From: Terry Reilly

Sent: Wednesday, February 05, 2020 3:55:27 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 02/05/20 + S&D’s

PDF attached includes US S&D’s

MARKET WEATHER MENTALITY FOR CORN AND SOYBEANS:

Weather continues supportive of crops in most of Brazil and Argentina. There is some concern over rainfall in Brazil delaying some of this year’s soybean harvest, but the bottom line should not impact production for most areas. A few areas in Argentina may become too wet in the next few days after some heavy rain already occurred overnight.

Australia’s summer crops will get some additional rainfall in this coming week and India crops will remain in good shape. China still has potential for improving rapeseed production potential once spring arrives due to recent precipitation and improving soil moisture in parts of southeastern Europe into Kazakhstan may do to the same for those areas in the spring.

Southeast Asia weather will trend a little wetter in the coming week restoring favorable soil moisture to many Indonesian and Malaysian crop areas. Rain is needed most in parts of Peninsular Malaysia.

Overall, weather today is likely to contribute a bearish bias on market mentality.

MARKET WEATHER MENTALITY FOR WHEAT:

There is very little risk of crop threatening cold for small grain crops around the world. Cooling in the U.S. this week in the west-central and southwestern Plains will prove to be beneficial since recent temperatures were so very warm. No crop damage occurred in the west-central high Plains region this morning as temperatures dropped near and below zero Fahrenheit due to snow cover.

Improving precipitation in southeastern Europe and the southwestern grain areas of the Commonwealth of Independent states may improve production potentials in the spring. China’s winter crops are still expected to improve in the early spring if there are a few timely rain events as temperatures trend warmer

India is still expecting a huge winter wheat crop and the only thing needed would be a few timely rain events this month and no extreme heat. Some of those conditions will be met in this coming week.

Rain in east-central Australia this week will be great enough to bolster topsoil moisture and possibly improve a few water reservoir levels, but much more rain will be needed before autumn planting begins in April. The recent weather trends have looked appealing with rain falling more frequently easing some of the dryness.

North Africa wheat is still a concern with southwestern Morocco production already expected to be down. Timely rain will be needed later this month and in March to support reproduction and filling throughout northern Africa. Early February will be dry and warm biased.

Overall, weather today will likely produce a mixed influence on market weather mentality.

Source: World Weather Inc. and FI

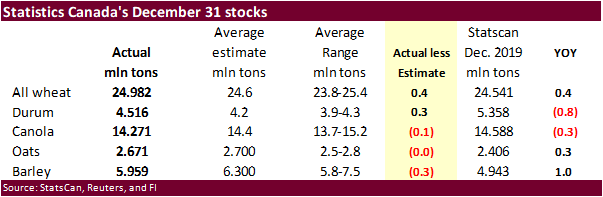

- Statcan Canada wheat, soybean, barley, canola and durum stocks, 8.30am

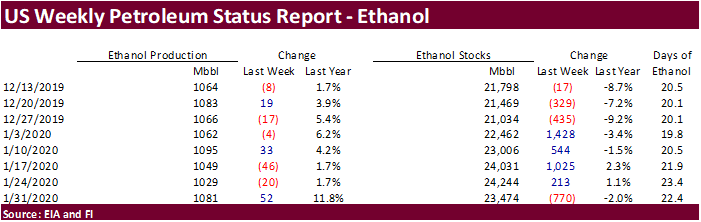

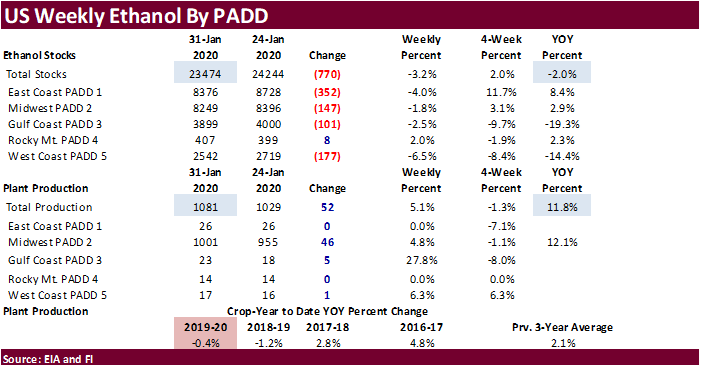

- EIA U.S. weekly ethanol inventories, production, 10:30am

- New Zealand ANZ Bank Commodity World Price

THURSDAY, FEB. 6:

- UN’s FAO World Food Price Index, 4am

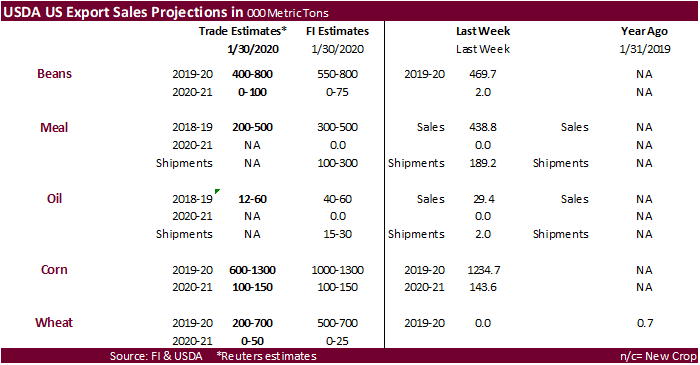

- USDA weekly crop net-export sales for corn, soybeans, wheat, 8:30am

FRIDAY, FEB. 7:

- ICE Futures Europe weekly commitments of traders report on coffee, cocoa, sugar positions ~1:30pm (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- Agricultural conference organized by consultancy IKAR, Moscow

- Guatemala Coffee Exports

Source: Bloomberg and FI

· US ADP Employment Change Jan: 291K (exp 158K; prev 202K)

· US Trade Balance (USD) Dec: -48.9B (exp -48.2B; prev -43.1B)

· Canadian International Merchandise Trade (CAD) Dec: -0.37B (exp -0.61B; prev -1.09B)

· US December Crude Oil Exports Reached 3.669Mln BPD (prev 3.023Mln BPD) – RTRS

· US DoE Crude Oil Inventories Change (W/W) 31-Jan: 3355K (est 3000K; prev 3548K)

– Distillate Inventories Change (W/W): -1512K (est -200K; prev -1289K)

– Cushing OK Crude Inventories Change (W/W): 1068K (prev 758K)

– Gasoline Inventories Change (W/W): -91K (est 1800K; prev 1203K)

– Refinery Utilization (W/W): 0.20% (est 0.15%; prev -3.30%)

- March corn futures ended 1.50 cent lower on lack of confirmation of US corn export developments. China plans to sell 2.96 million tons of corn from state reserves on February 7. This is an indicator China is short corn in selected areas.

- Ukraine said the coronavirus problem in China may not impact grain shipments to that country. China imports a good amount of corn and sunflower oil from Ukraine. APK-Inform reported Ukraine corn exports to China were 208,000 tons during the week of January 25-31.

· WTO crude oil traded more than $1.50 higher in part to reports that researchers in China and UK made breakthroughs on inhibiting the virus. Volatility is high and funds seem to enjoy getting in and out of this market. The swings have been staggering.

· Indonesia may import up to 200,000 tons of corn this year for use in animal feed.

- Pork product prices have weakened in China since the outbreak of the coronavirus, in part to lower consumption and China state reserve sales of frozen pork. Look for China to continue releasing pork out of reserves.

- Brazil’s ethanol consumption in 2019 hit a record 32.8 billion liters (8.6 billion gallons), up 10.5% from 2018, according to Unica. This consisted of hydrous ethanol of 22.5 billion liters, up 16.3%, and anhydrous ethanol 10.3 billion liters.

- The USDA Broiler Report showed eggs set in the US up 4 percent and chicks placed up 4 percent. Cumulative placements from the week ending January 4, 2020 through February 1, 2020 for the United States were 953 million. Cumulative

- placements were up 4 percent from the same period a year earlier.

US weekly ethanol production and stocks showed a big miss by the trade. US production was reported up 52,000 barrels to 1.081 million. The trade was looking for unchanged. US ethanol stocks declined by a large 770,000 barrels while the trade was looking for a 249,000 decrease (not a big miss when thinking about the recent large weekly swings). We see this report as slightly supportive for corn. Production last week was the third highest so far for the corn marketing year (Sep-Aug). Stocks were third highest for the corn marketing year.

- China plans to sell 2.96 million tons of corn from state reserves on February 7.

Soybean complex.