US corn was bought at $4.22 over the September 2022 contract for May 1-20 if US Gulf or May 16-June 4 is from PNW. Another 65,000 tons from Argentina was bought at $3.4760 over the September for June 1-20 shipment. South Korea’s NOFI bought about 207,000 tons of animal feed corn. They passed on 65,000 tons of feed wheat.

India’s sunflower oil imports fell 54% during February to 140,000 tons from January due to Black Sea shipping problems. Palm oil imports in February fell to 470,000 tons and soybean oil imports dropped 5.5% to 370,000 tons. May Malaysian palm oil settled up 148 ringgit to 6,808 ringgit. Cash palm was up $35/ton to $1,770/ton. China May soybeans were up 0.5%, meal down 0.8%, soybean oil up 0.3% and palm 1.2% higher.

Chicago wheat futures rose above $11.00 a bushel for the first time since 2008, extending a rally as Russia’s invasion continues. May Paris wheat futures were up 0.25 euro at 341.00 euros at the time this was written. China wheat futures increased to over 3,450 yuan per ton on Thursday, a new contract high. Domestic prices are up sharply, by more than 100 yuan in the past week, with bids as high as 3,250 yuan per ton. Bloomberg: A labor dispute at one of Canada’s largest railways is threatening to further disrupt global supplies of fertilizer just as farmers need key nutrients to plant spring crops. Jordan’s state grains buyer seeks 120,000 tons of milling wheat on March 9. Bangladesh seeks 50,000 tons of milling wheat on March 16 for shipment within 40 days of contract signing. Turkey ended up buying 285,000 tons of wheat this week, below initial announcements of 370,000 tons as they scaled back due to high prices.

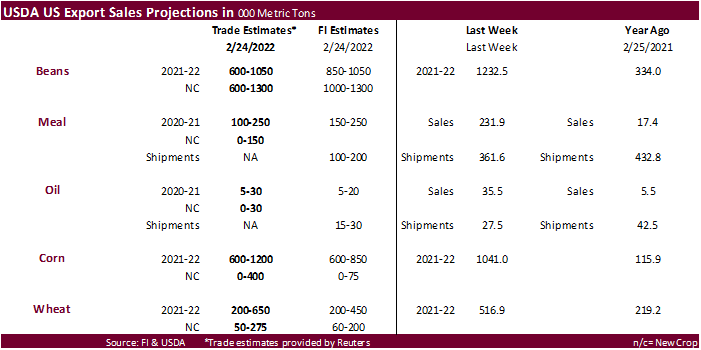

Export sales due up at 7:30 am CT.

![]()

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.