From: research

Sent: Tuesday, April 14, 2020 7:09:29 AM (UTC-06:00) Central Time (US & Canada)

To: research

Subject: Daily Market Report – April 14, 2020

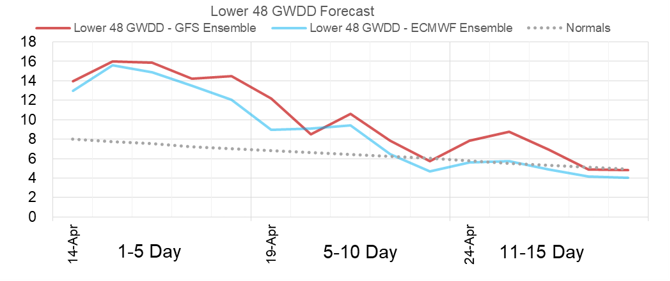

Both the GFS Ensemble and ECMWF Ensemble continue to show cooler than normal weather for the next week, after which both trend towards the 10Y normal.

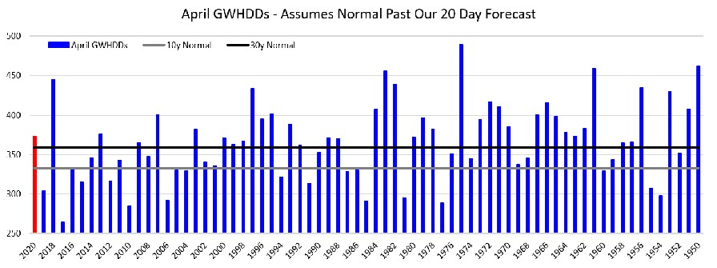

According to Maxar Weather Desk, this April is set to be slightly cooler than the 30 year normal with the current forecast and normal beyond that. This is similar to April is 2011 and 2013.

For week ending April 10, we are projecting a 62 Bcf storage injection. With dropping demand across the country, the last couple of storage estimates have be been more bearish than consensus. This week the Bloomberg survey currently stands at 65 Bcf.

Fundamentals:

Daily US natural gas production is estimated to be 91.7 Bcf/d this morning. Today’s estimated production is -0.03 Bcf/d lower than yesterday, and +0.28 higher than the 7D average.

Natural gas consumption is modelled to be 86.6 Bcf today, +5.9 Bcf higher than yesterday and +8.3 Bcf higher than the 7D average. US power burns are expected to be 27.6 Bcf today, and US ResComm usage is expected to be 28.3 Bcf.

Net LNG deliveries are expected to be 8.7 Bcf/d today.

Mexican exports are 4.9 Bcf/d. Canadian imports dropped to 5.0 Bcf/d.

Bloomberg IM: Het Shah

enelyst DM: @het.co

Tel: 917-975-2960

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.