From: Terry Reilly

Sent: Friday, August 17, 2018 3:57:55 PM (UTC-06:00) Central Time (US & Canada)

Cc: Terry Reilly

Subject: FI Ag Commitment of Traders 08/17/18

PDF attached

CFTC Commitment of Traders

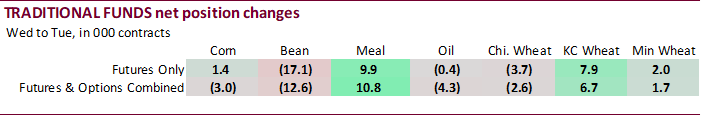

· Traditional funds for the futures and options position only bought about 24,400 contracts more corn than previous thought, and also bought more than expected soybeans and Chicago wheat than expected, for the week ending 8/17.

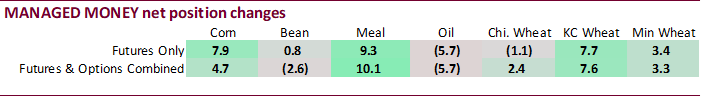

· The managed money fund position in soybeans oil was a record short 97,124 contracts for futures only, and record net short 96,687 contracts for futures and options combined.

· For traditional funds futures only, the net short position in soybean oil was reported near record.

· Funds backed off their net long position in wheat.

· Money managers bought meal and sold soybeans and oil. They added long positions to KC wheat.

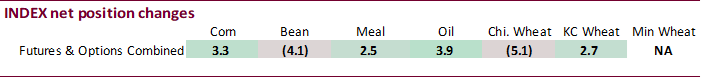

· Index funds were quiet last week, but they did unwind 5,100 Chicago wheat contracts.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.