From: Terry Reilly

Sent: Friday, January 31, 2020 3:12:40 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 01/31/20

PDF attached

Month

to date: (FI

price performance can be found after the text)

·

Corn down 1.7%

·

Oats up 4.0%

·

Soybeans down 7.5%

·

Soybean meal down 3.0%

·

Soybean oil down 13.2%

·

Palm oil down 14.7%

·

Coffee down 20.9%

·

WTI down 15.4%

·

USD/BRL up 6.3%

MARKET

WEATHER MENTALITY FOR CORN AND SOYBEANS:

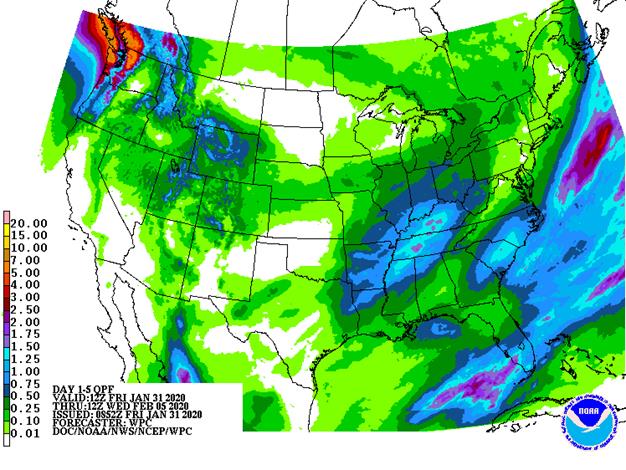

South

America weather still looks mostly good, although a close watch on the rain distribution is warranted in Argentina and far southern Brazil during the next few weeks. Recent forecast model runs have been promoting timely rainfall for these areas, but if precipitation

is missed there could be some greater concern over production potential. For now Brazil is still on target for a huge soybean crop and good early corn crop. Argentina’s corn and soybeans will produce favorably, although not necessarily ideally. Some production

cut has already occurred to early season corn and sunseed in parts of Argentina due to spring dryness.

Weather in eastern Australia improved briefly recently due to rain and some additional precipitation is forthcoming this weekend into next week. South Africa will dry down for a while this week raising some potential for mild crop stress especially in western

production areas.

Southeast Asia rainfall will be well mixed and mostly supportive of palm oil development. Rain in China and India will be typical of this time of year with winter crops in China poised for improvement as spring approaches because of recent past precipitation.

Southeastern Europe remains too dry, but there is potential for some rain and mountain snow this week from there into Kazakhstan possibly easing long term dryness in Romania, the lower Danube River Basin and parts of Ukraine. A moisture boost is needed by

spring to support planting and early season winter rapeseed development.

Overall, weather today will produce a neutral to slightly bearish bias to market mentality.

MARKET

WEATHER MENTALITY FOR WHEAT:

There

is still no risk of winterkill around the world for the next couple of weeks. That will leave winter crop conditions mostly unchanged. China crops will improve in the spring because of recent precipitation. India’s crops are still expected to yield extremely

well.

There

is still some concern over Morocco weather and the lack of rain in the southwest may harm production. A few other areas in northern Africa will also need some timely rain in February to protect production potentials.

Middle

East wheat conditions are rated favorably, but would benefit from some greater rain. Southeastern Europe, Ukraine, southern Russia and Kazakhstan may get some needed precipitation in the next week to improve soil moisture for spring crop development. Warm

weather will continue to minimize the risk of winterkill and some areas may become snow free.

U.S.

crops are not likely to experience much change in the next two weeks and the same is true for southeastern Canada. With that said some unusually warm weather this weekend will be followed by colder conditions next week, but no winterkill is presently expected.

Winter hardiness is weakening in the U.S. southern Plains.

Overall,

weather today will have a neutral bias on market mentality.

Source:

World Weather Inc. and FI

- ICE

Futures Europe weekly commitments of traders report on coffee, cocoa, sugar positions ~1:30pm (~6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - U.S.

agricultural prices paid and received, cattle inventory - Paris

Grain Day conference. Topics include outlook for Black Sea/Europe grains and challenges facing the oilseed market - AmSpec,

Intertek, SGS: Malaysia’s Jan. 1-31 Palm Oil Exports, Kuala Lumpur

MONDAY,

FEB. 3:

- USDA

weekly corn, soybean, wheat export inspections, 11am - Australia

commodity index, 12:30am - Brazil

soybean, sugar, corn, coffee exports - U.S.

soybean crush, DDGS production, corn for ethanol, 3pm - EU

weekly grain, oilseed import and export data - Honduras,

Costa Rica January coffee exports - International

Cotton Advisory Committee releases monthly report - Ivory

Coast cocoa arrivals

TUESDAY,

FEB. 4:

- U.S.

Agriculture Economy Barometer Index, 9:30am - New

Zealand global dairy trade auction

WEDNESDAY,

FEB. 5:

- Statcan

Canada wheat, soybean, barley, canola and durum stocks, 8.30am - EIA

U.S. weekly ethanol inventories, production, 10:30am - New

Zealand ANZ Bank Commodity World Price

THURSDAY,

FEB. 6:

- UN’s

FAO World Food Price Index, 4am - USDA

weekly crop net-export sales for corn, soybeans, wheat, 8:30am

FRIDAY,

FEB. 7:

- ICE

Futures Europe weekly commitments of traders report on coffee, cocoa, sugar positions ~1:30pm (~6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Agricultural

conference organized by consultancy IKAR, Moscow - Guatemala

Coffee Exports

Source:

Bloomberg and FI

Bloomberg

bull/bear survey taken

Wed.

·

Soybeans: Bullish: 7 Bearish: 6 Neutral: 12

·

Corn: Bullish: 8 Bearish: 4 Neutral: 13

·

Wheat: Bullish: 2 Bearish: 13 Neutral: 10

·

Raw sugar: Bullish: 5 Bearish: 0 Neutral: 3

·

White sugar: Bullish: 5 Bearish: 0 Neutral: 3

·

White-sugar premium: Bullish: 4 Bearish: 0 Neutral: 4

·

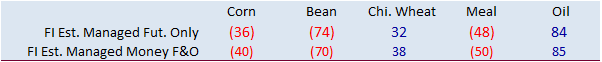

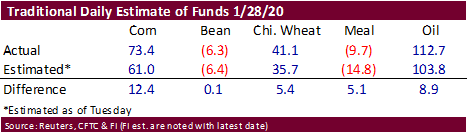

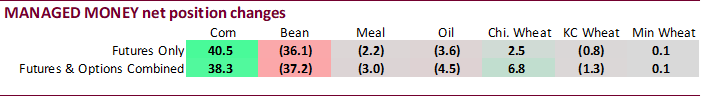

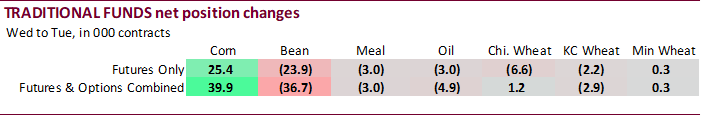

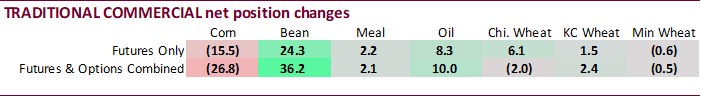

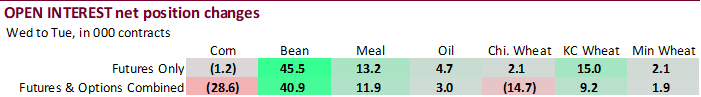

No major surprises for the week ending January 28.

·

Traders were more long in corn, soybeans, meal and oil than expected.

·

Money managers added 38,300 net long contracts in corn. Keep in mind the week change for corn ending Jan 28 was down only 2.5 cents.

·

Money managers sold a good amount of soybeans, so unwinding of soybean/corn spreads could have been a feature.

US

Personal Income Dec: 0.2% (exp 0.3%; R prev 0.4%)

–

Personal Spending Dec: 0.3% (exp 0.3%; prev 0.4%)

–

Real Personal Spending Dec: 0.1% (exp 0.1%; prev 0.3%)

US

PCE Core Deflator (M/M) Dec: 0.2% (exp 0.1%; prev 0.1%)

–

PCE Core Deflator (Y/Y) Dec: 1.6% (exp 1.6%; R prev 1.5%)

–

PCE Deflator (M/M) Dec: 0.3% (exp 0.2%; R prev 012%)

–

PCE Deflator (Y/Y) Dec: 1.6% (exp 1.6%; R prev 1.4%)

US

Employment Cost Index Q4: 0.7% (exp 0.7%; prev 0.7%)

Canadian

GDP (M/M) Nov: 0.1% (exp 0.0%; prev -0.1%)

–

GDP (Y/Y) Nov: 1.5% (exp 1.4%; prev 1.2%)

Canadian

Industrial Product Price (M/M) Dec: 0.1% (exp 0.0%; R prev -0.1%)

US

Chicago PMI Jan: 42.9 (est 48.9; prev 48.2)

US

Univ. Of Michigan Sentiment Jan F: 99.8 (est 99.1; prev 99.1)

–

Univ. Of Michigan Conditions Jan F: 114.4 (prev 115.8)

–

Univ. Of Michigan Expectations Jan F: 90.5 (prev 88.3)

–

Univ. Of Michigan 1-Year Inflation Jan F: 2.5% (prev 2.5%)

–

Univ. Of Michigan 5-10 Year Inflation Jan F: 2.5% (prev 2.5%)

·

March corn traded much of the day lower as traders study the global economic impact of the coronavirus but rallied to close 1.75 cents higher on late technical buying and spreading against soybeans & wheat.

US corn is the cheapest in the world and South Korean buyers have been taking advantage of the price dip.

·

Funds were estimated net buyers of 11,000 corn contracts.

·

The World Health Organization declared a global health emergency. As of Friday morning, the death toll was up to 213 in China, while confirmed cases jumped to 9,692.

·

The European Commission raised their 2019-20 European Union corn import projection to 20 million tons from 19 million previously. Wheat exports were left unchanged 28 million tons.

USDA

reported US January 1 cattle heard at 94.4 million head, down from 94.8 million head on January 1, 2019, and 0.1 million head above a Bloomberg trade estimate.

Other

highlights: https://release.nass.usda.gov/reports/catl0120.txt

US

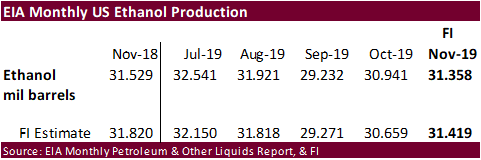

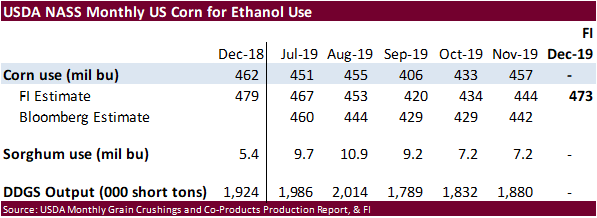

ethanol production in November was 31.358 million barrels, slightly below expectations. We left our 2019-20 US corn for ethanol usage unchanged at 5.400 billion bushels, 25 million above USDA.

-

Under

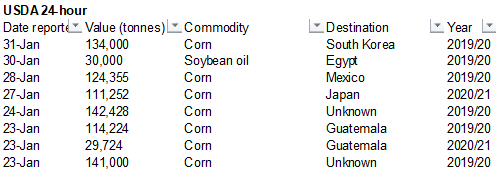

the 24-hour announcement system, private exporters reported optional origin sales of 134,000 tons of corn for delivery to South Korea during the 2019-20 marketing year.

-

South

Korea’s Major Feedmill Group (MFG) bought 69,000 tons of optional origin corn at $214.69 a ton c&f for arrival around May 1. -

South

Korea’s NOFI bought 68,000 tons of corn at around $213.60 a ton c&f for arrival around May 10. -

South

Korea’s FLC bought about 65,000 tons of corn at $213.99 a ton c&f for arrival around May 5.

-

India’s

MMTC passed on 175,000 tons of GMO-free corn for shipment by Feb. 10. Lowest price offer in the tender was reported to be $226.80 a ton c&f.

-

CBOT

March corn is seen in a $3.65 and $3.95 range