From: Terry Reilly

Sent: Friday, August 03, 2018 6:12:45 PM (UTC-06:00) Central Time (US & Canada)

Cc: Terry Reilly

Subject: FI Ag Commitment of Traders 08/03/18

PDF attached

CFTC Commitment of Traders Report

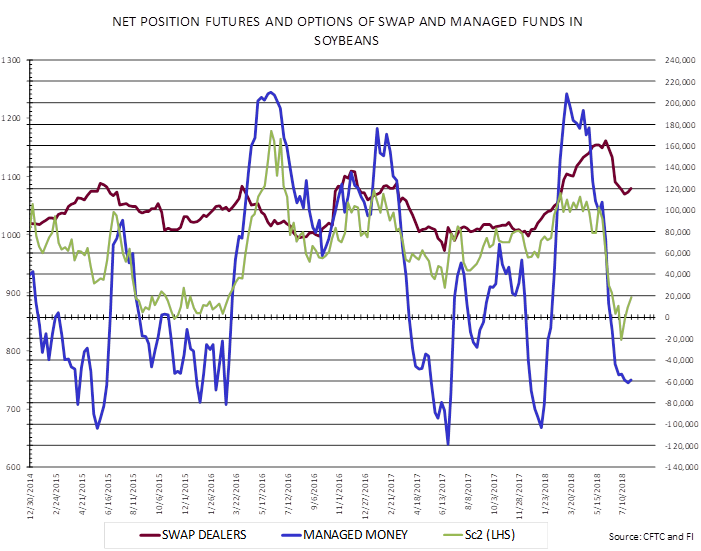

· Chicago wheat, futures only position for traditional funds was a record net long 75,028 contracts as of 7/31, taking out 8/21/12.

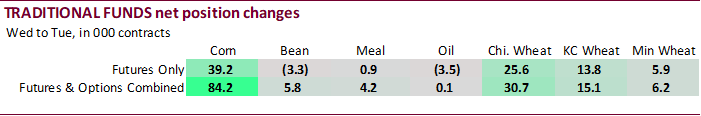

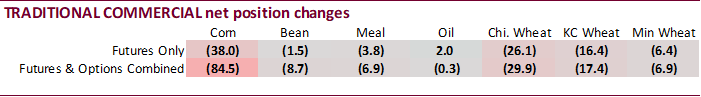

· For the week ending July 31, traditional funds were buyers of corn, Chicago wheat, KC wheat and MN wheat. Futures only for soybeans traditional funds sold a little and bought a small amount in the futures and options positions.

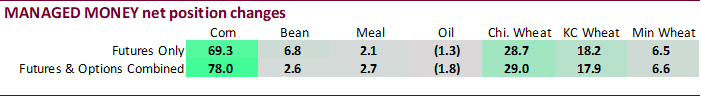

· For managed money, funds were large buyers of corn, bought a good amount of Chicago wheat and added longs to KC wheat.

· Traditional funds were about 16k less long in corn that trade expectations, 22k more short in soybeans were the traditional funds posted a short position of 14,100, heavier buyers in Chicago wheat than anticipated and didn’t sell as much meal as the daily estimate of funds suggested.

· We estimate the funds futures only for traditional funds going home on Friday at net long 118k corn, net short 24k soybeans, net long 88k meal, net short 56k soybean oil, and net long 84k wheat.

· Traditional funds futures only in soybean oil hold a near record short position. (55.1 short 8/1/13). For options combined the record short was hit three weeks ago. Managed money positions for soybean oil are also near record net short.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.