From: Terry Reilly

Sent: Saturday, February 15, 2020 11:54:49 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 02/14/20

PDF attached

US

is on holiday Monday. Positioning seen today. Covid-19 continues to hang over the grain markets.

USDA

released its 2020:

·

Agriculture projections

https://www.ers.usda.gov/publications/

·

Agriculture Baseline Database

https://www.ers.usda.gov/calendar/?month=2&year=2020&day=14

Agriculture

Baseline https://www.ers.usda.gov/webdocs/publications/95912/oce-2020-1.pdf?v=1705.6

2020

US GDP was estimated at 1.9% versus 2.5% in 2019

2020

US Acreage: (table 4)

·

Corn 94.5 versus 89.9 in 2019

·

Soybeans 84.0 versus 76.5 in 2019

·

All-Wheat 45.0 versus 45.2 in 2019

2020-21

US carryout

·

Corn 2.754 billion versus USDA Feb. WOB of 1.892 billion for 2019-20

·

Soybeans 518 million versus USDA Feb. WOB of 425 for 2019-20

·

All-Wheat 950 million versus USDA Feb. WOB of 940 for 2019-20

MARKET

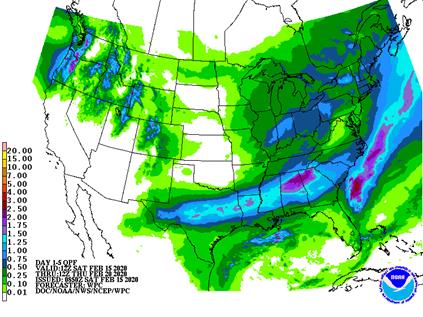

WEATHER MENTALITY FOR CORN AND SOYBEANS:

Not

much has changed overnight. Favorable soil moisture is present in Argentina, Brazil, South Africa, India and some eastern Australia locations which should support crop development. There is still some concern over harvest conditions in early season soybean

areas of Goias and southwestern Minas Gerais which may lead to more delay in second season corn planting, but progress is being made every day and it looks as though the pace is not far from the five year average even though much slower than last year. Good

field working conditions have been occurring in other areas and that should minimize the amount of crop that will be later planted.

Too much rain in northeastern South Africa in the past week has resulted in some flooding. Crop damage has not been assessed, but the region impacted is a minor production region in eastern Limpopo and northeastern Mpumalanga. Other areas in South Africa have

ideal crop development conditions.

More

rain will fall this week in northern and eastern Europe and from there to Ukraine and that will improve early season crop development potentials for areas that were too dry last autumn.

China’s

winter crops are still rated favorably with a big potential for improving rapeseed conditions in the early weeks of spring after recent weeks of rain.

India’s

winter crops are still poised to perform quite favorably, despite a drier biased outlook for the next ten days.

Southeast

Asia crops are still rated well, despite erratically distributed rainfall in recent weeks.

Eastern

Australia sorghum conditions have improved, but drought remains in key production areas and much more rain will be needed before winter planting of canola begins in late April. Summer crop development has improved, but it will still be a very small crop.

Today’s weather will have a mixed influence on market mentality.

MARKET

WEATHER MENTALITY FOR WHEAT:

Many

of the winter crop areas in the world that experienced poor crop establishment because of dryness last autumn have seen some timely precipitation in recent weeks. The moisture should help improve winter crop establishment prior to reproduction this spring.

There has also been very little winterkill this year and that should be supporting larger crops. With that said there may have been some damage in a few minor wheat areas in central Nebraska Thursday morning when temperatures fell near slightly below zero

Fahrenheit while snow cover was minimal. Today’s bitter cold in the Midwest occurred in mostly snow covered areas.

The

biggest dry concern today is in North Africa and in particular southwestern Morocco where durum wheat and barley production has been cut. There is potential for larger small grain production losses from North Africa if improved rainfall does not occur soon.

Spain and Portugal are also drying out, but have adequate subsoil moisture for now. The outlook leaves most of these areas dry or mostly dry for the next ten days and perhaps longer.

Overall,

weather today will continue to provide a mixed influence on market mentality.

Source:

World Weather Inc. and FI

Bloomberg

Ag Calendar

FRIDAY,

FEB. 14:

- ICE

Futures Europe weekly commitments of traders report on coffee, cocoa, sugar positions ~1:30pm (~6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

crop conditions – French crops office expected to resume crop-conditions reports after winter break - New

Zealand food prices - Biosev

holds analyst conference call to discuss 4Q earnings.

MONDAY,

FEB. 17:

- MARS

bulletin – monthly report on Europe crop conditions - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals - Cosan

Earnings Conference Call, Sao Paulo - HOLIDAY:

U.S. (President’s Day)

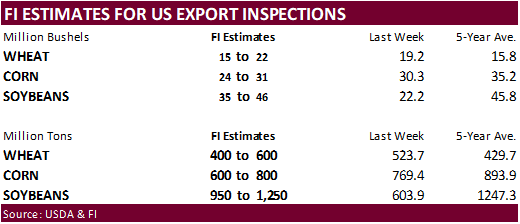

TUESDAY,

FEB. 18:

- Australian

crop report from Abares, Canberra - USDA

weekly corn, soybean, wheat export inspections, 11am - New

Zealand global dairy trade auction

WEDNESDAY,

FEB. 19:

- EIA

U.S. weekly ethanol inventories, production, 10:30am - EARNINGS:

Marfrig

THURSDAY,

FEB. 20:

- USDA

Agricultural Outlook – corn, wheat, soy, cotton acreage, 8:20am - USDA

milk, read meat production, 3pm - Malaysia’s

Feb. 1-20 palm oil exports data - EARNINGS:

Wilmar

FRIDAY,

FEB. 21:

- USDA

outlook — corn, soy, wheat cotton end-stockpiles - USDA

weekly crop net-export sales for corn, soybeans, wheat, 8:30am - ICE

Futures Europe weekly commitments of traders report on coffee, cocoa, sugar positions ~1:30pm (~6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - U.S.

Cattle on Feed, 3pm - EARNINGS:

Pilgrim’s Pride

Source:

Bloomberg and FI

·

US Retail Sales Advance (M/M) Jan: 0.3% (est 0.3% ; prevR 0.2% ; prev 0.3%)

·

US Import Price Index (M/M) Jan: 0.0% (est -0.2% ; prevR 0.2% ; prev 0.3%)

·

US Industrial Production (M/M) Jan: -0.3% (est -0.2% ; prevR -0.4% ; prev -0.3%)

·

US Capacity Utilization Jan: 76.8% (est 76.8% ; prevR 77.1% ; prev 77.0%)

·

US Manufacturing (SIC) Production Jan: -0.1% (est -0.1% ; prevR 0.1% ; prev 0.2%)

·

US Univ. Of Michigan Sentiment Feb P: 100.9 (est 99.5; prev 99.8)

–

Univ. Of Michigan Conditions Feb P: 113.8 (est 114.0; prev 114.4)

–

Univ. Of Michigan Expectations Feb P: 92.6 (est 90.0; prev 90.5)

–

Univ. Of Michigan 1-Year Inflation Feb P: 2.5% (est 2.4%; prev 2.5%)

–

Univ. Of Michigan 5-10 Year Inflation Feb P: 2.3% (prev 2.5%)

·

Canadian Existing Home Sales (M/M) Jan: -2.9% (est -0.1% ; prev 0.9%)

·

March corn futures ended 1.75 lower, in a quiet trade, on waning US export demand. China was a big buyer of Ukraine corn this week.

·

March corn traded in a 3-penny range by mid-morning and ended up in a 5.25 cent range for the day.

·

$3.80 March corn traded at least once over the last 12 sessions.

·

Reuter reported cargos of US chicken bound for China have been rerouted to nearby countries because of the coronavirus outbreak.

·

High water levels for lower Midwestern rivers are slowing barge traffic.

·

1500+ deaths and nearly 66,500 cases of coronavirus were recorded as od Sat. morning.

·

The Baltic Dry Index increased 4 points on Friday to 425. Capesize remains negative at 294.

·

China sold 1.32 million tons of reserve corn to feed users across the southern provinces last week.

·

China’s state reserve held an auction on Friday to sell 20,000 tons of frozen pork.

They apparently sold 14k.

Soybean

complex.