From: Terry Reilly

Sent: Tuesday, July 17, 2018 2:40:38 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 07/17/18

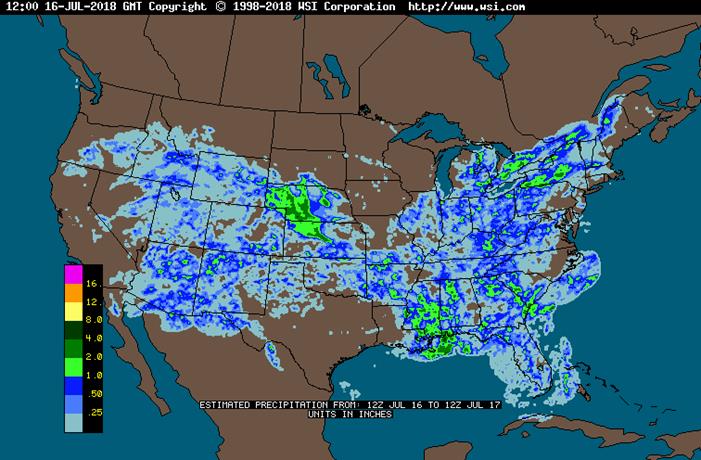

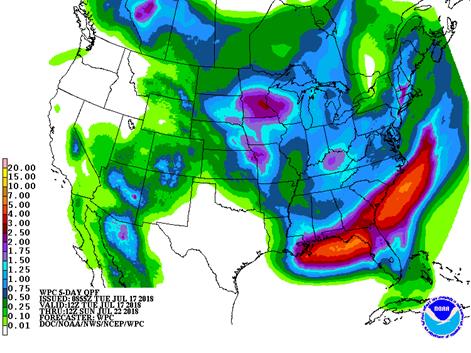

· Several waves of rain are forecast across the northern and central Plains, Midwest, Delta and southeastern states through July 31.

· The U.S. Pacific northwest and northwestern U.S. Plains will be dry or mostly dry during the next ten days

· Net drying will continue across the southwestern Corn Belt and the southern Plains.

· The Delta and southeastern states will see a mix of rain and sunshine.

· The northwestern Plains will see an increase of net drying.

· We are hearing lack of corn tasseling across WI. Feedback is welcome.

· The Canada Prairies will see net drying across the southern crop areas. Western and northern Alberta will be wettest.

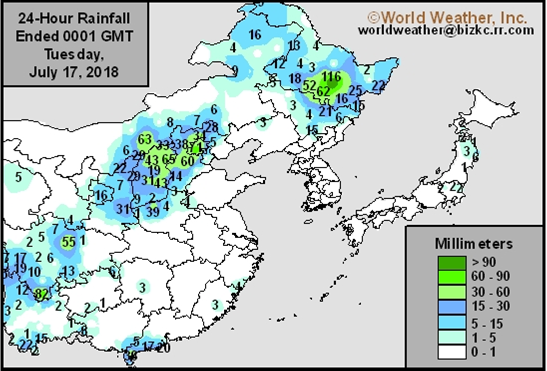

· East-central China will continue to see net drying this week but the Northeast Provinces will improve with rain.

· Frequent rain will fall from eastern Europe through the western CIS this week.

· Western Europe will trend wetter this week.

Source: World Weather Inc. and FI

SIGNIFICANT CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST CORN BELT EAST CORN BELT

Tdy-Wed Up to 15% daily cvg of

up to 0.20” and locally

more each day; wettest

east; some days may be

dry

Wed-Fri 85% cvg of up to 0.75”

and local amts to 1.50”

with a few bands of

1.50-3.30”; far SE and

far NW driest

Thu-Sat 90% cvg of up to 0.75”

and local amts over 2.0”;

driest SW

Sat 15% cvg of up to 0.15”

and locally more; east

Wisc. wettest

Sun-Mon 55% cvg of up to 0.50” 15-35% daily cvg of

and local amts to 1.10”; up to 0.35” and locally

wettest NW more each day;

wettest east

Jul 24-25 5-15% daily cvg of up 40% cvg of up to 0.30”

to 0.20” and locally and locally more;

more each day north and east wettest

Jul 26 15% cvg of up to 0.20”

and locally more

Jul 26-28 55% cvg of up to 0.50”

and locally more

Jul 27-29 60% cvg of up to 0.50”

and locally more

Jul 29-31 5-20% daily cvg of up

to 0.25” and locally

more each day

Jul 30-31 10-25% daily cvg of

up to 0.25” and locally

more each day

U.S. DELTA/SOUTHEAST SIGNIFICANT PRECIPITATION EVENTS

DELTA SOUTHEAST

Tdy-Wed 65% cvg of up to 0.35” 55% cvg of up to 0.75”

and local amts to 0.75”; and local amts to 2.0”;

far north and far south wettest south

driest

Thu 30% cvg of up to 0.75”

and local amts to 2.0”;

wettest SE

Thu-Fri 5-20% daily cvg of up

to 0.25” and locally

more each day;

wettest north

Fri-Sat 75% cvg of up to 0.75”

and local amts to 1.75”

Sat-Mon Up to 15% daily cvg of

up to 0.20” and locally

more each day; some

days may be dry

Sun-Mon 10-25% daily cvg of

up to 0.35” and locally

more each day; Va.

and Carolinas wettest

Jul 24-25 40% cvg of up to 0.40”

and local amts to 1.0”

Jul 24-26 60% cvg of up to 0.75”

and local amts to 1.50”;

wettest NE

Jul 26 15% cvg of up to 0.25”

and locally more

Jul 27-31 10-25% daily cvg of 15-35% daily cvg of

up to 0.35” and locally up to 0.60” and locally

more each day more each day

Source: World Weather Inc. and FI

Source: World Weather Inc. and FI

TUESDAY, JULY 17:

- New Zealand dairy auction on Global Dairy Trade online market starts ~7am ET (~noon London, ~11pm Wellington)

WEDNESDAY, JULY 18:

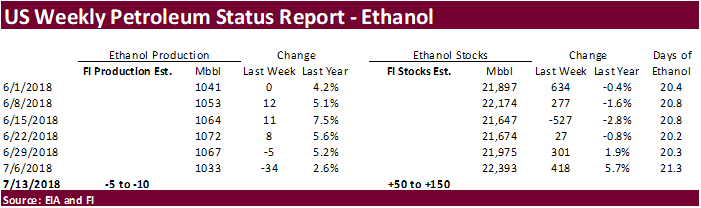

- EIA U.S. weekly ethanol inventories, output, 10:30am

THURSDAY, JULY 19:

- Nicaragua on holiday

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am

- USDA red meat production for June, 3pm

- National Confectioners Association North America 2Q cocoa grind, ~4pm

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

FRIDAY, JULY 20:

- Colombia on holiday

- Cocoa Association of Asia is set to release 2Q cocoa grind data

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- USDA milk production for June, 3pm

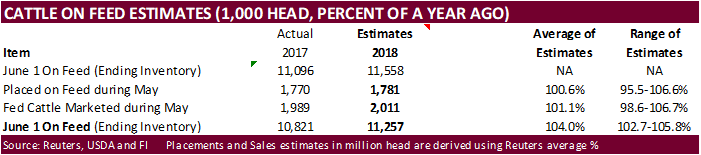

- USDA cattle on feed for June, 3pm

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly updates on French crop conditions

Source: Bloomberg and FI

Side note: Moody’s Changes America’s Outlook To Stable From Negative (ICE)

Corn.

- Corn prices advanced 3.50-4.50 cents on short covering after USDA reported a drop in US G/E conditions.

· Note on Monday we dropped our US corn yield by 2.0 bu/ac to 178.5 and lowered production by 175 million. Planalytics increased their yield to 176.2 bu/ac from 174.0. Soybean & Corn Advisor left their 178.0 yield estimate unchanged from the previous week.

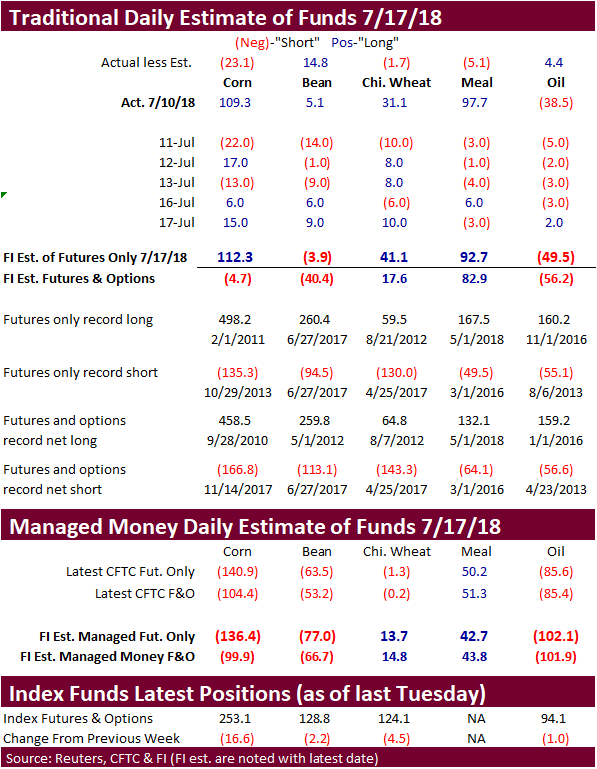

- Funds bought an estimated net 15,000 corn contracts.

· Ukraine shipped 2.6 million tons of corn to China during the September through June period. Ukraine shipped a total of 16.6 million tons during this period, down 17 percent from a year earlier. The EU is the largest importer of Ukraine corn.

· The USDA Cattle on Feed report will be released on Friday.

· US WTI Futures Settles Up 2 Cents At $68.08; Gain Of 0.03% (ICE)

· China sold about 52-53 million tons of corn out of reserves this season.

Soybean complex.

· Soybean prices continued to rebound on short covering after nearly hitting a decade low. USDA lowered US G/E soybean conditions which was supportive.

· We picked up there was possible interest by China to open trade negotiations with the US. Details were lacking.

· Soybeans jumped nearly 10 cents after more than 2,000 November soybeans traded at 8:55 am CT.

· August soybeans finished 10 cents higher and November up 9.50 cents.

· The products were under pressure on profit taking, at least in meal. This pressured the CBOT crush margins by a good amount.

· Soybean meal settled unchanged to $1.10 lower and soybean oil 4-9 points higher.

· Funds bought an estimated net 9,000 soybean contracts, sold 3,000 meal and bought 2,000 soybean oil.

· There was a headline about USDA Sec Perdue saying farmers won’t be "made whole" by assistance. They are trying to have a Trade aid plan for farmers by Sept harvest period. Details on any plan are lacking.

· The soybean export prices for Brazil premium US widened to $68/ton as of early Monday for August shipment, leading some to think another $3-$5/ton move will attract China to buy US soybeans. Brazil producers have been reserved sellers of soybeans as of recent, but there is growing fear that the premium will disappear if the US and China settled the trade disputes. Meanwhile, Oil World shortened their timetable when SA supplies dry up to around the end of August.

· Brazil is on track to export nearly 11 million tons of soybeans in July. FH July shipments reached 5.3MMT versus 3.38MMT a year ago.

· Soybean & Corn Advisor increased their Brazil soybean crop estimate by 2.0 million tons to 119.0MMT from the previous week.

· FC Stone warned high freight rates could hinder soybean area growth for the 2018-19 growing season. They didn’t provide an estimate but last May they looked for a 5 percent growth. Brazil planted 35.145 million hectares of soybeans in 2017. We are looking for the 2018-19 area to increase 2.3 percent to 35.950 million. FC Stone also estimated fertilizer demand for the upcoming crop could decline 3.7 percent because of high freight rate costs.

· Note the NOPA table that circulated yesterday had the wrong year ago numbers published. Attached is the correct version for current versus year ago comparison.

· US domestic demand for soybeans is very good. US exports are hanging in there as lower prices are attracting traditional and non-traditional buyers. At $8.50 basis the November, look for importing countries other than China to take advantage.

· It’s starting to get a little too dry across SE Asian palm growing regions.

· Yesterday we dropped our US soybean yield by 0.3 bu/ac to 48.9 and lowered production by 28 million. Planalytics increased their yield to 49.5 bu/ac from 49.0. Soybean & Corn Advisor left their 51.0 yield estimate unchanged from the previous week.

- China sold 54,706 of rapeseed oil out of 61,000 tons offered at an average price of 6077 yuan per ton, or $908.60/ton, 87 percent of the total.

· China sold 832,302 tons of soybeans out of reserves so far, this season.

- The CCC seeks 12,500 tons of soybean meal for Honduras, opened until July 18, for early October shipment.

- Results awaited: Iran seeks 30,000 tons of sunflower oil on July 10.

- Results awaited: Iran seeks 30,000 tons of palm olein oils on July 10.

- Iran seeks 30,000 tons of soybean oil on August 1.

- South Korea seeks 1,500 tons of non-GMO soybeans on July 25 for September-December delivery.

· US wheat futures traded higher on short covering and ongoing global crop concerns, despite weather improving for some major exporting regions.

· September Chicago punched through its 200-day and 20-day MA’s, ending 9.25 cents higher. September KC also traded above its 20-day but is well below its 200-day. September KC settled 6.25 cents higher. MN traded higher but prices remain near their respected contract lows. MN ended 3.50-5.50 cents higher.

· Funds today bought an estimated net 10,000 SRW wheat contracts.

· Australia will see another round of net drying in eastern Australia, threatening crop establishment. Longer-term, traders are worried El Nino will yield negatively impact crops in the eastern regions. Rain is badly needed.

· Rain prospects increase this week for Rain in western Russia, Belarus, Poland and western Ukraine. But too much rain could fall in some areas.

· Dry and warm weather for the northwestern US Plains, PNW, and Canadian southern Prairies are threatening yields.

· Manitoba, Canada, crop report said hot temps have advanced crops but the province would benefit from a good rain. They are also monitoring diseases and insect activity.

· Jordan passed on 120,000 tons of barley for Oct/Nov shipment.

- China sold 954 tons of imported wheat from state reserves at auction at an average price of 2350 yuan/per ton or $352.05/ton, 0.05 percent of what was offered.

- Japan seeks 57,914 tons of US food wheat on Thursday for September loading.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on July 18 for arrival by December 28.

· Jordan seeks 120,000 tons of wheat on July 19 for Oct-Nov shipment.

- Bangladesh seeks 50,000 tons of optional origin milling wheat on July 25 for shipment within 40 days of contract signing.

Rice/Other

· Results awaited: Mauritius seeks 6,000 tons of white rice for Sep 1-Nov 30 shipment.

- Thailand seeks to sell 120,000 tons of raw sugar on July 18.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.