From: Terry Reilly

Sent: Tuesday, February 18, 2020 3:19:02 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 02/18/20

·

Flooding remains a serious issue across the far southern Delta and Southeast.

·

Snow and rain will develop in the southern U.S. Plains Wednesday and Thursday with accumulations of 1 to 4 inches.

·

A larger central U.S. storm is expected during mid- to late-week next week that will bring significant moisture to the upper Midwest, northern Plains and a part of the western Corn Belt.

·

Argentina’s Chaco saw flooding over the weekend where more than 14 inches fell.

·

Argentina’s bottom line is mostly favorable.

·

Brazil crops will all received rain at one time or another during the next two weeks.

Source:

World Weather Inc. and FI

MARKET

WEATHER MENTALITY FOR CORN AND SOYBEANS:

Not

much has changed overnight. Favorable soil moisture is present in Argentina, Brazil, South Africa, India and some eastern Australia locations which should support crop development. There is still some concern over harvest conditions in early season soybean

areas of Goias and southwestern Minas Gerais which may lead to more delay in second season corn planting, but progress is being made every day and it looks as though the pace is not far from the five year average even though much slower than last year. Good

field working conditions have been occurring in other areas and that should minimize the amount of crop that will be later planted.

Too much rain in northeastern South Africa in the past week has resulted in some flooding. Crop damage has not been assessed, but the region impacted is a minor production region in eastern Limpopo and northeastern Mpumalanga. Other areas in South Africa have

ideal crop development conditions.

More

rain will fall this week in northern and eastern Europe and from there to Ukraine and that will improve early season crop development potentials for areas that were too dry last autumn.

China’s

winter crops are still rated favorably with a big potential for improving rapeseed conditions in the early weeks of spring after recent weeks of rain.

India’s

winter crops are still poised to perform quite favorably, despite a drier biased outlook for the next ten days.

Southeast

Asia crops are still rated well, despite erratically distributed rainfall in recent weeks.

Eastern

Australia sorghum conditions have improved, but drought remains in key production areas and much more rain will be needed before winter planting of canola begins in late April. Summer crop development has improved, but it will still be a very small crop.

Today’s weather will have a mixed influence on market mentality.

MARKET

WEATHER MENTALITY FOR WHEAT:

Many of the winter crop areas in the world that experienced poor crop establishment because of dryness last autumn have seen some timely precipitation in recent weeks. The moisture should help improve winter crop establishment prior to reproduction this spring.

There has also been very little winterkill this year and that should be supporting larger crops. With that said there may have been some damage in a few minor wheat areas in central Nebraska Thursday morning when temperatures fell near slightly below zero

Fahrenheit while snow cover was minimal. Today’s bitter cold in the Midwest occurred in mostly snow-covered areas.

The biggest dry concern today is in North Africa and in particular southwestern Morocco where durum wheat and barley production has been cut. There is potential for larger small grain production losses from North Africa if improved rainfall does not occur

soon. Spain and Portugal are also drying out but have adequate subsoil moisture for now. The outlook leaves most of these areas dry or mostly dry for the next ten days and perhaps longer.

Overall, weather today will continue to provide a mixed influence on market mentality.

Source:

World Weather Inc. and FI

Bloomberg

Ag Calendar

TUESDAY,

FEB. 18:

- Australian

crop report from Abares, Canberra - USDA

weekly corn, soybean, wheat export inspections, 11am - New

Zealand global dairy trade auction

WEDNESDAY,

FEB. 19:

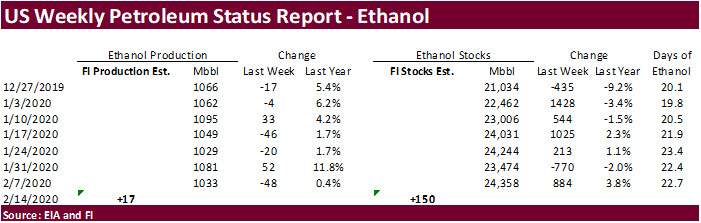

- EIA

U.S. weekly ethanol inventories, production, 10:30am - EARNINGS:

Marfrig

THURSDAY,

FEB. 20:

- USDA

Agricultural Outlook – corn, wheat, soy, cotton acreage, 8:20am - USDA

milk, read meat production, 3pm - Malaysia’s

Feb. 1-20 palm oil exports data - EARNINGS:

Wilmar

FRIDAY,

FEB. 21:

- USDA

outlook — corn, soy, wheat cotton end-stockpiles - USDA

weekly crop net-export sales for corn, soybeans, wheat, 8:30am - ICE

Futures Europe weekly commitments of traders report on coffee, cocoa, sugar positions ~1:30pm (~6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - U.S.

Cattle on Feed, 3pm - EARNINGS:

Pilgrim’s Pride

Source:

Bloomberg and FI

USDA

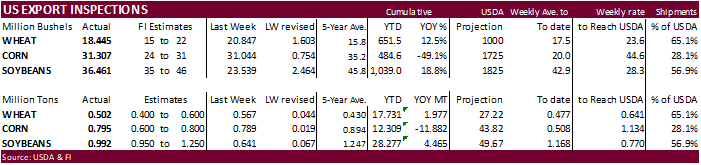

inspections versus Reuters trade range

Wheat

501,990 versus 400000-600000 range

Corn

795,228 versus 600000-800000 range

Soybeans

992,294 versus 700000-1250000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING FEB 13, 2020

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 02/13/2020 02/06/2020 02/14/2019 TO DATE TO DATE

BARLEY

144 8,830 0 28,432 6,852

CORN

795,228 788,549 941,811 12,308,616 24,190,837

FLAXSEED

0 24 0 520 242

MIXED

0 0 0 0 0

OATS

0 100 0 2,766 1,993

RYE

0 0 0 0 0

SORGHUM

74,141 77,577 118,255 1,300,785 799,017

SOYBEANS

992,294 640,620 1,083,567 28,277,053 23,812,175

SUNFLOWER

0 0 0 0 0

WHEAT

501,990 567,349 363,523 17,730,804 15,753,830

Total

2,363,797 2,083,049 2,507,156 59,648,976 64,564,946

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

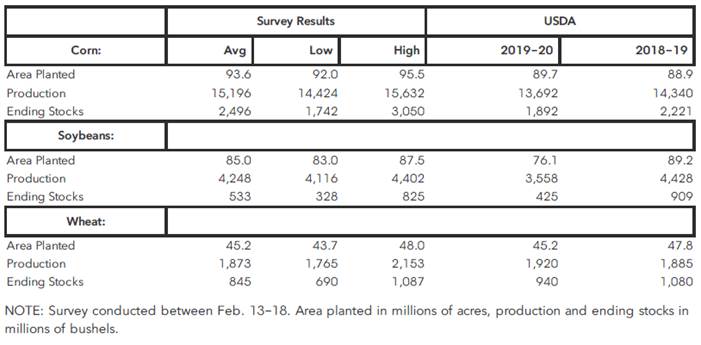

USDA

Outlook forum Bloomberg trade estimates:

·

Euro hit a 34-month low.

·

Canada Manufacturing Sales (M/M) Dec: -0.7% (est 0.7% ; prevR -1.0% ; prev -0.6%)

·

(Reuters) – China will cut some pension contributions and insurance fees to help companies cope with the coronavirus, while firms in Hubei province, the epicenter of the outbreak, won’t have to pay pensions,

jobless and work-injury insurance until June.

·

China also lowered one key interest rate to pump more funds into their system.

·

March corn futures ended 5.25 cents higher in part to a strong rally in soybeans and renewed hopes China will buy US agriculture products by March 15.

·

CH traded at $3.80 every trading day since January 27.

·

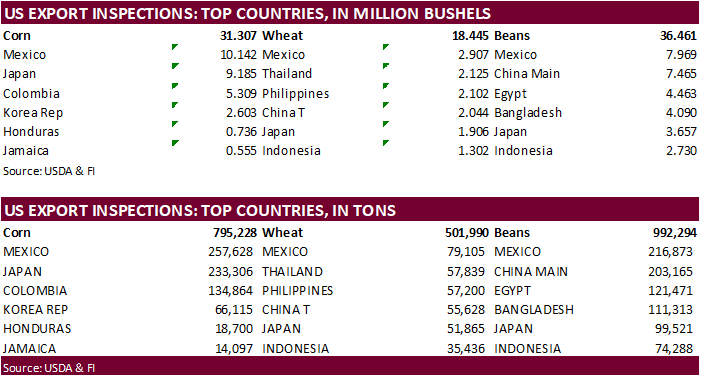

USDA US corn export inspections as of February 13, 2020 were 795,228 tons, high end of a range of trade expectations, above 788,549 tons previous week and compares to 941,811 tons year ago. Major countries

included Mexico for 257,628 tons, Japan for 233,306 tons, and Colombia for 134,864 tons.

·

Rallies maybe limited on PNW corn tender woes. Platts reported two South Korean firms (MFG and NOFI) stopped taking offers for US PNW corn due to quality problems. High levels of broken corn foreign material

(BCFM) was noted.

·

High water levels for lower Midwestern rivers continue to slow barge traffic.

-

As

of Tuesday morning, China put the overall death toll at 1,868 and 72,436 infections.

-

Brazil’s

Mato Grosso was 63 percent complete on corn plantings, above 52 percent for the 5-year average.

-

Soybean

and Corn Advisory: Estimated the Argentina corn crop at 49.0 million tons, up 1.5 million, and left Brazil unchanged at 100.0 million tons.

·

General Administration of Customs: China removed import restrictions on U.S. poultry and poultry products that were imposed in 2013, 2014 and 2015. (Bloomberg)

·

China warned the poultry and product industry may take a hit from coronavirus. Poultry prices are down hard this year as demand eroded.

·

Bulgaria reported a bird flu outbreak (N5N8) at a duck farm in the southern part of the country.

·

India officials mentioned demand for chicken dropped over the past three weeks after social media reports speculated the coronavirus was thought to be spread through chickens. Broiler chicken prices have

fallen to 35 rupees a kg from around 70 rupees in January.

·

Zimbabwe plans to import Uganda to make up for a shortfall in consumption.

·

South Korea’s MFG bought 135,000 tons of optional origin corn at $211.79/ton c&f for arrival around June 11 and $211.78 for arrival around June 18. One more cargo may have traded.

·

South Korea’s NOFI bought 66,000 tons of optional origin corn at $212.30/ton c&f for arrival around May 20.

Soybean

complex.