From: Terry Reilly

Sent: Thursday, May 28, 2020 5:06:03 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 05/28/20

PDF attached

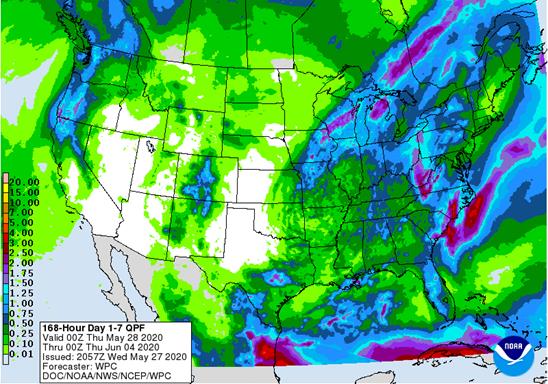

MARKET WEATHER MENTALITY FOR CORN AND SOYBEANS: U.S. planting weather will improve with drier and warmer conditions in the coming week. Faster crop development is also anticipated. In South America, conditions have not changed much, and Brazil’s second season corn crop will continue to fill and mature into early June under mostly favorable conditions.

Harvest weather is advancing well in Argentina and the planting outlook for Australia is fair to good, although greater rain is needed in many canola production areas. There is also need for rain in central and eastern portions of Saskatchewan while planting delays due to too much rain continue in parts of western Alberta.

Central and parts of northern China need rain for some of its unirrigated coarse grain and oilseed production areas and not much is expected for a while.

Europe’s dryness in the southeast has been largely eliminated in recent weeks along with dryness in Ukraine, but northwestern parts of the continent continue to dry out. Rain in France and Germany is needed soon to protect summer grain and oilseed production potentials.

Weather today will likely have a mixed influence on market mentality.

MARKET WEATHER MENTALITY FOR WHEAT: Concern about Black Sea and eastern CIS New Lands’ dryness continues to ease. The only areas that will experience serious dryness will be in Kazakhstan and the lower Volga River Valley, although some areas in the southeastern New Lands will also experience some crop moisture stress until greater rain evolves. The southeastern New Lands will get some rain next week.

Northwestern Europe’s dry bias remains a concern for some of its small grain crops and a close watch on the situation is warranted. Little to no rain is expected in the U.K., northern France and northern Germany for at least another week. Rain in Eastern Europe and the western CIS will be great for their small grains.

Rain in Australia will be limited to southern coastal areas only during the coming week to ten days which may raise some concern for interior crop areas as time moves along. South Africa still needs rain in its wheat areas as does western and some southern Argentina crop areas.

Some wheat damage may have occurred from flooding rain in interior southern Brazil late last week, but the lighter rain in Sao Paulo, Paraguay and Mato Grosso do Sul was very good for those crops. Conditions are expected to improve in southern Brazil, but additional rain coming up soon will disrupt the drying process.

China’s winter wheat crop has performed well. Dryness occurring now is expected to spur on faster crop maturation and eventual harvesting. Spring grains in northeastern China have benefited greatly from recent rain and crop conditions have improved.

Canada’s Prairies are too wet in the west and a little too dry in portions of central and eastern Saskatchewan and west-central Manitoba. Changes in Canada are at least a full week away with rising crop stress in the dry areas of Saskatchewan and west-central Manitoba. Ontario and Quebec are experiencing better wheat development conditions, although recent heat has accelerated drying trends.

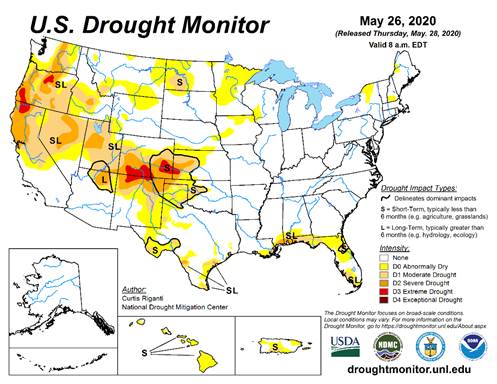

Heat and dryness are now slated for the western U.S. high Plains region through the next week to ten days. This will stress immature crops that are unirrigated resulting in some lower yield and grain quality. The more mature crops will be sped faster to full maturity by the heat. Recent rain in Nebraska and northern Kansas was good for wheat development and yield.

U.S. spring wheat planting and establishment is advancing well. Some rain would be welcome, but the drier areas may not get much until late next week.

Overall, weather today may provide a mixed bias to market mentality.

Source: World Weather Inc. and FI

Seven-day outlook:

THURSDAY, May 28:

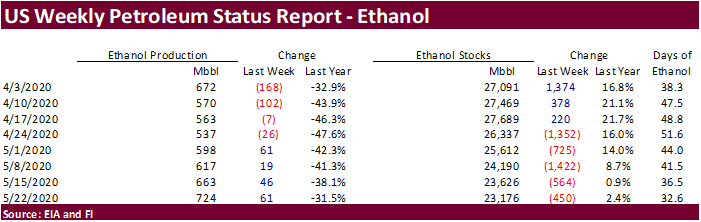

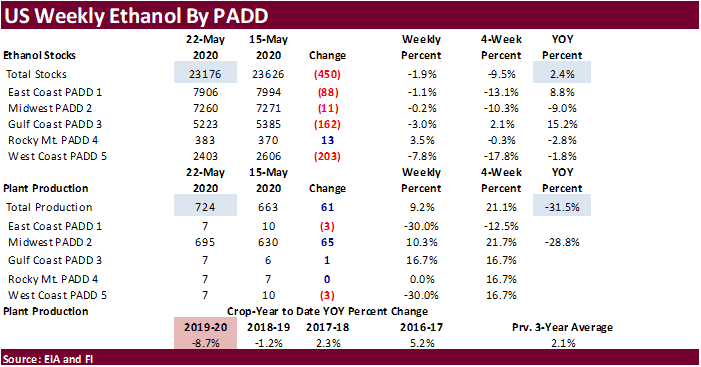

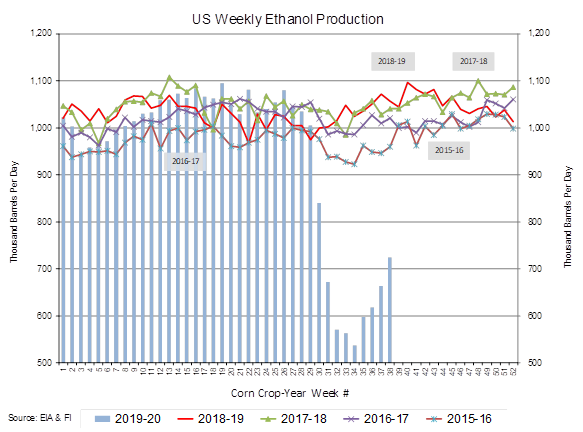

- EIA U.S. weekly ethanol inventories, production, 11:00am

- International Grains Council monthly report

- Port of Rouen data on French grain exports

- Poland crop plantings report

- EARNINGS: Sanderson Farms

FRIDAY, May 29:

- ICE Futures Europe weekly commitments of traders report on coffee, cocoa, sugar positions

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly update on crop conditions

- USDA weekly crop net-export sales for corn, soybeans, wheat, cotton, 8:30am

- U.S. Agricultural prices paid, received, 3pm

- Vietnam’s General Statistics Office releases data on coffee, rice, rubber exports in May

- Shanghai exchange’s weekly commodities inventory

Source: Bloomberg and FI

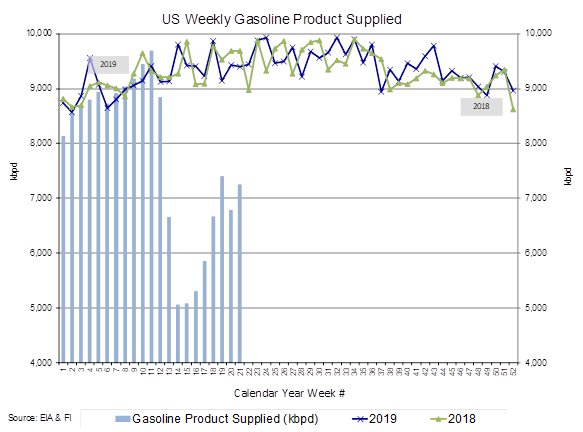

· US DoE Crude Oil Inventories (W/W) 22-May: 7928K (est -1911K; prev -4982K)

– Distillate Inventories (W/W): 5495K (est 2500K; prev 3831K)

– Cushing OK Crude Inventories (W/W): -3395K (prev -5587K)

– Gasoline Inventories (W/W): -724K (est 150K; prev 2830K)

– Refinery Utilization (W/W): 1.90% (est 0.90%; prev 1.50%)

· US GDP Annualised (Q/Q) Q1 S: -5.0% (exp -4.8%; prev -4.8%)

· US Initial Jobless Claims May-23: 2123K (exp 2100K; R prev 2446K) – Continuing Claims May-16: 21052K (exp 25680K; prev 24912K)

– Continuing Claims May-16: 21052K (exp 25680K; prev 24912K)

· The advance seasonally adjusted insured unemployment rate was 14.5 percent for the week ending May 16, a decrease of 2.6 percentage points from the previous week’s revised rate.

· US Durable Goods Orders Apr P: -17.2% (exp -19.1%; R prev -15.3%)

– Durables Ex Transportation Apr P: -7.4% (exp -15.0%; R prev -0.6%)

– Cap Goods Orders Nondef Ex Air Apr P: -5.8% (exp -10.0%; R prev -0.8%)

– Cap Goods Nondef Ex Air Apr P: -5.4% (exp -12.2%; R prev -0.3%)

· US Personal Consumption Q1 S: -6.8% (exp -7.5%; prev -7.6%)

– GDP Price Index Q1 S: 1.6% (exp 1.3%; prev 1.3%)

– Core PCE (Q/Q) Q1 S: 1.6% (exp 1.8%; prev 1.8%)

· Corn futures traded higher by mid-morning on firm US corn basis. Positive US weekly ethanol data added to the supportive undertone. Chicago corn basis jumped 15 cents to 15 over the July. Good rain showers today across the US corn belt did little to limit gains. July corn yesterday closed above its 20-day MA. Today it broke above the 50-day MA at 329.00, something not seen since January, but was unable to close above it. The rally had nothing to do with the 2020 US corn outlook, or the upward revision to the EU corn production.

· Short covering was a big factor today. On April 20th futures closed at 322.25 and funds were short 145k. Today they are about 248k short. That’s about 100k that is under water.

· Funds were net buyers of 28,000 corn corntracts.

· In years US producers see rapid plantings there tends to be an expansion in the corn area. With 70 percent combined good/excellent, the US corn crop is looking up above 16 billion bushels, versus 13.663 billion for 2019.

· The IGC estimated 2020-21 world grain production at 2.230 million tons, 12 million tons higher than the previous month. Consumption was downward revised 4 million tons to 2.218 million tons. Global corn production for 2020-21 was increased 11 million tons to 1.169 billion tons.

- Ukraine’s Trader’s Union, UGA, sees 2020 corn harvest at a record 37.0 MMT, from 35.9 MMT last year.

· China sold all of its 4 million tons of corn from state reserves. This was the first auction of the season. 3.66 million tons of corn is from 2015. Average price was 1,765 yuan per ton.

· China’s Heilongjiang increased its corn crop planting area, to 14.37 million hectares, 33,333 hectares more than last year.

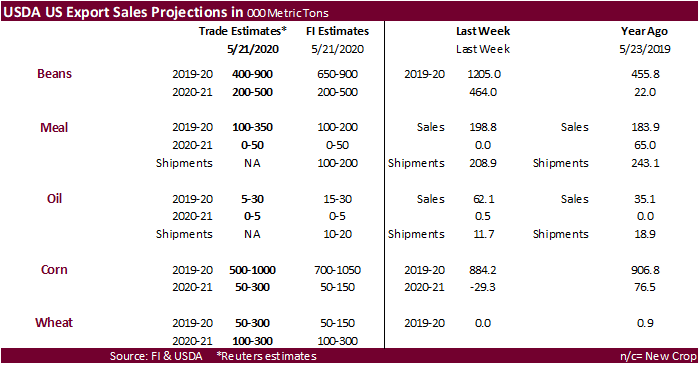

· USDA Export sales are delayed until Friday morning.

· The USDA Broiler Report showed eggs set in the US down 2 percent and chicks placed down 5 percent.

· Ethanol RIN prices jumped from 41 to 44 earlier in the day, but we are unsure why. DOE didn’t update their weekly ethanol production and stocks until 10:00 am.

- Results awaited: Syria seeks 50,000 tons of soymeal and 50,000 tons of corn on May 24, for delivery within four months of purchase.

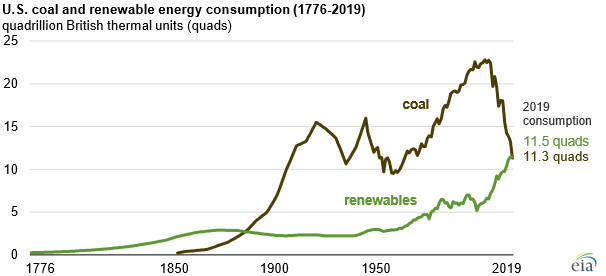

Thought this was interesting to see

EIA: In 2019, U.S. annual energy consumption from renewable sources exceeded coal consumption for the first time since before 1885, according to the U.S. Energy Information Administration’s (EIA) Monthly Energy Review. This outcome mainly reflects the continued decline in the amount of coal used for electricity generation over the past decade as well as growth in renewable energy, mostly from wind and solar. Compared with 2018, coal consumption in the United States decreased nearly 15%, and total renewable energy consumption grew by 1%.

https://www.eia.gov/todayinenergy/detail.php?id=43895&src=email

- July corn is seen in a $3.10 and $3.50 range. December lows could reach $2.90 if US weather cooperates.