From: Terry Reilly

Sent: Friday, March 06, 2020 7:37:19 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 03/06/20

PDF attached

Coronavirus:

100,000+ cases, 4,000+ deaths

Another

turbulent week to get behind us. From a 10+ percent decline in WTI crude oil, sharply lower trade in the USD and 30-year U.S. yields showing off their largest slide since 2009, among other wild swings in markets, traders drove up fear indexes. One index

worth monitoring is the Markit CDX North America Investment Grade Index (below).

The

Markit CDX North America Investment Grade Index

is composed of 125 equally weighted credit default swaps on investment grade entities, distributed among 6 sub-indices: High Volatility, Consumer, Energy, Financial, Industrial, and Technology, Media & Tele-communications. Markit CDX indices roll every 6 months

in March & September.

Source:

Bloomberg and FI

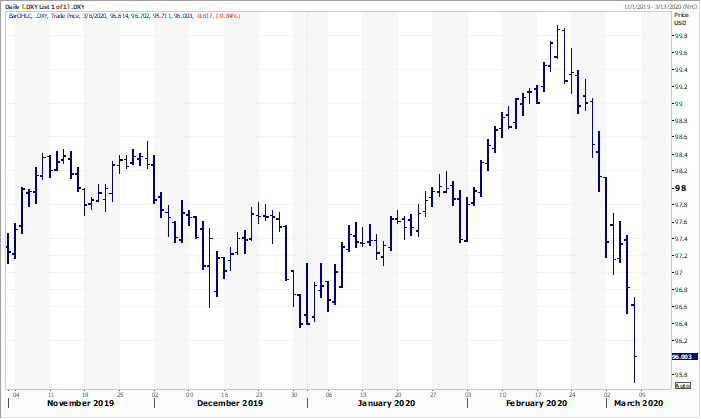

USD

Source:

Reuters

MARKET

WEATHER MENTALITY FOR CORN AND SOYBEANS:

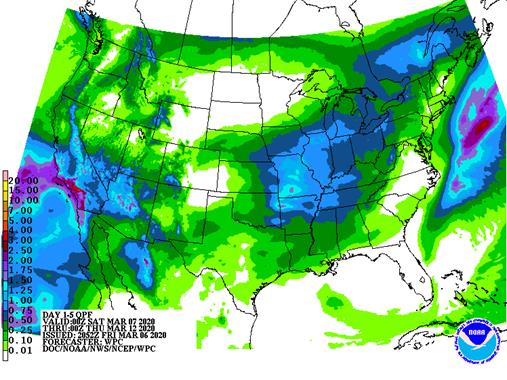

Rain

advertised for central and interior southern Argentina next week will ease dryness and could bring on better crop conditions, although follow up rain will be needed in some areas. Northern Argentina will still have some ongoing dryness issues with the earlies

rainfall occurring after March 15. Argentina will continue to progressively become too dry through Monday, however.

Brazil’s

drying in the west and south will be ideal for promoting soybean harvesting and second season crop planting. Wet weather in Minas Gerais and Goias should ease up during the next ten days, although showers and thunderstorms will still occur periodically. Subsoil

moisture remains sufficient to support crops in Brazil. Rain will be needed in much of the south a week from now and it may get some rain after March 15.

India’s and China’s winter crop outlooks are still good, and improvement has occurred in recent weeks across parts if Europe. South Africa’s weather has not changed from that of late last week.

The

U.S. outlook remains wet for many areas from the lower Midwest into the Delta and interior southeastern states over the next couple of weeks possibly slowing early season planting potentials. There is plenty of time for the weather to improve for better planting

potentials, but it will not happen in the next couple of weeks.

Overall,

today’s weather will have a mixed influence on market mentality.

MARKET

WEATHER MENTALITY FOR WHEAT:

Earlier

than usual crop development is expected for many production areas around the world, but as long as there is no threatening cold coming up the situation is not likely to be significant. Huge crops are still expected from India and China will end up with a big

crop as well. North Africa production is destined to be low based mostly on dryness in Morocco and northwestern Algeria. Europe winter crops are in mostly good shape, although rain is still needed in the southeast.

U.S.

wheat is expected to remain in favorable shape, but greening and early season development in the southern Plains could be aggressive for a while due to unusually warm weather.

Overall,

weather today may produce a mixed influence on market mentality.

Source:

World Weather Inc. and FI

- ICE

Futures Europe weekly commitments of traders report on coffee, cocoa, sugar positions ~1:30pm (~6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

SATURDAY,

MARCH 7:

- China

soybean import volume data

MONDAY,

MARCH 9:

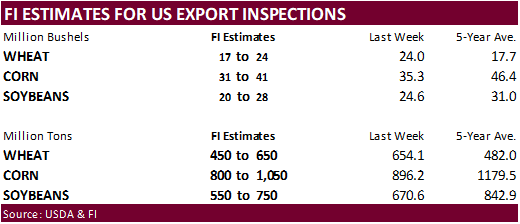

- USDA

weekly corn, soybean, wheat export inspections, 11am - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals

TUESDAY,

MARCH 10:

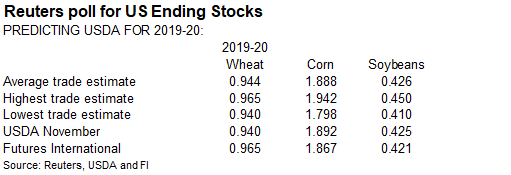

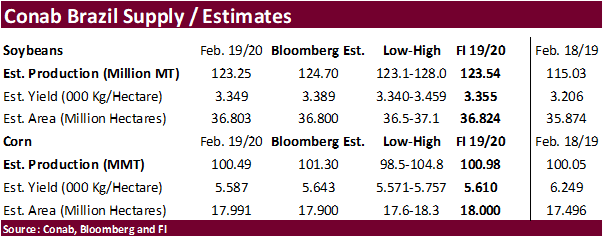

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, noon - Brazil

Conab soybean and corn yield, area and production, 8am - China

agriculture ministry (CASDE) supply & demand monthly report - AmSpec,

Intertek, SGS release palm oil export data for March 1-10 - Malaysian

Palm Oil Board data on palm production, exports, stocks - Ros

Agro 4Q results

WEDNESDAY,

MARCH 11:

- EIA

U.S. weekly ethanol inventories, production, 10:30am - Santander

and Datagro hold sugar, ethanol conference, Sao Paulo - FranceAgriMer

monthly cereals balance sheet

THURSDAY,

MARCH 12:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, 8:30am - Port

of Rouen data on French grain exports - New

Zealand food prices, 5:45pm

FRIDAY,

MARCH 13:

- ICE

Futures Europe weekly commitments of traders report on coffee, cocoa, sugar positions ~1:30pm (~6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

Deliveries,

registrations, OI & Options

Bunge

was active again cancelling soybean meal registrations. Wednesday night they cancelled 435. Thursday evening another 72 were cancelled.

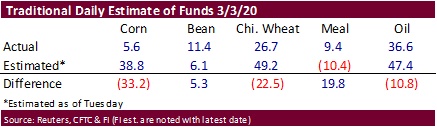

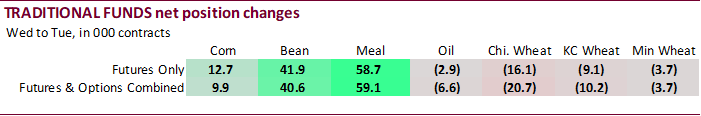

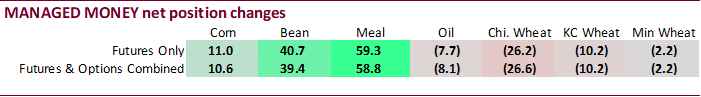

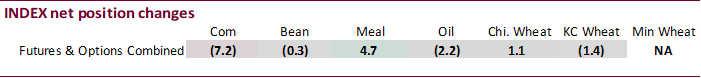

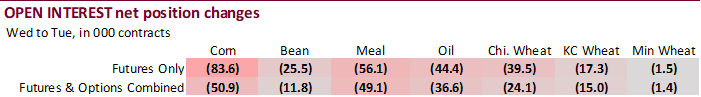

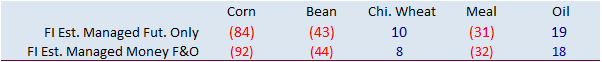

CFTC

Commitment of Traders

・

Big changes for the week ending March 3 for soybeans and corn. Money managers that week bought net 39,400 soybean contracts and 58,800 soybean meal. Money managed were light net sellers of corn and bought

soybean oil and wheat.

・

Funds were much less long in corn than expected by 33,200 contracts, and also much less long in Chicago by 22,500 contracts. Funds were off 19,800 contracts in their meal position.

Macros

・

Lufthansa Announces Plans To Reduce Flight Capacity By ‘Up To 50%’ On Coronavirus

・

OPEC Has No Intention To Cut Output Without Russia – RTRS Source (Russia rejected OPEC’s cuts)

・

WTI was down more than $2.00/barrel before the US day session started.

・

Mexico made a deal to imports millions of barrels of Venezuelan crude oil.

・

US Non-Farm Payrolls Feb 273K (est 175K; prevR 273K; prev 225K)

-US

Average Earnings (M/M) Feb 0.3% (est 0.3%; prev 0.2%)

-US

Average Earnings (Y/Y) Feb 3.0% (est 3.0%; prev 3.1%)

-US

Unemployment Rate Feb 3.5% (est 3.6%; prev 3.6%)

・

US Private Payrolls Feb 228K (est 160K; prevR 222K; prev 206K)

-US

Manufacturing Payrolls Feb 15K (est -3K; prevR -20K; prev -12K)

-US

Average Workweek Hours Feb 34.4 (est 34.3; prev 34.3)

-US

Participation Rate Feb 63.4% (prev 63.4%)

・

US Trade Balance Jan -$45.3 Bln (est -$46.1 Bln; prev R -$48.6 Bln; prev -$48.9 Bln)

・

US Wholesale Inventories (M/M) Jan F: -0.4% (est -0.2%; prev -0.2%)

–

Wholesale Trade Sales (M/M) Jan: 1.6% (prev R -0.2%)

・

Canada Trade Balance Jan -C$1.47 Bln (est -C$0.78 Bln; prevR -C$0.73 Bln; prev -C$0.40 Bln)

・

Canada Employment Change Feb 30.3K (est 11.0K; prev 34.5K)

-Canada

Unemployment Rate Feb 5.6% (est 5.6%; prev 5.5%)

・

Corn futures ended lower by 5.75 cents basis May and 4.50 for the July position. Lower energy products dragged corn futures lower on Friday despite USDA corn 24-hour announcements and sharply lower USD.

At $3.7600 for the May contract, many believe corn could see another leg down in the market. May corn ended 2.1 lower for the week.

・

WTI crude was down $4.29 at $41.62, or 9.35% (as of 3:00 pm CT). It’s down 32 percent year-to-date. The US energy complex fell more than 5 percent today.

・

Flow was good FH Friday. Futures and options volume was little heavier than normal by mid-session, bias spreads CK 379 STOP 5000X TO 376.5 3000 MORE 376.25-375.75. For the afternoon session, it was quiet

for most of the ag markets.

・

In a barter transaction, Mexico will supply Venezuela with corn and water trucks in exchange for millions of barrels of crude oil.

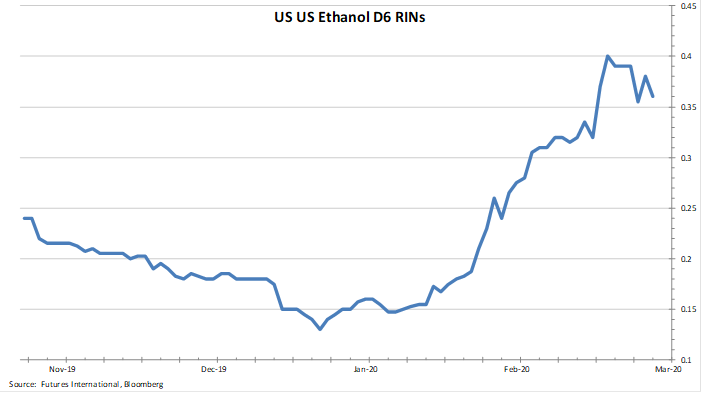

・

D4 and D6 RIN prices traded lower early on Friday on uncertainty whether or not there will be a reduction in small refinery waivers for 2019. Several US biofuel groups are slamming the Administration

- South

Korea’s KFA bought 65,000 tons of corn from South America at around 207.95/ton c&f for June 1-30 shipment.

- Under

the 24-hour announcement system, private exporters reported to the U.S. Department of Agriculture:

–Export

sales of 211,336 tons of corn for to delivery to unknown destinations during the 2019/2020 marketing year.

–Export

sales of 234,688 tons of corn for delivery to Japan during the 2019/2020 marketing year.

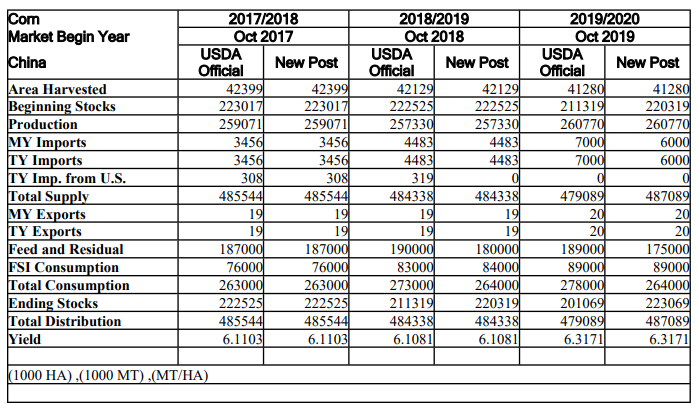

The

USDA Attaché updated their China corn S&D

and they look for corn imports in 2019-20 to end up near 6 million tons. China took more than 2.0 million tons of Ukrainian corn during the September through mid-February period. In 2018-19 China bought 3.84 million tons of corn from Ukraine. It’s hard to

see China buying more than 3.0 million tons of corn from the United States for the 2019-20 marketing year even if US prices become competitive.

Soybean

complex.