From: Terry Reilly

Sent: Wednesday, February 19, 2020 3:00:20 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 02/19/20

Global vegetable oil markets were on the defensive. USDA set to release new-crop US crop estimates on Friday. We will see corn, soybean, and all-wheat US planted area projections on Thursday.

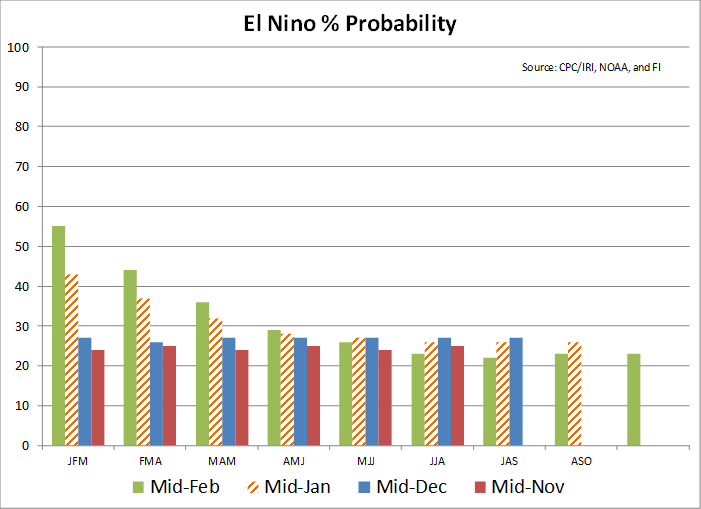

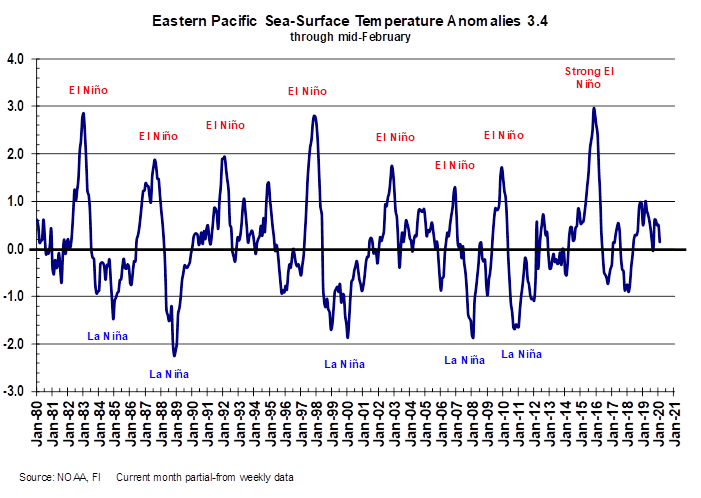

Mid-February ENSO suggests the potential for near term El Nino increased from last month’s forecast.

· Argentina will dry down over the next 5-6 days, but the country has plenty of soil moisture to allow conditions to remain favorable.

· Southern Brazil will dry down over the next two weeks but there is an opportunity for some rain Feb 24-29.

· Flooding remains a serious issue across the far southern Delta and Southeast.

· Snow and rain will develop in the southern U.S. Plains Wednesday and Thursday with accumulations of 1 to 4 inches.

· A larger central U.S. storm is expected during mid- to late-week next week that will bring significant moisture to the upper Midwest, northern Plains and a part of the western Corn Belt.

Source: World Weather Inc. and FI

MARKET WEATHER MENTALITY FOR CORN AND SOYBEANS:

Drying in Argentina over the next week to ten days will eventually grab the market’s attention, but today’s soil moisture is very good and crops will coast through this first week of net drying without much stress. Timely rain will be needed again later in March to ensure the best production potential.

Brazil crop weather still looks quite appealing with timely rain in most production areas and seasonable temperatures.

South Africa will have its best summer grain and oilseed production year since 2017 with weather over the next two weeks maintaining that favorable outlook.

Southeast Asia palm oil weather remains quite favorable and little change will occur through the next two weeks.

China’s winter rapeseed should experience much improvement early this spring after abundant winter precipitation. India’s winter grain and oilseed crops are also expected to perform well.

Europe weather is mostly good and winter crops will need timely rainfall to support normal development this spring especially in Spain where the greatest drying has occurred recently.

Concern is rising over early season corn planting delays in the U.S. Delta and interior southeastern states because of too much rain. The problem of moisture excesses will continue into March delay will be realized.

Overall, weather today will likely support a mixed influence on market mentality with bearish bias.

MARKET WEATHER MENTALITY FOR WHEAT:

North Africa, Spain and Portugal are drying down and significant rain will soon be needed in unirrigated areas to ensure the best production potential. Some yield cuts have already occurred in southwestern Morocco, but losses elsewhere have not been as significant. Rain must fall soon, however, since reproduction is getting under way in North Africa and will soon occur in the Iberian Peninsula and without rain and good soil moisture yields will come crashing downward.

Limited winterkill around the world this year has kept production potentials mostly good, although winter crops were not well established in the U.S., Southeastern Europe, southern Russia, Kazakhstan or China. With that said most of these areas have received good amounts of moisture during the winter which should translate into improving crop development potential early in the spring so that production potentials are favorably restored.

India is still expecting a large crop even though there is not much precipitation expected in key wheat areas for a while. Some showers will occur in eastern and far northern parts of the nation in this coming week which will support some reproduction.

Overall, weather is still not offering a good reason for serious market price appreciation. If anything, weather conditions have left a good reason to expect crop improvements early this spring. Overall, weather today may offer a neutral to bearish bias to market mentality.

Source: World Weather Inc. and FI

- EARNINGS: Marfrig

- USDA Broiler Report

THURSDAY, FEB. 20:

- EIA U.S. weekly ethanol inventories, production, 10:30am

- USDA Agricultural Outlook – corn, wheat, soy, cotton acreage, 8:20am

- USDA milk, read meat production, 3pm

- Malaysia’s Feb. 1-20 palm oil exports data

- EARNINGS: Wilmar

FRIDAY, FEB. 21:

- USDA outlook — corn, soy, wheat cotton end-stockpiles

- USDA weekly crop net-export sales for corn, soybeans, wheat, 8:30am

- ICE Futures Europe weekly commitments of traders report on coffee, cocoa, sugar positions ~1:30pm (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly update on crop conditions

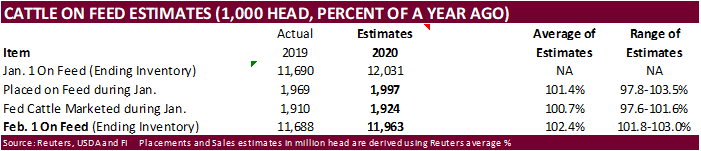

- U.S. Cattle on Feed, 3pm

- EARNINGS: Pilgrim’s Pride

Source: Bloomberg and FI

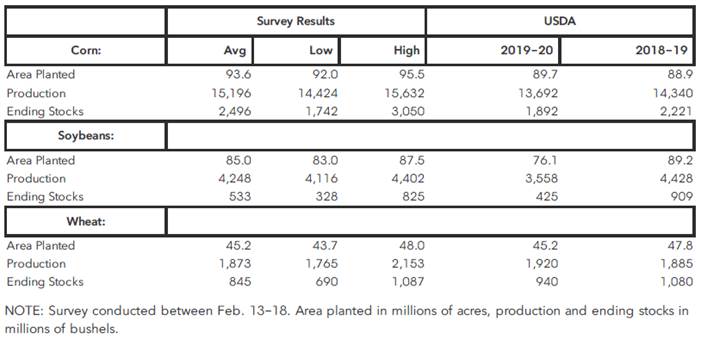

USDA Outlook forum Bloomberg trade estimates:

· US Housing Starts Number (Jan): 1.567Mln (est 1.425Mln, prevR 1.626Mln)

· US PPI Final Demand Y/Y (Jan): 2.1% (est 1.6%, prev 1.3%)

· Canada CPI Inflation (M/M) Jan): 0.3% (est 0.2%, prev 0.0%)

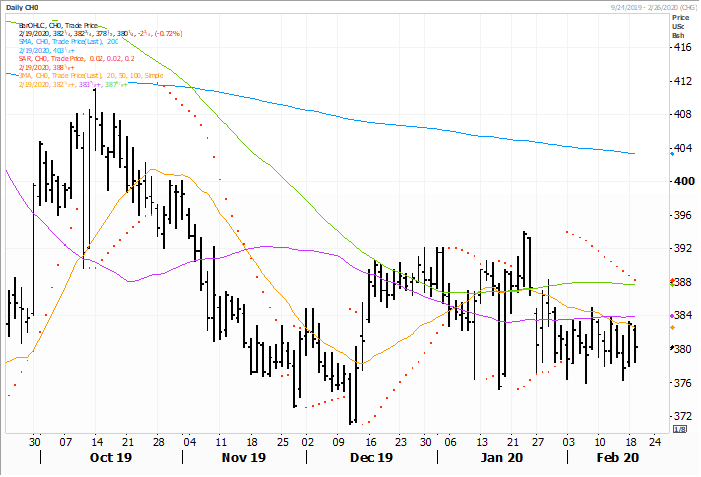

· March corn futures ended 2.50 cents lower. News in corn was light. Corn futures were lower on lack of US corn sales to South Korea and large South American crop prospects. Brazil is rapidly planting second crop corn following soybean harvest that is running near average.

· CH traded at $3.80 every trading day since January 27.

· USDA’s annual outlook conference starts on Thursday and before the trade gets to see the 2020-21 US commodity outlooks on Friday, we should get some area numbers during the morning opening speeches. Analysts estimates in millions of acres compared to 2020 baseline and 2019:

corn 84.6/84.0/76.1, soybeans 93.6/94.5/89.7, all wheat 44.9, 45.0, 45.2. This assumes Reuters estimates. Bloomberg estimates are above the corn section.

- As of Wed., China put the overall death toll at 2,000+ and 75,200+ infections.

- Zimbabwe received 42,000 tons of corn from Mozambique.

· The USDA Broiler Report showed eggs set in the US up 3 percent and chicks placed up 5 percent. Cumulative placements from the week ending January 4, 2020 through February 15, 2020 for the United States were 1.34 billion. Cumulative placements were up 4 percent from the same period a year earlier.

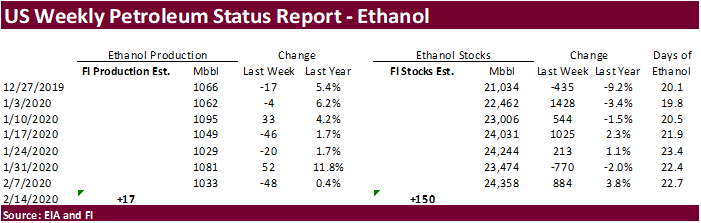

· A Bloomberg poll looks for weekly US ethanol production to be up 16,000 at 1.049 million barrels from the previous week and stocks to increase 47,000 barrels to 24.405 million.

· South Korea’s FLC bought an optional origin corn cargo at $211.74 c&f for arrival around May 20.

· It was confirmed NOFI bought an optional origin corn cargo at $211.54 c&f foe arrival around May 20.

· Total SK purchases this week amount to about 330,000 tons. Black Sea origin was noted for FLC.

CBOT March Corn

Source: Reuters and FI

- CBOT March corn is seen in a $3.75 and $3.90 range.

- CBOT May is seen in a $3.80 and $4.00 range.

Soybean complex.