From: Terry Reilly

Sent: Monday, March 16, 2020 1:55:55 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 03/16/20

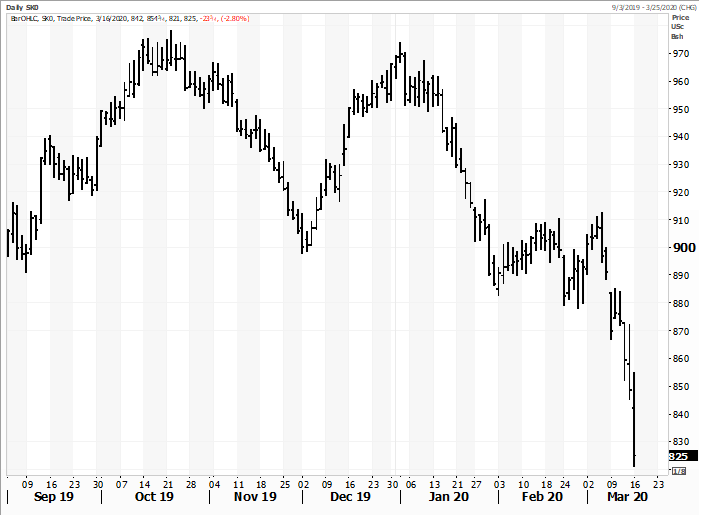

Fed Slashes Rates to Near Zero, Deploys Massive Bond Buying of $700 bil. Macros continue to dictate prices. Fundamentals will return eventually.

SK0

Source: Reuters and FI

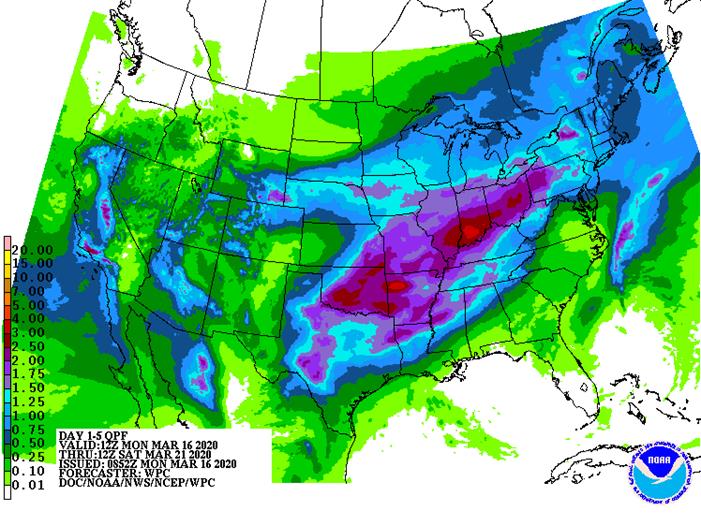

MARKET WEATHER MENTALITY FOR CORN AND SOYBEANS:

Today’s weather will not provide much bullish support except from the United States where a wet bias will continue in the Delta and Tennessee River Basin as well as in parts of central and eastern crop areas of Texas. South Texas moisture will be welcome and dry conditions in the far southeastern U.S. will support planting.

South America weather is still advertised to be mostly good for Argentina and southern Brazil, although the distribution of rain over the next two weeks will have much to say about late season corn, soybean and peanut production.

South Africa rainfall will be good for production and drier weather in eastern Australia will be supportive of early season sorghum and other coarse grain and oilseed crops.

India winter crops are still poised for excellence this year and drier weather will be needed in late March and especially April to protect crop quality.

China’s winter weather has spring planting prospects looking very good. Rain in Spain and Portugal will improve spring planting potentials and support improved winter crop conditions.

Rain is still needed throughout Southeast Asia, but mostly in the mainland areas and in some of the northern palm oil and coconut production areas.

Overall, weather today will maintain a neutral to bearish bias to market mentality

MARKET WEATHER MENTALITY FOR WHEAT:

Cooling in southern Russia and southern Ukraine this week will help keep winter crop development in check after recent greening. Winter crop development potential in China remains very good and India is experiencing some fine filling conditions after a successful reproductive season. Europe wheat small grain production potential continues to improve and rain in North Africa and Spain this week may bring on some improvement for those areas as well.

U.S. winter crops are in mostly good shape, although drier weather is needed in the Delta. Southeastern Canada and the heart of the Midwest also need some drier weather.

Overall, weather today will maintain a neutral to bearish bias to market mentality.

Source: World Weather Inc. and FI

- USDA weekly corn, soybean, wheat export inspections, 11am

- EU weekly grain, oilseed import and export data

- AmSpec, Intertek, SGS release palm oil export data for March 1-15

- Ivory Coast cocoa arrivals

TUESDAY, MARCH 17:

- New Zealand global dairy trade auction

WEDNESDAY, MARCH 18:

- EIA U.S. weekly ethanol inventories, production, 10:30am

THURSDAY, MARCH 19:

- USDA weekly crop net-export sales for corn, soybeans, wheat, cotton, 8:30am

- Port of Rouen data on French grain exports

- USDA total milk, red meat production, 3pm

FRIDAY, MARCH 20:

- ICE Futures Europe weekly commitments of traders report on coffee, cocoa, sugar positions ~1:30pm (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly update on crop conditions

- AmSpec, Intertek, SGS release palm oil export data for March 1-20

- U.S. cattle on feed, 3pm

Source: Bloomberg and FI

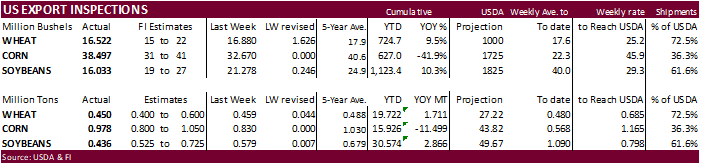

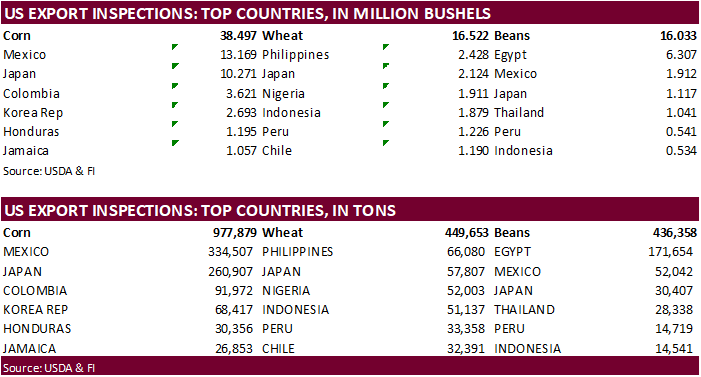

USDA inspections versus Reuters trade range

· Wheat 449,653 versus 350000-600000 range

· Corn 977,879 versus 700000-1050000 range

· Soybeans 436,358 versus 400000-750000 range

GRAINS INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING MAR 12, 2020

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———– WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 03/12/2020 03/05/2020 03/14/2019 TO DATE TO DATE

BARLEY 1,197 0 836 30,328 7,810

CORN 977,879 829,865 812,893 15,925,674 27,424,573

FLAXSEED 0 0 24 520 366

MIXED 0 0 0 0 0

OATS 100 0 0 2,866 2,093

RYE 0 0 0 0 0

SORGHUM 76,528 58,711 25,519 1,536,916 974,701

SOYBEANS 436,358 579,102 849,700 30,573,717 27,707,970

SUNFLOWER 0 0 0 0 0

WHEAT 449,653 459,400 385,143 19,722,391 18,011,087

Total 1,941,715 1,927,078 2,074,115 67,792,412 74,128,600

————————————————————————-

CROP MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED; SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES WATERWAY SHIPMENTS TO CANADA.

· May corn ended 11 cents lower at $3.5475 and July down 10 cents to $3.5850.

· Corn futures were lower on weakness in WTI and other outside commodity markets. The selloff pulled grain and oilseeds prices to fresh multi-month lows. Reuters noted S&P 500 companies lost $2 trillion in market value after markets opened on Monday.

· Agriculture futures and options volume were heavy.

· USDA shuttered parts of its main Washington, DC, headquarters after an employee tested positive for coronavirus.

· USDA US corn export inspections as of March 12, 2020 were 977,879 tons, within a range of trade expectations, above 829,865 tons previous week and compares to 812,893 tons year ago. Major countries included Mexico for 334,507 tons, Japan for 260,907 tons, and Colombia for 91,972 tons.

· Ukraine announced they will restrict food exports, travel, surgeries, and many other routine activities. They are in talks with the IMF for financial support. They are urging people to stay at home. Ukraine later said they are not planning to ban grain exports, which could have trigged some additional pressure to corn futures.

· Germany reported a H5N8 bird flu case in Saxony.

· The EU imported 14.83 million tons of corn so far this year, down 14 percent from the same period year ago.

- South Korea’s KFA indeed buy 52,000 tons of corn on Friday, at $202.90/ton c&f for arrival around August 5.

- South Korea’s MFG bought 132,000 tons of corn at $200.40/ton to $203.40/ton c&f for August 9 and July 21 arrival, respectively.

Soybean complex.

- CBOT soybeans traded 14 to 27 cents lower, led by bear spreading on widespread commodity selling. WTI was below $30. Soybean meal fell $3.20 basis the May position and May soybean oil closed 138 points lower at 24.99. Soybean oil fell to its lowest level since October 2006.

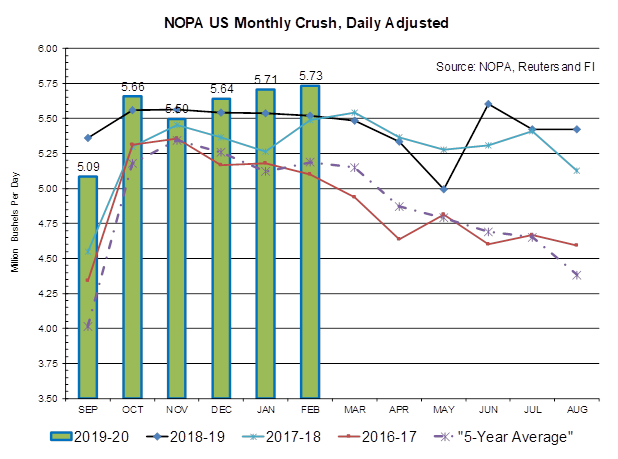

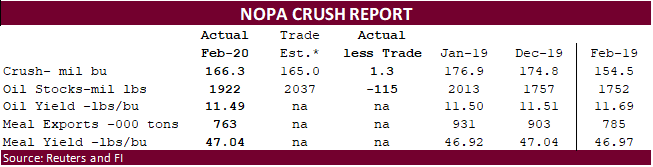

- NOPA’s soybean crush came in above trade expectations and soybean oil stocks were more than 100 million pounds below an average trade guess. See table below and attached FI NOPA deck.

- US producer selling remains slow on weaker soybean futures.

- Ukraine sunflower exports, according to APK-Inform, are running 76 percent above last year’s pace at 2.781 million tons (Aug-Sep).

- Brazil soybean harvest progress as of late last week was just over 60 percent, up about 10 points from the previous week.

- IEG Vantage noted the soybean condition in Brazil’s Rio Grande do Sul fell hard from the previous week. Limited rainfall has been hurting soybean conditions since early February.

- Note the midday weather model (GFS) increased rain from southern Mato Grosso into northern Mato Grosso do Sul and nearby Goias Saturday into next Monday. World Weather noted it may have been overdone.

- Last week the BA Grains Exchange lowered its Argentina soybean crop to 52 million tons, down 4.6% from its previous estimate. Note USDA took Argentina soybean production up by 1 million tons to 54.0 million tons in its March update.

· USDA US soybean export inspections as of March 12, 2020 were 436,358 tons, low end of a range of trade expectations, below 579,102 tons previous week and compares to 849,700 tons year ago. Major countries included Egypt for 171,654 tons, Mexico for 52,042 tons, and Japan for 30,407 tons.

- ITS reported Malaysian palm exports at 489,635 tons for the first 15 days of the month, down 9.6 percent from the same period a month ago.

- Poor palm oil demand from India was to blame for the decline in Malay palm exports.

- European rapeseed futures sank to their lowest level since FH 2015.

- EU soybean imports reached 9.93 million tons from July 2019 through March 15, 4 percent below last year. EU rapeseed imported reached 4.42 million tons, a 40 percent increase from the same period year earlier. That’s impressive. Soybean meal imports were running at 12.5 million tons, a 2 percent increase from year earlier. Palm oil imports are naturally running below last year’s pace at 3.93 million tons, a 14 percent decline.

- There were no 24-hour announcements this morning for the soybean complex.

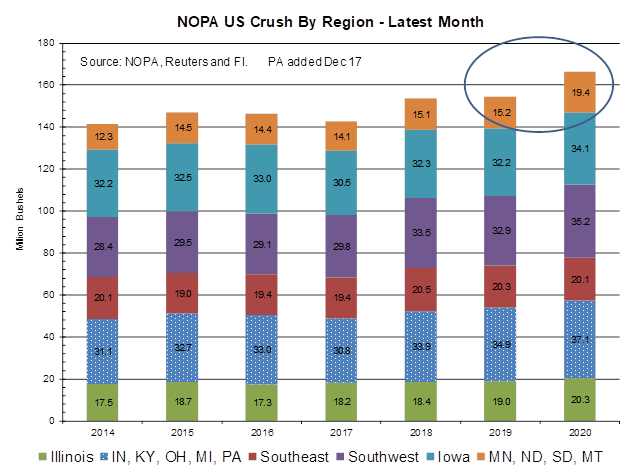

NOPA reported a record daily crush rate for the month of February. At 5.73 million bushels per day, it was up from 5.71 in January. The February crush came in at 166.3 million bushels, 1.3 million above a Reuter trade guess and well above 154.5 million in February 2019. Note 2020 there was an extra day to account for. Soybean oil stocks were reported at 1.922 billion pounds, 115 million below an average trade guess and below 2.013 billion reported for January 2020. At the end of February, US soybean oil stocks are highest for that month since 2014. Soybean oil stocks for the southeast were 20.1 million pounds, slightly below 20.3 million for February 2019. SBO stocks for the southwest were 35.2 million pounds, above 32.9 million year earlier. The soybean yield came in at 11.49 pounds per bushel, below 11.50 previous month, and well below 11.69 pounds year ago. Soybean meal exports during February slipped to 763,000 short tons from 785,000 year earlier. Cumulative October-February soybean meal exports are running slightly below last year’s pace. This implies US domestic soybean meal demand is robust.

Updated 3/16/20 – revised lower

- May soybeans are seen in a wide $7.75-$8.50 range.

- May meal is seen in a $280 to $315 range

- May soybean oil range is 24.00 to 28.00

· US wheat traded lower in KC and Chicago following outside markets despite strong global import demand. Mn closed up 3 cents basis the May position. It was interesting to see MN wheat and rice as the two markets with a higher close.

· USDA US all-wheat export inspections as of March 12, 2020 were 449,653 tons, within a range of trade expectations, below 459,400 tons previous week and compares to 385,143 tons year ago. Major countries included Philippines for 66,080 tons, Japan for 57,807 tons, and Nigeria for 52,003 tons.

· Russian grain exports increased over the past week due to a weak ruble, according to SovEcon. Russian wheat with 12.5% protein content loaded from Black Sea ports fell by $6 to $207 a ton FOB at the end of last week, according to SovEcon via Reuters.

· Egypt said they have enough wheat for 3.6 months in reserves. They also said they have enough soybean oil to last until August 1.

· Germany’s 2020 wheat crop was seen at 22.79 million tons, according to the local farm coop, down 1.2 percent from last year. The rapeseed crop was seen at 3.44 million tons, up 21.9 percent from last year.

· Coceral lowered their outlook for EU soft wheat production to 136.5 million tons from 137.9 million last month and compares to their forecast of 145.7 million tons for 2019.

· May Paris wheat futures were down 2.00 euros to 175.00 euros.

· EU soft wheat exports reached 22.2 million tons since July, a staggering 72 percent increase from the same period a year ago. We don’t see EU slowing down anytime soon.

- Tunisia seeks 67,000 tons of durum wheat and 25,000 tons of soft wheat on March 17, optional origin. The durum is for April 10-May 25 shipment, depending on origin, and soft wheat for April 1-10 shipment. They last picked up soft wheat on March 11 at $206.74/ton.

- Algeria seeks 50,000 tons of durum wheat on March 17 for April shipment.

- Jordan seeks 120,000 tons of feed barley on March 18.

- Jordan seeks 120,000 tons of milling wheat on March 17.

- Japan in an SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of feed barley for arrival in Japan by Aug 27, on March 18.

- Syria seeks 200,000 tons of wheat from Russia by March 23. No purchase was made that closed on February 17.

- Ethiopia seeks 400,000 tons of wheat on April 7. IN a separate tender, they seek 200,000 tons of wheat on April 1. Both are optional origin.

Rice/Other

- South Korea seeks 73,664 tons of rice on March 25 for arrival around end of Sep. to Oct 31.

- Sugar prices hit a 6-month low.

Updated 3/16/20

· CBOT Chicago May wheat is seen in a $4.75-$5.40 range

· CBOT KC May wheat is seen in a $4.00-$4.65 range

· MN May wheat is seen in a $4.90-$5.35 range

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.