From: Terry Reilly

Sent: Saturday, February 29, 2020 9:25:50 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 02/28/20

PDF attached

What

a week. USD tanked late on Friday after Powell commented on using tools to stabilize economy. COVID-19: 83,000+ infected and 2,800+ deaths.

More

countries report initial cases. https://www.bbc.com/news/world-51235105

Three trillion+ USD has been wiped out of the S&P since the panic started. 2870 is the 50 percent retracement level for the S&P.

MARKET

WEATHER MENTALITY FOR CORN AND SOYBEANS:

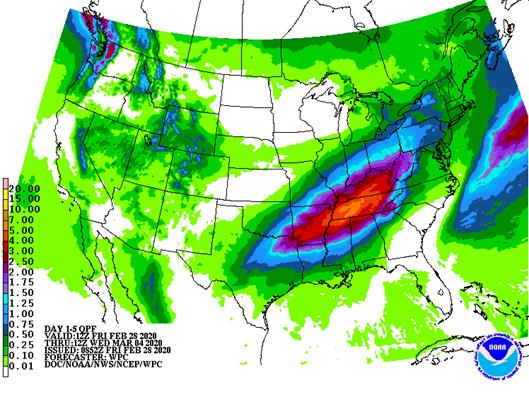

Concern

about Argentina drying and rising crop stress potentials over the next couple of weeks may begin influencing market trade in the next few days. There will also be some concern over flooding rain expected in Minas Gerais, Goias, Rio de Janeiro and northeastern

Sao Paulo, Brazil in the next seven days. Some important drying will occur in Brazil before the greater rain falls and that will support second season planting for a while.

Southeast

Asia weather is quite varied. World Weather, Inc. anticipates an erratic shower and thunderstorm pattern in March supporting early season moisture boosting.

Winter grain and oilseed crops will remain favorably rated and poised for improvement in the spring in China and southeastern Europe. India’s winter crops are expected to perform well this year because of greater than usual rainfall.

U.S. early season planting may be slow this year in the Delta, southeastern states and possibly the lower Midwest because of frequent rain and wet field conditions.

South

Africa will get some timely rainfall along with parts of Australia to maintain a favorable outlook. With that said, eastern Australia production has not improved much, but some sorghum has received supplemental rainfall recently.

Overall,

weather today may contribute a neutral to slightly bullish bias, but other world factors will likely have much more influence on the market

MARKET

WEATHER MENTALITY FOR WHEAT:

Worry

over rising temperatures in the central and southern U.S. Plains over the next couple of weeks might have the markets attention. Wheat will be brought out of dormancy in Texas and Oklahoma along with areas to the east. Cold weather may return later in March

and/or April to bring back freezes which could place some of the crop at risk. Crops in Kansas, Colorado and Nebraska will lose winter hardiness as well.

Russia

crops are going to come into spring favorably moist except in the far south where greater rain will be needed. Kazakhstan will also need greater rain in the spring while Ukraine already has enough moisture to induce some improvement just as soon as seasonal

warming arrives.

North

Africa’s outlook has not changed for Morocco, but there is a little more rain slated for Tunisia and northeastern Algeria over the next two weeks. No general soaking of rain is expected, but any showers would be welcome.

Australia’s winter small grains will not be planted prior to late April which leaves plenty of time for improved weather and soil conditions.

India’s

wetter outlook over the next two weeks will further ensure a significantly large-sized winter crop.

France

and Spain need to warm up along with Italy to support spring planting and to stimulate early season crop development when weather conditions improve.

Overall, weather today will likely maintain a mixed influence on market mentality.

Source:

World Weather Inc. and FI

- ICE

Futures Europe weekly commitments of traders report on coffee, cocoa, sugar positions ~1:30pm (~6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - U.S.

agricultural prices paid, received, 3pm - EARNINGS:

Olam, Golden Agri, Sime Darby

MONDAY,

MARCH 2:

- AmSpec,

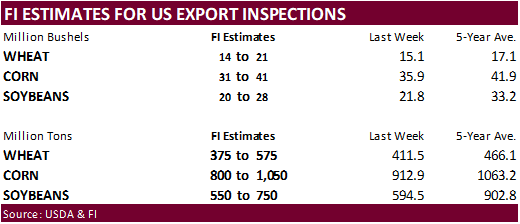

Intertek, SGS palm oil export data for Feb. 1-28 - USDA

weekly corn, soybean, wheat export inspections, 11am - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals - Australia

commodity index, 12:30am - Brazil

soybean, sugar, corn and coffee exports, 1:15pm - USDA

soybean crush, DDGS output, corn for ethanol, 3pm - SGS

palm oil export data for Feb. 1-29

TUESDAY,

MARCH 3:

- Abares

agriculture outlook conference, Canberra - Purdue

Agriculture Sentiment, 9:30am - BRF

4Q19 earnings before market open, Sao Paulo

WEDNESDAY,

MARCH 4:

- EIA

U.S. weekly ethanol inventories, production, 10:30am - New

Zealand commodity price - Abares

agriculture outlook conference - CNGOIC’s

monthly supply/demand report on China soy, corn

THURSDAY,

MARCH 5:

- FAO

world food price index, 4am - Day

1 of three-Day National Coffee Association USA Annual Convention - Intertek

Malaysia palm oil export data for March 1-5 - USDA

weekly crop net-export sales for corn, soybeans, wheat, 8:30am - Port

of Rouen data on French grain exports

FRIDAY,

MARCH 6:

- ICE

Futures Europe weekly commitments of traders report on coffee, cocoa, sugar positions ~1:30pm (~6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

SATURDAY,

MARCH 7:

- China

soybean import volume data

Source:

Bloomberg and FI

·

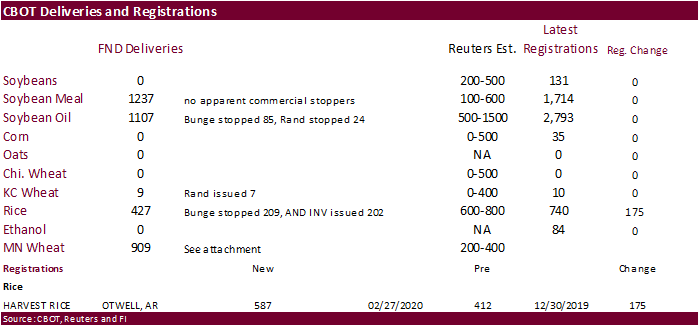

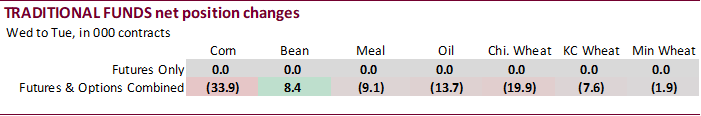

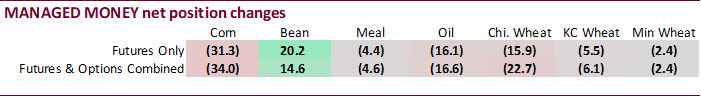

Managed money futures and options showed soybean meal net short a record 77,112 contracts.

·

Traditional funds were just shy of the record net short for soybean meal

·

US$ Swaps pricing is hinting up to 4 interest US rate cuts by January 2021, according to analysts.

·

US Wholesale Inventories M/M (JanP): -0.2% (est 0.1%, prev -0.2%)

·

US Personal Income (Jan): 0.6% (est 0.4%, prevR 0.1%)

·

US Personal Spending (Jan): 0.2% (est 0.3%, prevR 0.4%)

·

US PCE Deflator (M/M) Jan: 0.1% (est 0.2%, prev 0.3%)

US

PCE Deflator (Y/Y) Jan:1.7% (est 1.8%, prev 1.6%)

US

PCE Core Deflator (M/M) Jan: 0.1% (est 0.2%, prev 0.2%)

US

PCE Core Deflator (Y/Y) Jan: 1.6% (est 1.7%, prev 1.6%)

·

Canada Quarterly GDP Annualized Q4: 0.3% (est 0.3%, prevR 1.1%)

·

Canada Industrial Product Price (M/M) Jan: -0.3% (prevR 0.3%)

·

US Chicago PMI Feb: 49.0 (est 46.0; prev 42.9)

·

Mexico and Several Other Countries Confirms First Case Of The Coronavirus

·

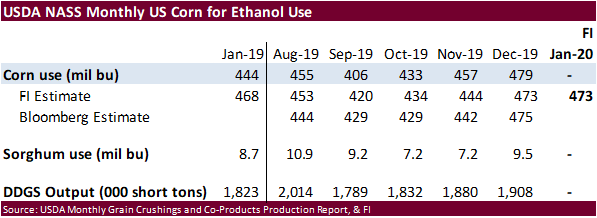

CBOT corn futures reached new contract lows on Friday. But

May

corn ended

0.25 cents higher

despite starting the day lower on coronavirus concerns. Friday positioning led to bull spreading. With Argentina suspending grain and oilseed registrations, bull traders bought the front end of the corn market. July corn ended unchanged and September was

down 0.25 cent.

·

Crude oil was down more than $2.00/barrel as of 1:31 CT.

·

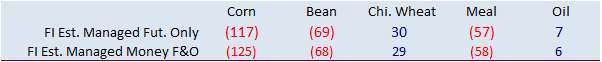

Funds bought an estimated net 5,000 corn contracts.

·

Farm Futures: US corn area 96.6 million. That would be second largest on record behind 2012.

·

China’s NBS reported 2019 pork output fell 21.3 percent from a year earlier.

·

CME raised hog futures trading limits to 3.75 cents per pound from 3.00 cents.

·

None reported

Soybean

complex.

- May

soybeans ended 2.25 cents lower, May meal $2.00 higher, and May soybean oil 51 points lower.

-

Argentina

averted a strike after the main crushing union announced to delay it for at least 14 days. The government may raise the soybean export tax to 33% from the current 30% as soon as next week. There was speculation product taxes could be left unchanged. This

allowed soybeans to pair some losses from session lows. Soybean meal found support over the ongoing Argentina economic situation and the USDA announcement for soybean meal sold to the Philippines. The meal deliveries didn’t seem to have an impact on the

market. Registrations were high anyway. Soybean oil fell hard by 47-52 points.

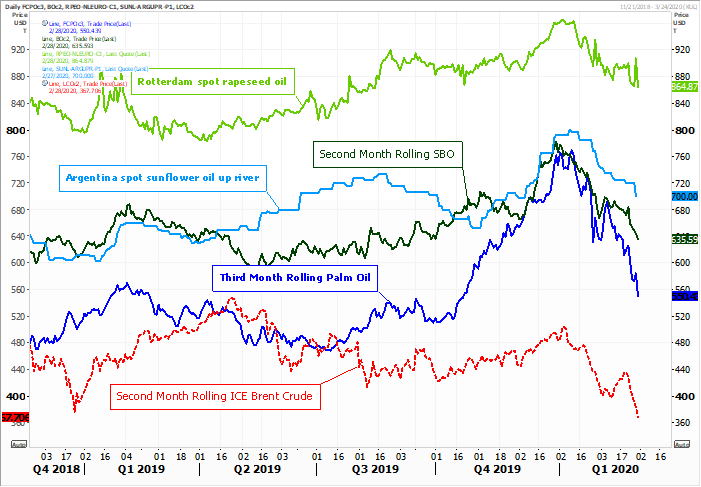

Malaysian

palm oil on Friday fell nearly 6 percent and cash was hammered by falling about $30/ton. Palm oil is a steal, in our opinion. For the week, crude palm oil when imported into Rotterdam is down around 6.3 percent from the previous week.

-

South

American soybean meal premiums when imported into Rotterdam were up $3-$9/ton on Friday from the previous day.

- Funds

sold an estimated net 6,000 soybean contracts, bought 5,000 soybean meal and sold 7,000 soybean oil.

-

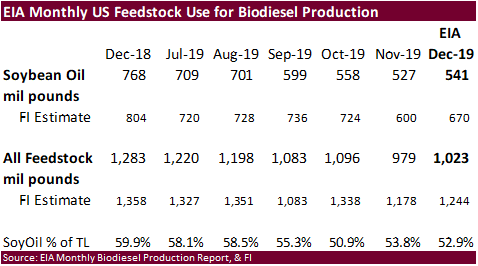

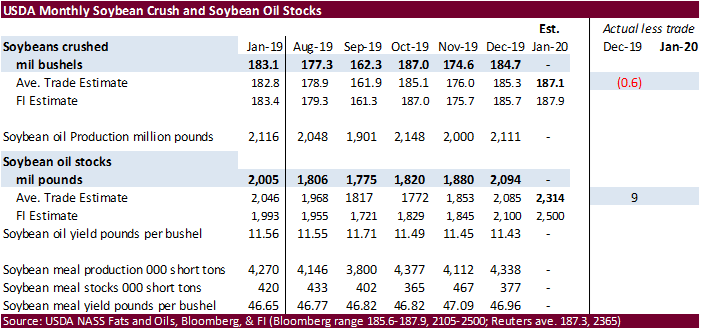

EIA

reported a very low US soybean oil for biodiesel use figure Friday morning, further pressuring soybean oil futures.

·

Brazil’s currency made a new record low on Friday.

·

Farm Futures: US soybean area 80.6 million acres

·

Russia’s AgMin proposed increasing sunflower export tariffs, already set at 6.5 percent or not less than 9.75 euros (about $10.60/ton). Some speculate the tariff could go to 20 percent.

·

China cash crush margins as of this morning, using our calculation, were 126 cents per bushel (133 previous day), compared to 159 cents a week ago and negative 12 cents around this time last year.

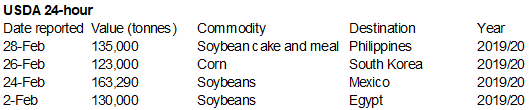

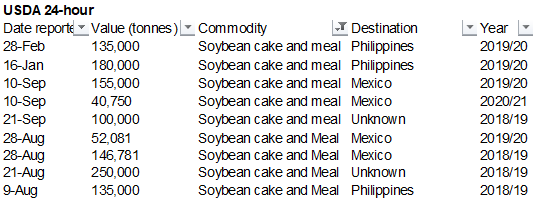

- Under

the 24-hour system, USDA reported 135,000 tons of soybean meal was sold to the Philippines for 2019-20 delivery.

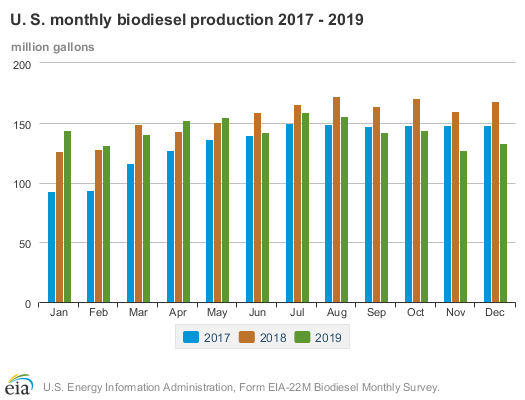

U.S.

production of biodiesel

was 133 million gallons in December 2019, 6 million gallons higher than production in November 2019.

- The

use of soybean oil for biodiesel production is ending up much lower than what we estimated, and December’s figure raises the question whether or not US soybean oil consumption for biodiesel will reach USDA’s 8.200-billion-pound target. The low use partially

justifies why NOPA soybean oil stocks were unusually higher than expected at the end of December and January.

- There

were a total of 1,023 million pounds of feedstocks used to produce biodiesel in December 2019, up from 979 million in November and down from 1283 million for December 2018. We had a working estimate of 1,244 million pounds for December 2019.

- Soybean

oil remained the largest biodiesel feedstock during December 2019 with 541 million pounds consumed, above 527 million pounds above November and below 768 million pounds for December 2018. FI was looking for 670 million pounds!

- Soybean

oil use for the first three months of the crop-year average 52.5 percent of total feedstock versus 57.3 percent year earlier.

- We

lowered our soybean for biodiesel production to 8.175 billion pounds, 25 million below USDA. Our tentative 2019-20 US soybean oil carryout is 1.46 billion pounds, below 1.515 billion USDA February S&D. This will change when NASS updates their US crush.

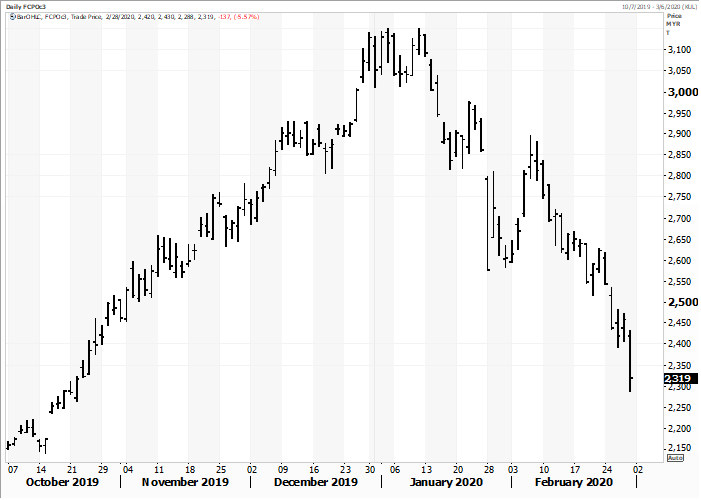

Third

month rolling Malaysian palm oil chart

Source:

Reuters and FI

-

May

soybeans are seen in a wide $8.65-$9.15 range. -

May

meal is seen in a $280 to $3.05 range -

May

soybean oil range is 28.00 to 31.00 (lowered 50)

·

US wheat traded the day mostly lower on coronavirus concerns. KC and MN ended higher on late short covering.

May

Chicago was down 2.50 cents, May KC wheat finished 1.50 cents higher and May MN ended 3.50 cents higher.

Chicago

wheat down for the third session on coronavirus concerns.

·

USD was lower by 34 points as of 1:40 pm CT.

·

Funds sold an estimated net 3,000 Chicago wheat contracts.

·

French wheat crop ratings were 64 percent as of Feb 24, down one point from the previous week but well below 85 percent year ago.

·

May Paris wheat futures were down 2.25 at 184.25 euros.

- The

Philippines bought 275,000 tons of feed wheat, optional origin, at $200-$230/ton for May 20-July 22 shipment.

- Jordan

seeks 120,000 tons of wheat on March 3. - Jordan

seeks 120,000 tons of feed barley on March 4. - Japan

in an SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of feed barley for arrival in Japan by July 30, on March 4.

- Morocco

seeks 354,000 tons of US durum wheat on March 5 for arrival by May 31. - Syria

seeks 200,000 tons of wheat from Russia by March 23. No purchase was made that closed on February 17.

Rice/Other

- China

set 2020 rice support prices to between 2420-2600 yuan per ton, and capped purchases to 50 million tons (30 japonica and 20 Indica).

- Indonesia

looks to import 130,000 tons of sugar from India.

Updated 2/28/20

·

CBOT Chicago May wheat is seen in a $5.00-$5.60 range

·

CBOT KC May wheat is seen in a $4.35-$4.85 range

·

MN May wheat is seen in a $4.95-$5.50 range

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for

the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender

immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.