From: Terry Reilly

Sent: Thursday, July 12, 2018 3:24:54 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 07/12/18

PDF attached

-

The

National Weather Service’s Climate Prediction Center (CPC) forecast a 65 percent chance of El Nino during fall, and about 70 percent during winter 2018-1. They see neutral conditions through the northern hemisphere summer 2018. -

The

US Midwest will be hot though the weekend. -

The

US Midwest will see several rounds of timely rain are expected during the next two weeks, but not heavy in any locations. Some areas may receive multiple events, resulting in slowing of development.

-

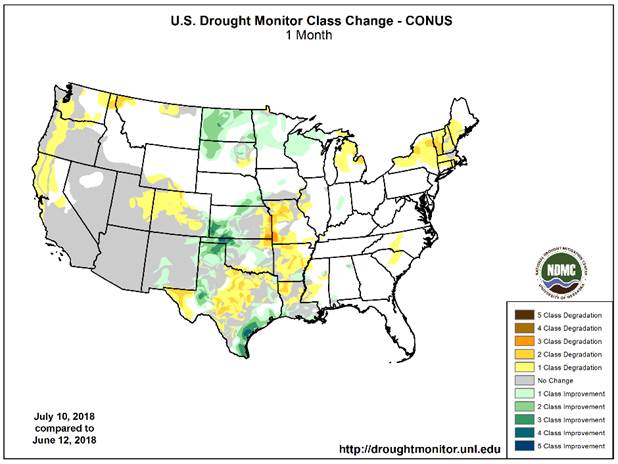

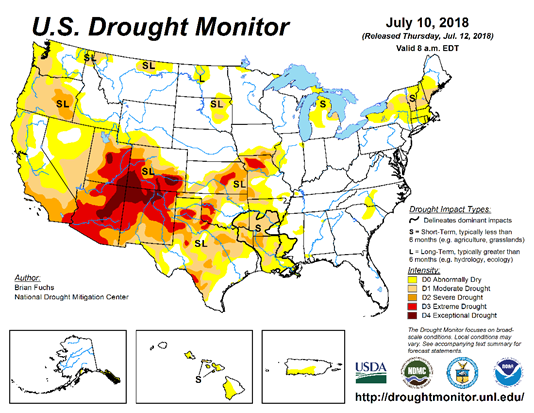

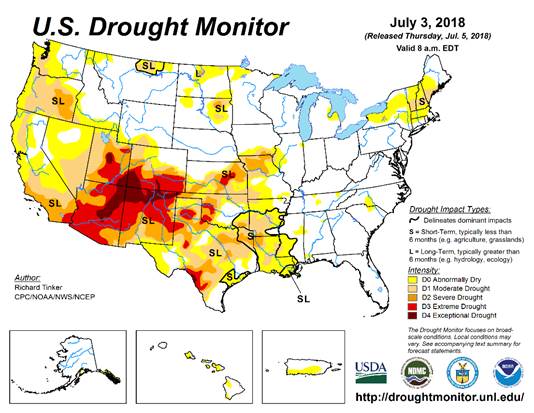

For

areas that receive little or no precipitation, we believe crop stress is most vulnerable across eastern Kansas into Missouri and portions of southeastern Iowa and west-central Illinois. These areas show short top soil moisture, and should be monitored over

the next couple of weeks. -

Rain

prospects improve for the Delta. -

Periodic

rainfall and warm temperatures should be good for summer crop development for US hard red wheat.

-

There

are no issues with Brazil second corn crop harvesting. -

Europe

will continue to see net drying in parts of the northern and western growing regions, but in general weather is expected to improve this weekend into next week for many dry areas.

-

Net

drying is expected to persist across eastern Ukraine and in Russia’s southern, central and Volga regions.

-

Australia

will see an increase in net drying.

Source:

World Weather Inc. and FI

SIGNIFICANT

CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST

CORN BELT EAST CORN BELT

Tdy-Fri

60% cvg of up to 0.75” Mostly dry with a few

and local amts over 2.0”; insignificant showers

east-central S.D. to NE

Neb. wettest; SE and

far

NW driest

Sat

30% cvg of up to 0.75” 25% cvg of up to 0.65”

and local amts to 1.75”; and local amts to 1.30”;

Iowa wettest north Il. wettest

Sun-Mon

70% cvg of up to 0.60”

and

local amts to 1.40”;

far

NW driest

Sun-Tue

90% cvg of up to 0.75”

and

local amts to 2.0”;

driest north

Tue-Jul

19 50% cvg of up to 0.75”

and local amts to 2.0”;

wettest south

Wed-Jul

20 65% cvg of up to 0.75”

and local amts to 1.75”

Jul

20-21 35% cvg of up to 0.35”

and locally more;

wettest

north

Jul

21-22 30% cvg of up to 0.25”

and locally more

Jul

22-23 5-20% daily cvg of up

to 0.30” and locally

more each day

Jul

23-24 5-20% daily cvg of up

to 0.30” and locally

more each day

Jul

24-26 60% cvg of up to 0.65”

and

locally more

Jul

25-27 50% cvg of up to 0.40”

and locally more

U.S.

DELTA/SOUTHEAST SIGNIFICANT PRECIPITATION EVENTS

DELTA

SOUTHEAST

Tdy-Sun

20-40% daily cvg of

up to 0.75” and locally

more each day; rain

shifts

from NE to SW

during the period

Tdy-Sun

5-20% daily cvg of up

up to 0.30” and locally

more each day

Mon-Tue

60% cvg of up to 0.60”

and

local amts to 1.30”;

wettest

north

Mon-Wed

75% cvg of up to 0.75”

and local amts to 1.75”

Wed

20% cvg of up to 0.30”

and locally more

Jul

19 15% cvg of up to 0.30”

and

locally more

Jul

20-22 60% cvg of up to 0.75”

and local amts to 1.50”;

wettest north

Jul

21-22 70% cvg of up to 0.75”

and local amts to 1.75”

Jul

23-26 10-25% daily cvg of 13-35% daily cvg of

up to 0.30” and locally up to 0.35” and locally

more

each day more each day

Source:

World Weather Inc. and FI

- USDA

weekly net-export sales for corn, wheat, soy, cotton, 8:30am - U.S.

National Weather Service’s Climate Prediction Center will release its latest forecast for El Nino, 9am - USDA’s

monthly World Agricultural Supply and Demand Estimates (WASDE) report for July, noon - Brazil

coffee exporters group Cecafe releases data on shipments in June and the prospect for exports in 2018-19 crop - Strategie

Grains publishes monthly EU grains report - Port

of Rouen data on French grain exports - Buenos

Aires Grain Exchange weekly crop report - Bloomberg

weekly survey of analysts’ expectations on grain, sugar prices - EARNINGS:

Suedzucker

FRIDAY,

JULY 13:

- China’s

General Administration of Customs releases preliminary commodity trade data for June, including soy and palm oil, 10pm ET Thursday (10am Beijing Friday)

- ICE

Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC

commitments of traders weekly report for period ending July 10 on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly updates on French crop conditions

Source:

Bloomberg and FI

Bloomberg

weekly bull/bear survey (taken Wed.)

·

Soybeans: Bullish: 3 Bearish: 11 Neutral: 6

·

Wheat: Bullish: 6 Bearish: 5 Neutral: 9

·

Corn: Bullish: 7 Bearish: 9 Neutral: 4

·

Raw Sugar : Bullish: 2 Bearish: 3 Neutral: 4

·

White sugar: Bullish: 2 Bearish: 3 Neutral: 4

·

White-sugar premium: Widen: 2 Narrow: 2 Neutral: 5

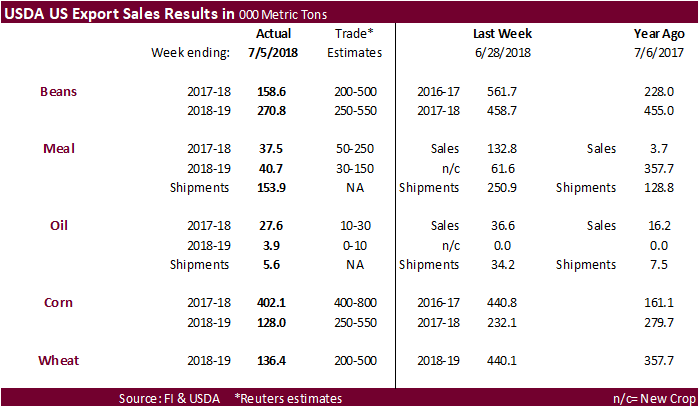

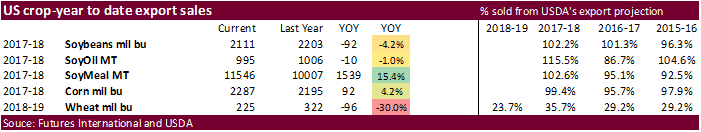

USDA

US export sales were poor all around.

·

USDA reported soybean export sales for the first week of July at 158,600 tons, below trade expectations and well below 561,700 tons last week.

Reductions included unknown destinations for 296,900 tons.

New-crop soybean sales were 270,800 tons versus 458,700 tons last week.

·

USDA export sales for meal were a low 37,500 tons for 2017-18 and 40,700 tons for 2018-19. Shipments were 153,900 tons.

·

Soybean oil export sales of 27,600 tons were ok. Shipments were a low 5,600 tons.

·

USDA reported US corn export sales at 402,100 tons for 2017-18 and 128,000 tons for 2018-19. Both amounts were poor, in our opinion.

·

All-wheat export sales were a dismal 136,400 tons.

USDA

released their July supply and demand report

Initial

reaction

·

The report concentrated on changes to demand, not so much to supply.

·

The report is bullish corn, friendly wheat, and bearish soybeans and soybean products.

·

The corn buying post report maybe short lived. We look for US inventories to increase next month when USDA reports their initial 2018 survey based yield estimate.

·

Note USDA did not change its US corn and soybean yields from June. Current crop conditions suggest the August yields will be higher than USDA’s current working estimates.

·

Some of the changes in US demand were the largest we have ever seen.

USDA

Executive Briefing

https://www.usda.gov/oce/commodity/wasde/Secretary_Briefing.pdf

https://www.nass.usda.gov/Newsroom/Executive_Briefings/2018/07-12-2018.pdf

·

There is speculation China and the US will come back to the table for trade talks. China, U.S. Hint at Chance for Talks After Trump’s Tariff Threat

https://www.bloomberg.com/politics/articles/2018-07-11/u-s-china-trade-talks-said-to-stall-as-tariff-dispute-escalates

·

WTI Futures Settle At $70.33/Bbl, Down $0.05

·

Initial Jobless Claims:214K(est 225K, prevR 232k)

·

Continuing Claims: 1739K(est 1730k, prevR 1742k)

·

CPI (M/M) June: 0.1% (est 0.2%, prev 0.2%)

·

CPI Ex Food And Energy (M/M) June: 0.2% (est 0.2%, prev 0.2%)

·

CPI (Y/Y) June: 2.9% (est 2.9%, prev 2.8%)

·

CPI Ex Food And Energy (Y/Y) June: 2.3% (est 2.3%, prev 2.2%)

·

CPI Index NSA: 251.989 (est 252.092m, prev 251.588)

·

CPI Core Index SA: 257.305 (est 257.361, prev 256.889)

·

Real Avg Weekly Earning (Y/Y) June: 0.2% (prev 0.3%

·

Real Avg Hourly Earning (Y/Y) June:0.0% (prev 0.0%)

·

Canada New Housing Price Index (m/m) May: 0.0% (est 0.1%, prev 0.0%)

·

Canada New Housing Price Index (y/y) May: 0.9% (est 1.0%, prev 1.6%)

Corn.

-

CBOT

corn hit

contract lows before the release of the USDA report. September corn ended 5.25 cents higher after USDA unexpectedly lower old and new-crop US inventories. They cited the US is on track for report exports. Short covering added to the firm undertone.

·

We didn’t see the US yield increase for corn that we were looking for.

-

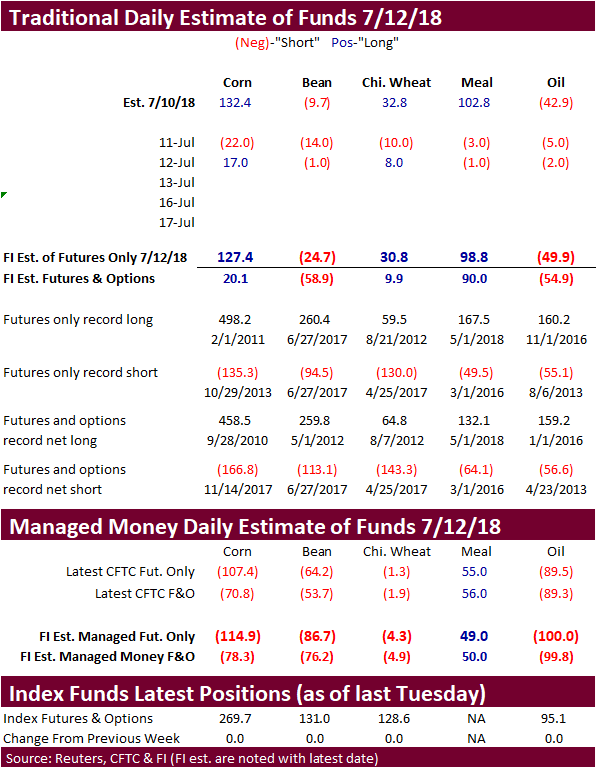

Funds

bought an estimated net 17,000 corn contracts. -

Hot

temperatures will set in across the US Midwest over the next week. -

USDA

export sales were poor, but low prices are attracting some buyers. -

South

Korea extended coverage through December.

·

EPA biofuel waiver count

Applied Approved Pending

2016

20 19 0

2017

33 29 4

2018

0 na na

·

The USDA Broiler Report this week showed eggs set up 3 percent and chicks placed up 2 percent. Cumulative placements from the week ending January 6, 2018 through July 7, 2018 for the United States were 4.96

billion. Cumulative placements were up 2 percent from the same period a year earlier.

USDA

highlights

·

US stocks of corn for 2017-18 were decreased 75 million bushels to 2.027 billion by USDA from last month due to a 50-million-bushel downward revision in US corn for feed usage to 5.450 million bushels, offset

by a 25-million-bushel increase in ethanol and 100 million increase in exports.

·

2017-18 corn exports are projected at 2.400 billion. 2018-19 on the other hand are 2.225 billion. We assume Brazil’s soybean area will increase 3.2 percent for 2018-19, resulting in a lower corn area. This

could allow USDA a cushion of about 400-500 million bushels of an increase in exports for new-crop should the market realize a 600 to 800 million bushel increase in 2018 US production from a higher August yield, if good crop conditions remain. We are at 180.5

bushels per acre versus USDA’s 174.0 bushels for the 2018 yield.

·

USDA increased new-crop US production by 190 million after incorporating the higher harvested area.

·

2018-19 feed was taken up 75 million and ethanol lowered 50 to 5.625 billion bushels. USDA is looking for new-crop US ethanol to expand only 25 million. With all the new high efficiency ethanol plants coming

online, new and existing expansion, we think USDA is way too low on current and new-crop corn for ethanol usage.

·

USDA lowered new-crop US corn stocks by an unexpected 25 million bushels to 1.552 billion, 160 million below the trade average. Stocks are projected down 23 percent from 2017-18.

·

The result decreased the new-crop STU to 10.5 percent versus 10.8% last month.

·

2017-18 world corn production and stocks were lowered 1.0 million tons each. USDA cut 2017-18 Brazil corn output by 1.5 million tons to 83.5 million, 15 million below 2016-17.

·

New-crop 2018-19 world corn production was increased 1.9 million tons but stocks were revised down 2.7 million tons (US, EU and Mexico part of that reduction in stocks).

·

2018-19 Eu corn production was increased 500,000 tons to 61.5 million, 700,000 below 2016-17. This could go lower next month.

·

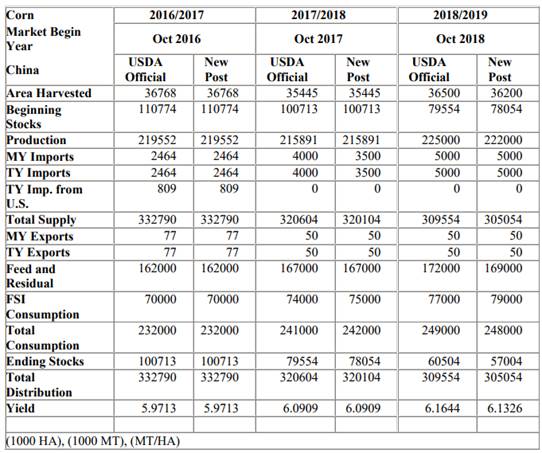

There were no changes to China’s new-crop production of 225 million tons, despite other reports suggesting lower output.

·

USDA: The season-average corn price received by producers is lowered 10 cents at the midpoint for a range of $3.30 to $4.30 per bushel.

·

South Korea’s KFA bought 60,000 tons of optional origin corn at $205.74/ton c&f for arrival around December 5.

·

South Korea’s NOFI group bought an unknown volume of optional origin corn at $204.28 a ton c&f for arrival around Dec. 25.

·

China sold 1.235 million tons of corn out of state reserves at an average price of 1528 yuan per ton or $228.26/ton, 31 percent of the total offered.

·

China will offer more corn on 13. China sold about 51-52 million tons of corn this season.

·

The EU awarded 139,432 tons of duty free corn, exhausting its second half 2018 import quota.

USDA

Attaché China corn S&D

Source:

USDA Attaché and FI

USDA

Export Sales Highlights

-

Corn:

Net sales of 402,100 MT for 2017/2018 were down 9 percent from the previous week and 33 percent from the prior 4-week average. Increases were reported for South Korea (195,300 MT, including 130,000 MT switched from unknown destinations and decreases of 800

MT), Mexico (159,400 MT, including decreases of 9,200 MT), Japan (141,900 MT, including 51,800 MT switched from unknown destinations and decreases of 11,800 MT), Saudi Arabia (110,000 MT, including 101,000 MT switched from unknown destinations), and Indonesia

(62,100 MT, switched from unknown destinations). Reductions were primarily for unknown destinations (435,100 MT) and El Salvador (16,400 MT). For 2018/2019, net sales of 128,000 MT were reported for Mexico (105,000 MT), unknown destinations (20,000 MT),

and France (2,400 MT). Exports of 1,396,700 MT were down 8 percent from the previous week and 9 percent from the prior 4-week average. The destinations were primarily to Japan (294,600 MT), Mexico (276,000 MT), South Korea (198,100 MT), Saudi Arabia (110,000

MT), and Vietnam (83,000 MT). Optional Origin Sales: For 2017/2018, the current optional origin outstanding balance of 337,000 MT is for South Korea (206,000 MT), unknown destinations (91,000 MT), and Egypt (40,000 MT). For 2018/2019, new optional origin

sales of 137,000 MT were reported for South Korea. The current outstanding balance of 325,000 MT is for South Korea (205,000 MT), Saudi Arabia (70,000 MT), and unknown destinations (50,000 MT). -

Barley:

No net sales were reported for the week. Exports of 2,000 MT were to Japan.

-

Sorghum:

Net sales reductions of 38,800 MT, for 2017/2018 resulted as increases for China (2,100 MT), were more than offset by reductions for Mexico (38,000 MT) and unknown destinations (3,000 MT). Exports of 12,000 MT were to Japan (10,100 MT), China (1,000 MT),

and Mexico (900 MT). -

Beef:

Net sales of 16,200 MT for 2018 were up 25 percent from the previous week, but down 8 percent from the prior 4-week average. Increases were primarily for Japan (6,300 MT, including decreases of 2,500 MT), South Korea (4,000 MT, including decreases of 900

MT), Mexico (1,800 MT), Hong Kong (900 MT, including decreases of 200 MT), and Taiwan (800 MT, including decreases of 100 MT). For 2019, net sales of 200 MT were reported for Japan. Exports of 15,300 MT were down 17 percent from the previous and from the

prior 4-week average. The primary destinations were Japan (5,800 MT), South Korea (3,600 MT), Taiwan (1,400 MT), Mexico (1,400 MT), and Canada (1,300 MT). -

Pork:

Net sales of 9,200 MT for 2018 were down 44 percent from the previous week and 43 percent from the prior 4-week average. Increases were reported for Japan (3,600 MT), Australia (1,800 MT), Hong Kong (900 MT), Canada (900 MT), and Mexico (700 MT). Exports

of 18,500 MT were down 9 percent from the previous week and 4 percent from the prior 4-week average. The primary destinations were Mexico (6,700 MT), Japan (3,300 MT), South Korea (2,300 MT), Canada (1,300 MT), and Hong Kong (1,100 MT).

Soybean

complex.

·

Soybeans traded two-sided, a few times, ending moderately higher on short covering. Soybeans hit fresh contract lows earlier. Rumors China and the US may open up trade talks underpinned selected commodities

before the release of the USDA report. USDA surprised the trade by slashing new crop US soybean exports (by 6.8 million tons-less than one month of China consumption), effectively boosting the inventories at the end of 2018-19. We viewed the report as bearish,

but sharply higher corn and wheat futures lent strength to CBOT soybeans. Soybean meal ended mostly higher (front months) and soybean oil fell 13-16 points.

·

Our thinking is if China does not buy US soybeans, somebody else will.

·

Funds sold an estimated net 1,000 soybean contracts, sold 1,000 meal and sold 2,000 soybean oil.

·

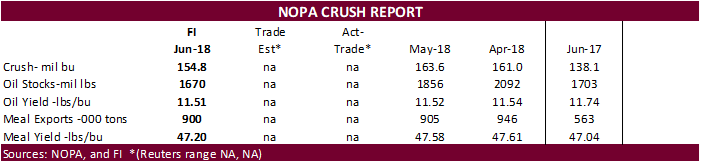

The cash soybean oil market is getting tight. Downtime picked up this month and some crushers are raising their basis.

·

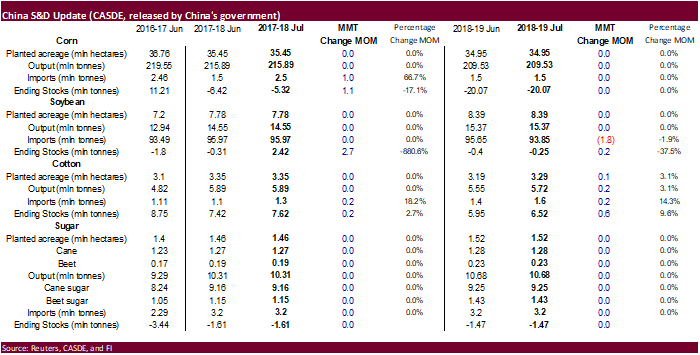

China in its monthly CASDE report, lowered its outlook for soybean imports for 2018-19 to 93.85MMT from 95.65 million in June (-1.8MMT). CASDE mentioned China’s soybean import costs for soybeans could increase

by 100 yuan ($14.95) per ton from the previous month’s forecast.

·

A Chinese newspaper noted “China’s 25 percent import tariffs will drive up the cost of US soybean imports by 700-800 yuan per ton (about 105-120 US dollars; 80-90 pounds), which is about 300 yuan per ton (44

US dollars; 34 pounds) higher than Brazilian soybeans.”

·

China has not bought US soybeans since late June.

·

China’s Sinograin said they do not need to depend on US soybeans for state reserves, citing China has ample stocks of soybeans (which is a government secret).

-

The

association of German farm cooperatives lowered its projection for Germany’s 2018 winter rapeseed crop to 3.55 million tons from 4.05 million in June, down 16.8 percent year on year.

·

An Argentina lineup shows a good increase in soybean oil and soybean meal demand for first half July, and the volumes have already outpaced June.

·

Palm oil prices are nearing a 3-year low. September Malaysian palm was 18 lower at MYR2186.

Oil

World has a 2100MYR target ($519.80/ton) in the “medium term”.

·

NOPA is due out with the US soybean crush on Monday, July 16.

·

Day 2. Please respond if you like to chime in. We are taking a poll on where the price floor might be at for nearby CBOT soybeans from now until end of harvest (early November), assuming China/US trade

issue do not get resolved. Lowest level we heard was $6.50. Any feedback or response is welcome.

USDA

highlights

·

A bullish corn outlook limited losses for US soybean futures.

·

US stocks of soybean for 2017-18 were lowered 40 million bushels (1.09MMT) to 465 million by USDA from last month due to an increase in crush (15) and exports (20), along with higher residual and lower imports

(3).

·

The US 2017-18 carryout came in 42 million bushels less than a Reuters trade estimate.

·

The result decreased the STU to 10.9% versus 12% last month.

·

Sounds bullish? Well USDA made big changes for 2018-19 assuming no change in the US/China trade tariff situation.

·

US 2018-19 soybean stocks were estimated at 580 million bushels, largest since 2006-07, 109 million above a Reuters trade estimate, and 195 million greater than last month.

·

USDA increased production by 30 million bushels to 4.310 billion, after incorporating the June

Acreage report.

·

Considering China absent from the US soybean export market, USDA lowered exports by 250 million bushels to 2.040 billion, 45 million below 2017-18.

·

The crush for 2018-19 was raised 45 million bushels to 2.045 billion, 15 above 2017-18.

·

This resulted in a US carryout expanding 54 percent from 2017-18.

·

US soybean oil for biodiesel for 2017-18 was increased 100 million pounds and exports raised 50 million. SBO production was increased 290 million pounds after USDA increased its crush. Current year soybean

oil stocks are up 140 million pounds from previous month, bearish in our opinion.

·

For new-crop, USDA increased US soybean oil production by 520 million pounds. With a higher carry in, USDA decided to stuff 500 million pounds in biodiesel and another 100 million in exports, resulting in

a 60-million-pound increase in SBO 2018-19 ending stocks.

·

USDA increased US 2017-18 soybean meal production by 600,000 short tons, and increased domestic use by 100,000 and exports by 400,000 short tons. This increased the carryout by 100,000 short tons to 400,000

short tons. Note new-crop ending stocks were also raised 100,000 short tons to 400,000. This might become the new norm. USDA traditionally used 300,000 short tons as a benchmark carryout.

·

New-crop US soybean meal production was increased 1 million short tons. USDA’s 1.1 million short ton increase in 2018-19 meal supply allowed them to increase domestic use by 300,000 and exports by 700,000

tons. 2018-19 US soybean meal exports of 13.100 million short tons are still 400,000 below 2017-18.

·

USDA lowered 2016-17 Argentina soybean production by 2.8 million tons but global stocks decreased only 700,000 tons.

·

2017-18 world ending stocks increased 3.5 million tons. USDA increased Brazil’s soybean production by 0.5 million tons to 119.5 million. Argentina was left unchanged.

·

2018-19 world soybean production was increased 4.3 million tons to 359.5 million, 22.8 million above 2017-18.

·

What was most surprising was a 11.3 million ton increase in 2018-19 world soybean stocks to 93.8 million, 2.3 million above the current year, which is a record. US soybean stocks increased 5.3 million tons.

·

USDA took new-crop Brazil and Argentina production up 2.5 and 1.5 million tons, respectively.

·

USDA increased 2018-19 Brazil soybean exports by 2.1 million tons to 75 million tons, 0.3MMT higher than 2017-18.

·

USDA: The U.S. season-average soybean price is forecast at $8.00 to $10.50 per bushel, down $0.75 at the midpoint. Soybean meal prices are forecast at $315 to $355 per short ton, down $15.00 at the midpoint.

The soybean oil price forecast at 28 to 32 cents per pound, down 1.5 cents at the midpoint.

-

China

will offer 61,000 tons of rapeseed oil on July 17. -

Iran

seeks 30,000 tons of sunflower oil on July 10. -

Iran

seeks 30,000 tons of palm olein oils on July 10. -

Iran

seeks 30,000 tons of soybean oil on August 1.

·

China sold 832,302 tons of soybeans out of reserves so far, this season.

USDA

Export Sales Highlights

-

Soybeans:

Net sales of 158,600 MT for 2017/2018 were down 72 percent from the previous week and 62 percent from the prior 4-week average. Increases were reported for Egypt (176,000 MT, including 177,000 MT switched from unknown destinations and decreases of 9,200 MT),

Indonesia (85,800 MT, including 68,000 MT switched from unknown destinations and decreases of 600 MT), Taiwan (68,300 MT, including 63,000 MT switched from unknown destinations and decreases of 100 MT), the United Arab Emirates (43,800 MT, including 40,000

MT switched from unknown destinations), and Japan (34,700 MT, including decreases of 400 MT). Reductions were for unknown destinations (296,900 MT) and Mexico (35,700 MT). For 2018/2019, net sales of 270,800 MT were reported for unknown destinations (150,500

MT), Argentina (60,000 MT), and Mexico (21,800 MT). Exports of 733,600 MT were down 22 percent from the previous week and 1 percent from the prior 4-week average. The destinations included Egypt (271,000 MT), Indonesia (101,100 MT), Taiwan (87,600 MT),

China (71,300 MT), and Mexico (62,800 MT). Optional Origin Sales: For 2018/2019, the current optional origin outstanding balance of 228,000 MT is for China (165,000 MT) and unknown destinations (63,000 MT). Export for Own Account: New exports for own

account totaling 29,700 MT were reported to Canada. The current outstanding balance of 130,900 MT is for Canada. -

Soybean

Cake and Meal: Net sales of 37,500 MT for 2017/2018–a marketing-year low–were down 72 percent from the previous week and 68 percent from the prior 4-week average. Increases were reported for Portugal (27,500 MT, including 28,000 MT switched from unknown

destinations and decreases of 500 MT), Vietnam (10,500 MT), the Dominican Republic (9,400 MT, including decreases of 1,500 MT), Canada (7,100 MT), and the Philippines (5,600 MT). Reductions were reported for Colombia (16,500 MT), Venezuela (9,600 MT), unknown

destinations (6,500 MT), and El Salvador (3,000 MT). For 2018/2019, net sales of 40,700 MT were primarily for unknown destinations (36,000 MT). Exports of 153,900 MT were down 39 percent from the previous week and 41 percent from the prior 4-week average.

The primary destinations were the Philippines (47,800 MT), Portugal (27,500 MT), Mexico (23,100 MT), Canada (17,600 MT), and Colombia (6,700 MT).

-

Soybean

Oil: Net sales of 27,500 MT for 2017/2018 were down 25 percent from the previous week, but up 33 percent from the prior 4-week average. Increases were primarily for unknown destinations (12,000 MT), Peru (8,000 MT), Jamaica (3,500 MT), and Colombia (2,200

MT). For 2018/2019, net sales of 3,900 MT were reported for Mexico (3,400 MT) and the Dominican Republic (500 MT). Exports of 5,600 MT were down 84 percent from the previous week and 74 percent from the prior 4-week average. The primary destinations were

Colombia (3,500 MT), Mexico (1,600 MT), and Canada (400 MT).

·

US wheat futures ended higher on short covering amid a bullish USDA report. September MN traded to fresh contract low before the release of the USDA report. Chicago led all three markets higher. More private

trade groups continue to lower EU wheat production prospects.

·

Funds today bought an estimated net 8,000 SRW wheat contracts.

·

USDA US all-wheat export sales were a dismal 136,400 tons.

-

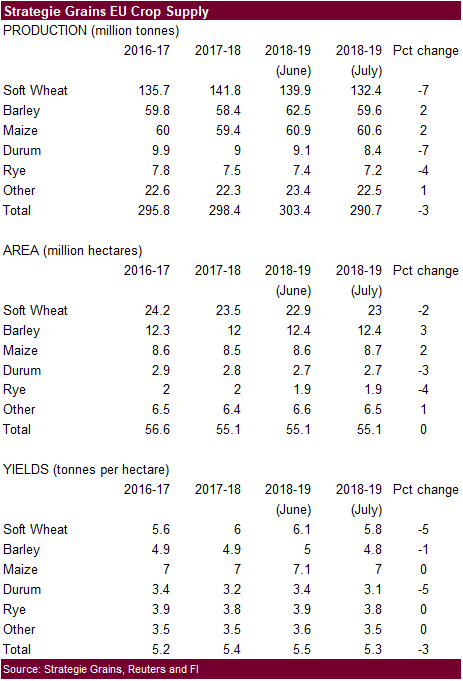

Strategie

Grains lowered their EU soft wheat crop production estimate by 7.5MMT to 132.4 million tons from 139.9 million (a 5.8MMT cut for France & Germany), down 7 percent from 2017. Barley was lowered to 59.6 million tons from 62.5 million, and corn to 60.6 million

tons from 60.9 million tons. Soft wheat exports were lowered to 21.1MMT from 22.7MMT previously, but still higher than 20.7MMT in 2017-18.

-

The

association of German farm cooperatives lowered its projection for Germany’s 2018 wheat crop to 21.53 million tons from 22.89 in June, down 12.1 percent on the year. They mentioned the dry areas across the north and north east.

-

December

Paris wheat was up 2.25 euros to 183.25 euros. -

The

USDA Attaché updated their S&D’s for Ukraine and they see the wheat crop for 2018-19 at 25.740 million tons, below USDA’s June official forecast of 26.500 million tons.

https://gain.fas.usda.gov/Recent%20GAIN%20Publications/Grain%20and%20Feed%20Update_Kiev_Ukraine_7-6-2018.pdf

·

the Ukrainian Grain Association estimated the 2018-19 Ukraine wheat crop at 25 million tons, from 25.8 million earlier this month.

USDA

Highlights

·

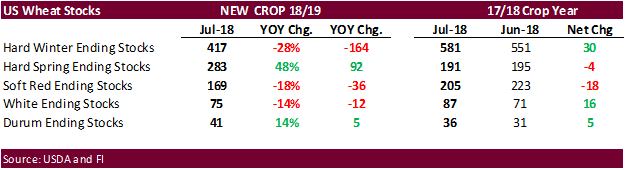

USDA increased US 2018-19 wheat stocks by 39 million bushels to 985 billion, 12 million above an average trade guess.

·

US wheat production was increased 54 million bushels to 1.881 billion, 23 million above a Reuters trade guess. Winter wheat was taken down 5 million bushels, with higher HRW (7), lower SRW (13), and higher

White (1).

·

US other spring was estimated at 614 million bushels, 15 million above the trade and well above 416 million bushels in 2017.

·

US durum was pegged at 75 million, 3 million above the trade and up from 55 million in 2017.

·

USDA adjusted their all-wheat US carry in stocks by increasing it by 20 million (June 1 stocks), resulting in 74 million bushels increase in total supply. So, USDA increased its 2018-19 feed use by 10 million

and lifted exports 25 million higher to 975 million, 74 million above 2017-18. US exports need to improve to reach USDA’s export target.

·

By class, USDA in its initial estimate, projected a decline in US HRW, SRW, and White stocks from the previous year. HRW and Durum US stocks are expected to increase from 2017-18.

·

The US STU is currently at 46.2% versus 45.1% last month.

·

The bullish case in wheat is tied with the world balance.

·

2018 world production was lowered 8.4 million tons to 736.3 million tons, 21.7 million below 2017.

·

World ending stocks were decreased 5.3 million to 260.9 million tons, 12.6 million below 2017-18.

·

Production for Australia (2.0), Ukraine (1.0), Russia (1.5), EU (4.4), and China (1.0) were lowered from the previous month.

·

USDA: The 2018/19 season-average farm price is lowered $0.10 per bushel at the midpoint to a projected range of $4.50 to $5.50.

·

Saudi Arabia seeks 595,000 tons of wheat on Friday.

·

Saudi Arabia seeks 1,740,000

million tons of fodder barley during the period September-October 2018.

-

Bangladesh

seeks 50,000 tons of optional origin milling wheat on July 25 for shipment within 40 days of contract signing.

-

China

sold 1,000 tons of 2013 imported wheat from state reserves at auction at an average price of 2380 yuan/per ton or $356.99/ton, 0.05 percent of what was offered.

·

Japan bought 62,865 tons of milling wheat this week. (Reuters)

Details

are as follows (in tons):

COUNTRY

TYPE QUANTITY

U.S.

Western White 17,177 *

U.S.

Dark Northern Spring (protein minimum 14.0%) 11,353 *

Australia

Standard White (West Australia) 34,335 *

Shipments:

* Loading between Sept. 1 and Sept. 30, 2018

·

The EU awarded 26,774 tons of duty free soft wheat.

-

Japan

in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on July 18 for arrival by December 28.

·

Jordan seeks 120,000 tons of barley for Oct/Nov shipment on July 17.

·

Jordan seeks 120,000 tons of wheat on July 19 for Oct-Nov shipment.

Rice/Other

·

Mauritius seeks 6,000 tons of white rice on July 13 for Sep 1-Nov 30 shipment.

-

Thailand

seeks to sell 120,000 tons of raw sugar on July 18. -

South

Korea bought 82,800 tons of non-glutinous rice for arrival between September and December. Details for the purchased products are as follows:

TONNES(M/T) GRAIN TYPE PRICE($/T) ORIGIN ARRIVAL/PORT

20,000 Brown Short 638.00 Vietnam Sept 15/Incheon

20,000 Brown Short 648.00 Vietnam Sept 15/Ulsan

20,000 Brown Short 638.00 Vietnam Sept 15/Masan

10,000 Brown long 468.95 Thailand Sept 30/Mokpo

10,000 Brown long 467.40 Thailand Sept 30/Donghae

2,800 Milled Medium 513.80 Vietnam Dec 1-31/Busan

Source:

Reuters and FI

USDA

Export Sales Highlights

-

Wheat:

Net sales of 136,400 MT for 2017/2018 were down 69 percent from the previous week and the prior 4-week average. Increases were primarily for Nigeria (78,000 MT, including 30,000 MT switched from unknown destinations), the Philippines (75,800 MT, including

40,000 MT switched from unknown destinations), Guatemala (34,100 MT, including 32,300 MT switched from unknown destinations), Mexico (27,100 MT), and Indonesia (22,000 MT, including 20,000 MT switched from unknown destinations). Reductions were reported for

unknown destinations (129,300 MT) and Nicaragua (4,000 MT). Exports of 285,900 MT were reported to Taiwan (49,300 MT), the Philippines (41,800 MT), Guatemala (37,300 MT), Mexico (36,700 MT), and Japan (33,200 MT).

-

Rice:

Net sales of 36,900 MT for 2017/2018 were up 36 percent from the previous week and 51 percent from the prior 4-week average. Increases were reported for Haiti (31,500 MT), Mexico (18,000 MT), Guatemala (1,500 MT), Canada (1,400 MT, including decreases of

700 MT), and the United Arab Emirates (800 MT). Reductions were reported for Colombia (17,500 MT). For 2018/2019, net sales of 17,500 MT were reported for Colombia. Exports of 22,400 MT were down 40 percent from the previous week and 39 percent from the

prior 4-week average. The destinations were primarily to Haiti (14,800 MT), Mexico (1,800 MT), Canada (1,800 MT), Japan (1,300 MT), and the United Arab Emirates (800 MT).

-

Cotton:

Net sales of 121,600 running bales for 2017/2018 were up noticeably from the previous week and from the prior 4-week average. Increases were reported for Vietnam (93,500 RB, including 1,300 RB switched from China and decreases of 200 RB), Turkey (7,000 RB),

China (5,600 RB), Indonesia (4,000 RB, including 500 RB switched from Japan and 300 RB switched from unknown destinations), and Algeria (3,300 RB). Reductions were reported for Japan (700 RB) and unknown destinations (300 RB). For 2018/2019, net sales of

251,400 RB reported for Vietnam (126,900 RB), Guatemala (48,400 RB), Mexico (25,400 RB), and South Korea (15,900 RB), were partially offset by reductions for Honduras (400 RB) and Japan (300 RB). Exports of 257,400 RB were down 38 percent from the previous

week and 34 percent from the prior 4-week average. The primary destinations were Vietnam (68,700 RB), Turkey (49,400 RB), Indonesia (32,200 RB), China (23,400 RB), and Mexico (18,400 RB). Net sales of Pima totaling 1,900 RB for 2017/2018 were up 82 percent

from the previous week, but down 30 percent from the prior 4-week average. Increases were reported for China (1,700 RB, switched from Hong Kong), Thailand (1,100 RB), Bangladesh (500 RB), and South Korea (500 RB, switched from Vietnam). Reductions were for

Hong Kong (1,700 RB). For 2018/2019, net sales of 1,900 RB were reported for India (1,300 RB), China (400 RB), and Egypt (200 RB). Exports of 17,200 RB were up 43 percent from the previous week and 66 percent from the prior 4-week average. The primary destinations

were China (4,900 RB), India (2,600 RB), Mexico (1,800 RB), Thailand (1,500 RB), and Turkey (1,300 RB). Optional Origin Sales: For 2017/2018, options were exercised to export 1,400 RB to Indonesia from the United States. The current optional origin outstanding

balance is 6,400 RB, all Indonesia. Exports for Own Account: The current outstanding balance of 13,000 RB is for Vietnam (6,300 RB), China (6,200 RB), and Bangladesh (500 RB).

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.