From: Terry Reilly

Sent: Monday, January 27, 2020 2:05:53 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 01/27/20

PDF attached does not include the daily estimate of funds. It will be sent out later.

Coronavirus fears drove commodities lower. Some of the ag markets closed well off session lows.

MARKET WEATHER MENTALITY FOR CORN AND SOYBEANS:

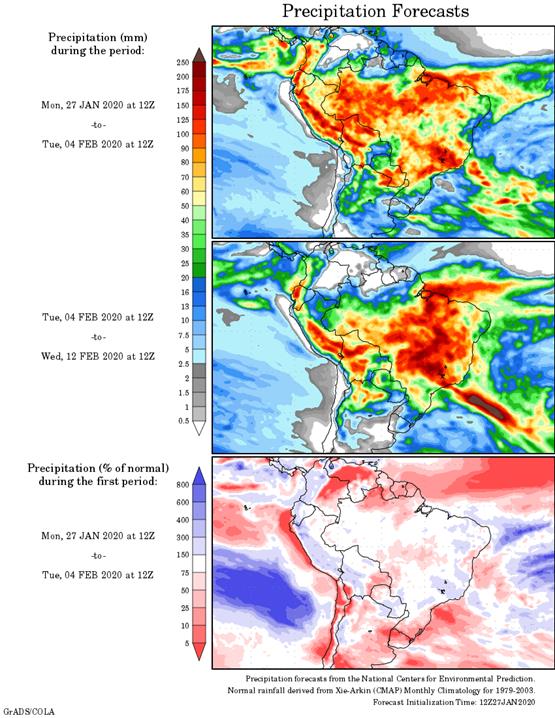

There is still not much reason for concern over Brazil summer crop conditions, but Argentina is still a little worry. Argentina is not likely to see failing rainfall over a large enough area to move markets in a big manner especially not with Brazil’s weather so good.

Weather in eastern Australia improved briefly during the weekend, but this week will trend drier again. South Africa will dry down for a while raising some potential for mild crop stress.

Southeast Asia rainfall will be well mixed and mostly supportive of palm oil development. Rain in China and India will be typical of this time of year with winter crops poised for improvement as spring approaches because of recent past precipitation.

Southeastern Europe remains too dry, but there is potential for some rain and mountain snow this week from there into Kazakhstan possibly easing long term dryness in Romania, the lower Danube River Basin and parts of Ukraine. The moisture boost will be important for spring planting and early season winter rapeseed development.

Overall, weather today will produce a neutral to slightly bearish bias to market mentality.

MARKET WEATHER MENTALITY FOR WHEAT: There is still no risk of winterkill around the world for the next couple of weeks. That will leave winter crop conditions mostly unchanged. China crops will improve in the spring because of recent precipitation. India’s crops are still expected to yield extremely well.

There is still some concern over Morocco weather and the lack of rain in the southwest may harm production. A few other areas in northern Africa will also need some timely rain in February to protect production potentials.

Middle East wheat conditions are rated favorably, but would benefit from some greater rain. Southeastern Europe, Ukraine, southern Russia and Kazakhstan may get some needed precipitation in the next two weeks to improve soil moisture for spring crop development. Warm weather will continue to minimize the risk of winterkill and some areas may become snow free.

U.S. crops are not likely to experience much change in the next two weeks and the same is true for southeastern Canada.

Overall, weather today will have a neutral bias on market mentality.

Source: World Weather Inc. and FI

Source: World Weather Inc. and FI

- USDA weekly corn, soybean, wheat export inspections, 11am

- MARS crop bulletin – monthly report on crop conditions in Europe.

- EU weekly grain, oilseed import and export data

- Ivory Coast cocoa arrivals

- HOLIDAY: China, Australia, Hong Kong, Malaysia, Singapore

TUESDAY, JAN. 28:

- AmSpec, Intertek, SGS: Malaysia’s Jan. 1-25 Palm Oil Exports, Kuala Lumpur

- HOLIDAY: China, Hong Kong

WEDNESDAY, JAN. 29:

- EIA U.S. weekly ethanol inventories, production, 10:30am

- HOLIDAY: China

THURSDAY, JAN. 30:

- USDA weekly crop net-export sales for corn, soybeans, wheat, 8:30am

- GUS Polish pig population data, Warsaw

- HOLIDAY: China

FRIDAY, JAN. 31:

- ICE Futures Europe weekly commitments of traders report on coffee, cocoa, sugar positions ~1:30pm (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- U.S. agricultural prices paid and received, cattle inventory

- Paris Grain Day conference. Topics include outlook for Black Sea/Europe grains and challenges facing the oilseed market

- AmSpec, Intertek, SGS: Malaysia’s Jan. 1-31 Palm Oil Exports, Kuala Lumpur

Source: Bloomberg and FI

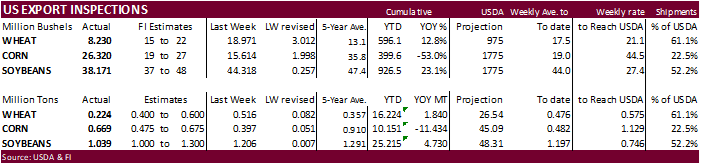

USDA inspections versus Reuters trade range

Wheat 223,994 versus 400000-600000 range

Corn 668,559 versus 500000-900000 range

Soybeans 1,038,840 versus 700000-1300000 range

Corn.

· Nearby corn futures traded 5.50-6.75 cents lower on fears the coronavirus virus spreading across China will disrupt feed demand. The back months were 2.50-4.00 cents lower. The real issue might be a slowdown in China’s GDP. Impact is not known. We are hearing there are several restaurant cancelations among several businesses closing down, including processing plants.

· March corn traded below its 40-day and 50-day MA’s, settling at a 10-day low.

· Bear spreading was a feature today.

· Funds were net sellers of an estimated 11,000 corn contracts.

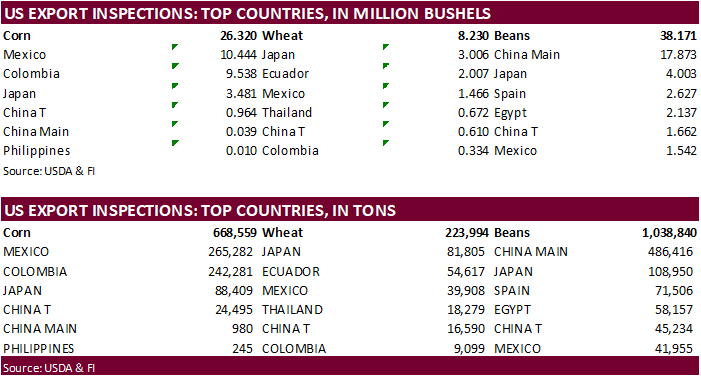

· USDA US corn export inspections as of January 23, 2020 were 668,559 tons, within a range of trade expectations, above 396,613 tons previous week and compares to 968,585 tons year ago. Major countries included Mexico for 265,282 tons, Colombia for 242,281 tons, and Japan for 88,409 tons.

· President Trump is expected to sign the USMCA on Wednesday.

· The Baltic Dry Index fell 11 points or 2.0 percent to 546, more than a 3-year low.

· USDA updated their 2020 food inflation projections for the US and pork prices are expected to increase 2.0-3.0 percent and all food up 1.5-2.5 percent. Attached after the comment is the full table.

· CME hog futures for the April position fell by limit by late morning, trading at its lowest level since October. Meanwhile volatility in that market fell its lowest level since June. The coronavirus appears to be a problem for many markets.

- Under the 24-hour reporting system, private exporters sold 111,252 tons of corn for delivery to Japan during the 2020-21 marketing year.