From: Terry Reilly

Sent: Thursday, July 19, 2018 4:49:52 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 07/19/18

PDF attached

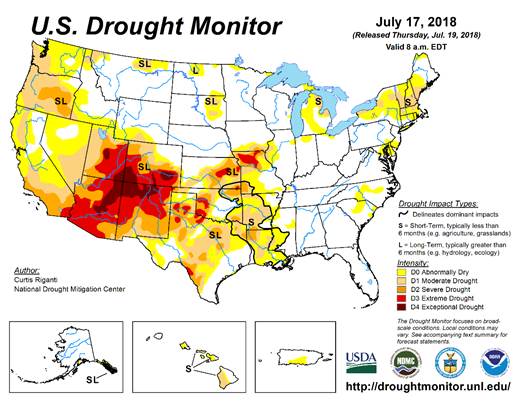

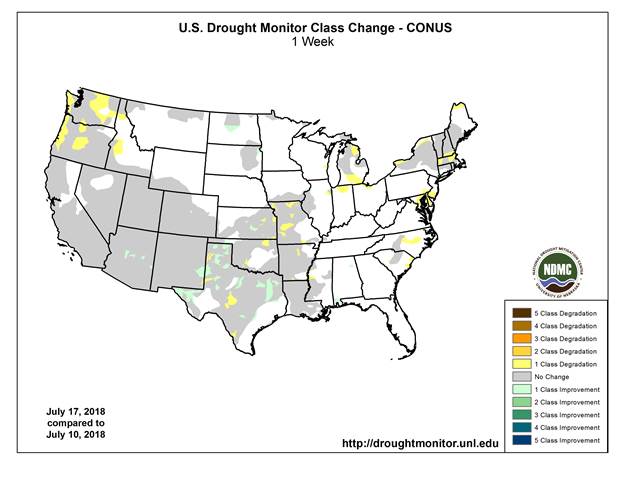

· We are already thinking of a 1-2 decrease in spring wheat conditions this week after hot and dry weather set in across the PNW. Note the drought monitor shows drought conditions expanding across the Pacific Northwest.

· G/E US corn conditions could decline 2 and soybeans down one.

· There were no major changes to the 2-week US weather outlook for the Midwest as of Thursday morning.

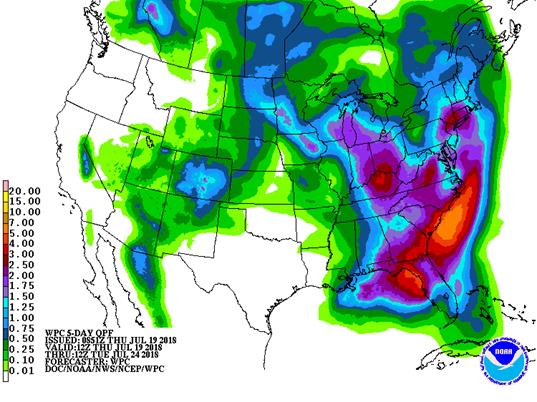

· 1-5 day suggests rainfall of 0.20 to 0.75 inch will impact the southwestern Corn Belt while 0.50 to 1.50 inches occurs in many other areas.

· Stress to crops is likely to increase in the drier parts of Delta again when rain becomes restricted Friday into next week.

· The U.S. Pacific northwest and northwestern U.S. Plains will be dry or mostly dry during the next ten days

· Net drying will continue across the southwestern Corn Belt and the southern Plains.

· The Canada Prairies will see net drying across the southern crop areas. Western and northern Alberta will be wettest.

· East-central China will continue to see net drying this week but the Northeast Provinces will improve with rain.

· Frequent rain will fall from eastern Europe through the western CIS.

· Western Europe is improving.

· Southern Brazil and Argentina will receive widespread rain during the balance of this workweek.

Source: World Weather Inc. and FI

SIGNIFICANT CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST CORN BELT EAST CORN BELT

Tdy-Fri 75% cvg of up to 0.75” and local amts to 1.25”

with some bands of 1.25-2.75” from SE and

east-central N.D. to east-central Ia. and south Wi.;

driest SW

Tdy-Sat 90% cvg of 0.30-1.30” and local amts to 2.0”

with a few bands of 2.0-3.25” and lighter

rain in few areas; west-central Il. driest

Sat 15% cvg of up to 0.20” and locally more;

Wisc. Wettest

Sun-Mon 40% cvg of up to 0.50” and local amts to 1.10”; 25-45% daily cvg of up to 0.65” and locally

wettest NW more each day; driest west

Tue-Wed 5-20% daily cvg of up to 0.30” and locally 65% cvg of up to 0.75” and local amts to 1.50”;

more each day driest west

Jul 26 15% cvg of up to 0.25” and locally more

Jul 26-27 35% cvg of up to 0.75” and local amts to 1.50”;

west-central areas wettest

Jul 27-28 50% cvg of up to 0.75” and local amts to 1.50”;

driest north

Aug 28-29 5-20% daily cvg of up to 0.30” and locally more each day

Aug 29-30 5-20% daily cvg of up to 0.30” and locally

more each day

Jul 30-Aug 1 45% cvg of up to 0.60” and locally more

Jul 31-Aug 2 50% cvg of up to 0.60” and locally more

U.S. DELTA/SOUTHEAST SIGNIFICANT PRECIPITATION EVENTS

DELTA SOUTHEAST

Fri 15% cvg of up to 0.65” and locally more;

far north wettest

Fri-Sun 85% cvg of up to 0.75” and local amts to 1.50”

with some 1.50-3.0” bands; driest SW

Sat-Mon Up to 15% daily cvg of up to 0.20” and locally

more each day; some days may be dry

Mon-Tue 50-75% daily cvg of up to 0.75” and locally

more each day; driest west

Tue 20% cvg of up to 0.20” and locally more;

wettest north

Wed-Jul 26 15-35% daily cvg of up to 0.50” and locally

more each day

Wed-Jul 27 80% cvg of up to 0.75” and local amts over 2.0”

Jul 27-28 65% cvg of up to 0.75” and local amts to 1.50”

Jul 28-30 80% cvg of up to 0.75” and local amts over 2.0”

Jul 29-31 5-20% daily cvg of up to 0.25” and locally

more each day

Jul 31-Aug 2 15-35% daily cvg of up to 0.50” and locally

more each day

Aug 1-2 10-25% daily cvg of up to 0.30” and locally

more each day

Source: World Weather Inc. and FI

FRIDAY, JULY 20:

- Colombia on holiday

- Cocoa Association of Asia is set to release 2Q cocoa grind data

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- USDA milk production for June, 3pm

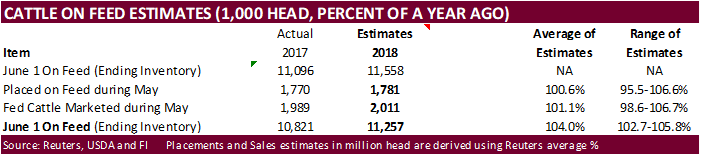

- USDA cattle on feed for June, 3pm

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly updates on French crop conditions

Source: Bloomberg and FI

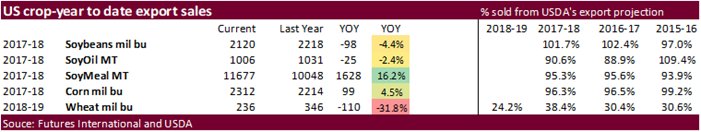

USDA export sales for both old and new-crop corn and soybean export sales were good.

Wheat sales were average. Old-crop corn sales positive along with shipments. Bean sales lag. Row crop shipment pace catching up. BRZ and ARG buying US grains.

Weekly Bloomberg Survey (taken Wed)

· Wheat: Bullish: 11 Bearish: 2 Neutral: 7

· Corn: Bullish: 12 Bearish: 5 Neutral: 3

· Soybeans: Bullish: 9 Bearish: 5 Neutral: 6

· Raw sugar: Bullish: 3 Bearish: 1 Neutral: 5

· White sugar: Bullish: 2 Bearish: 3 Neutral: 4

· White-sugar premium: Widen: 0 Narrow: 4 Neutral: 5

· US Initial Jobless Claims (W/W) 14-Jul: 207K (est 220K; prev R 215K)

– Continuing Claims (W/W) 7-Jul: 1751K (est 1729K; prev R 1743K)

· US Philadelphia Fed Business Outlook Jul: 25.7 (est 21.5; prev 19.9)

· Canadian ADP Employment Report Jun: -10.5K (prev 2.9K)

Corn.

- Corn prices traded firmer on positive NAFTA comments out of Mexico’s EconMin Guajardo saying talks to restart July 26 and can announce an agreement in principle before September.

- Good USDA export sales underpinned prices. Note the USDA initially reported corn sales to Argentina. They later said it was an error.

- EPA reported lower ethanol (D6) blending credits for June at 1.26 BLN from 1.30 BLN in May.

- Funds bought an estimated net 12,000 corn contracts.

- Buenos Aries Grain Exchange lowered Argentina 2017/18 corn production to 31 MMT from 32 MMT. Harvest is 76% complete up from 70.6% last week

- There is talk Japan has been slowing corn commitments for the Oct-Dec period because of a weakening Yen.

· Hog prices traded higher on renewed ideas NAFTA talks are improving.

·

Soybean complex.

- Soybeans rose for the fourth consecutive day on technical buying. Fear over US/China trade relations weigh on the market still but with the positive comments around NAFTA, buyers are gaining confidence.

· Soybeans are lower early on widespread commodity selling and higher USD. Soybean meal is slightly higher and soybean oil lower.

· EPA reported lower biodiesel (D4) blending credits for June at 317 MLN from 350 MLN in May.

· Funds bought an estimated net 3,000 soybean contracts, 3,000 meal and sold 3,000 soybean oil.

· USDA export sales for old-crop were poor but new-crop were good for soybeans. Soybean meal and oil shipments were supportive, but commitments could have been better.

· Uruguay’s soybean crop was downgraded by Oil World to 1.45 million tons, now down about 60 percent from last year, which limited exports to less than 800,000 tons during the April-June period.

· China’s soybean meal inventories were down from the previous week on improved demand, by 10,000 tons to 1.3 million tons.

· United Oilseeds cut its est. for EU rapeseed output by 9.2% at the end of last month because of adverse weather (Bloomberg)

· Indonesia’s energy minister asked the parliament to increase the biodiesel subsidy in 2019, to 2,500 rupiah per liter in 2019, from 500 rupiah per liter current.

- South Korea seeks 1,500 tons of non-GMO soybeans on July 25 for September-December delivery.

- Iran seeks 30,000 tons of soybean oil on August 1.

· US wheat traded higher on continued concerns over Black Sea and EU dryness.

· Funds today bought an estimated net 6,000 SRW wheat contracts.

· USDA all-wheat export sales came in at the low end of expectations. Note the USDA initially reported wheat sales to Argentina. They later said it was an error.

- China’s NBS estimated the wheat crop at 128.4 million tons, down 2.4 percent from the previous year, lowest since 2016.

- December Paris wheat ended up 1.50 euros to 189.25 euros.

- BA Exchange reported wheat planting 92.5% complete vs 87.2% last week.

Export Developments.

- Japan bought 57,914 tons of US food wheat for September loading.

Details are as follows (in tons):

COUNTRY TYPE QUANTITY

U.S. Western White 15,433 *

U.S. Dark Northern Spring(protein minimum 14.0%) 13,146 *

U.S. Hard Red Winter(Semi Hard) 29,335 *

Shipments: * Loading between Sept. 1 and Sept. 30, 2018

· The EU awarded 32,709 tons of wheat under import quotas.

- China sold 1,978 tons of 2013 wheat from state reserves at auction at an average price of 2357 yuan/per ton or $348.75/ton, 0.11 percent of what was offered.

· Jordan passed on 120,000 tons of wheat for Oct-Nov shipment.

· Jordan seeks 120,000 tons of barley on July 24.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on July 25 for arrival by December 28.

- Bahrain Flour Mills seeks 17,000 tons of semi-hard wheat and 8,000 tons of hard wheat, on July 24, valid until July 25, for shipment in late Aug/early Sept. Origins include Australia, Baltics, & Canada.

- Bangladesh seeks 50,000 tons of optional origin milling wheat on July 25 for shipment within 40 days of contract signing.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.