From: Terry Reilly

Sent: Wednesday, January 08, 2020 5:15:34 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 01/08/20

PDF attached

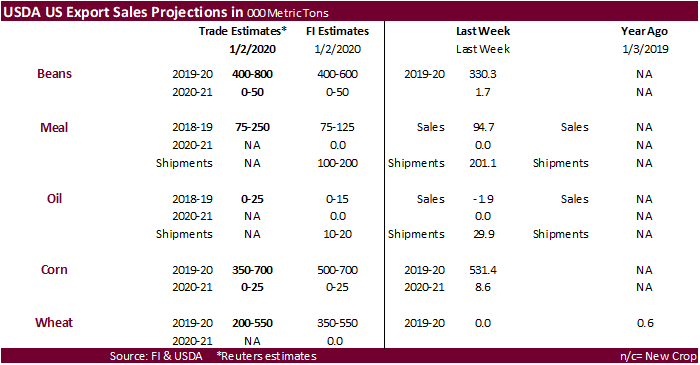

USDA

Weekly Export Sales Report Delayed

WASHINGTON,

Jan. 8, 2019 ― The U.S. Department of Agriculture’s Export Sales Report for the week ending Jan. 2 will be published at 8:30 a.m. EST on Friday, Jan. 10, instead of Thursday, Jan. 9, due to the weather-related closure of Washington, D.C.-area federal offices

on afternoon of Jan. 7.

![]()

MARKET

WEATHER MENTALITY FOR CORN AND SOYBEANS:

Weather

conditions in many Brazil and Argentina crop areas will be favorable over the next two weeks, although a close watch on the rain distribution is warranted. A few pockets could be a little too dry. Rio Grande do Sul will get some relief from dryness Thursday

into the weekend. Some areas in Paraguay received needed rain Monday and far southern areas will get rain Thursday into the weekend. Parts of Argentina’s north need timely rainfall will get some, but additional moisture will be needed.

South

Africa summer crop conditions should be largely beneficial over the next couple of weeks. Australia weather will continue hot and too dry for crop changes, although it would not be surprising to see some rain in eastern parts of the nation later this month.

India’s

winter crops are in very good condition and should remain that way for the next two weeks. Summer crop harvesting in the south will continue around brief periods of rain.

China

rapeseed conditions will have potential for improvement in the spring after this week’s storm system brought significant moisture to the production region. A follow up storm system will see to it the region is plenty moist in the spring.

Southern

Europe and the southwestern parts of the CIS will dry out for a while, but winter crops are dormant or semi-dormant and will not be bothered. A boost in precipitation will be needed in the late winter prior to the start of spring growth.

Overall,

weather today will likely provide a mixed influence on market mentality with a slight bearish bias prevailing.

MARKET

WEATHER MENTALITY FOR WHEAT:

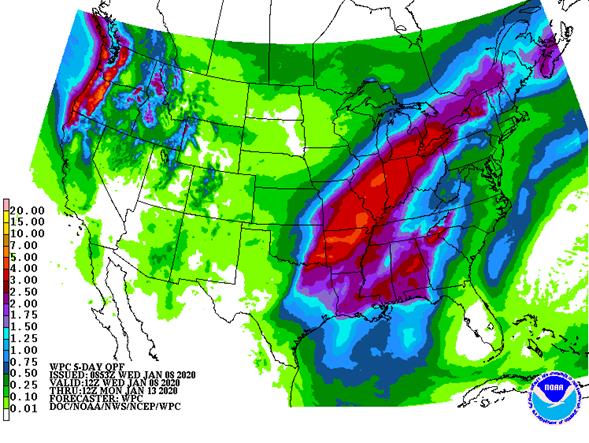

Winter

crop conditions around the world are either in fair to good condition or poised for improvement. Recent moisture in the United States will be good for spring crop development. Snow will develop in the northwestern U.S. Plains before bitter cold conditions

evolve in the next week to ten days to prevent winterkill.

Ukraine,

southern Russia and Kazakhstan are still snow free and some winter crops are not well established due to dryness and change is needed by spring to improve crops.

There

is no risk of crop threatening cold in Russia, Europe or most of China’s key winter crop production areas for the coming week to ten days. Winter crops are not as well established as they should be in some areas of southeastern Europe locations or in parts

of China, but recent rain and snow in eastern China will see to it that big improvements occur prior to the start of aggressive crop development in the spring.

India’s

winter crops are poised to perform quite well this year and rain in Pakistan Sunday into Monday will improve the outlook there as well.

Dryness

in northern Africa will be closely monitored with Morocco the only area at risk of lower production today but drying in northwestern Algeria will continue for a while.

Overall,

weather today will likely produce a mixed influence on market mentality.

Source:

World Weather Inc. and FI

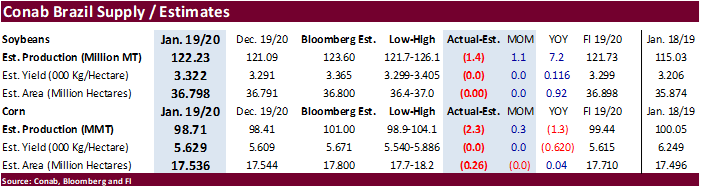

- Conab

releases 4th estimate for Brazil’s soy, corn crops

THURSDAY,

JAN. 9:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, 8:30am - Port

of Rouen data on French grain exports - United

Nation’s FAO Food Price Index - Australia’s

Bureau of Meteorology releases climate statement - New

Zealand commodity price

FRIDAY,

JAN. 10:

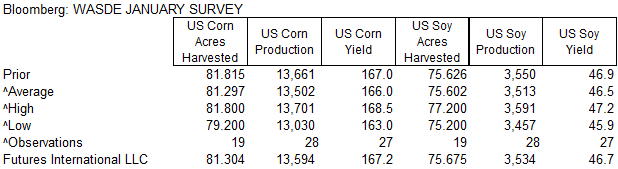

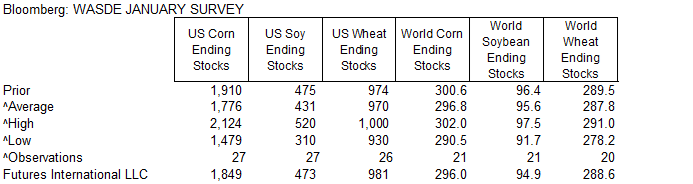

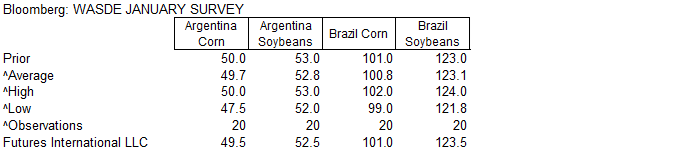

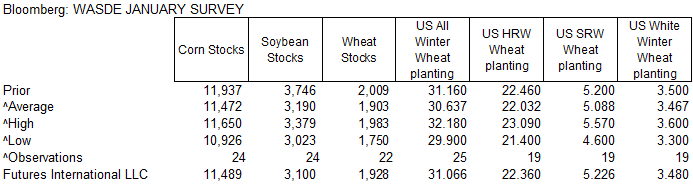

- USDA’s

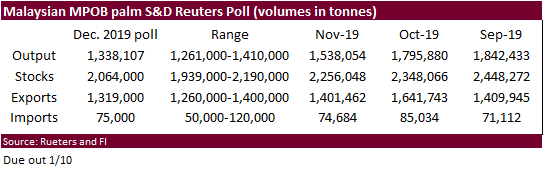

monthly World Agricultural Supply and Demand (WASDE) report, noon - Malaysia

end-2019 palm oil stocks, production, export numbers; Jan. 1-10 palm oil export data from AmSpec, Intertek and SGS - U.S.

winter wheat seeding forecast - USDA

quarterly wheat, barley, corn, soybean stocks, noon - ICE

Futures Europe weekly commitments of traders report on coffee, cocoa, sugar positions ~1:30pm (~6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

Source:

Bloomberg and FI

US

ADP Employment Change Dec: 202K (exp 160K; prev 124K)

US

DoE Crude Oil Inventories (W/W) 03-Jan: 1164K (est -3250K; prev -11463K)

–

DoE Distillate Inventories (W/W): 5330K (est 3500K; prev 8776K)

–

DoE Cushing OK Crude Inventories (W/W): -821K (prev -1449K)

–

DoE Gasoline Inventories (W/W): 9137K (est 3200K; prev 3212K)

–

Refinery Utilization (W/W): -1.50% (est 0.15%; prev 1.20%)

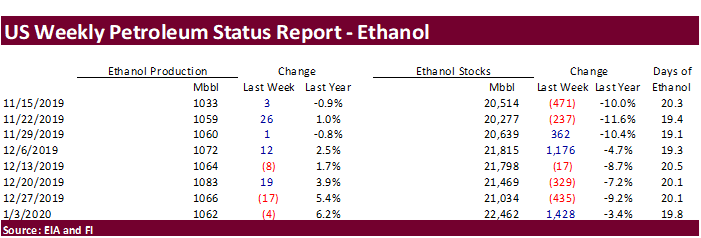

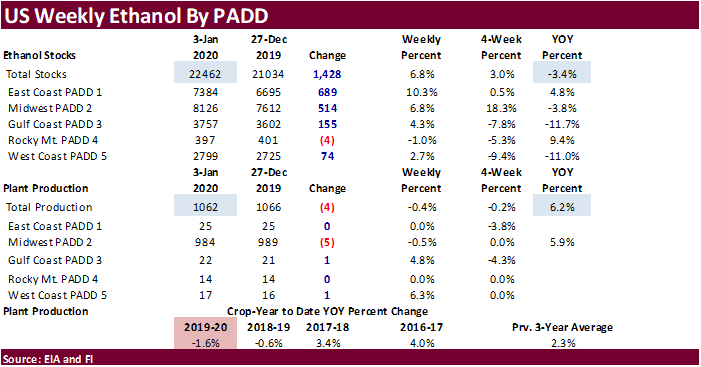

Corn.

・

Nearby corn futures were weaker (back months were up) following a higher USD, lower crude oil, positioning ahead of the USDA reports and China ethanol developments. Macro influences had a major impact on CBOT

wheat, soybean and corn prices today. Adding onto the bearish undertone in corn was a 6.8 percent increase in US ethanol stocks from the previous week, as reported by the EIA. Conab reported Brazil corn production (98.71) below a Bloomberg average but the

trade appeared to be shrugging off the update. Uncertainty over the size of the South American corn and soybean crop has not seem to be a large factor in prices lately. Traders are more concerned with geopolitical developments and positioning ahead of the

USDA January 10 reports. With this said, there were a considerable risk on/off activity in commodities today. WTI fell more than $3.00, and when the February contract broke below $60/barrel, there was a huge spike in corn volume. Theory is that funds were

shoring up long positions in WTI, and dumping money into corn and wheat, and possibly soybeans. Other than that, the fundamentals didn’t favor bull traders in corn, wheat or soybeans today, in our opinion. Unless you traded solely on Conab estimates.

・

March corn support is seen at $3.8075, then $3.7875.

・

Funds were even in corn.

・

Corn volatility is very low.

・

Baltic Dry Index fell another 2.3 percent or 18 points to 773. Lowest since April 2017 and down 20 consecutive sessions.

・

Gold was down about $14 as and Dow futures up 244 points.

・

USD was 29 points higher.

・

WTI crude oil dropped more than $3.00/barrel.

・

China suspended its initiative to boost the national ethanol blending target to 10 percent due to tight supply of corn stocks. In 2017 they announced a 10 percent blend mandate by 2020. This is perceived

to be negative for US corn futures as traders hoped China would increase US ethanol imports amid phase one trade deal. Reuters noted “Reaching the 2020 target would have required about 15 million tons of the biofuel annually, more than four times current

output, or some 45 million tons of corn, which is about 16% of the country’s current consumption.” Brazil has plans to ramp up corn for ethanol capacity. Like the US, Brazil would like to export ethanol to China. China corn reserves were projected around

50 to 60 million tons last fall, about a quarter where they were thought to be at in 2017.

・

Bulgaria plans to cull another 40,000 pigs due to another outbreak of African swine fever. Last year Bulgaria culled 130,000 pigs.

・

India reported a bird flu outbreak in Chhattisgarh (H5N1).

・

China reported a bird flu outbreak in Xinjiang (H5N6).

165

swans were infected.

・

The weekly USDA Broiler Report showed eggs set in the United States up 4 percent and chicks placed up 4 percent.

・

China sow herd increased 2.2 percent in December from November and is up 7 percent since September. China does not report the number of its sow heard but it was thought it declined 40 percent in September

compared to the previous year. Some analysts estimate 55 percent of the pig crop was lost since mid-2018. Poultry production was up 3 million tons or about 15% in 2019

U.S.

average retail gasoline prices in 2019 were slightly lower than in 2018

https://www.eia.gov/todayinenergy/detail.php?id=42435&src=email

-

South

Korea’s KOCOPIA bought 60,000 tons of corn at $218.28/ton c&f for arrival in March.

-

Under

the 24-hour reporting system, exporters sold 207,000 tons of corn to unknown for 2020-21 delivery.

-

Revised:

India’s MMTC delayed their import tender for 175,000 tons (50k previously) of non-GMO corn from Jan 7 to January

14,

valid until January 22, for shipment by February 10. Another source put shipment by Jan 22.