From: Terry Reilly

Sent: Tuesday, January 07, 2020 1:47:55 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 01/07/20

PDF attached does not include fund estimates as they were not available at the time this was written

MARKET WEATHER MENTALITY FOR CORN AND SOYBEANS:

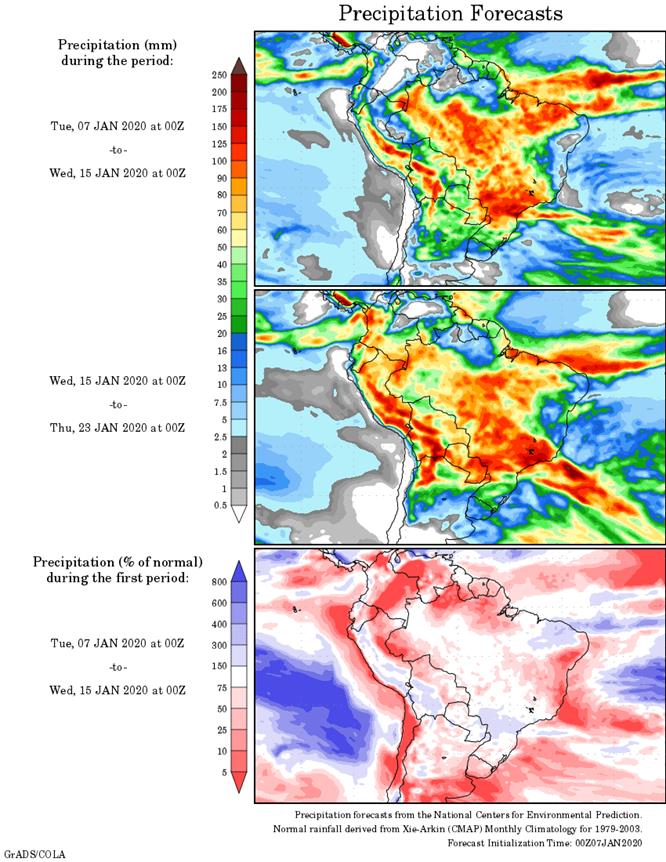

Weather conditions in many Brazil and Argentina crop areas will be favorable over the next two weeks, although a close watch on the rain distribution is warranted. A few pockets could be a little too dry. Rio Grande do Sul will get some relief from dryness Thursday with follow up showers next week. Some areas in Paraguay received needed rain overnight and far southern areas will get rain Thursday. Parts of Argentina’s north need timely rainfall will get some, but additional moisture will be needed.

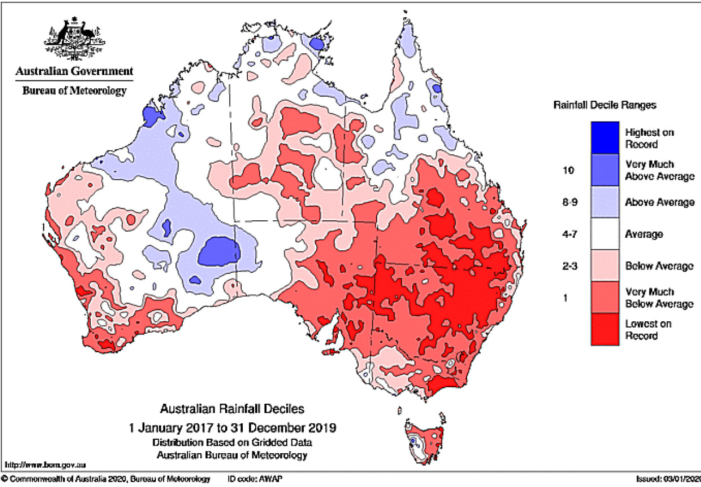

South Africa summer crop conditions should be largely beneficial over the next couple of weeks. Australia crops will continue hot and too dry for change, although it would not be surprising to see some rain in eastern parts of the nation later this month.

India’s winter crops are in very good condition and should remain that way for the next two weeks. Summer crop harvesting in the south will continue around brief periods of rain.

China rapeseed conditions will have potential for improvement in the spring after this week’s storm system brought significant moisture to the production region. A follow up storm system will see to it the region is plenty moist in the spring.

Southern Europe and the southwestern parts of the CIS will dry out for a while, but winter crops are dormant or semi-dormant and will not be bothered. A boost in precipitation will be needed in the late winter prior to the start of spring growth.

Overall, weather today will likely provide a mixed influence on market mentality with a slight bearish bias.

MARKET WEATHER MENTALITY FOR WHEAT:

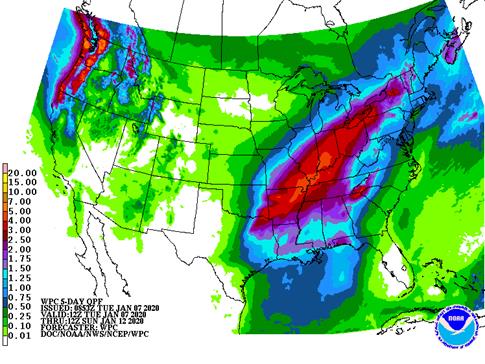

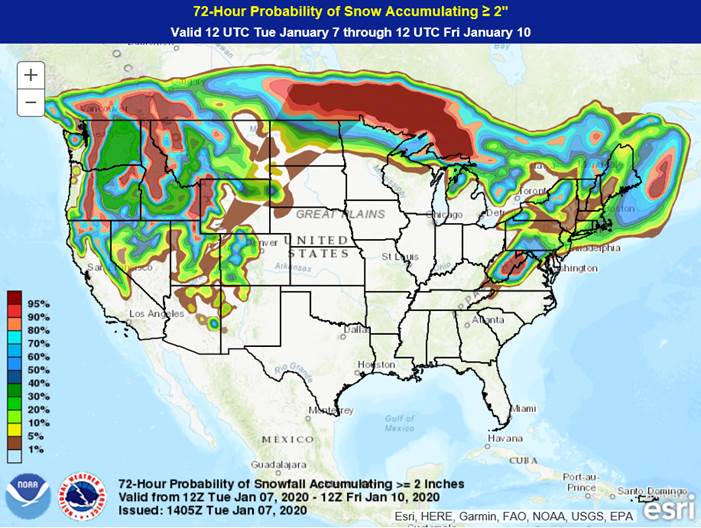

Winter crop conditions around the world are either in fair to good condition or poised for improvement. Recent moisture in the United States will be good for spring crop development. Snow will develop in the northwestern U.S. Plains before bitter cold conditions evolve in the next week to ten days to prevent winterkill.

Ukraine, southern Russia and Kazakhstan are still snow free and some winter crops are not well established due to dryness and change is needed by spring to improve crops.

There is no risk of crop threatening cold in Russia, Europe or most of China’s key winter crop production areas for the coming week to ten days. Winter crops are not as well established as they should be in some areas of southeastern Europe locations or in parts of China, but recent rain and snow in eastern China will see to it that big improvements occur prior to the start of aggressive crop development in the spring.

India’s winter crops are poised to perform quite well this year and rain in Pakistan Sunday into Monday will improve the outlook there as well.

Dryness in northern Africa will be closely monitored with southwestern Morocco the only area at risk of lower production today but drying in northern Morocco and northwestern Algeria will continue for a while.

Overall, weather today will likely produce a mixed influence on market mentality.

Source: World Weather Inc. and FI

- New Zealand global dairy trade auction

WEDNESDAY, JAN. 8:

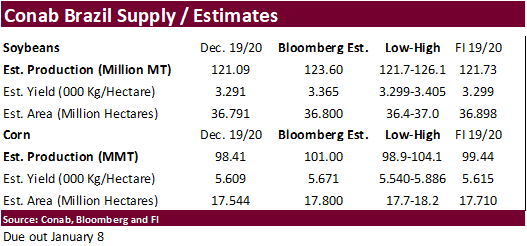

- Conab releases 4th estimate for Brazil’s soy, corn crops

THURSDAY, JAN. 9:

- USDA weekly crop net-export sales for corn, soybeans, wheat, 8:30am

- Port of Rouen data on French grain exports

- United Nation’s FAO Food Price Index

- Australia’s Bureau of Meteorology releases climate statement

- New Zealand commodity price

FRIDAY, JAN. 10:

- USDA’s monthly World Agricultural Supply and Demand (WASDE) report, noon

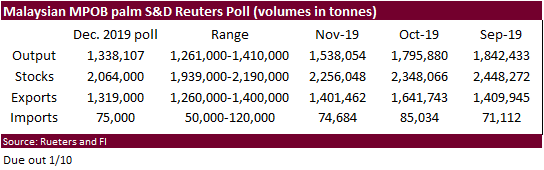

- Malaysia end-2019 palm oil stocks, production, export numbers; Jan. 1-10 palm oil export data from AmSpec, Intertek and SGS

- U.S. winter wheat seeding forecast

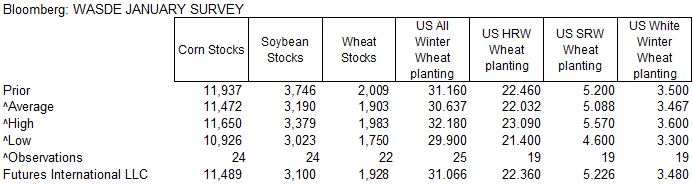

- USDA quarterly wheat, barley, corn, soybean stocks, noon

- ICE Futures Europe weekly commitments of traders report on coffee, cocoa, sugar positions ~1:30pm (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

Source: Bloomberg and FI

US Trade Balance (USD) Nov: -43.1B (est -43.7B ; prevR -46.9B ; prev -$47.2B)

US Good Trade Balance (USD) Nov: -62.99B (prev -63.19B)

US Factory Orders (M/M) Nov: -0.7% (est -0.8%; prev R 0.2%)

– Factory Orders Ex-Transportation (M/M) Nov: 0.3% (prev R 0.3%)

– Durable Goods Orders (M/M) Nov F: -2.1% (est -2.0%; prev -2.0%)

– Durables Ex-Transportation (M/M) Nov F: -0.1% (prev 0.0%)

– Cap Goods Orders Nondef Ex-Air Nov F: 0.2% (prev 0.1%)

– Cap Goods Ship Nondef Ex-Air Nov F: -0.3% (prev -0.3%)

Corn.

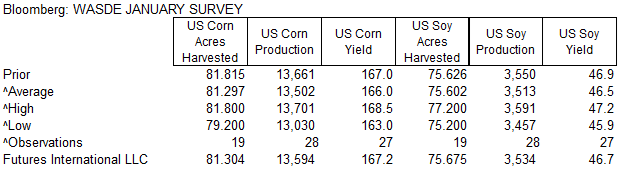

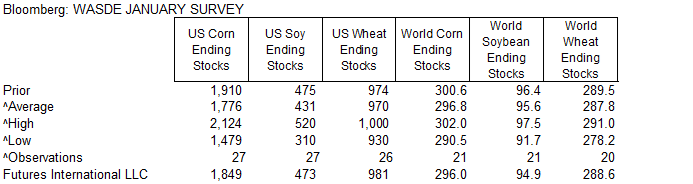

· According to a Bloomberg average, traders are looking for a 518,000-acre cut in the US corn harvested area to 81.297 million acres. For the soybean area, the average is a touch higher than USDA November (75.626 million). A Reuters survey calls for US corn production to decrease nearly 150 million bushels from November (0.8 bu lower yield). For soybeans, traders are looking for production to decline 38 million bushels (0.3 lower yield).

· China will leave their grain import quotas unchanged despite heavy criticism by US trade officials. China’s annual quota for wheat is 9.64 million tons, 7.2 million tons for corn and 5.32 million tons for rice.

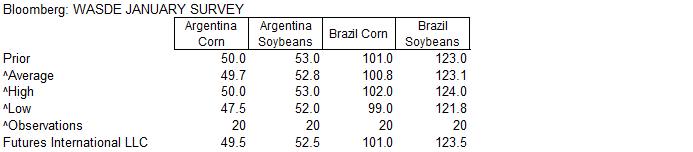

· Corn and Soybean Advisory: 2019/20 Brazil Corn Estimate lowered 1.0 mt to 101.0 Million Tons

· Gold was up about $2.70 as of 1:30 pm CT.

· USD was 35 points higher.

Baltic Dry Index: LT 791 on 1/7/20, down 19 sessions

Down 299 from a week ago, or 27%

Down 49% month over month

Down 38% from December 31, 2018

Record high was 11,793 on 5/20/2008

CRB Index is up 2.8% from this time last month and up 9.7% from the end of 2018.

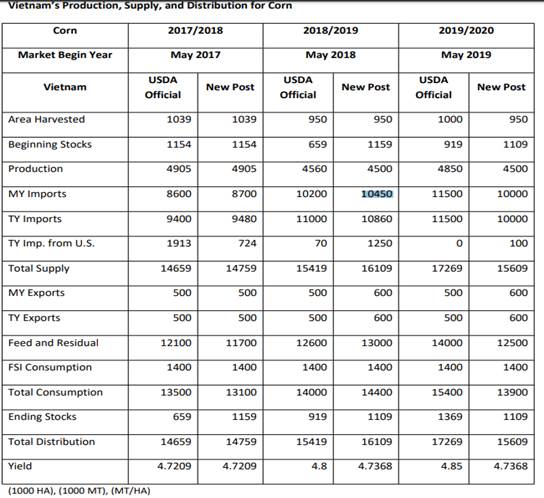

- Revised: India’s MMTC delayed their import tender for 175,000 tons (50k previously) of non-GMO corn from Jan 7 to January 14, valid until January 22, for shipment by February 10. Another source put shipment by Jan 22.

· Soybeans traded lower in a risk off session and technical selling. USDA is set to release their annual crop production report on Friday. Cash market was a little weaker and USD was up about 31 points in early afternoon trading. Recent rains across South America are seen beneficial for the corn and soybean crops.

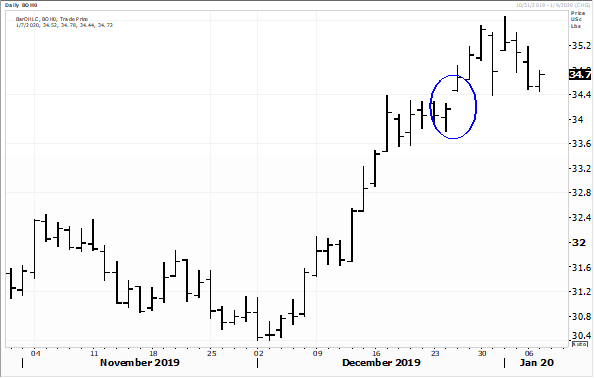

· March soybeans rebounded to settle 0.75 cent lower at $9.4400, March meal down $1.60 at $301.30/short ton, and March soybean oil up points at 34.74 cents. The March soybean crush increased 0.50 cent at 101.75 cents.

· A group in India is campaigning palm oil end users to stop importing palm oil from Malaysia.

· There was talk Argentina may suspend their 3-percentage point increase on agriculture taxes.

· Corn and Soybean Advisory: 2019/20 Brazil Soybean Estimate Lowered 1.0 mt to 122.0 Million

· Argentina producers continue to stage protests over higher export taxes.

· Traders are eying the March soybean oil gap of 34.25-34.38.

Source: Reuters

- USDA CCC seeks 14,650 tons of packaged vegetable oils for export to Yemen on January 7 with shipment February 1-29 (Feb. 16-Mar. 15 for plants at ports).

· US wheat futures traded lower on lack of fresh news despite traders looking for a lower 2020 US winter wheat area.

· March Chicago was up 0.25 cent (May down 0.50), March KC down 2.25 cents, and March Minn down 1.75 cents.

· Traders see support for March Chicago wheat at $5.4250, then $5.3850.

· March Paris wheat futures closed 0.25 euro higher at 188.50.

· Russian wheat export prices were a little softer on Tuesday.

- Jordan passed on 120,000 tons of wheat.

- Zimbabwe imported 30,000 tons of wheat from Argentina.

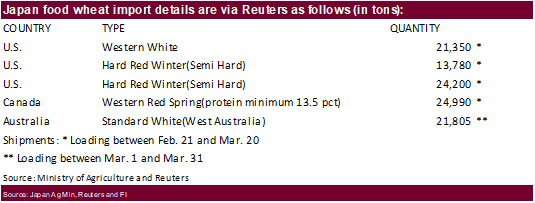

- Japan seeks 106,125 tons of wheat on Thursday.

- Results are awaited on Ethiopia in for 80,000 tons of durum wheat and another 75,000 tons of soft wheat.

- Morocco seeks to import about 354,000 tons of US durum wheat on January 9 for arrival by May 31.

- Mauritius seeks 95,000 tons of optional origin wheat flour on Jan. 10, 2020, for shipment between July 1, 2020, and June 20, 2021.

- Turkey seeks 550,000 tons of red milling wheat on January 14, minimum protein content of 13.5% for January 21-February 15 shipment.

- Turkey seeks 100,000 tons of durum wheat on January 14 for Jan 25-Feb 25 shipment.

· Syria seeks 200,000 tons of soft wheat from Russia on January 20, 2020.

Rice/Other

- Results awaited: Syria seeks 45,000 tons of white rice on Jan. 6, 2020. (Reuters) Short grain white rice of third or fourth class was sought. No specific country of origin was specified in the tender, traders said. Some 25,000 tons was sought for supply 90 days after confirmation of the order and 20,000 tons 180 days after supply of the first consignment. The rice was sought packed in bags and offers should be submitted in euros. A previous tender from the agency for 45,000 tons of rice with similar conditions had closed on Nov. 13.

- Results awaited: South Korea seeks another 30,764 tons of rice on Jan 7 for Sep-Oct arrival.

Details of the new tender are as follows:

TONNES(M/T) GRAIN TYPE ARRIVAL/PORT

20,000 Brown Medium Sept.1-Oct.31,2020/Busan

10,764 Brown Medium Sept.1-Oct.31,2020/Gwangyang

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.