From: Terry Reilly

Sent: Thursday, January 09, 2020 3:24:53 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 01/09/20

PDF attached

USDA

Weekly Export Sales Report Delayed

WASHINGTON,

Jan. 8, 2019 ― The U.S. Department of Agriculture’s Export Sales Report for the week ending Jan. 2 will be published at 8:30 a.m. EST on Friday, Jan. 10, instead of Thursday, Jan. 9, due to the weather-related closure of Washington, D.C.-area federal offices

on afternoon of Jan. 7.

![]()

MARKET

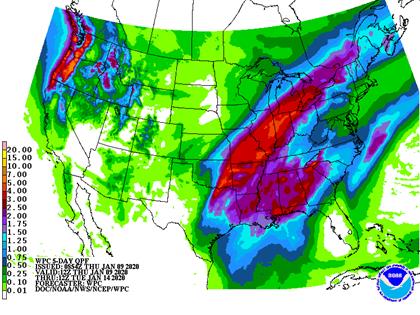

WEATHER MENTALITY FOR CORN AND SOYBEANS:

Weather

conditions in many Brazil and Argentina crop areas will be favorable over the next two weeks, although a close watch on the rain distribution is warranted. A few pockets could be a little too dry. Rio Grande do Sul will get some relief from dryness over the

coming week with northern soybeans benefiting more than southern corn or rice production areas. Paraguay will receive additional rain periodically over the coming week to further improve soil and crop conditions. The same is expected over all neighboring areas.

Parts

of Argentina’s north need timely rainfall and will get some over the coming week to ten days.

South

Africa summer crop conditions should be largely beneficial over the next couple of weeks. Australia weather will continue hot and too dry for crop changes, although it would not be surprising to see some rain in eastern parts of the nation later this month.

India’s

winter crops are in very good condition and should remain that way for the next two weeks. Summer crop harvesting in the south will continue around brief periods of rain.

China

rapeseed conditions will have potential for improvement in the spring after this week’s storm system brought significant moisture to the production region. A follow up storm system will see to it the region is plenty moist in the spring.

Southern

Europe and the southwestern parts of the CIS will be dry biased for a while, but winter crops are dormant or semi-dormant and will not be bothered. A boost in precipitation will be needed in the late winter prior to the start of spring growth.

Overall,

weather today will likely provide a mixed influence on market mentality with a slight bearish bias prevailing.

MARKET

WEATHER MENTALITY FOR WHEAT:

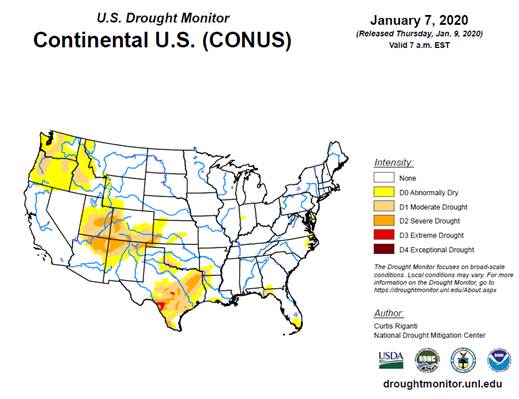

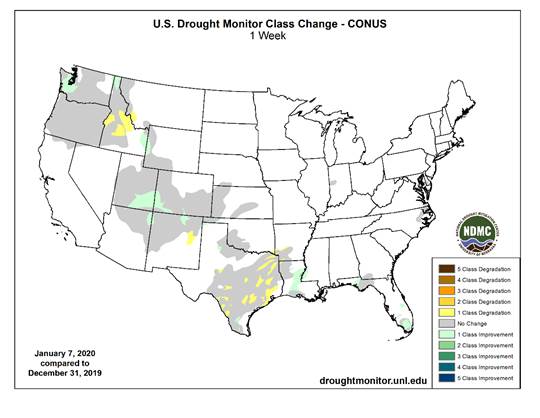

Winter

crop conditions around the world are either in fair to good condition or poised for improvement. Recent moisture in the United States will be good for spring crop development. Snow is accumulating in the northwestern U.S. Plains before bitter cold conditions

evolve in the next week to ten days to prevent winterkill.

Portions

of Ukraine, southern Russia and Kazakhstan are still snow free and some winter crops are not well established due to dryness and change is needed by spring to improve crops.

There

is no risk of crop threatening cold in Russia, Europe or most of China’s key winter crop production areas for the coming week to ten days. Winter crops are not as well established as they should be in some areas of southeastern Europe locations or in parts

of China, but recent rain and snow in eastern China will see to it that big improvements occur prior to the start of aggressive crop development in the spring.

India’s

winter crops are poised to perform quite well this year and rain in Pakistan Sunday into Monday will improve the outlook there as well.

Dryness

in northern Africa will be closely monitored with Morocco the only area at risk of lower production today but drying in northwestern Algeria will continue for a while.

Overall,

weather today will likely produce a mixed influence on market mentality.

Source:

World Weather Inc. and FI

US

CPC:

no active El Nino or La Nina

- Port

of Rouen data on French grain exports - United

Nation’s FAO Food Price Index - Australia’s

Bureau of Meteorology releases climate statement - New

Zealand commodity price

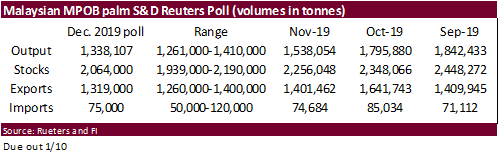

FRIDAY,

JAN. 10:

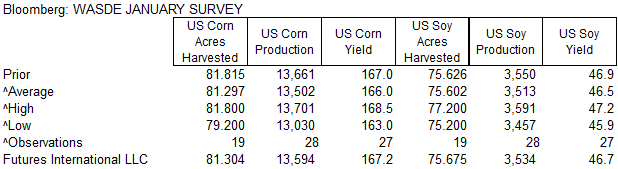

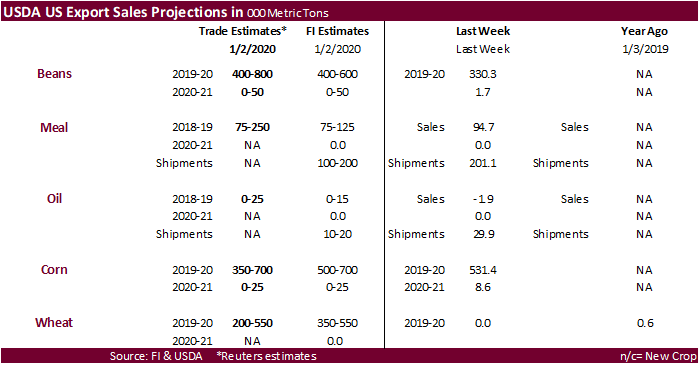

- USDA

weekly crop net-export sales for corn, soybeans, wheat, 8:30am - USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, noon - Malaysia

end-2019 palm oil stocks, production, export numbers; Jan. 1-10 palm oil export data from AmSpec, Intertek and SGS - U.S.

winter wheat seeding forecast - USDA

quarterly wheat, barley, corn, soybean stocks, noon - ICE

Futures Europe weekly commitments of traders report on coffee, cocoa, sugar positions ~1:30pm (~6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

Source:

Bloomberg and FI

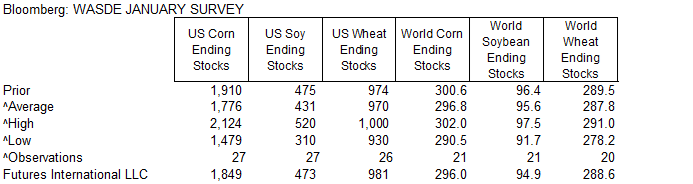

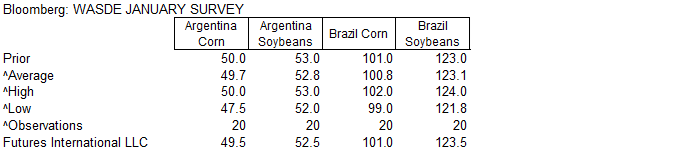

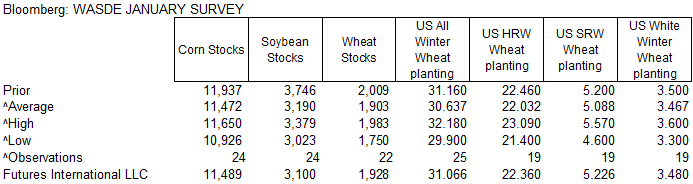

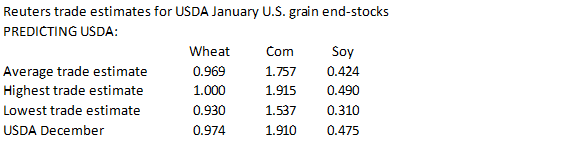

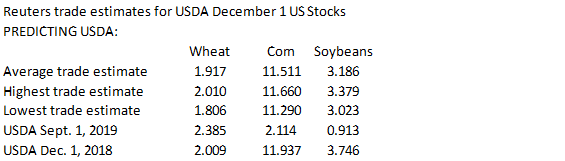

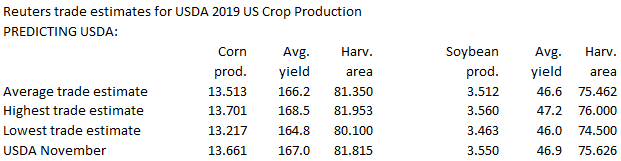

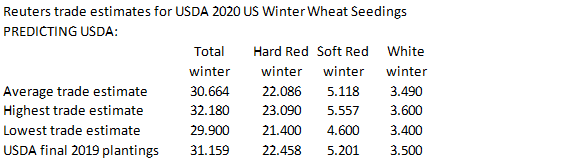

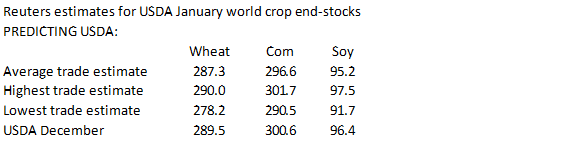

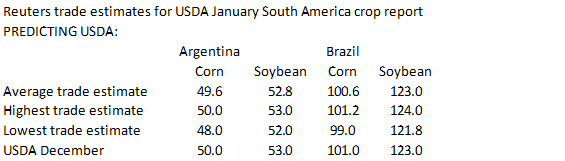

Reuters

Estimates

Source:

Reuters and FI

Bloomberg

Bull/Bear survey

・

Soybeans: Bullish: 10 Bearish: 9 Neutral: 5

・

Corn: Bullish: 9 Bearish: 4 Neutral: 11

・

Wheat: Bullish: 6 Bearish: 10 Neutral: 8

・

Raw sugar: Bullish: 2 Bearish: 1 Neutral: 4

・

White sugar: Bullish: 4 Bearish: 0 Neutral: 3

・

White-sugar premium: Bullish: 5 Bearish: 0 Neutral: 2

・

China Says Liu He to Travel to U.S. for Trade Deal Signing

https://www.bloomberg.com/news/articles/2020-01-09/china-says-liu-to-visit-washington-from-jan-13-for-deal-signing

・

US Initial Jobless Claims Jan 4: 214K (est 220K ; prevR 223K ; prev 222K)

・

US Continuing Claims Jan 9: 1.803M (est 1.72M ; prev 1.728M)

Corn.

・

Corn futures traded two-sided, ending 0.50-1.25 cents on positioning.

・

Funds were net sellers of an estimated 6,000 corn contracts.

・

March corn traded above its 50-day moving average and touched its 100-day moving average but ended below both levels.

・

Gold was down about $8.60 as of 1:27 pm CT and Dow futures up 136 points.

・

USD was 13 points higher as of 1:27 pm CT and WTI slightly higher.

・

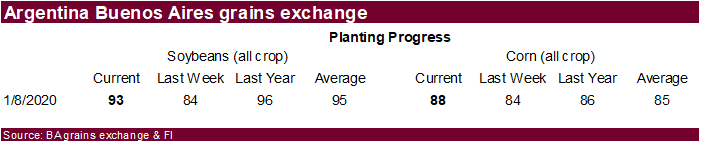

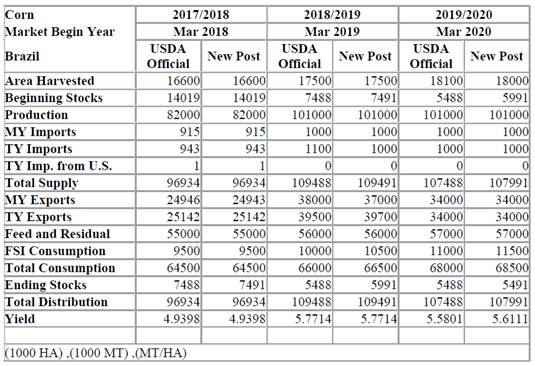

Agroconsult sees the 2019-20 Brazil corn area up 2 percent to 17.8 million hectares, and production at 101.6 million tons, down 1.3 percent from previous year.

・

Poland reported 55 outbreaks of African swine fever in wild boar near the German border last month. Germany has been building fences to prevent a spread of the disease. A discovery of ASF in Germany would

be a huge blow for the country as they are large exporters of pork.

・

Traders will be watching the phase one trade signing in Washington next week.

・

Crumbling Corn Adding to Woes for American Grain Exporters

https://www.bloomberg.com/news/articles/2020-01-08/crumbling-pale-corn-adds-to-woes-for-american-grain-exporters

・

INTL FCStone estimated summer-corn output in Rio Grande do Sul at 4.8 million tons, down from 6 million tons last month. EMATER/RS full season corn is 5.95 million tons. RGSD really has only one season for

corn due to its climate.

・

USDA is set to release their annual crop production report on Friday. U.S. corn production seen 159m bu lower, yields seen a point lower at 166 bu/acre. Dec. 1 corn stocks seen at 11.47b bu, 465m less than

in Dec. 2018.

・

EIA: Natural gas prices in 2019 were the lowest in the past three years

https://www.eia.gov/todayinenergy/detail.php?id=42455&src=email

・

FAS USDA Attaché: Brazil March-February corn exports could decline to 34 million tons from their forecast of 37 million year earlier.

https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Grain%20and%20Feed%20Update_Brasilia_Brazil_09-27-2019

-

South

Korea’s NOFI bought 69,000 tons of optional origin corn at $211.95/ton c&f for arrival around April 15.

-

South

Korea’s FLC bought 66,000 tons of US corn at $207.49/ton c&f for shipment between Jan. 25 and Feb. 25 from the U.S. Pacific Northwest coast.

-

Yesterday

South Korea’s KOCOPIA bought 60,000 tons of corn at $218.28/ton c&f for arrival in March.

-

Revised:

India’s MMTC delayed their import tender for 175,000 tons (50k previously) of non-GMO corn from Jan 7 to January

14,

valid until January 22, for shipment by February 10. Another source put shipment by Jan 22.