File(s) attached

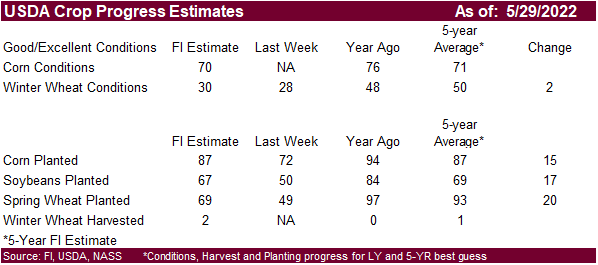

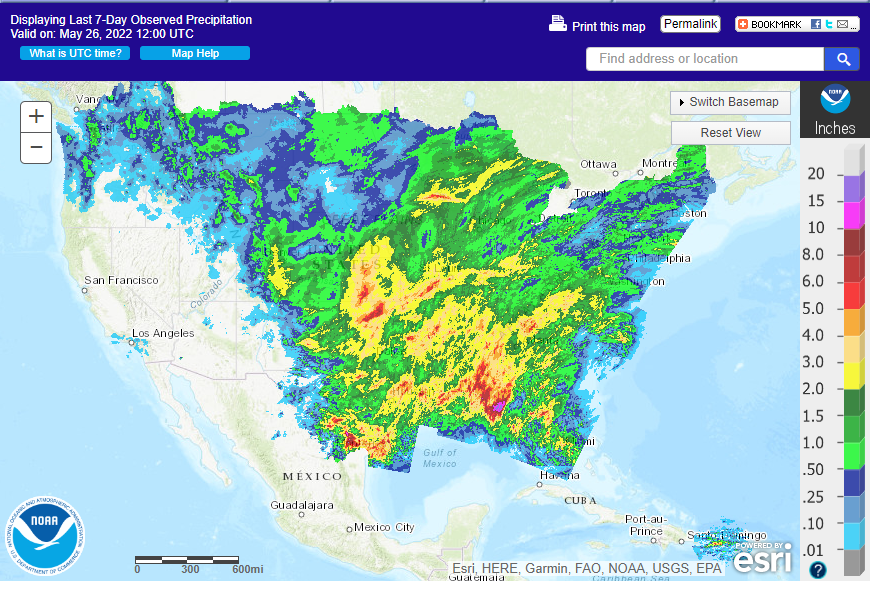

Indonesia announced they will allocate 1 million tons of palm oil for the export market, but no details or timeline were provided. We see little reaction in soybean oil futures from this news. Palm oil did sell off. Soybeans are trading near contract highs and profit taking is not out of the question today. Expect a light trade ahead of the US holiday weekend. US markets will resume trading Monday evening (CT). The USD is lower and WTI crude oil is off nearly $0.60. The models for the US and EU weather forecasts improved for the short term. Expect good US Midwest plantings next week. South Korea bought a variety of 124,700 tons of wheat from Canada, US, and Australia. French wheat conditions again deteriorated. French soft wheat was rated 69% G/E versus 73% previous week and 80% year ago. The rating is down 20 points over the past three weeks. USDA could possibly issue their initial US corn crop condition next week. Corn emerged generally needs to be around 50 percent for conditions to be reported and as of May 22, corn was at 39 percent. We are eying 70 percent good/excellent for initial 2022 ratings, same as the 5-year average and down from 76 year ago. We look for US wheat harvest to be reported at around 2 percent as of this Sunday. Malaysian palm oil ended 180 ringgit per ton lower at 6,353 and cash was down $10/ton at $1,555 ton. China September soybean futures were up 0.2%, meal up 2.3%, SBO 1.4% higher and China palm oil up 2.8%. Offshore values were leading SBO 92 points lower (90 higher for the week to date) and meal $2.40 short ton higher (0.30 higher for the week).

![]()

Past 7 days

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.