From: Terry Reilly

Sent: Thursday, April 09, 2020 5:36:48 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 04/09/20

PDF attached

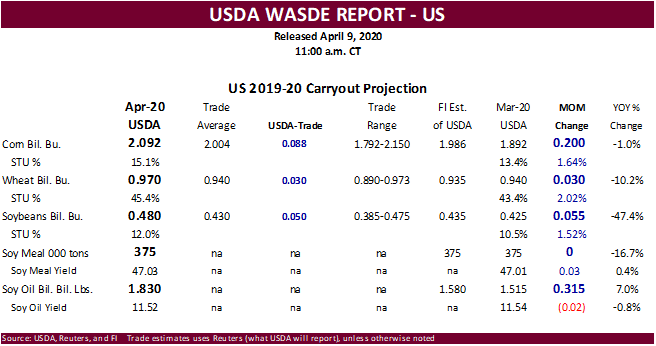

USDA

reported US ending stocks for soybeans, corn and wheat above trade expectations. SA soybean production was revised lower but corn for Argentina and Brazil were unchanged.

Statistics

Canada will delay its April 24 planting intentions report due to the COVID-19 pandemic.

Conab

reported a 1.8MMT upward revision to its Brazil corn production and lowered soybeans by 2.1 million tons from March. China CASDE showed projected 2019-20 China corn imports higher but industrial use down from last month. USDA export sales were good for grains

but not so great for the soybean complex and wheat. USD traded sharply lower.

US

Initial Jobless Claims Apr 4: 6606K (exp 5500K; prevR 6867K; prev 6648K). Fed also announced a new 2.3 trillion program to support economy.

![]()

USDA

April supply and demand

Bearish

for all three commodities but bulls waiting on the sideline added to positions. One supportive feature was a combined downward revision to Argentina and Brazil soybean production by 3.5 million tons.

USDA

NASS and OCE executive summaries

https://www.nass.usda.gov/Newsroom/Executive_Briefings/index.php

https://www.usda.gov/oce/commodity/wasde/Secretary_Briefing/index.htm

- US

stocks for soybeans, corn and wheat came in above expectations.

- USDA

took a pessimistic view on corn for ethanol demand, as they should, but cut soybean oil for biodiesel as well, by a large amount, which we thought was unwarranted.

- US

corn for ethanol demand was lowered 375 million bushels to 5.050 billion bushels, well below 5.378 billion in 2018-19. Corn exports were unchanged at 1.725 billion bushels. Imports were decreased 5 million to 45 million. USDA took corn feed and residual

up 150 million bushels to 5.675 billion bushels compared to 5.430 billion for 2018-19. Food use saw a small increase. US ending stocks were lifted higher by 200 million bushels to 2.092 billion, 88 million above a Reuters trade guess. The high US stocks

suggest 2020-21 US carryout could reach over 2.4 billion bushels. - US

soybean exports were revised down 50 million bushels to 1.775 billion, still above 1.748 billion for 2018-191. USDA lowered the soybean residual by 24 million and raised the crush by 20 million to a record 2.125 billion bushels. Seed use was lowered 2 million.

US 2019-20 ending stocks ended up 55 million bushels to 480 million bushels, 50 million above an average trade guess, and 47 percent below 2018-19.

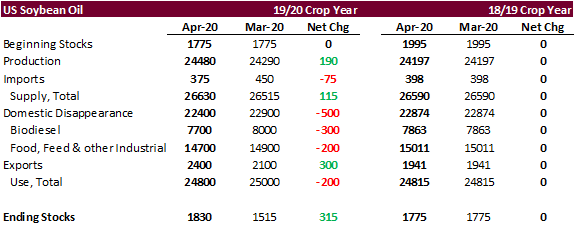

- US

soybean oil for biodiesel production was revised down 300 million pounds, and exports up 300 million, but food use was lowered 200 million pounds. With the higher product year crush, soybean oil production was lifted higher by 190 million pounds, and imports

lowered 75 million. The 2019-20 soybean oil yield was lowered two tenths to 11.52 pounds per bushel, which matches our estimate.

- Our

US soybean balance sheet looks very different from USDA. We are under the assumption US biodiesel plants are not seeing the slowdown in output like corn for ethanol plants. In fact, there is good coverage for this quarter and next quarter, and there are

ideas soybean oil for biodiesel feedstock will be in more demand as other feedstocks will be able to source over the short-term, like restaurant grease and corn oil.

- US

soybean meal exports were up 250,000 short tons from the previous month to 13.450 million short tons. Domestic use was increased 300,000 short tons to 37.1 million short tons. USDA increased production for soybean meal by 500,000 short tons, in large part

to higher crush. The yield was slightly increased. - US

all-wheat feed was revised down 15 million bushels to 135 million bushels, a surprise in our opinion. Exports were lowered 15 million bushels to 985 million bushels.

- All-wheat

wheat stocks were revised 30 million bushels higher to 970 million bushels. By class, Hard Red Winter and Soft Red Winter were reduced 10 million and 5 million bushels, respectively. - Note

the USDA will resurvey producer corn & soybean area and supply for Michigan, Minnesota, South Dakota and Wisconsin and publish adjustments in its May 12 crop production report, if warranted. North Dakota will be done at a later date.

https://www.nass.usda.gov/Newsroom/Notices/2020/04-07-2020.php

- USDA

made no changes to Brazil and Argentina corn production but lowered soybean production.

- Brazil’s

soybean crop was revised down 1.5 million tons to 124.5 million tons and Argentina soybeans taken down 2.0 million to 52.0 million tons.

- China

soybean imports were taken up 1.0 million tons. Brazil exports were raised 1.5 million tons.

- Global

soybean stocks were projected down 2.0 million tons from the previous month to 338.1 million tons, 5.7 percent below 2018-19.

- World

corn and wheat ending stocks were taken up 5.8 and 5.6 million tons, respectively.

- Russian

wheat exports were reduced by 1.5 million tons, which was partially offset by a slight upward revision to EU wheat exports.