From: Terry Reilly

Sent: Thursday, January 23, 2020 2:16:01 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 01/23/20

PDF attached

MARKET WEATHER MENTALITY FOR CORN AND SOYBEANS:

Worry in the market place over wet weather in parts of northern Brazil and drying in southern Brazil as well as Argentina will continue to direct the market from a weather perspective for a while. However, some caution is needed here because conditions in both countries have been and still are extremely good. A week to ten days of these anomalies may not hinder crops as much as some folks want to believe and some caution is needed. The only states in Brazil that will become too wet are Goias and Minas Gerais and that will only be the case for a week to maybe ten days. Most of the areas expected to dry out for a while will see subsoil moisture carry crops for a while limiting the period in which crop stress is expected to be a threat to production. The key to production will be what happens late in the first week of February and on into the second week – if drying prevails there will be a threat to some crop yields.

In the meantime, South Africa rainfall will be erratic for a while with eastern areas more favored for rain than the west. A greater need for moisture will soon evolve in the western production areas.

Recent rain in eastern Australia improved some of the irrigated summer crops and more rain is expected in eastern and northern Queensland and northeastern New South Wales through Saturday before the region dries out and heats up again.

India’s winter oilseed crop is suspected of being in better than usual condition and China will see improved establishment in the spring when seasonal warming occurs. China’s winter crops were not well established last autumn, but have experienced improved precipitation in recent weeks that will be of use to establishment when it warms up once again.

Overall, weather today may provide a mixed bias to market mentality.

MARKET WEATHER MENTALITY FOR WHEAT:

Not much has changed relative to that of Wednesday.

Little to no winterkill has likely occurred in key wheat production areas in the Northern Hemisphere so far this winter, although a few crops in Montana might have been negatively impacted by recent cold weather.

In the meantime, India is poised to have a high yielding crop this year. Crops in the Middle East are expected to yield relatively well and China weather has improved in recent weeks and that should translate into better crop establishment during the spring. Hebei, China still needs moisture.

Southeastern Europe crops are not as well established as they should be, but winter weather has been mild leaving very little threat of crop damage thus far. Much of Russia has snow on the ground, but temperatures are well above average and expected to stay warm minimizing the threat of winterkill. Some snowmelt is expected in Russia, however.

Overall, weather today should have a neutral to slightly bearish bias on market mentality.

Source: World Weather Inc. and FI

- USDA total milk, red meat production, 3pm

FRIDAY, JAN. 24:

- USDA weekly crop net-export sales for corn, soybeans, wheat, 8:30am

- ICE Futures Europe weekly commitments of traders report on coffee, cocoa, sugar positions ~1:30pm (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

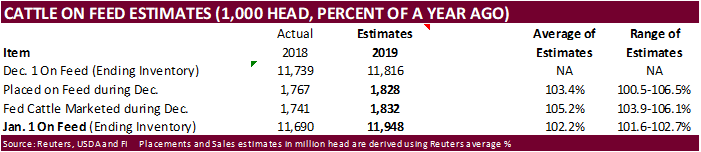

- U.S. poultry slaughter, cattle on feed (25 jan 1.30 am)

- HOLIDAY: China

Source: Bloomberg and FI

· US Initial Jobless Claims 211K (est 214K; prevR 205K; prev 204K)

-US Continuing Claims 1.731 Mln (est 1.750 Mln; prevR 1.768 Mln; prev 1.767 Mln)

Corn.

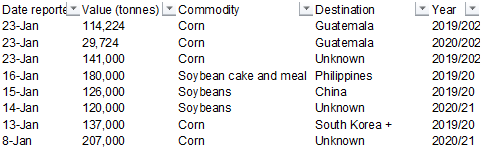

· Corn futures trended lower early then rallied on tightening supplies. Nearby futures broke above a short-term trading range, and March corn traded at its highest level since November. At 9:35 am CT, 10,000 CH stopped out $3.92-$9.93. March/May spread firmed on lack of US producer selling. Corn basis at Burns Harbor, IN increased 13 cents to 5 under. Basis was up 3 cents for Cincinnati, OH and increased 1-2 cents at two IL river terminal locations. South American supplies for old crop are tightening and end users are turning to the US to source corn through May. Under the 24-hour announcement system, USDA reported a total of 284,948 tons of corn was sold to Guatemala and Unknown.

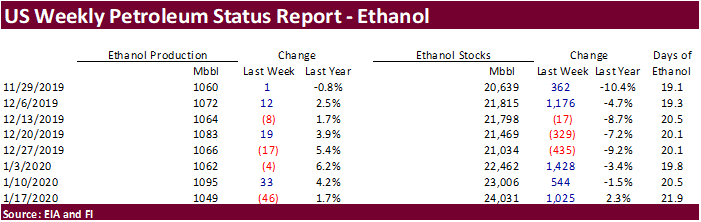

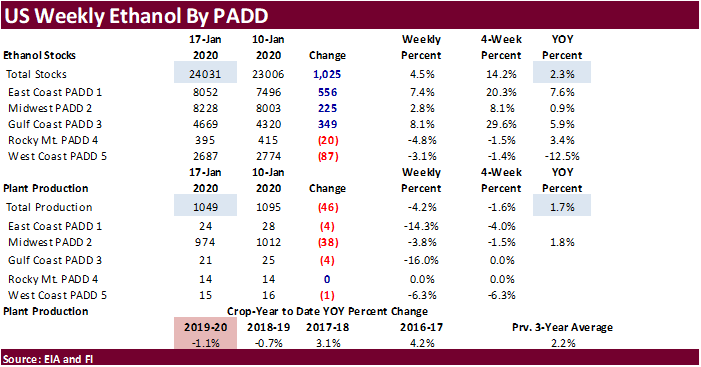

· The weekly EIA ethanol production and stocks report was perceived to be bearish.

· WTI crude was under pressure by more than $1.10 and USD turned 18 higher by 1:30 CT.

· The Baltic Dry Index fell 47 points or 7.5% to 576 points. The capesize index .BACI slipped 118 points, or 36.3%, to 207.

· Meanwhile the surplus of supertankers in the Middle East during the next month is set to increase to more than double the usual level for this time of year, according to a weekly Bloomberg survey.

· The BA Grains Exchange reported Argentina corn plantings at 95 percent, up from 91 percent previous week and compares to 93 percent last year and 94 average.

· South Africa will supply Zimbabwe millers 100,000 tons of corn.

· IGC increased their estimate of the global corn production estimate by 8 million tons to 1.111 billion tons, below their forecast of 1.129 million tons in 2018-19.

· U.S. Dec. pork supplies in cold storage were 581 million pounds, up 15% from Dec. 2018.

· The US produced 9.8 billion eggs in December, up 3.9 percent from Dec 2018.

- Results awaited: Algeria seeks 20,000 tons of corn and 30,000 tons of soybean meal for March 1-15 and February 10-25 shipment, respectively. Lowest offer for 20,000 tons of corn was $212.25 a ton c&f and 30,000 tons of soymeal was $394.50 a ton.

- CBOT March corn is seen in a $3.70 and $4.05 range