File(s) attached include daily estimate of funds

Day 22. We are seeing a rebounding in many agriculture markets and WTI crude oil this morning from headline trading. A Kremlin spokesman said a headline that peace talks were progressing was “wrong” but more discussions are expected today, according to Bloomberg. Export sales report due out at the end of the hour. Indonesia changed its tune on restricting palm exports by removing the export volume for palm oil products and raise export levy ceiling instead. June Malaysian palm oil settled 131 ringgit lower to 5,936 (2.2%). Cash palm was down $35/ton to $1,520/ton (2.3%). China May soybeans were up 0.9%, meal up 1.5%, soybean oil down 1.5% and palm down 1.2%. China National Grain and Oils Information Center (CNGOIC) estimates China producers will expand soybean plantings by 1.3 million hectares. USDA showed China planted 8.4 million hectares of soybeans in 2021-22, down from 9.883 million in 2020-21 and 9.332 million for 2019-20. CNGOIC – China sold 186,000 tons of imported soybean oil and 256,000 tons of imported soybeans from its reserves between late February and March 14. Canadian Pacific Railway will lock out its employees in 72 hours (announced Wednesday) if there is no agreement with a union. Ukrainian Deputy Agriculture Minister reported winter wheat crops are in good condition and the country will have enough bread this year. Summer production is unpredictable. Earlier this week APK-Inform estimated Ukraine’s 2022 spring grain crop plantings could fall 39% to 4.7 million hectares. Ukraine started spring plantings in some areas but the AgMin said its not possible to estimate a figure at this time. Strategie Grains lowered their EU-27 soft wheat estimate for 2022-23 to 126.9 million tons from 128.0 previously. They left barley and corn production unchanged at 51.9 and 66.8 million tons, respectively.

Export Developments:

- The Korea Feed Association (KFA) bought 65,000 tons of optional origin corn at $418.00 a ton c&f for June arrival.

- South Korean flour mills seek 45,000 tons of US milling wheat this Friday, March 18, for shipment between May 16 and June 15.

- Iraq’s lowest offer for 50,000 tons of optional origin hard wheat was $528.00/ton c&f from Australia. Price offers are valid until the 22nd. Lowest price offered for U.S. wheat was $648 a ton c&f liner out, followed by $659. Canadian wheat was offered at $554.50 and $564 a ton c&f liner out. German wheat was offered at $570 a ton and Romanian at $569.

- Turkey’s TMO started buying wheat and at least 175,000 tons 11.5% & 12.5% protein traded at $444.80 to $478.45/ton c&f. They are in for 270,000 tons of milling wheat for March 25 – April 22 shipment.

- Japan bought 104,480 tons of food wheat as expected.

- Jordan seeks 120,000 tons of milling wheat on March 24. Possible shipment combinations are May 16-31, June 16-30, July 1-15 and July 16-31.

- Algeria bought 50,000 tons of barley at around $470/ton c&f, for April 1-15 and April 16-30 shipment.

![]()

Source: World Weather Inc.

- International Grains Council’s monthly market report

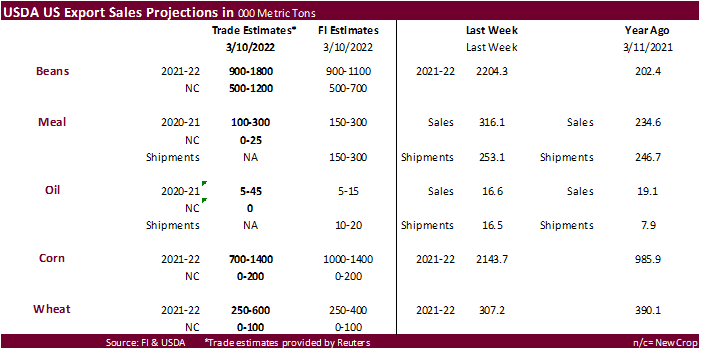

- USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- HOLIDAY: Bangladesh

Friday, March 18:

- ICE Futures Europe weekly commitments of traders report, ~1:30pm

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- China’s second-batch of Feb. imports for corn, pork and wheat

- FranceAgriMer weekly update on crop conditions

- HOLIDAY: India

Source: Bloomberg and FI

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.