From: research

Sent: Wednesday, April 08, 2020 7:08:12 AM (UTC-06:00) Central Time (US & Canada)

To: research

Subject: Daily Market Report – April 8, 2020

Natural gas prices rose substantially yesterday – counter to WTI prices. The dropping WTI prices added some concern about tighter fundamentals as more oil rigs would be taken out of operation leading to dropping associated gas volumes. The prompt month currently sits at 1.88.

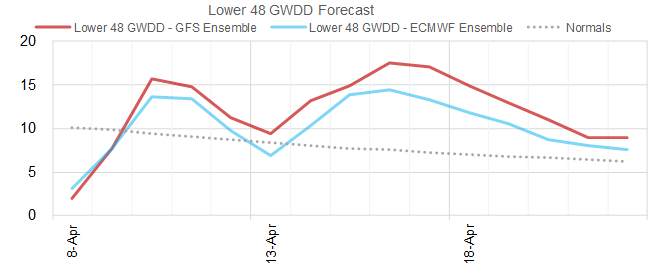

The cooler weather in the 15 day forecast also keep April natural gas consumption higher than normal. It the latest 00z run, the GFS Ensemble added some more HDDs in the back end of the forecast, while the ECMWF Ensemble trended cooler. Overall, the forecast past GD10 shows temps well below the 10Y normal.

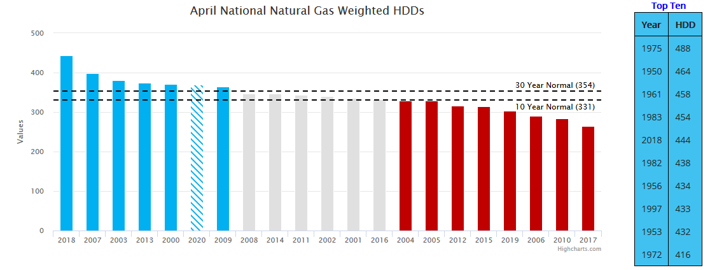

Below is an image from CWG showing April shaping up to be one of the coolest on record. 2018 was the coolest April in the last 20 years.

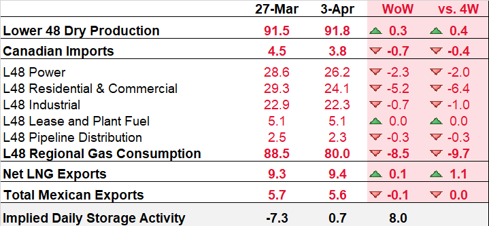

For today’s EIA storage report we are projecting a +32 Bcf injection for week ending April 3. This is the first injection of the year as we enter summer. In the midst of the ongoing Coronavirus pandemic, with most of the US under some form of a state-mandated lock-down, the effects of demand destruction and warmer than normal temperatures led to looser balances. Power burns dropped by 2.3 Bcf/d WoW, and ResComm demand dropped by 5.2 Bcf/d WoW.

Fundamentals:

Daily US natural gas production is estimated to be 89.4 Bcf/d this morning. Today’s estimated production is -1.5 Bcf/d lower than yesterday, and -1.78 lower higher than the 7D average. This is quite a large drop DoD; hence we suspect this will be revised higher in later nomination cycles.

Natural gas consumption is modelled to be 73.5 Bcf today, +0.8 Bcf higher than yesterday and -3.5 Bcf lower than the 7D average. US power burns are expected to be 29.5 Bcf today, and US ResComm usage is expected to be 15.6 Bcf.

Net LNG deliveries are expected to be 8.3 Bcf/d today. Sabine Pass continues to hold steady around 3.3 Bcf/d which is 75-80% of its peak intake.

Mexican exports are 4.9 Bcf/d. Canadian imports dropped to 3.9 Bcf/d.

Bloomberg IM: Het Shah

enelyst DM: @het.co

Tel: 917-975-2960

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.