From: Terry Reilly

Sent: Thursday, July 26, 2018 4:55:41 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 07/26/18

PDF attached

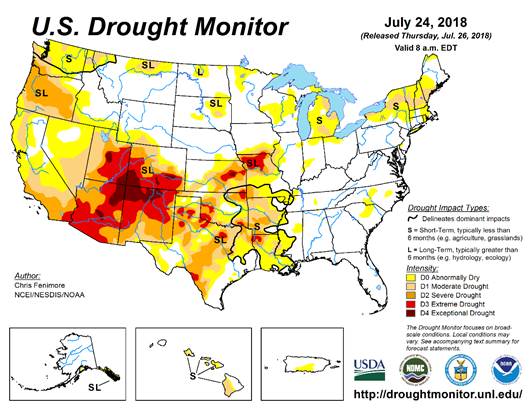

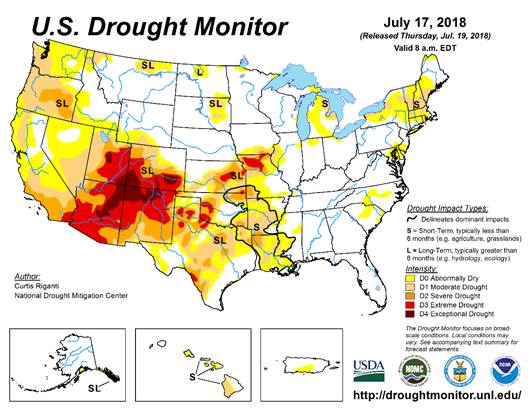

· The US Drought Monitor shows expansion of net drying across WI and Missouri.

· The morning 6-10 day is drier for the southwestern Midwest, northern Delta, and southern Plains. 11-15 day is drier for the north central Plains.

· Eastern Argentina saw rain into Uruguay and southern Brazil.

· The ridge of high pressure is expected to stay centered over the southwestern United States throughout this week, creating a northwesterly flow aloft in the central U.S., Northern Plains and Corn Belt.

· It was hot again across the US southwest.

· The western Corn Belt will see net dry this week. The eastern Midwest will see rain.

· Not all areas of the southwestern Corn Belt will remain dry this week. A very important event will occur this weekend with 0.30 to 0.80 inch of rain likely and local totals to 1.50 inches.

· Other U.S. weather late this week through the weekend will be wettest from the central Plains into the lower Ohio River Valley and far northern Delta.

· Warmer temperatures will evolve late in the first week of August, but no excessive heat is expected.

WORLD WEATHER AREAS OF GREATEST INTEREST THIS WEEK

· Southern Oscillation Index has held close to zero in the past few days this adds support for improved rain potentials in eastern Australia during August

· Rain is already advertised for New South Wales Friday into Saturday with 0.10 to 0.50 inch

· Both Queensland and New South Wales may get some additional rain of significance late next week and into the following weekend

· Japan’s heat wave continues with temperatures high into the 90s and over 100 degrees Fahrenheit expected to prevail into the weekend

· Tropical Storm Jongdari is expected to reach Honshu, Japan late in the weekend and will bring some relief to the recent hot, dry, weather, but might also bring some damaging wind and flooding rain to areas near the coast southwest of Tokyo

· Western Europe continues to heat up with 90s reaching into Germany and France with extremes possibly reaching 100 briefly ahead of weekend showers

· Sweden also reached into the lower 90s Fahrenheit Wednesday

· France, Germany, the U.K. and Scandinavia will receive some rain this weekend and then trend drier and warmer again during the second half of next week into the following weekend.

· Rainfall of 0.20 to 0.75 inch is expected with the U.K. getting local totals over 1.00 inch

· Stress through Friday and that returning next week is expected for many crop areas with losses in production likely to continue expanding, despite the showers

· Eastern Europe and the far western CIS will see frequent rain maintaining concern over unharvested small grain quality for a few more days, but much less rain is expected in western Russia by the weekend and improving conditions will occur next week; Belarus, western Ukraine and eastern Poland will stay wet into next week

· Indonesia and Malaysia rainfall remains erratic and lighter than usual with little sign of change

· India’s Monsoon will take a short term break with most of the west and south experiencing net drying conditions for the next week to ten days

· Subsoil moisture will carry crops favorably during this period of time, but greater rain must return in August

· Rain and soil moisture will continue adequately to abundantly in northeastern parts of the nation throughout the forecast period

· Interior eastern and central China areas will be drying in the coming week with temperatures rising well above average

· Extreme highs over 100 are expected with little to no rain of significance

· Topsoil moisture has already been depleted in many areas and subsoil moisture is decreasing

· Crop stress will become common during the week next week as the heat and dryness prevails

· U.S. Midwest weather will be mild to cool with sufficient rainfall to maintain good crop development

· The forecast models are wetter today than they were Wednesday, but some of the rain is likely overdone

· Dry pockets will remain in the southwest and far northeast parts of the region, despite expected shower activity

· Southern U.S. Plains livestock and crops will experience some relief from hot dry conditions this weekend

· Key Texas crop areas will stay dry into Sunday, but some rain will fall in West Texas today and early Friday and again Sunday into Monday

· Sunday and Monday’s precipitation will be most significant and may bring relief to West Texas dryness in at least a portion of the region.

· SW Canada Prairies, northwestern U.S. Plains and U.S. Pacific Northwest will stay drier and warmer biased through the next week

· Some rain is expected in the Prairies late Sunday into Tuesday, but the drought areas in the south will receive the least rainfall

Source: World Weather Inc. and FI

SIGNIFICANT CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST CORN BELT EAST CORN BELT

and locally more;

north and east wettest

Fri-Sat 65% cvg of up to 0.75”

and local amts to 2.0”;

wettest south

Sat-Sun 40% cvg of up to 0.65”

and local amts to 1.20”;

wettest west

Sun-Mon 45% cvg of up to 0.75”

and local amts to 1.50”;

wettest south

Mon-Wed 80% cvg of up to 0.60”

and local amts to 1.20”

Tue-Wed 10-20% daily cvg of

up to 0.35” and locally

more each day

Aug 2 20% cvg of up to 0.30”

and locally more

Aug 2-3 65% cvg of up to 0.60”

and local amts to 1.30”

Aug 3-4 70% cvg of up to 0.55”

and local amts to 1.20”

Aug 4-5 10-25% daily cvg of

up to 0.60” and locally

more each day

Aug 5-7 15-30% daily cvg of

up to 0.50” and locally

more each day

Aug 6-9 5-20% daily cvg of up

to 0.35” and locally

more each day

Aug 7-9 5-20% daily cvg of up

to 0.30” and locally

U.S. DELTA/SOUTHEAST SIGNIFICANT PRECIPITATION EVENTS

DELTA SOUTHEAST

Tdy 20% cvg of up to 0.35”

and locally more;

wettest north

Tdy-Fri 15-30% daily cvg of

up to 0.50” and locally

more each day;

driest west

Fri-Sat Up to 15% daily cvg of

up to 0.20” and locally

more each day; some

days may be dry

Sat-Sun 20-40% daily cvg of

up to 0.75” and locally

more each day;

wettest NE

Sun-Mon 85% cvg of up to 0.75”

and local amts to 1.50”

Mon-Wed 90% cvg of up to 0.75”

and local amts to 1.50”

with a few bands of

1.50-3.0”

Tue-Wed 50% cvg of up to 0.40”

and local amts to 0.80”;

wettest south

Aug 2-4 80% cvg of up to 0.75”

and local amts to 2.0”

Aug 2-5 15-30% daily cvg of

up to 0.40” and locally

more each day

Aug 5-9 10-25% daily cvg of

up to 0.40” and locally

more each day

Aug 6-9 5-20% daily cvg of up

to 0.25” and locally

more each day

Source: World Weather Inc. and FI

Bloomberg weekly agenda

THURSDAY, JULY 26:

- Intl Grains Council monthly grains report, 8:30am ET (1:30pm London)

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am

- Allendale holds webinar on livestock outlook, 3pm ET (2pm CST)

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Wheat Quality Council’s U.S. spring wheat crop tour, 3rd day

- Grain World crop tour in Canada, final day

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

- World Trade Organization holds a General Council meeting that will last through July 27 to cover issues related to the U.S.-China trade conflict

- EARNINGS: Nestle SA, Anheuser-Busch Inbev, Diageo Plc

FRIDAY, JULY 27:

- Thailand, Peru public holidays

- G20 Agriculture ministers meet in Buenos Aires

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly updates on French crop conditions

Source: Bloomberg and FI

· Initial Jobless Claims (Jul 21): 217K (est 215K, prevR 208k)

Corn.

- Corn futures posted gains despite a violent trade in wheat and soybeans.

- Funds bought an estimated net 6,000 corn contracts.

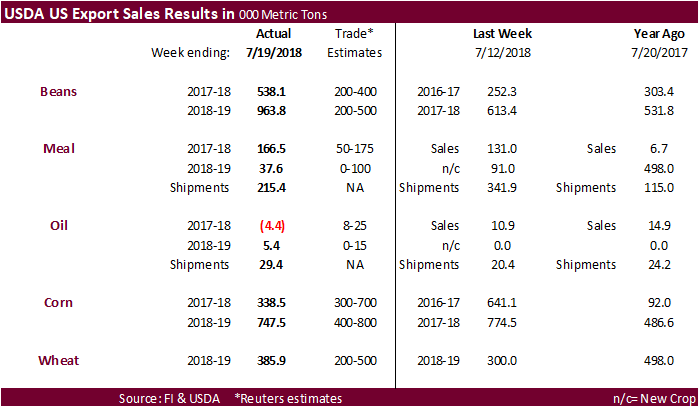

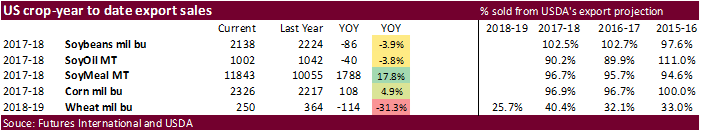

· USDA US corn export sales were within expectations.

- South Africa’s CEC left its corn crop forecast unchanged at 13.2 million tons. Traders were looking for 13.305 million tons. USDA is at 13.8 million tons, down from 17.55 million in 2017.

- Ukraine saw additional rain today after heavy rain fell Wednesday.

· China could see net drying and warm temperatures that may stress the crop.

· China sold 1.169 million tons of corn out of auction at an average price of 1,540 yuan per ton ($227.45/ton), nearly 30 percent of what was offered.

· China sold about 56.8 million tons of corn out of reserves this season.

USDA export sales

- Corn: Net sales of 338,500 MT for 2017/2018 were down 47 percent from the previous week and 42 percent from the prior 4-week average. Increases were reported for Mexico (110,800 MT, including decreases of 47,800 MT), South Korea (72,000 MT, including decreases of 3,900 MT), Israel (47,000 MT, including 50,000 MT switched from unknown destinations and decreases of 3,000 MT), unknown destinations (42,400 MT), and Egypt (41,400 MT). Reductions were primarily for Argentina (80,000 MT) and France (20,000 MT). For 2018/2019, net sales of 747,500 MT were reported for Mexico (249,900 MT), unknown destinations (125,400 MT), Japan (114,000 MT), Taiwan (79,000 MT), and South Korea (69,000 MT). Exports of 1,281,900 MT were down 1 percent from the previous week and 10 percent from the prior 4-week average. The destinations were primarily to Mexico (338,600 MT), Japan (283,400 MT), South Korea (198,500 MT), Colombia (95,700 MT), and Peru (77,800 MT). Optional Origin Sales: For 2017/2018, increases were reported for Italy (25,000 MT, switched from unknown destinations). Options were exercised to export 68,000 MT to South Korea and 40,000 MT to Egypt from the United States. Options were exercised to export 23,800 MT to Italy from other than the United States. Decreases totaling 67,300 MT were reported for Italy (1,300 MT) and unknown destinations (66,000 MT). The current optional origin outstanding balance of 138,000 MT is for South Korea. For 2018/2019, the current outstanding balance of 463,000 MT is for South Korea (343,000 MT), Saudi Arabia (70,000 MT), and unknown destinations (50,000 MT).

- Barley: No net sales were reported for the week. Exports of 1,600 MT were to Japan (1,500 MT) and South Korea (100 MT).

- Sorghum: Net sales of 1,000 MT were for Japan. Exports of 13,000 MT were to Japan (11,000 MT) and Mexico (2,000 MT).

Soybean complex.

· The soybean complex traded two-sided. Range was wide again. Sell stops triggered large trades early. The volatility has been nerve wreaking for some traders. Bottom line is that US demand remains good and with China virtually absent from the US export market, soybeans are still finding a home.

· Funds were net sellers of 5,000 soybeans, bought 4,000 soymeal, and sold 4,000 soybean oil contracts.

· USDA US soybean export sales exceeded expectations. Shipments of the products were good. There were 406,200 tons of new-crop soybeans reported from the 963,800 tons total.

· The market this week already saw a surge in recent US/Canadian soybean exports to the EU. If they take it to the next level by buying a large amount of soybean meal, then you might be able to add to a bullish case.

· The CNGOIC reported crush rates at ports declined from last week to 1.61 million tons from 1.71 million. Soybean stocks were running at about 5 weeks of supply needs.

· China is slowing down on importing soybeans. Soybean meal demand did improve but it’s still well down from a couple months ago. Meal and oil stocks fell from the previous week.

· Brazil exported 1.7 million tons of soybean last week, down from 2 million previous week. One analyst noted commitments rose to nearly 62 million tons. The lineup for Brazil is still hefty for this time of year.

· Brazil is seeking a 5-million ton soybean meal export quota from China.

· Canada’s canola yield was estimated at 41.9 bu/ac, above 41.1 in 2017, according to the Grain World crop tour.

· Ukraine’s stats department reported 2018 rapeseed area at 1.042 million hectares. That’s up 32 percent from 2017.

· Indonesia palm oil stocks could decline in June according to a survey to 4.7 million tons. Stocks were at a two-year high at the end of May at 4.76 million tons.

· Indonesia will leave its CPO export tax unchanged for August at zero.

· The National Development and Reform Commission (NDRC) is meeting to discuss how to change feed proportions for end users.

- South Korea passed on 1,500 tons of non-GMO soybeans for September-December delivery.

- Iran seeks 30,000 tons of soybean oil on August 1.

- Iran seeks 30,000 tons of sunflower oil on September 24.

· China sold 1.031 million tons of soybeans out of reserves so far, this season.

USDA export sales

- Soybeans: Net sales of 538,100 MT for 2017/2018 were up noticeably from the previous week, and up 69 percent from the prior 4-week average. Increases were reported for the Netherlands (143,300 MT, including 132,000 MT switched from unknown destinations), Egypt (141,400 MT, including 140,300 MT switched from unknown destinations and decreases of 2,300 MT), Mexico (92,500 MT, including decreases of 1,200 MT), Germany (58,200 MT), and Canada (49,700 MT, including decreases of 2,700 MT). Reductions were for unknown destinations (134,000 MT). For 2018/2019, net sales of 963,800 MT were reported for unknown destinations (406,200 MT), Pakistan (234,500 MT), and Mexico (95,000 MT). Exports of 823,600 MT were up 51 percent from the previous week and 21 percent from the prior 4-week average. The destinations included the Netherlands (143,300 MT), Egypt (141,400 MT), Mexico (136,700 MT), Bangladesh (83,100 MT), and Taiwan (80,600 MT). Optional Origin Sales: For 2017/2018, new optional origin sales of 66,000 MT were reported for unknown destinations. The current optional origin outstanding balance of 66,000 MT is for unknown destinations. For 2018/2019, decreases of 165,000 MT were reported for unknown destinations. The current outstanding balance of 63,000 MT is for unknown destinations. Export for Own Account: The current outstanding balance of 130,900 MT is for Canada. Export Adjustment: Accumulated exports of soybeans to the Netherlands were adjusted down 58,207 MT for week ending July 12th. The correct destination for this shipment is Germany and is included in this week’s report.

- Soybean Cake and Meal: Net sales of 166,400 MT for 2017/2018–marketing–year low–were up 27 percent from the previous week and 49 percent from the prior 4-week average. Increases were reported for Vietnam (69,100 MT, including 59,500 MT switched from unknown destinations), Thailand (58,600 MT), the Philippines (24,900 MT), Colombia (20,400 MT), and Morocco (14,200 MT). Reductions were reported for unknown destinations (59,500 MT) and El Salvador (5,000 MT). For 2018/2019, net sales of 37,600 MT were primarily for Jamaica (13,000 MT), unknown destinations (12,500 MT), and Vietnam (9,000 MT). Exports of 215,400 MT were down 37 percent from the previous week and 16 percent from the prior 4-week average. The primary destinations were Vietnam (77,600 MT), the Philippines (48,300 MT), Mexico (22,300 MT), Colombia (20,000 MT), and Canada (12,400 MT).

- Soybean Oil: Net sales reductions of 4,400 MT for 2017/2018 were down noticeably from the previous week and from the prior 4-week average. Increases were primarily for Mexico (5,300 MT), Colombia (1,300 MT), Costa Rica (800 MT, switched from Nicaragua), and the Dominican Republic (800 MT, including decreases of 4,300 MT), were more than offset by reductions for South Korea (10,000 MT), Peru (2,900 MT), and Nicaragua (800 MT). For 2018/2019, net sales of 5,400 MT were reported for the Dominican Republic (2,300 MT), South Korea (2,000 MT), and Honduras (1,000 MT). Exports of 29,400 MT were up 44 percent from the previous week and 74 percent from the prior 4-week average. The primary destinations were the Dominican Republic (13,100 MT), Colombia (5,100 MT), Jamaica (3,500 MT), and Nicaragua (2,600 MT).

· US wheat futures saw a yo-yo session, ending lower in Chicago and KC. MN settled mixed.

· Prices could go higher on Friday from the US crop tour results.

· After the close, the CME raised the initial margin for Chicago wheat by 14.8 percent to $1,550/contract from $1,350, for the September position.

· Funds today sold an estimated net 8,000 SRW wheat contracts.

· December Paris wheat futures fell 1.75 euros to 200.75 euros.

· Meanwhile, most major exporting countries outside the US posted higher fob wheat prices.

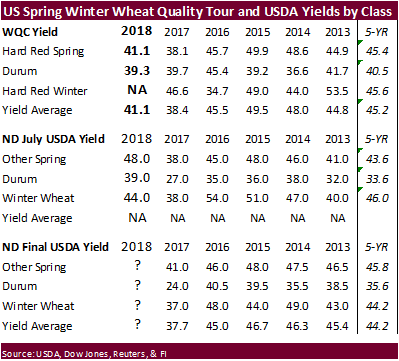

· HRS averaged 41.1 bu/acre compared to 38.1 bu/acre last year and below the 5-yr average of 45.4 bu/acre. ND’s G/E condition was last reported at 88 percent, up from 40% this time last year. This is leaving many to believe USDA will lower SW production in August.

· Canada’s all-wheat yield was estimated at 54.4 bu/ac, above 53.8 in 2017, according to the Grain World crop tour.

· USDA US all-wheat export sales improved from the previous week.

· IGC lowered its estimate of the world wheat crop by 16 million tons to 721 million tons. They left corn unchanged at 1.052 billion tons.

· Black Sea wheat volume is once again active.

· There are rumors of a Russian wheat embargo but with Russia production and stocks at high levels, we think this would be premature. CRM AgriCommodities reported it and the news was picked up by Bloomberg. Russian wheat exports are off to a great start but high stocks carried into the 2018-19 season should allow Russia to comfortably export wheat through first half of the crop-year, in our opinion.

· French growers AGPB sees the soft wheat crop at 35 million tons, above 33-34.5 million tons from other estimates.

· Arvalis estimated the French wheat crop protein level at an average 12 percent.

· Germany’s German Brewers Association projected supply will decline 1 million tons from 1.2 million in 2017.

· Bulgaria harvested 4.1 million tons of wheat as of July 19, 8 percent below a year ago. About three-fourths of the crop had been harvested.

Below is the BSW December price chart

Source: Reuters and FI

- Taiwan bought 102,775 tons of US wheat.

- The EU awarded 23,576 tons of wheat under import quota.

- China sold 2,766 tons of 2013 wheat out of auction at an average price of 2,300 yuan per ton ($339.25/ton), 0.16 percent of what was offered.

· Jordan passed on 120,000 tons of wheat.

· Jordan seeks 120,000 tons of barley on July 31.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on August 1 for arrival by January 31.

· Iraq seeks 50,000 tons of US, Canadian, and/or Australian wheat on July 29, valid until August 2.

- Results awaited: Bahrain Flour Mills seeks 17,000 tons of semi-hard wheat and 8,000 tons of hard wheat, on July 24, valid until July 25, for shipment in late Aug/early Sept. Origins include Australia, Baltics, & Canada.

Rice/Other

- Results awaited: Thailand seeks to sell 120,000 tons of raw sugar on July 18.

· Results awaited: Mauritius seeks 6,000 tons of white rice for Sep 1-Nov 30 shipment.

USDA export sales

- Wheat: Net sales of 385,900 MT for 2018/2019 were up 29 percent from the previous week and 7 percent from the prior 4-week average. Increases were reported for unknown destinations (100,800 MT), South Korea (80,500 MT, including decreases of 600 MT), Nigeria (68,000 MT), Japan (51,900 MT, including decreases of 500 MT), and the Dominican Republic (40,000 MT). Reductions were reported for Argentina (30,000 MT), Belgium (20,000 MT), and Brazil (16,600 MT). Exports of 409,100 MT were down 6 percent from the previous week, but up 12 percent from the prior 4-week average. The destinations were primarily to Japan (80,300 MT), Mexico (66,300 MT), South Korea (60,300 MT), Iraq (52,300 MT), and the Philippines (45,000 MT).

- Rice: Net sales of 6,200 MT for 2017/2018 were down 75 percent from the previous week and 79 percent from the prior 4-week average. Increases were reported for El Salvador (4,000 MT), Honduras (2,500 MT), Ghana (1,500 MT), Mexico (1,400 MT), and Canada (800 MT, including decreases of 500 MT). Reductions were reported for Saudi Arabia (5,200 MT), Guatemala (300 MT), and Liberia (100 MT). For 2018/2019, net sales of 6,600 MT were reported for Saudi Arabia (5,500 MT), Honduras (1,000 MT), and the Bahamas (100 MT). Exports of 23,300 MT were down 53 percent from the previous week and 44 percent from the prior 4-week average. The destinations were primarily to Mexico (15,600 MT), Canada (2,400 MT), Japan (1,100 MT), Jordan (900 MT), and Honduras (600 MT). Export for Own Account: New exports for own account totaling 100 MT were reported to Canada.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.