From: Terry Reilly

Sent: Tuesday, February 04, 2020 3:46:57 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 02/04/20

PDF attached

MARKET WEATHER MENTALITY FOR CORN AND SOYBEANS:

Better rainfall potentials in Argentina during the next two weeks will improve confidence in the nation’s favorable summer crop outlook. Argentina’s fair to good grain and oilseed output combined with Brazil’s huge soybean crop will likely keep a bearish bias on for those crops. South Africa weather may improve somewhat this weekend and next week to protect its production potential.

Australia’s summer crops will get some additional rainfall in this coming week and India crops will remain in good shape. China still has potential for improving rapeseed production potential once spring arrives due to recent precipitation and improving soil moisture in parts of southeastern Europe into Kazakhstan may do to the same for those areas in the spring.

Southeast Asia weather will trend a little wetter in the coming week restoring favorable soil moisture to many Indonesian and Malaysian crop areas. Rain is needed most in parts of Peninsular Malaysia.

Overall, weather today is likely to contribute a bearish bias on market mentality.

MARKET WEATHER MENTALITY FOR WHEAT:

There is very little risk of crop threatening cold for small grain crops around the world. Cooling in the U.S. this week will be preceded by snow in the areas where temperatures will get coldest (the west-central high Plains) which should protect crops from damage. Periods of snow in the west-central high Plains should lead to some improving topsoil moisture for better winter crop establishment in the early days of spring.

Improving precipitation in southeastern Europe and the southwestern grain areas of the Commonwealth of Independent states may improve production potentials in the spring. China’s winter crops are still expected to improve in the early spring if there are a few timely rain events as temperatures trend warmer

India is still expecting a huge winter wheat crop and the only thing needed would be a few timely rain events this month and no extreme heat. Some of those conditions will be met in this coming week.

Rain in east-central Australia this week will be great enough to bolster topsoil moisture and possibly improve a few water reservoir levels, but much more rain will be needed before autumn planting begins in April. The recent weather trends have looked appealing with rain falling more frequently easing some of the dryness.

North Africa wheat is still a concern with southwestern Morocco production already expected to be down. Timely rain will be needed later this month and in March to support reproduction and filling. Early February will be dry and warm biased.

Overall, weather today will likely produce a mixed influence on market weather mentality.

Source: World Weather Inc. and FI

- U.S. Agriculture Economy Barometer Index, 9:30am

- New Zealand global dairy trade auction

WEDNESDAY, FEB. 5:

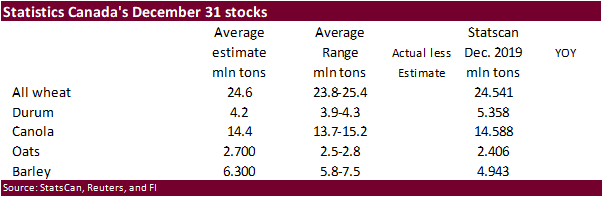

- Statcan Canada wheat, soybean, barley, canola and durum stocks, 8.30am

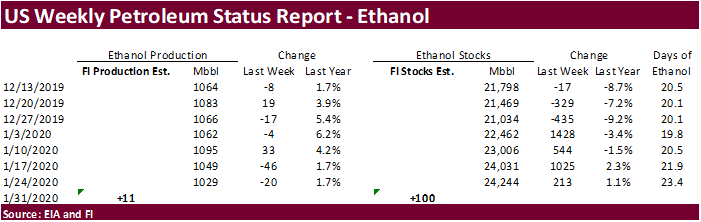

- EIA U.S. weekly ethanol inventories, production, 10:30am

- New Zealand ANZ Bank Commodity World Price

THURSDAY, FEB. 6:

- UN’s FAO World Food Price Index, 4am

- USDA weekly crop net-export sales for corn, soybeans, wheat, 8:30am

FRIDAY, FEB. 7:

- ICE Futures Europe weekly commitments of traders report on coffee, cocoa, sugar positions ~1:30pm (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- Agricultural conference organized by consultancy IKAR, Moscow

- Guatemala Coffee Exports

Source: Bloomberg and FI

Macros

US Factory Orders (M/M) Dec: 1.8% (est 1.2%; prev R -1.2%)

– Factory Orders Ex-Transportation (M/M) Dec: 0.6% (est 0.1%; prev R 0.2%)

– Durable Goods Orders (M/M) Dec F: 2.4% (est 2.4%; prev 2.4%)

– Durables Ex-Transportation (M/M) Dec F: -0.1% (est -0.1%; prev -0.1%)

– Cap Goods Orders Nondef Ex-Air (M/M) Dec F: -0.8% (est -0.9%; prev -0.9%)

– Cap Goods Ship Nondef Ex-Air (M/M) Dec F: -0.3% (prev -0.4%)

・ Corn futures ended 3.50 cents higher on technical buying. China corn futures closed higher despite virus concerns. More than 425 deaths and 20,500 cases have been reported. Lack of US export flash sales this morning could have capped today’s rally.

・ Funds were estimated net buyers of 9,000 corn contracts.

・ Brazil’s Mato Grosso Institute increased its 2019-20 second crop corn production to 32.44 million tons, up 0.82 million tons from the previous forecast, and compares to 32.3 million in 2018-19.

・ INTL FC Stone estimated Brazil’s first corn crop at 25.9MMT, up slightly from 25.75 million tons previous. They left unchanged their second corn crop at 72.0 million tons. This brings the total corn crop to 97.9 million. USDA is at 101 million tons.

・ Saudi Arabia reported an outbreak of H5N8 bird flu. 22,700 birds were killed.

・ Vietnam reported an outbreak of H5N6 bird flu. 3,000 birds are affected.

・ A Bloomberg poll looks for weekly US ethanol production to be unchanged at 1.029 million barrels from the previous week and stocks to decrease 249,000 barrels to 23.995 million.

African Swine Fever Shrinks Pork Production in China, Swells Demand for Imported Pork

- None reported

Soybean complex.