File(s) attached include China CASDE and daily estimate of funds

China released their CASDE report and Brazil’s Conab should be out shortly.

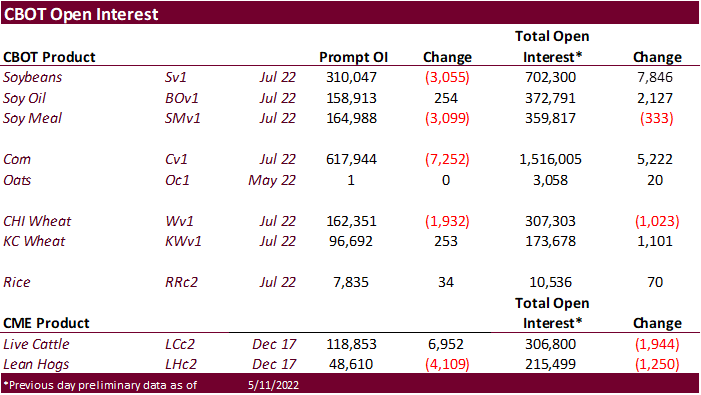

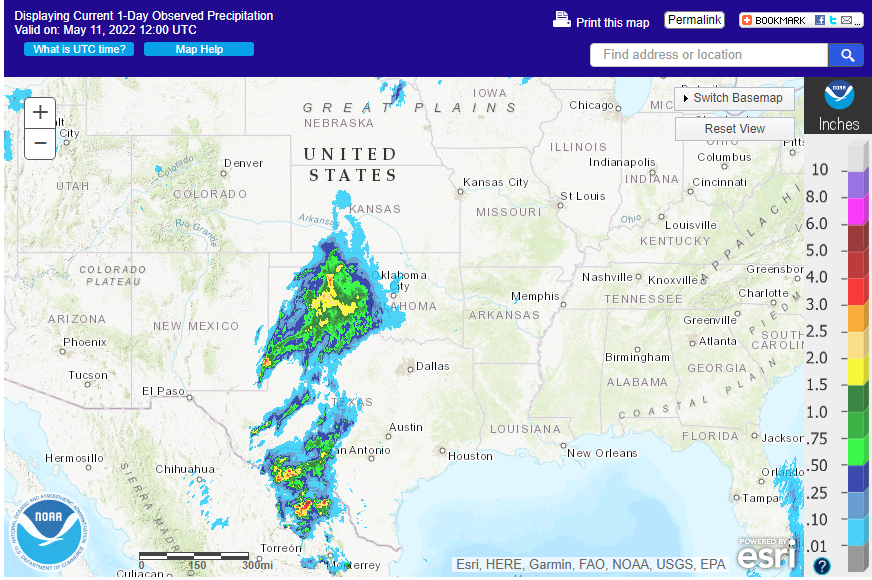

Soybeans are lower from China’s outlook for soybean imports for this year and new-crop. SBO is selling off from a reversal in product spreads, lower lead in offshore values and lower energy markets. Corn is higher on spreading against soybeans and a US weather forecast calling for rain this weekend for the Midwest. US wheat is mostly lower from a sharply higher USD. WTI was down more than $1.75 at the time this was written and USD up about 75 points.

China in their monthly CASDE report lowered 2021-22 soybean imports by a large 9 million tons to only 93 million tons. Their initial estimate for 2022-23 soybean imports are a low 95.2 million tons, indicating soybean imports will remain slow for at the balance of this year. China sees an 18 percent increase in the new-crop soybean planted area from last year, and production up 19 percent to 19.5 million tons from 2021-22. China in their monthly CASDE report reported initial 2022-23 corn planting acreage was seen down 1.8% from the previous year, at 42.52 million hectares, and new-crop corn imports are seen at 18 million tons, about in line with our estimate. China did not make any changes to their 2021-22 corn balance sheet. New crop corn production was estimated at 272.56 million tons, slightly higher from a year earlier.

Offshore values are leading SBO 370 points lower and meal $0.10 short ton lower. Malaysian palm oil ended 134 ringgit per ton lower to 6,342 and cash was down $40/ton at $1,560 ton.

China September soybean futures were up 0.6%, meal up 0.4%, SBO 1.3% higher and China palm oil up 0.6%. Strategie Grains lowered its forecast for EU soft wheat exports for 2021-22 by 1.5 million tons to 29.9MMT, citing Russian shipments have been better than expected. Ukraine May to date grain exports were nearly 300,000 tons, about half of what was exported during the same period year ago. Ukraine exported 46.2 million tons of grain so far for the soon to ending 2021-22 season, up from 39.7 million tons a year earlier.

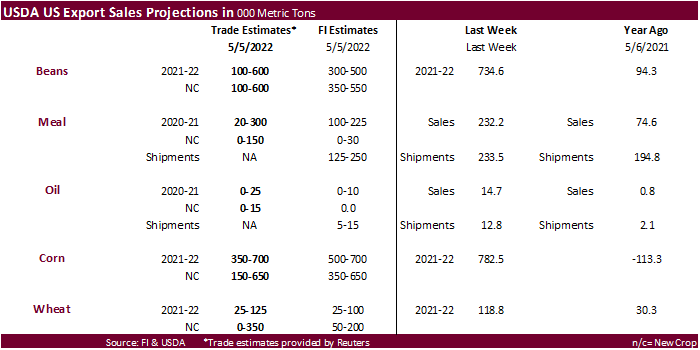

Taiwan’s MFIG seeks up to 65,000 tons of corn from the US and/or SA on May 18 for August shipment. China looks to sell 500,000 tons of soybeans from reserves on May 13, not 314,000 originally planned. Yesterday Algeria started buying wheat for July shipment. Volume is not known but initial purchases were reported around $466 a ton c&f. Japan bought 196,560 tons of food wheat. The 60,000 tons of wheat Jordan bought yesterday Indian origin ($436/ton).

![]()

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.