From: Terry Reilly

Sent: Wednesday, January 22, 2020 3:20:50 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 01/22/20

PDF attached

![]()

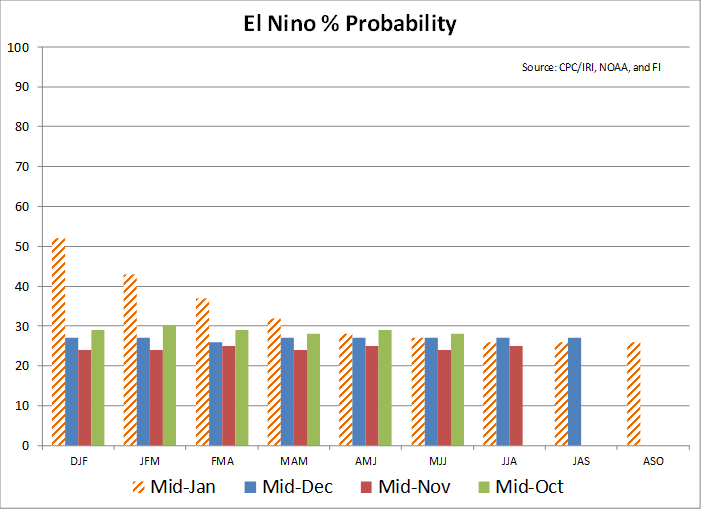

Mid-January update: Climate Prediction Center/NCEP/NWS and the International Research Institute for Climate and Society mentioned there is no active ENSO for the Northern Hemisphere spring 2020 (~60% chance), continuing through summer 2020 (~50% chance).

MARKET WEATHER MENTALITY FOR CORN AND SOYBEANS:

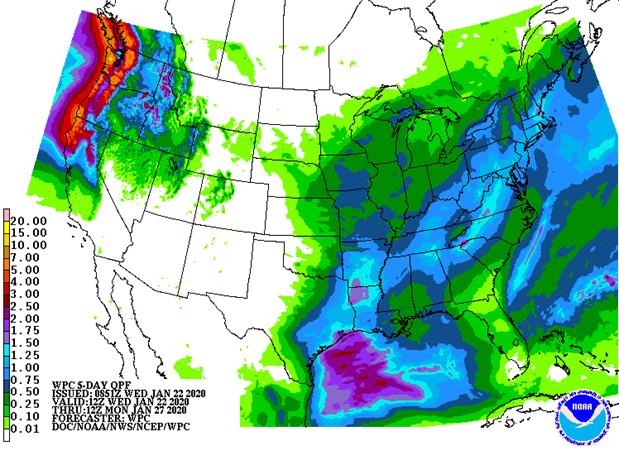

Rain is expected to fall more erratically in Brazil and Argentina over the next two weeks which may lead to a few areas of flooding in Minas Gerais and while a few areas in southern Brazil and Argentina become a little drier biased. Timely rain will be needed in the drier areas to prevent dryness from becoming a widespread significant problem.

In the meantime, South Africa rainfall will be erratic for a while with eastern areas more favored for rain than the west. A greater need for moisture will soon evolve in the western production areas.

Recent rain in eastern Australia improved some of the irrigated summer crops and more rain is expected in eastern and northern Queensland and northeastern New South Wales through Saturday before the region dries out and heats up again.

India’s winter oilseed crop is suspected of being in better than usual condition and China will see improved establishment in the spring when seasonal warming occurs. China’s winter crops were not well established last autumn, but have experienced improved precipitation in recent weeks that will be of use to establishment when it warms up once again.

Overall, weather today may provide a bearish bias to market mentality.

MARKET WEATHER MENTALITY FOR WHEAT:

Little to no winterkill has likely occurred in key wheat production areas in the Northern Hemisphere so far this winter, although a few crops in Montana might have been negatively impacted by recent cold weather.

In the meantime, India is poised to have a high yielding crop this year. Crops in the Middle East are expected to yield relatively well and China weather has improved in recent weeks and that should translate into better crop establishment during the spring. Hebei, China still needs moisture.

Southeastern Europe crops are not as well established as they should be, but winter weather has been mild leaving very little threat of crop damage thus far. Much of Russia has snow on the ground, but temperatures are well above average and expected to stay warm minimizing the threat of winterkill. Some snowmelt is expected in Russia, however.

Overall, weather today will likely have a neutral to slightly bearish bias on market mentality.

Source: World Weather Inc. and FI

- USDA monthly cold storage – pork, beef, poultry, 3pm

- EARNINGS: Barry Callebaut 1Q results

THURSDAY, JAN. 23:

- USDA total milk, red meat production, 3pm

FRIDAY, JAN. 24:

- USDA weekly crop net-export sales for corn, soybeans, wheat, 8:30am

- ICE Futures Europe weekly commitments of traders report on coffee, cocoa, sugar positions ~1:30pm (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

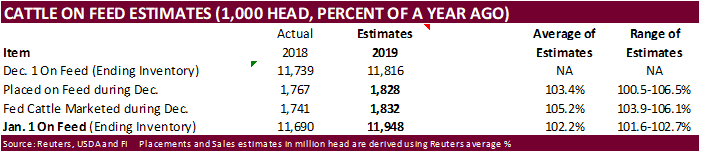

- U.S. poultry slaughter, cattle on feed (25 jan 1.30 am)

- HOLIDAY: China

Source: Bloomberg and FI

· US Chicago Fed National Activity Index (Dec): -0.35 (est 0.13, prevR 0.41)

· Canada New Housing Price Index (M/M) Dec: 0.2% (est 0.0%, prev -0.1%)

· Canada New Housing Price Index (Y/Y) Dec: 0.1% (est -0.1%, prevR -0.1%)

· Canada CPI NSA (M/M) Dec: 0.0% (est 0.0%, prev -0.1%)

· US Inventory Of Homes For Sale Dec: 1.40M Units, 3.0 Months’ Worth

– National Median Home Price For Existing Homes (USD) Dec: 274.5K or +7.8% From Dec 2018

Corn.

· Corn futures ended 1.25 cents higher in March, 0.75 cent higher in May, unchanged in July and slightly lowered in the deferred months. South Korean buying interest and talk of Egypt in for corn underpinned nearby corn. South Korea NOFI group bought 134,000 tons. They were in for three cargos. It was for optional origin, but some traders noted it could have been from the US as they are cheapest in the world.

· Funds were net buyers of an estimated 5,000 corn contracts.

· This week US ethanol producers in the western Corn Belt are paying as much as $4.00/bu on lack of producer selling. Dayton, OH went up 9 cents on their corn bids. Others in the eastern Corn Belt went up 3-9 cents.

· The Baltic Dry Index fell 66 points or 9.6% to 623 points. The capesize index slipped 170 points, or 34.3%, to 325.

· Italian tax police confiscated an illegal shipment of pork imported from China. 9.5 tons of pork as destroyed after authorities found the meat hidden under a shipment of vegetables in a storage facility near Padua (Northern Italy’s Veneto region). African swine fever virus is still showing up at local (China) slaughterhouse samples.

· The German AgMin confirmed a case of African swine fever was discovered in Poland in a wild boar, only 12 kilometers (7.4 miles) from the German border.

· The USDA Broiler report showed eggs set in the US up 4 percent and chicks placed up 4 percent. Cumulative placements from the week ending January 4, 2020 through January 18, 2020 for the United States were 571 million, up 4 percent from the same period a year earlier.

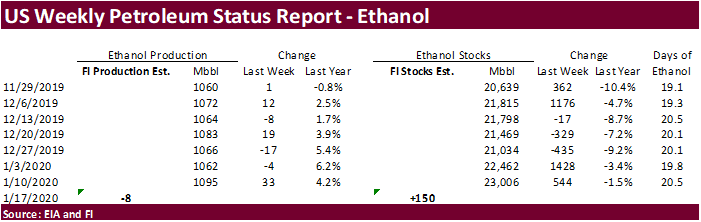

· A Bloomberg poll looks for weekly US ethanol production to be down 17,000 at 1.078 million barrels from the previous week and stocks to increase 224,000 barrels to 23.230 million.

· SK’s NOFI group bought 134,000 tons of corn. They were in for three cargos. It was for optional origin, but some traders noted it could have been from the US. One cargo was bought at $219.55 a ton c&f for arrival around April 20. Second cargo of 65,000 tons was bought at $218.88 a ton c&f for arrival around May 1. This cargo for arrival around May 10 was rejected. Either over the weekend or on Monday South Korea’s MFG bought 69,000 tons of corn at $217.90 a ton c&f for shipment by April 10. Last week KFA paid $216.30/ton c&f for arrival around April 20.

- Algeria seeks 20,000 tons of corn and 30,000 tons of soybean meal on January 23 for March 1-15 and February 10-25 shipment, respectively.

- CBOT March corn is seen in a $3.70 and $4.05 range