From: Terry Reilly

Sent: Tuesday, July 03, 2018 12:16:58 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 07/03/18

PDF attached

CBOT closed early today and US markets will be closed on Wednesday. Ags reopen Thursday morning, 8:30 CT.

CBOT holiday schedule: https://bit.ly/2jopcPG

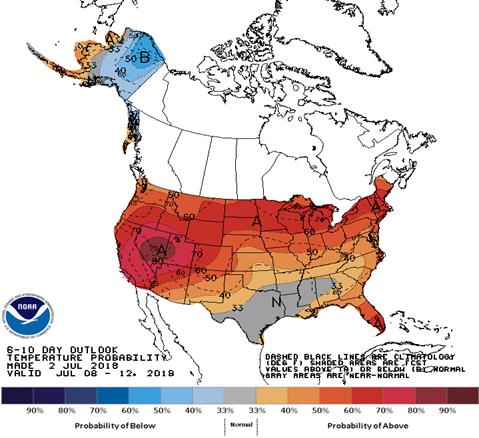

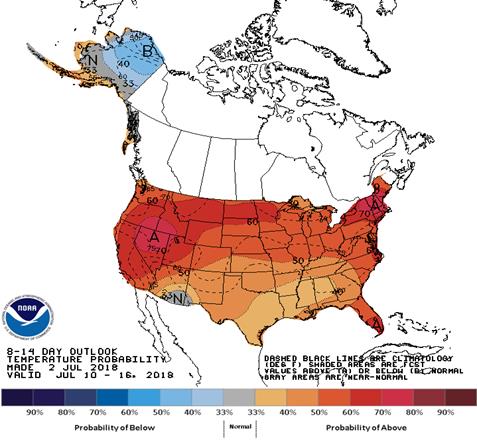

· Midday weather run: The GFS model brings a slightly stronger ridge of high pressure from the Plains to the Midwest Monday into next Tuesday, which is a day sooner than the previous run (World Weather, Inc.) No changes were made from morning outlook

· Australia’s Bureau of Meteorology sees a 50 percent change for El Nino this year. The last El Nino lowered Ausi grain production prospects in 2015-16. Argentina could benefit from El Nino with good rains.

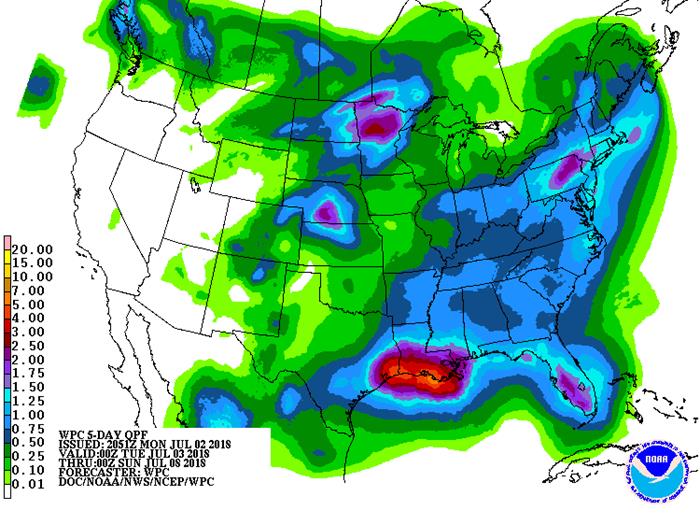

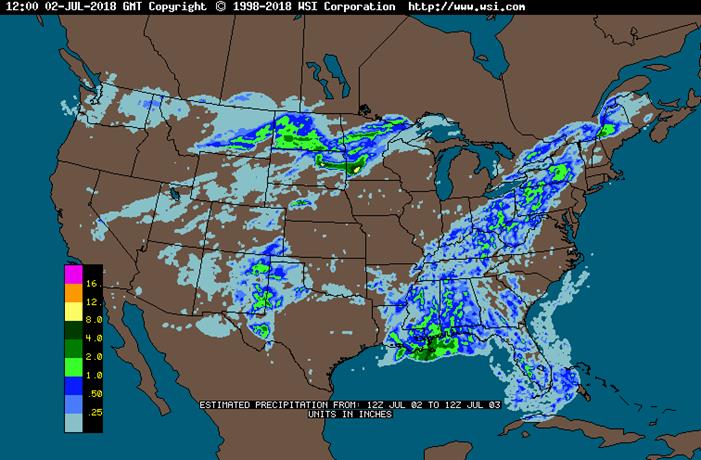

- The US Midwest eastern crop areas will be drier than the western areas. The high pressure aloft will build up across the Plains and Midwest this workweek before shifting to the High Plains region and Rocky Mountain region by Friday. The Midwest in general will see warm temperatures and restricted rainfall during this period. Rainfall will range from 0.25 to 0.75 inch with local totals to 1.00 inch by early next week. Then the ridge of high pressure will shift to the east Friday and then flatten out during the coming weekend and early in the week of July 9. New ridge development will evolve in the western United States later in the week of July 9.

- U.S. Delta and much of the southeastern United States will see a favorable mix of rain and sunshine.

- U.S. hard red winter wheat production areas will see a good mix of weather with net drying most dominant favoring crop maturation and harvest progress.

- The U.S. southern Plains drought will change little over the next 30 days.

- The U.S northern U.S. Plains will receive showers and thunderstorms through mid-week this week and then trend drier for a while.

- Canadian Prairies will see rain in the west, north and far east. The south-central and southwestern areas will be drier than usual.

- China weather improves for the dry areas of Liaoning, Hebei, and Shanxi over the next week.

- Western Australia will get some rain Monday and Tuesday. Victoria and South Australia has an opportunity for rain during mid-week this week.

- Northern Europe will continue to see net drying through at least July 11.

- The southern portions of Russia’s Southern Region will see 0.50” to 1.50” this week.

- Eastern Ukraine to western Kazakhstan will see some showers mid- to late-week.

- India could use rain across the central and western growing regions. Low rainfall has delayed planting progress. As of July 1, 15.5 million hectares of summer crops had been planted, down from 21.1 million at this time last year.

Source: World Weather Inc. and FI

SIGNIFICANT CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST CORN BELT EAST CORN BELT

Tdy 20% cvg of up to 0.75” 60% cvg of up to 0.50”

and local amts to 1.50” and locally more;

with some 1.50-2.25” north and west driest

amts from east N.D. to

NW Mn.

Wed-Thu 75% cvg of up to 0.75”

and local amts to 2.0”;

driest south

Wed-Fri 85% cvg of up to 0.75”

and local amts to 1.50”;

wettest east

Fri 10% cvg of up to 0.50”

and locally more;

mostly south

Sat-Sun 10-20% daily cvg of Mostly dry with a few

up to 0.60” and locally insignificant showers

more each day;

wettest north

Sat-Jul 9 Up to 20% daily cvg of

up to 0.25” and locally

more each day; some

days may be dry

Mon 15% cvg of up to 0.20”

and locally more

Mon-Jul 10 40% cvg of up to 0.30”

and local amts to 0.60”;

wettest north

Jul 10-11 40% cvg of up to 0.30”

and local amts to 0.60”

Jul 11-13 5-20% daily cvg of up

to 0.25” and locally

more each day

Jul 12-13 5-20% daily cvg of up

to 0.25” and locally

more each day

Jul 14-16 60% cvg of up to 0.65” 65% cvg of up to 0.65”

and locally more and locally more

DELTA SOUTHEAST

Tdy 60% cvg of up to 0.75” 30% cvg of up to 0.35”

and local amts to 1.75”; and locally more;

wettest south driest NE

Wed 30% cvg of up to 0.30” 65% cvg of up to 0.40”

and locally more; and local amts to 1.0”

wettest south

Thu 60% cvg of up to 0.50” 40% cvg of up to 0.50”

and local amts to 1.10”; and locally more;

driest north wettest north

Fri-Sat 80% cvg of up to 0.75” 80% cvg of up to 0.75”

and local amts to 1.50” and local amts to 1.75”

Sun-Mon 20-40% daily cvg of

up to 0.75” and locally

more each day;

wettest south

Sun-Jul 10 20-40% daily cvg of

up to 0.75” and locally

more each day;

driest north

Jul 10-12 15-35% daily cvg of

up to 0.50” and locally

more each day

Jul 11-12 10-25% daily cvg of

up to 0.35” and locally

more each day

Jul 13-14 15-35% daily cvg of

up to 0.40” and locally

more each day

Jul 13-17 20-40% daily cvg of

up to 0.60” and locally

more each day

Jul 15-17 10-25% daily cvg of

up to 0.30” and locally

more each day

Source: World Weather Inc. and FI

- New Zealand dairy auction on Global Dairy Trade online market starts ~7am ET Tuesday (~noon London Tuesday, ~11pm Wellington Tuesday)

- OECD-FAO annual report on agriculture outlook, 9am ET (2pm London)

WEDNESDAY, JULY 4:

- U.S. Independence Day holiday; CBOT grains trading closed

THURSDAY, JULY 5:

- Guatemala coffee exports for June

- AB Foods trading updates, 2am ET (7am London)

- FAO Food Price Index, 4am ET (9am London)

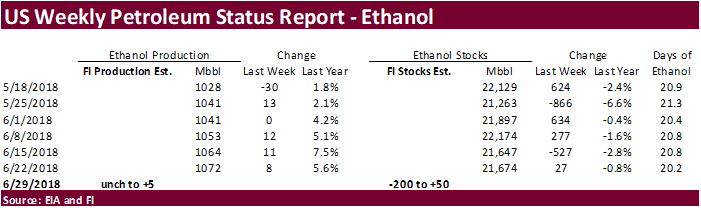

- EIA U.S. weekly ethanol inventories, output, 11am (delayed from Wednesday due to U.S. holiday)

- Andre Pessoa, head of Agroconsult, and executives from Brazil’s grain exporter group Anec speak on nation’s 2018-19 soybean and corn crops

- EU weekly grain, oilseed import and export data

- Port of Rouen data on French grain exports

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

FRIDAY, JULY 6:

- China is set to start levying tariffs on agriculture products, in retaliation for U.S. tariffs on imports from China

- USDA weekly crop net-export sales for corn, wheat, soy, cotton, 8:30am (delayed from Thursday due to U.S. holiday)

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders report will be delayed until Monday July 9

- FranceAgriMer weekly updates on French crop conditions

Source: Bloomberg and FI

· US jobs report is due out Friday.

Corn.

- CBOT corn ended higher, but bot high enough to erase the losses from Monday’s trade. Prices rebounded on light short covering ahead of the US holiday.

- FC Stone raised their outlook for Brazil’s corn crop to 79.15 million tons from 78.4 million previously.

- Brazil’s Mato Grosso corn harvest is 21 percent complete as of June 29, according to Imea, below 29 percent a year earlier.

- IKAR lowered Russia’s 2018 corn crop to 12.3 million tons, down from 12.8 million tons previously.

- Iowa temperatures over the next several days will widely vary from high to low, but we see no problem with a slightly slowdown in corn growth. If nights stayed above 80’s, then that’s when you start to see problems.

- 17 percent of the US crop is silking. Some states are ahead of normal (IL through lower Ohio River Valley). The next 4 weeks will be very important for US corn crop development.

- The US corn crop to date looks fantastic all over the major growing areas, with exception to some dry areas across the western part of the Delta and a few areas of the WCB, along with ponding in other areas where heavy rain occurred over last half June. Early crop soybeans don’t like too much water. Based on the current crop ratings, we are getting a lot of questions if the USDA will take their US corn and soybean yield estimates higher in the July report. Our bias is that they will leave soybeans unchanged at 48.5 bu/ac and raise the corn yield by 4 bushels per acre to 178 bu/ac. Going back to 2000, in most of the poor crop condition years, USDA lowered its July soybean yield from June in 2005 & 2012, and for corn they lowered it in 2004, 2008, and 2012. In good years, USDA never raised its soybean yield, but the corn yield increased in 2003 by 3 bu/ac.

- We recently lowered our August 1 corn yield by 0.5 to 180.5 bu/ac. Soybean and Corn Advisory is at 178.0, unchanged from the previous week. Planalytics is using 172.8 bu/ac.

· South Korea’s NOFI group bought 69,000 tons of corn at $205.99/ton for arrival by December 15.

· China plans to auction off 8 million tons of corn on July 5 and 6.

· US soybean complex traded mixed in a shortened session and all three markets closed lower. Soybeans sold off near the close, ending sown 4.50-5.50 cents. Crush margins slightly eroded after meal closed $1.70-2.20 lower. Soybean oil fell 14-19 cents.

· Looming US tariffs on Chinese goods are keeping nervous traders away from the market. It appears no one wants to own long positions in soybeans, when China is expected to shut off the US from importing soybeans. China already effectively stopped taking US cargos. One last US boat is expected to land on Thursday, day before the deadline kicks in. Lack of China buying has pressured US soybean prices but the this has provided opportunity for other major importers to secure US soybeans. Lower US soybean prices have also kept the US crush running at strong rates.

· Traders are looking for additional cancellations of US cargos by China when USDA updates their weekly export sales report. Little more than 1 million tons of soybean sales are on the books for China.

· Due to the federal holiday on July 4th, the next U.S. Export Sales report is scheduled for release at 8:30 A.M. on Friday, July 6, 2018. (USDA)

· Apparently, some Chinese crushers and importers were warned to look for a 15-20 percent decline in soybean arrivals over the next year, resulting in a large decline in soybean meal production, in the event tariffs go into effect on US soybeans.

· We lowered our US yield by 0.2 to 49.4 bu/ac. Soybean and Corn Advisory is at 51.0, unchanged from the previous week. Planalytics is using 49.0 bu/ac, up from 48.4 in June.

· Brazil will release trade data soon. We are looking for 10 million tons for soybean exports.

· The CFTC noted most of the volume in CME agriculture block trading occurs in the nearby contracts. The block trading was rolled out by the CME to provide trading opportunities to illiquid contracts.

· China plans to sell another 500,000 tons of soybeans and 50,000 tons of soybean oil out of reserves on Wednesday. China sold 376,965 tons of soybeans out of reserves so far, this season.

- Iran seeks 30,000 tons of sunflower oil on July 10.

- Iran seeks 30,000 tons of palm olein oils on July 10.

- Iran seeks 30,000 tons of soybean oil on August 1.

- All three US wheat markets rebounded on Tuesday in part to short covering ahead of the US July 4th holiday. Ongoing French and Russian crop concerns supported Paris wheat futures. The lower USD added to the positive sentiment for US markets.

- December Paris wheat futures were 2.00 euros higher.

- Russia’s AgMin said about 60,000 hectares in southern Russia’s Krasnodar region were affected by hail and high winds over the weekend. They didn’t say what crops were impacted by the unfavorable weather.

- Russia’s grain harvest totaled 9.5 million tons as of July 2 with an average yield of 3.82 tons/hectare, and compares to only 1.2 million tons a year ago with an average yield of 4.42 tons/hectare. (AgMin)

Export Developments.

- Lowest offer for Bangladesh seeking 50,000 tons of wheat was $256.38/ton from a Singapore trading company, for shipment within 40 days of contract signing.

- China sold 1,000 tons of 2013 imported wheat from state reserves at auction at an average price of 2330 yuan/per ton or $349.54/ton, 0.05 percent of what was offered.

- China sold 480 tons of 2012 wheat from state reserves at auction at an average price of 2320 yuan/per ton or $349.54/ton, 0.5 percent of what was offered.

- Results awaited: Algeria seeks optional origin milling wheat for September shipment.

- Results awaited: Syria seeks 200,000 tons of wheat on July 2 for Aug 1-Sep 30 shipment. Origins include Russian, Romania and/or Bulgaria.

· Jordan seeks 120,000 tons of barley on July 4 for Oct-Nov shipment.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on July 4 for arrival by December 28.

· Jordan seeks 120,000 tons of wheat on July 8 for Oct-Nov shipment.

Rice/Other

- China sold 104,647 tons of rice from state reserves at auction at an average price of 2396 yuan/per ton or $358.01/ton, 4.36 percent of what was offered.

- Results awaited: South Korea seeks 102,800 tons of rice for September-February arrival on June 27.

TONNES(M/T) GRAIN TYPE ARRIVAL/PORT

20,000 Brown Short Sept. 15, 2018/Incheon

20,000 Brown Short Sept. 15, 2018/Ulsan

20,000 Brown Short Sept. 15, 2018/Masan

10,000 Brown long Sept. 30, 2018/Mokpo

10,000 Brown long Sept. 30, 2018/Donghae

2,800 Milled Medium Dec. 1-31, 2018/Busan

10,000 Milled Medium Feb. 28, 2019/Busan

10,000 Milled Medium Feb. 28, 2019/Busan

- Results awaited: Iran seeks 50,000 tons of rice from Thailand on July 3.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.