From: Terry Reilly

Sent: Monday, February 03, 2020 5:13:39 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 02/03/20

PDF attached

MARKET

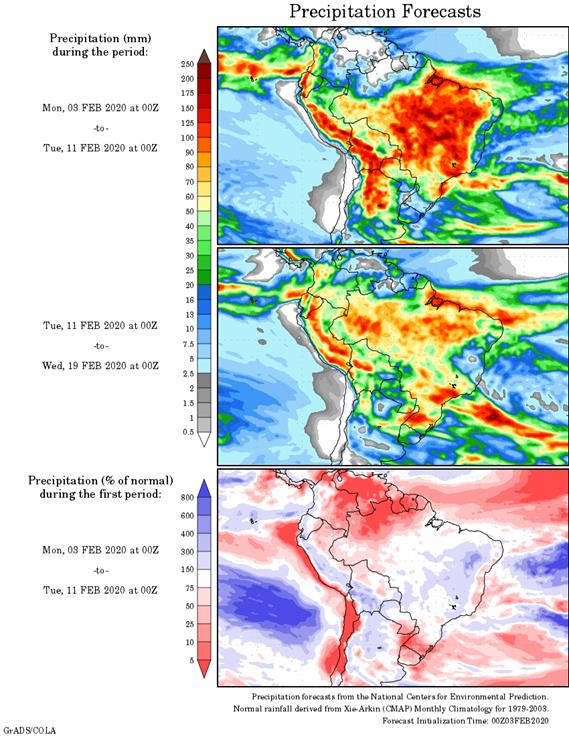

WEATHER MENTALITY FOR CORN AND SOYBEANS:

Better

rainfall potentials in Argentina during the next two weeks will improve confidence in the nation’s favorable summer crop outlook. Argentina’s fair to good grain and oilseed output combined with Brazil’s huge soybean crop will likely keep a bearish bias on

for those crops. South Africa weather may improve somewhat this weekend and next week to protect its production potential.

Australia’s

summer crops will get some additional rainfall in this coming week and India crops will remain in good shape. China still has potential for improving rapeseed production potential once spring arrives due to recent precipitation and improving soil moisture

in parts of southeastern Europe into Kazakhstan may do to the same for those areas in the spring.

Southeast

Asia weather will trend a little wetter in the coming week restoring favorable soil moisture to many Indonesian and Malaysian crop areas. Rain is needed most in parts of Peninsular Malaysia.

Overall,

weather today is likely to contribute a bearish bias on market mentality.

MARKET

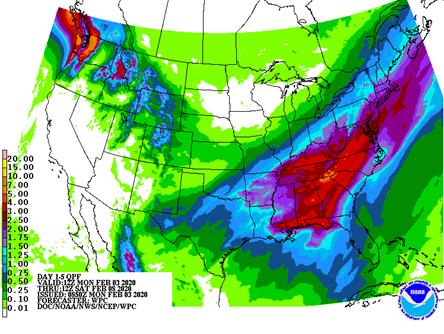

WEATHER MENTALITY FOR WHEAT:

There

is very little risk of crop threatening cold for small grain crops around the world. Cooling in the U.S. this week will be preceded by snow in the areas where temperatures will get coldest (the west-central high Plains) which should protect crops from damage.

Periods of snow in the west-central high Plains should lead to some improving topsoil moisture for better winter crop establishment in the early days of spring.

Improving

precipitation in southeastern Europe and the southwestern grain areas of the Commonwealth of Independent states may improve production potentials in the spring. China’s winter crops are still expected to improve in the early spring if there are a few timely

rain events as temperatures trend warmer

India is still expecting a huge winter wheat crop and the only thing needed would be a few timely rain events this month and no extreme heat. Some of those conditions will be met in this coming week.

Rain

in east-central Australia this week will be great enough to bolster topsoil moisture and possibly improve a few water reservoir levels, but much more rain will be needed before autumn planting begins in April. The recent weather trends have looked appealing

with rain falling more frequently easing some of the dryness.

North

Africa wheat is still a concern with southwestern Morocco production already expected to be down. Timely rain will be needed later this month and in March to support reproduction and filling. Early February will be dry and warm biased.

Overall,

weather today will likely produce a mixed influence on market weather mentality.

Source:

World Weather Inc. and FI

Selected

Brazil commodities exports:

Commodity

January 2020 December 2019 January 2019

COFFEE(60

KG BAG) 2,724,800 3,161,900 3,033,200

CRUDE

OIL (TNS) 4,292,600 8,721,100 4,980,900

ETHANOL

(LTR) 78,100,000 146,600,000 104,700,000

SOYBEANS

(TNS) 1,488,300 3,439,600 2,035,100

IRON

ORE 26,731,100 24,674,000 33,135,800

FROZEN

ORANGE JUICE (TNS) 27,700 32,100 16,200

NON-FROZEN

ORANGE JUICE (TNS) 131,400 203,000 121,400

SUGAR

RAW (TNS) 1,415,700 1,286,900 1,017,900

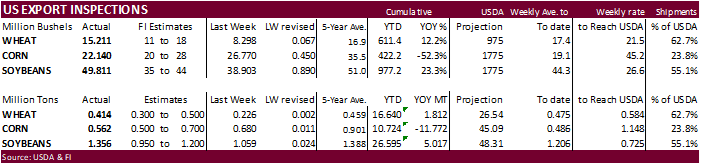

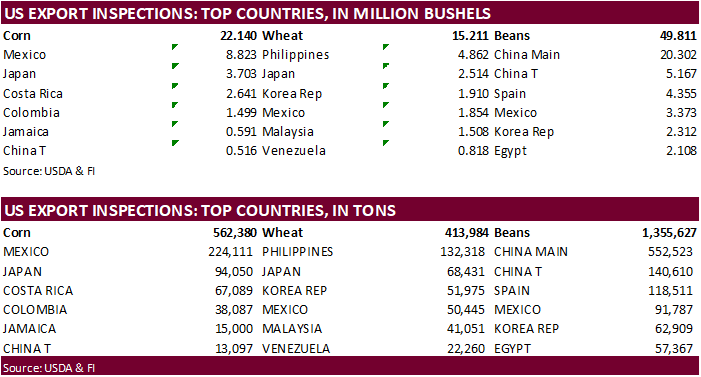

USDA

inspections versus Reuters trade range

Wheat

413,984 versus 300000-500000 range

Corn

562,380 versus 500000-800000 range

Soybeans

1,355,627 versus 550000-1200000 range

Combined

wheat, soybean, corn and sorghum export inspections have been running below this time last year for four consecutive weeks.

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING JAN 30, 2020

— METRIC TONS —

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 01/30/2020 01/23/2020 01/31/2019 TO DATE TO DATE

BARLEY

1,796 416 196 19,458 6,730

CORN

562,380 679,994 912,191 10,724,374 22,496,268

FLAXSEED

100 0 0 496 218

MIXED

0 0 0 0 0

OATS

400 200 200 2,666 1,993

RYE

0 0 0 0 0

SORGHUM

6,516 142,217 24,157 1,137,491 596,384

SOYBEANS

1,355,627 1,058,772 1,092,842 26,594,745 21,577,745

SUNFLOWER

0 0 0 0 0

WHEAT

413,984 225,825 443,265 16,639,729 14,827,601

Total

2,340,803 2,107,424 2,472,851 55,118,959 59,506,939

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

·

US Markit Manufacturing PMI Jan F: 51.9 (est 51.7; prev 51.7)

·

China’s central bank lowered the interest rates on reverse repurchase agreements by 10 basis points to 2.40% and cut the 14-day tenor to 2.55% from 2.65% previously.

·

March corn futures traded lower as coronavirus continues to spread. The contract settled 2.50 cents lower at $3.7875. More than 360 deaths from the virus have been reported.

·

Funds were estimated net sellers of 15,000 corn contracts.

·

USDA US corn export inspections as of January 30, 2020 were 562,380 tons, low end of a range of trade expectations, below 679,994 tons previous week and compares to 912,191 tons year ago. Major countries included

Mexico for 224,111 tons, Japan for 94,050 tons, and Costa Rica for 67,089 tons.

·

Lower futures early this week could attract additional global export interest, which may limit downside movement in prices over the next few days.

·

US hog futures were down about 0.8% around noon CT. China plans to release frozen pork from state reserves “whenever necessary” due to the virus outbreak. China also announced they plan to buy more meat

from the international market.

·

China culled 18,000 chickens after H5N1 bird flu was discovered in Hunan.

·

The Baltic Dry index fell 21 points or 4.3 percent to 466 points.

Illinois

River lock closure update:

Grain handlers, exporters, feed users, and Chicago Platts spread traders need to monitor forward ECB cash corn prices. And a handful of ethanol plants located near the Illinois River may feel some pain this summer as the U.S. Army Corps of Engineers released

an updated schedule for “short closure” lock repairs. Engineers will have to drain selected channel locks, making grain barges impassible for about 60 days, at least 3 of the 5 scheduled for summer 2020 repair, depending on water levels. This may become a

nightmare for several ECB ethanol plants. Ethanol plants stocking up on corn ahead of the closures may become a reality. Downtime is another option. Keep an eye on CBOT May corn deliveries. If the spreads are in good shape, heavy deliveries could be triggered,

indicating the handful of ethanol plants located on or near the river, and other grain end users are stockpiling. Also done discount large swings in corn basis and barge freight rates located between Chicago and Memphis-Cairo, from now until end of September.

Corn

shipments up through Canada could increase if Chicago basis weaken to an attractive level. So far, we have not seen any major divergence in basis. Peoria corn basis for spot was last 6 over the March, and forward April position was 3 over the May. Two locks

along the Illinois River are scheduled for repair in summer 2023. See link below for reference.

https://www.mvr.usace.army.mil/Missions/Navigation/Navigation-Status/

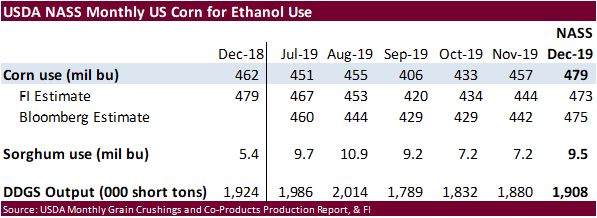

Corn

Grind. USDA

NASS reported the December corn for ethanol use at 479 million bushels, 4 million above a Bloomberg trade estimate, 23 million above the 457 million in November and 18 million above 462 million in December 2018. Sorghum use was 9.5 million bu. DDGS production

of 1.908 million short tons hit its highest level since August but was below 1.924 million produced in December 2018. The higher corn use and lower DDGS suggests poor quality corn could have impacted DDGS minimum specifications for use.

-

None

reported

-

CBOT

March corn is seen in a $3.65 and $3.95 range

·

CBOT soybeans

rallied after the open on signs of improving US soybean demand but paired some of the gains after news broke that Chinese officials hope the U.S. will agree on flexibility for purchase commitments from the phase-one trade deal. It hasn’t been 30 days since

the deal was signed January 15 and now traders again have to weigh in agriculture trade concerns on top of coronavirus concerns. This comes after China announced they plan to inject $173 billion into their economy. Early Monday they also lowered the interest

rates on reverse repurchase agreements by 10 basis points to 2.40% and cut the 14-day tenor to 2.55% from 2.65% previously. USDA export inspections showed China took just over 550,000 tons of soybeans. The market traded two-sided by mid-morning but rallied

to close 4 cents higher.