From: Terry Reilly

Sent: Tuesday, July 24, 2018 3:33:43 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 07/24/18

PDF attached

· The ridge of high pressure is expected to stay centered over the southwestern United States throughout this week, creating a northwesterly flow aloft in the central U.S., Northern Plains and Corn Belt.

· It was hot across the US southwest over the weekend.

· Rainfall across the Midwest over the weekend was restricted to the ECB and western Dakotas. Dry or mostly dry weather occurred in much of Illinois, western Indiana, western Kentucky, western Tennessee and from much of Missouri through Iowa to western and southern Minnesota and the eastern Dakotas.

· The western Corn Belt will see net dry this week. The eastern Midwest will see rain.

· Not all areas of the southwestern Corn Belt will remain dry this week. A very important event will occur this weekend with 0.30 to 0.80 inch of rain likely and local totals to 1.50 inches.

· Other U.S. weather late this week through the weekend will be wettest from the central Plains into the lower Ohio River Valley and far northern Delta.

· Warmer temperatures will evolve late in the first week of August, but no excessive heat is expected.

WORLD WEATHER AREAS OF GREATEST INTEREST THIS WEEK

· Indonesia and Malaysia rainfall remains erratic and lighter than usual

· Western Luzon Island, Philippines rainfall eased up Monday after a couple of weeks of frequent heavy to torrential rainfall

· Northern Vietnam weather has begun to dry down

· India’s Monsoon will take a short-term break from mid-week this week into the end of next week, but sufficient moisture is present in most of the nation to support crops favorably as long as rain resumes in August

· Northern Europe dryness is not likely to change much the remainder of this week, but some showers will begin to increase late in the week through early next week with Germany and Scandinavia seeing some relief

· Eastern Europe and the western CIS will see frequent rain maintaining concern over unharvested small grain quality for a few more days, but much less rain is expected by the weekend and improving conditions will occur next week

· Interior eastern and some central China areas will be drying in the coming week while remnants of Tropical Depression Ampil produce heavy rain in northeast parts of the nation for the next couple of days

· East-central Australia drought will be eased by showers in Queensland today and in New South Wales Thursday into Friday with some additional showers “possible” during mid-week next week

· U.S. Midwest weather will be mild to cool, but net drying is still expected in the central and southwestern Corn Belt through the end of this week. Rain this weekend is expected to bring some needed relief to dryness in the southwest

· Southern U.S. Plains livestock and crops will get relief from excessive heat the remainder of this week

· Key Texas crop areas will stay dry this week, but some rain will fall in West Texas Thursday into Friday and again Sunday into Monday

· SW Canada Prairies, northwestern U.S. Plains and U.S. Pacific Northwest will stay drier and warmer biased through the next week

Source: World Weather Inc. and FI

Bloomberg weekly agenda

TUESDAY, JULY 24:

- Wheat Quality Council’s U.S. spring wheat crop tour begins in North Dakota, with final data expected Thursday

- Grain World crop tour in Canada hosted by FarmLink begins in Manitoba, Saskatchewan and Alberta, with final data for spring wheat, canola, durum and pulses expected Thursday

- Allendale holds webinar on weather outlook, 3pm ET (2pm CST)

- Datagro’s Global Agribusiness Forum in Sao Paulo, final day

WEDNESDAY, JULY 25:

- Costa Rica public holiday; Pakistan holds general election

- Cargo surveyors AmSpec, Intertek to release data on Malaysia’s July 1-25 palm oil exports, 11pm ET Tuesday (11am Kuala Lumpur Wednesday); SGS data for same period, 3am ET Wednesday (3pm local time Wednesday)

- EIA U.S. weekly ethanol inventories, output, 10:30am

- Allendale holds webinar on grains and oilseeds, 3pm ET (2pm CST)

- U.S. poultry slaughter June, 3pm

- Wheat Quality Council’s U.S. spring wheat crop tour, 2nd day

- Grain World crop tour in Canada, 2nd day

- EARNINGS: Coca-Cola

THURSDAY, JULY 26:

- Intl Grains Council monthly grains report, 8:30am ET (1:30pm London)

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am

- Allendale holds webinar on livestock outlook, 3pm ET (2pm CST)

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Wheat Quality Council’s U.S. spring wheat crop tour, 3rd day

- Grain World crop tour in Canada, final day

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

- World Trade Organization holds a General Council meeting that will last through July 27 to cover issues related to the U.S.-China trade conflict

- EARNINGS: Nestle SA, Anheuser-Busch Inbev, Diageo Plc

FRIDAY, JULY 27:

- Thailand, Peru public holidays

- G20 Agriculture ministers meet in Buenos Aires

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly updates on French crop conditions

Source: Bloomberg and FI

Corn.

· Corn was lower during much of the session after trading higher over the past six sessions. Profit-taking noted.

· Private Analysts in Argentina said today that the Argentina 2018/19 corn harvest may reach 44 MLN tons on favorable prices and weather.

- The USDA said it will provide up to $12 BLN in farmer support to help offset losses incurred over the trade disputes. The market took this as long-term bearish due to the talk of direct payments to farmers and the fact that if the farmer is subsidized they will produce more crop.

- Funds sold an estimated net 9,000 corn contracts.

· The US weather forecast was a touch wetter for the WCB for the first week of the forecast, in our opinion.

· Production prospects were thought to have improved for EU and Russia, according to two recent reports. MARS increased its EU corn yield estimate on Monday. UAC estimated the 2018 Russian corn crop at 11.2 million tons, up from 10.1 million previously, and compares to 10.8 last year. Exports are seen at 4.6MMT tons vs 3.7 previously. Some of the increase in exports could go to China, in our opinion.

· US crop conditions are still very high. Some states are experiencing warm overnight temperatures across the southwestern Corn Belt. While this may advance growth and lower the potential yield, any crop losses should be more than offset by above trend yields in larger Midwestern producing states than have seen normal or mild overnight temperatures.

- On Monday we saw the first decline in corn option open interest since February 24 outside of 3 expiration Fridays, which is expected.

· US producer selling is slow.

· The Baltic Dry Index is over a 4-1/2 year high, led by the Capesize type vessels.

- EU animal unit producers are expected to use a little more corn this season due to rising feed wheat prices.

- The U.S. Department of Agriculture’s monthly cold storage report showed total pork inventories for June at 560.0 million pounds, down nearly 64 million from May – the second largest-ever withdrawal for the month (Reuters).

- South Africa’s CEC is due to update their 2018 corn production on Thursday and traders are looking for a slight increase to 13.305 million tons form 13.207 million previously. USDA is at 13.8 million tons, down from 17.55 million in 2017.

· China sold about 55.6 million tons of corn out of reserves this season.

· The soybean complex traded higher on short-covering and a bid leading up to the announcement of a USDA farm-aid package.

· President Trump plans to visit Dubuque, IA on Thursday. We may learn more what the government may/may not do to assist producers impacted by trade woes.

· Before that visit, there was talk the administration may reveal trade aid as early as today. The Washington Post reported the Administration may announce producer aid of $12 billion paid through direct assistance, a food purchase and distribution program, and a trade promotion program. Revitalizing the CCC program would allow this to happen without Congressional approval.

https://www.politico.com/story/2018/07/24/trump-trade-aid-for-farmers-737108

· A Bloomberg article noted some Chinese crushers in the north suspended crushing due to high soybean meal inventories.

· Funds were net buyers of 8,000 soybean, 3,000 soymeal, and 3,000 soybean oil contracts.

Export Developments

- China sold 2,377 tons of rapeseed oil out of auction at an average price of 6,000 yuan per ton ($883.30/ton), 4 percent of the total offered.

- South Korea seeks 1,500 tons of non-GMO soybeans on July 25 for September-December delivery.

- Iran seeks 30,000 tons of sunflower oil on September 24.

- Iran seeks 30,000 tons of soybean oil on August 1.

· China sold 972,370 tons of soybeans out of reserves so far, this season.

· US wheat futures took a breather early after rallying late last week, but turned higher by late morning (CT) after profit taking dried.

· Funds today sold an estimated net 1,000 SRW wheat contracts.

· The market was unable to hold gains after the premium built-in to the market post-open, from the impending USDA $12 BLN aid package, was taken out after details were released. Soybean farmers are to be the greater beneficiary of the aid compared to corn and wheat growers.

· December Paris wheat futures ended 2.25 euros higher at 197.00 euros, a new 3-yr high, on continued poor crop weather.

· The weekly Manitoba crop report showed hot temperatures accompanied with rain last week advanced quickly, which may lead to early harvesting.

· France is gearing up to ship 93,750 tons of wheat to Algeria and 74,600 tons of barley to China.

· Morocco’s grain production increased to 10.3 million tons in 2018, higher than 9.82 million tons projected in April and up 7.3 percent from last year.

- The 2018 US HRW wheat quality was good enough to blend this year with poor quality wheat from last year allowing for supplies to become more attractive. Some traders think wheat prices hit a recent bottom in part from a declining Russia wheat crop from last year. As we noted yesterday, the global wheat STU excluding China is the tightest since 2007-18.

- The Wheat Quality Council’s U.S. spring wheat crop tour began today in North Dakota. Results are due out Thursday.

· Egypt bought 420,000 MT of wheat for September 1-10 shipment details below:

o 60,000 MT Russian @ $234.21/ton C&F

o 60,000 MT Russian @ $235.61/ton C&F

o 60,000 MT Russian @ $236.00/ton C&F

o 60,000 MT Russian @ $236.76/ton C&F

o 60,000 MT Ukraine @ $235.99/ton C&F

o 60,000 MT Romanian @ $235.65/ton C&F

o 60,000 MT Romanian @ $235.33/ton C&F

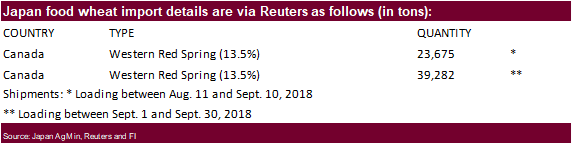

· Japan bought 62,957 tons of food wheat, all from Canada. Original details of tender as follows.

· Jordan passed on 120,000 tons of barley for Sep-Nov shipment.

· Jordan seeks 120,000 tons of wheat on July 26.

- China sold 28,742 tons of 2013 wheat out of auction at an average price of 2223 yuan per tons ($326.24/ton), 2 percent of what was offered.

- Bangladesh seeks 50,000 tons of optional origin milling wheat on July 25 for shipment within 40 days of contract signing.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on July 25 for arrival by December 28.

· Iraq seeks 50,000 tons of US, Canadian, and/or Australian wheat on July 29, valid until August 2.

- Results awaited: Bahrain Flour Mills seeks 17,000 tons of semi-hard wheat and 8,000 tons of hard wheat, on July 24, valid until July 25, for shipment in late Aug/early Sept. Origins include Australia, Baltics, & Canada.

Rice/Other

- China sold 76,086 tons of rice out of auction at an average price of 2375 yuan per tons, 4 percent of what was offered.

- Results awaited: Thailand seeks to sell 120,000 tons of raw sugar on July 18.

· Results awaited: Mauritius seeks 6,000 tons of white rice for Sep 1-Nov 30 shipment.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.