From: Terry Reilly

Sent: Monday, July 09, 2018 4:49:46 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments

PDF attached includes CFTC charts and FI tables with yield change on soybeans for USDA crop progress

Conab is due out July 10. Bloomberg survey:

Summary of |——-Survey Results——–|Conab

Results: | Average | Low | High | June | 2016-17

Soybean area (M| | | | |

Ha) | 35.0| 34.7| 35.2| 35.1| 33.9

Soybean | | | | |

production (M | | | | |

Tons) | 118.5| 117.4| 119.2| 118.1| 114.1

Soybean yield | | | | |

(k Kg/Ha) | 3.38| 3.35| 3.43| 3.36| 3.36

Corn area | | | | |

(Total) (M Ha) | 16.7| 16.0| 17.0| 16.7| 17.6

Corn production| | | | |

(M Tons) | 82.1| 79.0| 84.7| 85.0| 97.8

Corn Yield (k | | | | |

Kg/Ha) | 4.93| 4.79| 5.09| 5.10| 5.56

USDA inspections versus Reuters trade range

Wheat 268,221 versus 275,000-425,000

Corn 1,446,926 versus 850,000-1,600,000

Soybeans 654,834 versus 375,000-900,000

Corn.

- CBOT corn ended 5.25-6.25 cents lower from a weather forecast calling for good US pollination conditions over the next three weeks and light technical selling after Friday’s rally. Mild temperatures over the weekend were seen supportive for the start of the US corn silking stage. High pressure ridging over the next couple of weeks don’t show extreme hot temperatures associated with it. Temperatures will be warmer than normal across the US this week but trend cooler by the end of the week.

- Funds sold an estimated net 18,000 corn.

· 37 percent of the US corn crop reached the silking stage as of Sunday. With one-third of it pollinating, US corn is in good shape after milder temperatures over the weekend slowed evaporation rates. Dry weather this week appears to be less threatening for the US crop. Note the US Midwest will see 70-75 percent coverage Wed into Sat and 80 percent Sat into Tue of next week. More rain is expected July 17-20th. US G/E corn conditions decline one point, as expected.

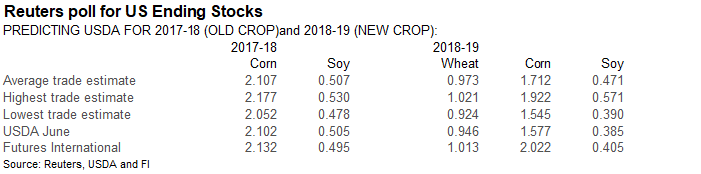

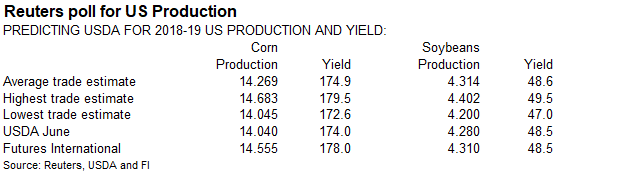

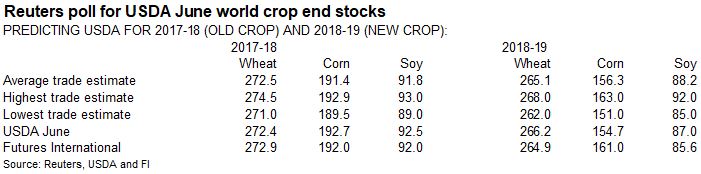

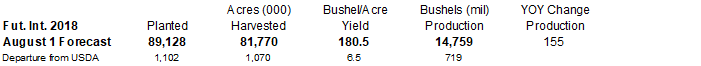

· We left out 180.5 bushels per acre US corn yield unchanged from the previous week. USDA may increase its yield on Thursday from its current 174.0 bushels. We think they will go to 178.0 bushels.

- USDA US corn export inspections as of July 05, 2018 were 1,446,926 tons, within a range of trade expectations, below 1,538,556 tons previous week and compares to 1,010,889 tons year ago. Major countries included Japan for 388,411 tons, Korea Rep for 291,013 tons, and Mexico for 241,613 tons.

- China will allow to import German poultry after banning it from bird flu.

University of Illinois farmdoc Too Much Pork, Tariffs Mean Too Few Buyers https://farmdocdaily.illinois.edu/2018/07/too-much-pork-tariffs-mean-too-few-buyers.html?utm_source=farmdoc+daily+and+Farm+Policy+News+Updates&utm_campaign=12cf9b771c-EMAIL_CAMPAIGN_WO_2017_01_03_COPY_02&utm_medium=email&utm_term=0_2caf2f9764-12cf9b771c-173649469

· US soybeans ended 21.50-22.50 cents lower, August meal $8.20 lower and August soybean oil 16 lower.

· Funds sold an estimated net 11,000 soybean contracts, sold 6,000 meal and sold 1,000 soybean oil.

· The strong move on Friday and mostly unchanged US weather forecast prompted light liquidation. Over the short-term, we still see upside in this market on oversold conditions.

· The US crop is well advanced and US weather is non-threatening.

· 47 percent of the US soybean crop is blooming, 20 points above average. 11 percent is already setting pods, 7 points above average. US soybean crop conditions for the combined good and excellent categories were unchanged at 71 percent, 9 points above a year ago. The soybean conditions were one point above a trade average.

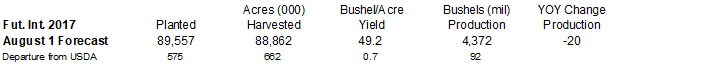

· We lowered our US soybean yield to 49.2 bushels per acre from 49.4. Production decreased to 4.372 billion bushels from 4.390 billion. USDA is at 4.280 billion. We look for USDA to leave its US soybean yield estimate unchanged on Thursday.

· China/US trade developments were slow over the weekend. China did mention they plan to use a portion of the tariffs to help employees affected by US tariffs.

· China will reimburse the buyer the 25% tariff on soybean imports from the U.S. if the cargoes are for state reserves. (Bloomberg). There was one cargo that showed up after the 25 percent tariff kick in on Friday, but that cargo will be headed to state reserves. We don’t think China will buy several cargos of US soybeans for state reserves to avoid the 25 percent tariff, and immediately sell them to crushers.

· The CNGOIC reported China crushed 1.82 million tons of soybeans last week, down 90,000 tons from the previous week. Meal demand slowed.

· India planting progress is running at a slow pace. 6.359 million hectares of oilseeds had been planted, down from 7.345 million a year ago.

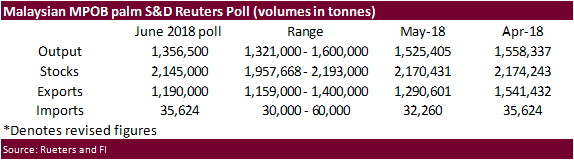

· MPOB is due out Tuesday.

· NOPA is due out with the US soybean crush on Monday, July 16.

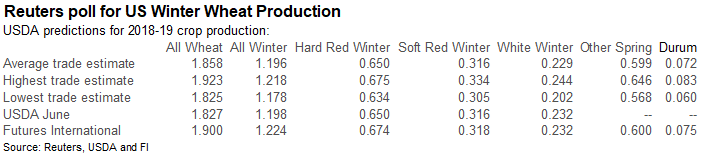

· US wheat futures traded lower but losses were limited on declining Russia crop prospects.

· After the close, Egypt’s GASC said they seek wheat for August 21-31 shipment.

· Funds today sold an estimated net 4,000 SRW wheat contracts.

· MN futures could decline on Tuesday based on US spring crop conditions.

- December Paris wheat fell 1.75 euros.

- SovEcon lowered its Russia wheat crop to 69.6 million tons from 72.5 million previously. They are still perceived as on the high side for production. Grain output was pegged at 113.9 million tons, down from 118.6 million tons previously. Corn was lowered 200,000 tons to 12.5 million tons, and barley lowered to 16.9 million from 17.8 million tons.

- Russian wheat exports totaled 40.4 million tons in 2017-18, up 50 percent from the previous year. Corn exports were 5.8 million tons, up 11 percent.

- Russia wheat export prices at the end of last week were mostly unchanged from the previous week.

- FC Stone EU soft wheat production survey: 135.3MMT (down 6.4MMT on last month).

- A recent Reuters poll pegged the EU soft wheat production at 136 million tons.

- Saudi Arabia plans to buy up to 700,000 tons of wheat per year from local producers.

- The EU reported 209,000 tons of soft wheat exports were exported during the first week of the local marketing year, down from 230,000 tons during the same period a year ago.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.