From: Terry Reilly

Sent: Monday, April 06, 2020 4:36:21 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 04/06/20

PDF attached

China’s

official manufacturing PMI rebounded to 52 in March after hitting an all-time low of 35.7 in February, boosting confidence of a recovery in China’s economic activity.

Dry

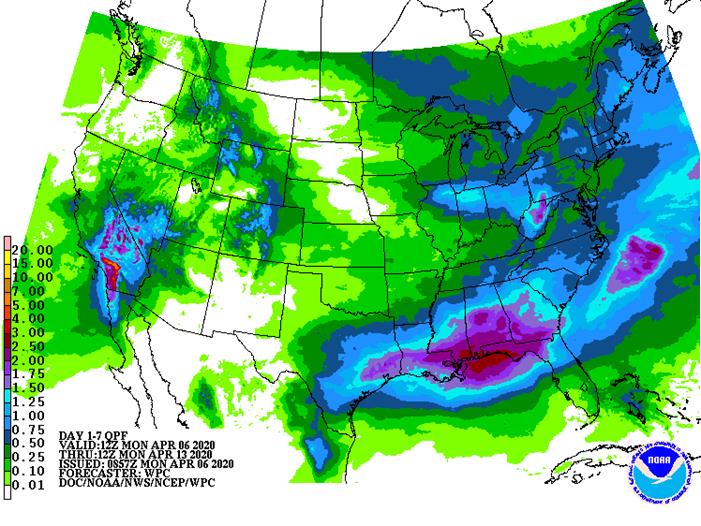

weather for Ukraine and Russia may expand this week. Also, dryness for SW Kansas, NW Ok, and SW Colorado with cooler, sometimes frigid temps, should be monitored. The US$ is slightly higher and WTI lower in the nearby position.

Weather

MARKET

WEATHER MENTALITY FOR CORN AND SOYBEANS:

Not

much has changed over the weekend. Concern will remain in the long-term outlook for some southern Safrinha crops in Brazil, but for now crop weather in the nation is mostly good. Crops in both Brazil and Argentina are mostly rated favorably, although there

is some dryness in the soil in parts of far southern Brazil. Argentina crop conditions are very good, but drying this week will firm up the ground in many areas with some central and far southwestern areas drying out soonest.

South Africa late season crop development will remain favorable and the weekend rain in eastern Australia coupled with that from late last week has improved pre-planting conditions for canola. More rain will be needed throughout all of southern Australia this

month to more favorably moisten the soil for aggressive early season planting.

India weather remains very good for late season crop maturation and early harvest progress.

Europe’s recent cold has not seriously hurt rapeseed. This week will trend warmer, but remain drier biased reducing soil moisture and raising the need for precipitation as seasonal warming continues.

U.S. planting conditions may improve for a little while this week as much warmer temperatures evolve and precipitation is more limited. Field progress will advance most significantly from the lower Delta to northern Florida, Georgia and South Carolina. South

Texas rainfall during the weekend will improve sorghum and corn conditions. More rain is needed especially in the far south of Texas.

China needs to warm up and dry down in the south to support corn planting, but rapeseed development in the key production areas will advance favorably.

Overall, weather today is not likely to have a big impact on market mentality, but there could be a slight bullish bias.

Source:

World Weather Inc. and FI

MARKET

WEATHER MENTALITY FOR WHEAT:

Concern

in the market place may continue today over a broad based drying trend in Europe and limited soil moisture in Romania, southwestern Ukraine Kazakhstan and eastern parts of Russia’s Southern Region. China wheat development will advance slowly this week and

India’s harvest will begin to increase. Australia’s rain in New South Wales and neighboring areas late last week and early in the weekend was good for lifting topsoil moisture, but follow up rain must occur prior to the planting season late this month.

U.S. weather will heat up for a while early this week and then turn colder late this week through next week. Permanent crop damaging conditions are unlikely, but some vegetative development in the Plains may get burned back.

North Africa wheat is still rated favorably in Tunisia and northeastern Algeria and the same is true in Spain. Morocco crop production is still expected to be down for the year because of persistent dryness.

Wheat in the Middle East will be frequent from Turkey through northern Iran to Afghanistan. Some of these areas need to start drying out to protect grain quality.

Overall, weather today is expected to have a mixed influence on market mentality with a slight bullish bias.

Source:

World Weather Inc. and FI

Seven-day

outlook: rain on the back end of the outlook

- USDA

weekly corn, soybean, wheat export inspections, 11am - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals - New

Zealand Commodity Price - USDA

Crop Progress

TUESDAY,

April 7:

- Purdue

Agriculture Sentiment, 9:30 am - France

agriculture ministry to issue field-crop planting estimates for 2020 season

WEDNESDAY,

April 8:

- EIA

U.S. weekly ethanol inventories, production, 10:30am - CNGOIC’s

monthly report on China soy, corn supply and demand - FranceAgriMer

monthly cereals balance sheet

THURSDAY,

April 9:

- USDA’s

monthly World Agricultural Supply and Demand (Wasde) report, noon - China

agriculture outlook committee (CASDE) to publish monthly supply/demand forecast for soybean, corn, cotton and sugar - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, 8:30am - Port

of Rouen data on French grain exports - Brazil

crop agency Conab posts 7th report on 2019-20 soy, grains output

FRIDAY,

April 10:

- ICE

Futures Europe weekly commitments of traders report on coffee, cocoa, sugar positions - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

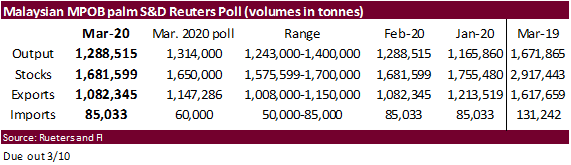

weekly update on crop conditions - Malaysian

Palm Oil Board to release stockpiles, export and production data - Cargo

surveyors AmSpec and Interetk to release Malaysia’s April 1-10 palm oil export numbers

Source:

Bloomberg and FI

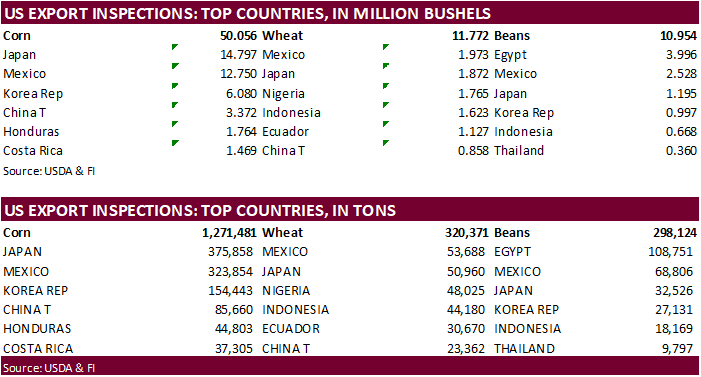

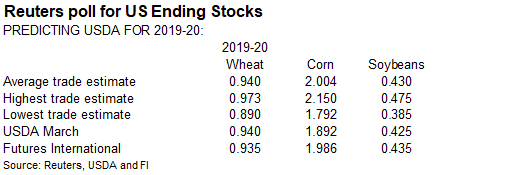

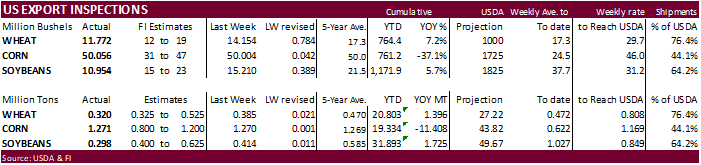

USDA

inspections versus Reuters trade range

Wheat

320,371 versus 300000-550000 range

Corn

1,271,481 versus 800000-1200000 range

Soybeans

298,124 versus 300000-650000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING APR 02, 2020

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 04/02/2020 03/26/2020 04/04/2019 TO DATE TO DATE

BARLEY

0 122 98 30,499 9,108

CORN

1,271,481 1,270,152 1,062,381 19,334,202 30,742,386

FLAXSEED

0 0 24 520 390

MIXED

0 0 0 0 0

OATS

0 0 0 3,243 2,093

RYE

0 0 0 0 0

SORGHUM

9,111 139,220 16,636 1,787,067 1,059,936

SOYBEANS

298,124 413,957 888,772 31,893,415 30,168,723

SUNFLOWER

0 0 0 0 0

WHEAT

320,371 385,208 556,180 20,802,893 19,407,084

Total

1,899,087 2,208,659 2,524,091 73,851,839 81,389,720

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

Russia

Said To Be Ready To Discuss ‘Very Substantial Oil Output Cuts’ Due To Global Demand Collapse C RTRS Citing Two Sources

–

Global Oil Output Cuts Of 10M Bpd May Not Be Enough To Balance Market

US

Crude Oil Futures Settle At $26.08/Bbl, Down $2.26 Or 7.97%

・

Corn futures traded lower to reach a fresh 3-1/2-year low on eroding US industrial corn usage. This has been the longest losing streak for the May contract since inception. Weakness in nearby WTI crude oil

weighed on prices. Saudi Arabia and Russia delayed a meeting to discuss output cuts.

・

A very large US company that produces big birds, the type that are generally sold to food service/restaurants, mentioned demand is down sharply and plans to slow production. Meanwhile two IA hog production

plants plan to shut, one coronavirus cases and other for cleaning.

・

An increase in US corn exports did little to limit corn futures price losses.

・

USDA US corn export inspections as of April 02, 2020 were 1,271,481 tons, above a range of trade expectations, above 1,270,152 tons previous week and compares to 1,062,381 tons year ago. SE Asian countries

were a good taker of US corn. Major countries included Japan for 375,858 tons, Mexico for 323,854 tons, and Korea Rep for 154,443 tons.

・

The US Farm Bureau in a letter to USDA that US producers are in financial need, stressing direct payments should be provided to cotton producers, livestock and cattle ranchers.

- USDA

reported US corn plantings at 7 percent complete (97 million acres surveyed), well above trade expectations and compares to 5 percent year ago and 5 percent average. The trade was looking for 3 percent complete.

- At

97 million acres, if realized, this could be devastating for US corn producers as prices basis the December futures contract could sink to $3.00 by October, in our opinion. Based on the wild price fluctuations over the past three weeks, we estimate the US

corn planted area at 94.79

million acres. The

trade is already looking for corn 2019-20 stocks to rise above 2.0 billion from current 1.892 billion when USDA updates their S&D on Thursday. For next year we see corn stocks rising above 2.450 billion bushels. Although the trade saw an uptick in corn export

commitments and shipments to SE Asia in recent weeks, the export pace still needs to increase to reach USDA’s 1.725 billion projection by August 31 remains too low. We look for this pace to increase from now until August as Brazil should remain focused on

exporting soybeans, therefore, we maintain a slightly higher 2019-20 US corn export forecast than USDA’s current estimate. $2.85-3.95 range basis December 2020 futures is not out of the question is the US sees favorable weather. But keep in mind for the

US balance sheet, there is great uncertainty over the upcoming US harvest price given unknown variables in a recovery in US ethanol demand, US final corn plantings, and US feed and export demand.

- On

a side note, we are looking for US weekly ethanol production to declined 55,000 barrels to 840,000 barrels and stocks to increase 450,000 barrels to a record 25.717 million.

- African

swine fever was discovered at a second pig farm in western Poland.

- Syria

seeks 50,000 tons of soybean meal in a combo with 50,000 tons of corn on May 12.

- CBOT

May is seen in a $3.10 and $3.70 range. July could reach below $3.00 if we see a major reduction in US ethanol production. December is seen in a $2.85-$3.95 range.

- CBOT

soybeans

traded mixed. Prices were lower early following price leadership from a lower soybean meal trade but rallied on renewed soybean/corn spreading and technical buying. May soybeans settled 1.25 cents higher and May soybean meal $6.20 lower. July ended at $299.90.

We think support for July meal is around the $295-$296 is a good support level. K/N soybean meal spreads were again under significant pressure. Watch soybean meal. If some US meat plants go offline and crush rates slow due to plant downtime, then meal could

see some support. Soybean oil ended 40 points higher on product spreading. - The

May/July soybean meal spread went from an inverse of $10.80 (May premium) as of settle March 20th to a carry of $2.40 (July premium) as of end of today’s (April 6) session, a $13.20 move and back to near where it settled March 16. On the way up it was a scare

in Argentina logistical issues and on the way down it was related to easing concerns over Argentina and threat of a decline in US feed demand.

- China

was on holiday. Buying interest was light for current year and next year shipments.

・

USDA US soybean export inspections as of April 02, 2020 were 298,124 tons, below a range of trade expectations, below 413,957 tons previous week and compares to 888,772 tons year ago. Major countries included

Egypt for 108,751 tons, Mexico for 68,806 tons, and Japan for 32,526 tons.

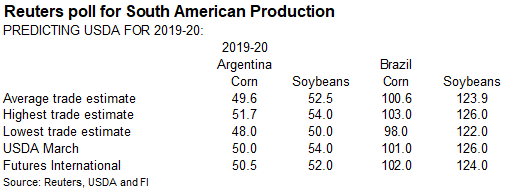

・

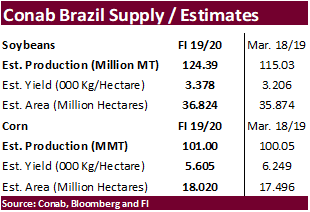

AgRural estimated the Brazil soybean crop at 123.8 million tons, down from 124.3 million previous. AgRural reported 83% of the Brazil crop had been harvested as of April 2. Late last week Abiove revised

their Brazil soybean production to 120.75 million tons from 118.7 million in February. ARC Mercosul put the Brazil 2019-20 soybean production at 123.5 million tons and harvesting at 86%.

・

Late last week IL crude was nominal 25 over, East nominal 50 over and the West nominal 25 under. Gulf degummed was nominal 200 over, fob. Argentina was nominally 50 over and Brazilian degummed oil moved to

55 over.

- Egypt

said they have enough vegetable reserves to last 5.8 months.

・

India March edible oil imports fell 3 percent from the previous year and November-March imports are now down 10 percent from the previous year. Palm imports in March were only 335,308 tons, down 38 percent

from the previous month, and compare to 802,443 tons in March 2019.

・

Ukraine sunflower exports since September were 3.086 million tons, up 78 percent from 1.731 million year earlier. APK-Inform.

・

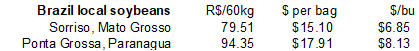

Malaysian palm markets:

Higher

on weaker MYR currency. ITS: Malaysian palm exports for April 1-5 reported 10 percent above same period last month.

・

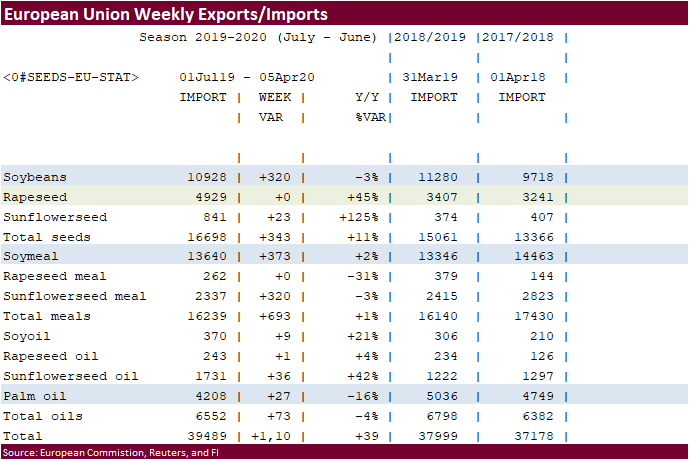

The European Union reported soybean import licenses since July 1 at 10.928 million tons, below 11.280 million tons a year ago, a 3 percent decrease. European Union soybean meal import licenses are running

at 13.640 million tons so far for 2019-20, below 13.349 million tons a year ago. EU palm oil import licenses are running at 4.208 million tons for 2019-20, down from 5.036 million tons a year ago, or down 16 percent.

USDA

Attaché on Canada oilseeds https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Oilseeds%20and%20Products%20Annual_Ottawa_Canada_03-15-2020

USDA

Attaché estimates India will import 16 million tons of vegetable oil in 2019-20, 13 percent above 2018-20.

https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Grain%20and%20Feed%20Annual_New%20Delhi_India_03-15-2020

- Saudi

Arabia asked their private sector to import 355,000 tons of wheat. - Syria

seeks 50,000 tons of soybean meal in a combo with 50,000 tons of corn on May 12.

- Egypt

bought 12,000 tons of local soybean oil at 10,225 Egyptian pounds ($648.79/ton) for May 1-25 delivery.

Updated

4/1/20 (top end of range lowered)

- May

soybeans are seen in a $8.40-$9.00 range. - May

meal is seen in a $305 to $340 range - May

soybean oil range is 24.50 to 27.50

- US

wheat futures ended higher led by Chicago (up 5.75-6.75 cents). KC was up 3.25-4.0 cents and MN higher by 1.75-2.50 cents.

- Paris

May milling wheat futures settled up 4.25 euros, or 2.2%, at 195.25 euros ($210.83) a ton. - US

wheat futures are lower on good global import demand and Black Sea weather. - USDA:

Initial 2020 US winter wheat ratings for the combined G/E were 62 percent versus 56% Reuters trade guess and compares to 60 percent year ago. The five-year average for early April winter wheat crop conditions is 48 percent (2018 was unusually low at 32 percent).

- This

was the best start for US early April winter wheat crop conditions since the 2010-11 marketing year (65), when comparing the combined good and excellent categories. The combined poor and very poor is lowest since 2019-20.

・

USDA US all-wheat export inspections as of April 02, 2020 were 320,371 tons, low end of a range of trade expectations, below 385,208 tons previous week and compares to 556,180 tons year ago. Major countries

included Mexico for 53,688 tons, Japan for 50,960 tons, and Nigeria for 48,025 tons.

- Russian

wheat export prices were steady at $198/ton according to IKAR. SovEcon reported $222/ton, up $5/ton.

- Ukraine’s

parliamentary committee said there is no reason to ban grain exports. They noted they have about 2.5 million tons of wheat in stocks to export by end of June after exporting 17.7 million tons so far this season. Ukraine’s Presidential Commissioner for Land

Affairs said they have enough the country has enough wheat for bakery demand and noted stock of wheat at the end of June, which is the end of the marketing year, will be 21% higher than the forecasted total amount of wheat consumption in the domestic market.

- Europe,

Romania and parts of the Black Sea region are trending drier. Black Sea dryness may continue into this week for half of the winter grain areas of Ukraine and Russia as the forecast for rain is less than 50 percent of normal through the end of this week.

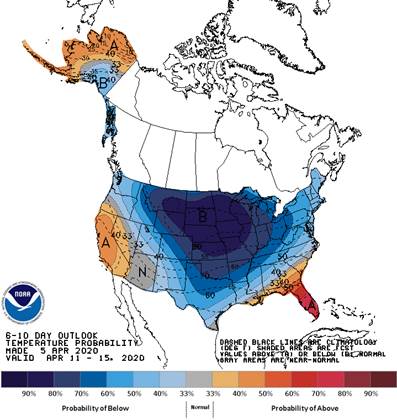

- US

temperatures will increase this early week before snapping back to below normal temperatures late this week through next week. Winter wheat crop damage is unlikely, but some vegetative development in the Great Plains may get burned back. 6-10 day temperature

outlook below.

- Saudi

Arabia’s SAGO started buying local wheat. Up to 700,000 tons of local wheat are allowed. - Egypt

will consider floating wheat import tenders on a C&F basis, not FOB, and hold a separate tender for freight due to uncertainty origin of purchase will be unable to fulfill commitments due to potential logistical problems over coronavirus. Last week Egypt

said they have enough wheat in its strategic reserves to last more than four months. They may tender soon. Egypt looks to increase their grain and other agriculture commodity stocks to last six months.

- USDA

Attaché estimates India will see a record wheat production of 105 million tons, up from 103.6 million in 2019-20. India wheat exports for 2020-21 were pegged at 1.0 million tons, up from 500,000 tons in 2019-20.

https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Grain%20and%20Feed%20Annual_New%20Delhi_India_03-15-2020

- French

wheat shipments outside the EU during March were 1.63 million tons, highest monthly volume for any month during the 2019-20 period, so far.

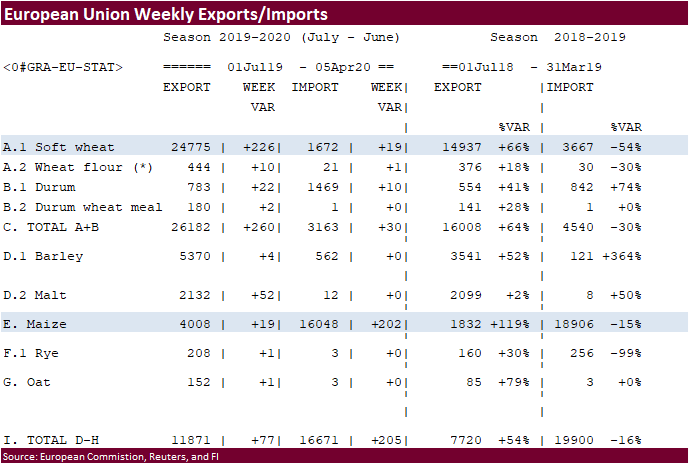

- The

European Union granted export licenses for 226,000 tons of soft wheat exports, bringing cumulative 2019-20 soft wheat export commitments to 24.775 MMT, up from 13.501 million tons committed at this time last year, a 66 percent increase. Imports are down 54

percent from year ago at 3.667 million tons.

- Turkey

seeks 250,000 tons of wheat on April 10 for April 20 and May 15 shipment, optional origin.

- Jordan’s

state grains buyer bought 120,000 tons of hard milling wheat, optional origin. One cargo was bought at 60,000 tons at $233.50 a ton c&f for shipment in the second half of June and another 60,000 tons at $226.50 a ton c&f for shipment in the first half of

July. - Syria

received 25,000 tons of wheat from Russia. - Ethiopia

seeks 400,000 tons of wheat on April 7. - In

an SBS import tender, Japan seeks 80,000 tons of feed wheat and 100,000 tons of barley on April 8 for arrival in Japan by July 31.

Rice/Other

- Cambodia

banned rice exports on April 5. - China

donated 1,000 tons of rice to South Sudan. - Egypt

said they have enough sugar reserves to last 8.6 months, and enough rice to last 4.2 months. Egypt consumes 2.5 million tons of rice a year.

Updated 4/2/20

- May Chicago $5.15 and $5.68 range

- May KC $4.40 and $4.90 range

- May MN $5.15 and $5.35 range

Terry Reilly

Senior Commodity Analyst C Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for

the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender

immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.