PDF attached does not include CFTC COT. That will be sent out later

As you most likely heard, the CME has suspended floor trading for options at the conclusion of Friday’s session. As we all deal with the uncertainty of this unknown virus and attempt to navigate the unknowns, we wanted to give an overview of what avenues for trading of options are available. Futures International LLC is and will remain one of the largest liquidity providers for agricultural products, having access to the world’s largest liquidity pools available. We have all the systems already in place to access these markets through block trades, cross trades, Globex and OTC if desired. Our liquidity pool includes, but not limited to, hedge funds, market makers, locals, and money managers that make markets. Futures International LLC has already been practicing execution during non pit hours for several years, so we are more than ready for this transition. As one of the largest options companies at the CBOT, we can provide the service needed both through execution and discovery.

Dow futures ended on a strong note on Friday.

Central banks are injecting money into local economies. US equity futures were limit up early this morning. China lowered bank reserve requirements for the second time this year.

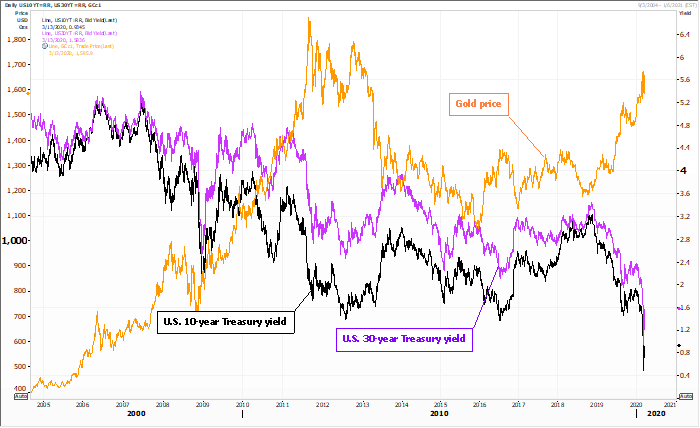

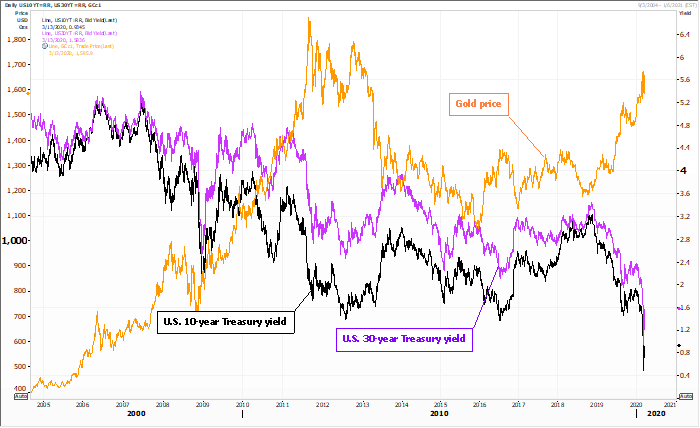

Source: Reuters and FI