From: Terry Reilly

Sent: Friday, July 27, 2018 3:57:17 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 07/27/18

PDF attached

·

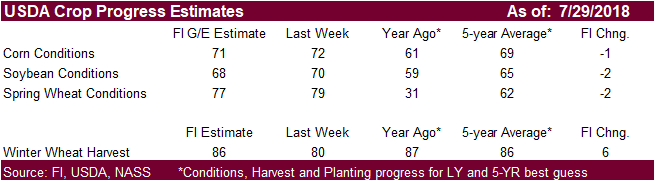

We look for US corn and soybean conditions to be unchanged to down 1 when updated early next week, and spring wheat ratings to slip 2 points in the combined G/E categories.

·

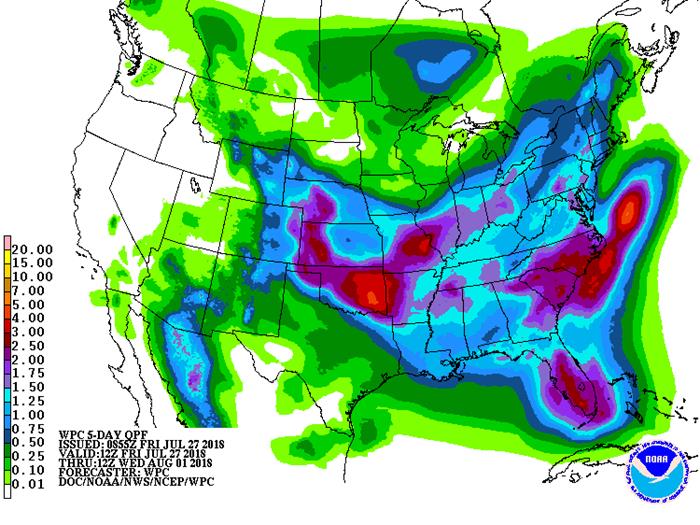

Cooler temperatures continue to dominate the bulk of the Midwest. Favorable conditions remain for corn silking and filling. Soil moisture levels remain a concern, especially for the southwestern Corn Belt. Other pockets of dry areas include

eastern Kansas, southern Iowa, northern Missouri growing areas, and central IL. The central and parts of the northern Great Plains remain in good shape after a wet week. The southern Midwest and Delta are slated to get rain over the next week.

·

The ridge of high pressure is expected to stay centered over the southwestern US through mid-next week.

·

A very important event will occur this weekend with 0.60 to 0.80 inch of rain likely and local totals to 1.50 inches.

·

Northern Europe remain hot and dry.

·

Ukraine’s central and western growing areas and southern Central Region saw good rain recently, improving conditions.

WORLD

WEATHER AREAS OF GREATEST INTEREST

·

Typhoon Jongdari will impact western Japan – the same area impacted by excessive flooding near mid-month and the same area impacted by excessive heat over the past week

·

Damage to some rice and citrus is possible

·

Property damage will be greatest from flooding

·

Mid-July floods killed 200 people

·

The past week of upper 90- and lower 100-degree heat killed 65 people and sent 22,000 to hospitals for heat-related illnesses

·

Jongdari will offer relief from the heat, but more flooding and some damage is expected to the same area already impacted by some very extreme weather this month

·

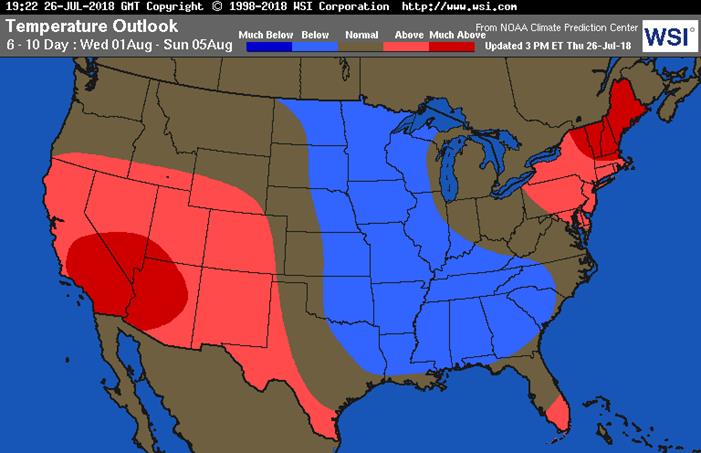

Excessive heat in the western United States through next week will stress livestock and most crops, irrigated or unirrigated

·

Extreme highs over 100 will reach into the U.S. Pacific Northwest with 90s Fahrenheit expected in British Columbia

·

Extreme highs near and above 120 will occur in the southwestern desert region

·

One of the few cool areas in the Northern Hemisphere right now is in the central United States and that coolness will prevail through the coming five days with some warming late next week and into the first weekend of August

·

Other areas of hot weather in Northern Hemisphere, include western Europe with 90s Fahrenheit reported from Spain to Scandinavia this week and extremes near and above 100 in parts of Spain

·

North Africa has cooled down a bit, but was over 120 degree Fahrenheit for several days in the past week

·

East-central China will experience extreme highs over 100 over the next week

·

Southwestern Canada’s Prairies will rise into the 90s again during the coming week

·

U.S. southern Plains will be in the 90s to slightly over 100 during the coming week and possibly hotter late in the first week of August

·

Southern Oscillation Index has held close to zero in the past several days this adds support for improved rain potentials in eastern Australia during August

·

Rain is already advertised for New South Wales and Queensland this weekend with 0.10 to 0.50 inch

·

Both Queensland and New South Wales may get some additional rain of significance late next week and into the following weekend

·

Japan’s heat wave continues with temperatures high into the 90s and over 100 degrees Fahrenheit expected to prevail into the weekend

·

Tropical Storm Jongdari is expected to reach Honshu, Japan late in the weekend and will bring some relief to the recent hot, dry, weather through all of western Japan early next week.

·

The storm will move through Shikoku and Kyushu early in the week producing heavy rain there as well

·

Western Europe continues to heat up with 90s reaching into Germany and France with extremes possibly reaching 100 briefly ahead of weekend showers

·

Sweden also reached into the lower 90s Fahrenheit Wednesday and Thursday

·

France, Germany, the U.K. and Scandinavia will receive some rain this weekend and then trend drier and warmer again during the second half of next week into the following weekend.

·

Rainfall of 0.20 to 0.75 inch is expected with the U.K. getting local totals of 1.00 to 2.00 inches – mostly in the north

·

Stress will continue into Saturday until the rain arrives and some temporary cooling will occur into early next week, but warmer and drier conditions will return briefly late next week.

·

Second week outlook, August 3 to 9 will not be as hot and dry as suggested Thursday; seasonably warm temperatures and some shower activity will impact the European continent

·

Eastern Europe and the far western CIS will see frequent rain maintaining concern over unharvested small grain quality for a few more days, but much less rain is expected in western Russia by the weekend and improving conditions will occur

next week; Belarus, western Ukraine and eastern Poland will stay wet into next week and then trend drier

·

Indonesia and Malaysia rainfall remains erratic and lighter than usual with little sign of change

·

India’s Monsoon will take a short term break with most of the west and south experiencing net drying conditions for the next week to ten days

·

Subsoil moisture will carry crops favorably during this period of time, but greater rain must return in August

·

Rain and soil moisture will continue adequately to abundantly in northeastern parts of the nation throughout the forecast period

·

Some Interior eastern and central China areas will be drying in the coming week with temperatures rising well above average

·

Rain is expected this weekend from Shandong to Sichuan offering a little break in the recent drying, but areas to the north and south will continue to dry out

·

Extreme highs over 100 are expected in some of the drier areas with little to no rain of significance

·

Topsoil moisture has already been depleted in many areas and subsoil moisture is decreasing

·

Crop stress increase during the week next week as the heat and dryness prevails in the pockets noted above

·

U.S. Midwest weather will be mild to cool with sufficient rainfall to maintain good crop development over the next two weeks

·

Dry pockets will remain in the southwest and far northeast parts of the region, despite expected shower activity

·

Southern U.S. Plains livestock and crops will experience some relief from hot dry conditions next week, but no general soaking of rain is expected

·

Key Texas crop areas will stay dry into Saturday, but some rain will fall in West Texas today and again Sunday into Tuesday

·

Sunday through Tuesday’s precipitation will be most significant and may bring some partial relief to West Texas dryness

·

Some relief to dryness may also occur in central and southern Texas during mid-week next week

·

SW Canada Prairies, northwestern U.S. Plains and U.S. Pacific Northwest will stay drier and warmer biased through the next week

·

Some rain is expected in the Prairies late Sunday into Tuesday, but the drought areas in the south will receive the least rainfall

Source:

World Weather Inc. and FI

SIGNIFICANT

CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST CORN BELT EAST CORN BELT

to 0.20” and locally

more each day;

wettest

north

Sat

40% cvg of up to 0.60”

and

local amts to 1.25”;

Neb. wettest

Sun-Mon

60% cvg of up to 0.75”

and local amts over 2.0”;

far south wettest

Sun-Tue

85% cvg of up to 0.75”

and local amts over 2.0”;

south Il. to north In.

wettest

Tue-Thu

15-35% daily cvg of

up

to 0.50” and locally

more each day; Ia.

to

Wisc. wettest

Wed-Aug

4 15-30% daily cvg of

up

to 0.35” and locally

more each day

Aug

3-5 75% cvg of up to 0.75”

and local amts to 1.50”;

far south driest

Aug

5-7 75% cvg of up to 0.65”

and local amts to 1.35”

Aug

6-10 5-20% daily cvg of up

to 0.30” and locally

more each day

Aug

8-10 10-25% daily cvg of

up

to 0.35” and locally

more each day

U.S.

DELTA/SOUTHEAST SIGNIFICANT PRECIPITATION EVENTS

DELTA

SOUTHEAST

Tdy-Sun

30-50% daily cvg of

up

to 0.75” and locally

more each day;

wettest NE

Sat-Sun

5-15% daily cvg of up

to 0.20” and locally

more each day

Mon-Tue

90-100% cvg of up to 0.75”

and

local amts over 2.0”;

far south driest

Mon-Wed

90-100% cvg of up to 0.75”

and local amts to 1.50”

with

a few bands of

1.50-3.0”

Wed-Aug

3 Up to 20% daily cvg of

up

to 0.25” and locally

more

each day; some

days may be dry

Thu-Aug

3 80% cvg of up to 0.75”

and local amts to 2.0”

Aug

4-6 10-25% daily cvg of 15-35% daily cvg of

up

to 0.30” and locally up to 0.50” and locally

more each day more each day

Aug

7-9 70% cvg of up to 0.65”

and locally more

Aug

7-10 75% cvg of up to 0.75”

and locally more

Source:

World Weather Inc. and FI

- Thailand

on holiday - EU

weekly grain, oilseed import and export data, 10am (3pm London) - USDA

weekly corn, soybean, wheat export inspections, 11am - USDA

weekly crop progress report, 4pm - Ivory

Coast weekly cocoa arrivals - EARNINGS:

Heineken NV

TUESDAY,

JULY 31:

- Cargo

surveyors AmSpec, Intertek and SGS release their respective data on Malaysia’s July palm oil exports - EARNINGS:

AGCO Corp., Archer-Daniels-Midland Co.

WEDNESDAY,

AUG. 1:

- Switzerland

public holiday - EIA

U.S. weekly ethanol inventories, output, 10:30am - USDA

soybean crush for June, 3pm - NOTE:

Starting this day, the U.S. Agriculture Department ends its decades-long policy of giving crop data to news organizations under embargo in favor of posting reports directly on the web. This could benefit businesses with ability to quickly scan and trade on

the figures

THURSDAY,

AUG. 2:

- Costa

Rica public holiday - FAO

food price index, 4am ET (9am London) - USDA

weekly net-export sales for corn, wheat, soy, cotton, 8:30am - Port

of Rouen data on French grain exports - Buenos

Aires Grain Exchange weekly crop report - Bloomberg

weekly survey of analysts’ expectations on grain, sugar prices - Colorado

State University provides its final seasonal forecast adjustment before the usual peak of the Atlantic hurricane season in late August - EARNINGS:

Pilgrim’s Pride Corp., Kellogg Co., Asahi Group Holdings

FRIDAY,

AUG. 3:

- ICE

Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly updates on French crop conditions - EARNINGS:

Kraft Heinz Co.

Source:

Bloomberg and FI

·

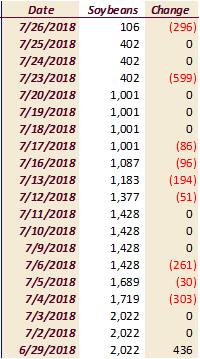

Soybeans down 296 to 106.

(CIRM – Chicago)

Weekly

Bloomberg Bull/Bear Survey

-

Wheat:

Bullish: 10 Bearish: 5 Neutral: 3 -

Corn:

Bullish: 10 Bearish: 5 Neutral: 3 -

Soybeans:

Bullish: 5 Bearish: 5 Neutral: 8 -

Raw

sugar: Bullish: 2 Bearish: 2 Neutral: 4 -

White

sugar: Bullish: 2 Bearish: 2 Neutral: 4 -

White-sugar

premium: Widen: 1 Narrow: 1 Neutral: 6

·

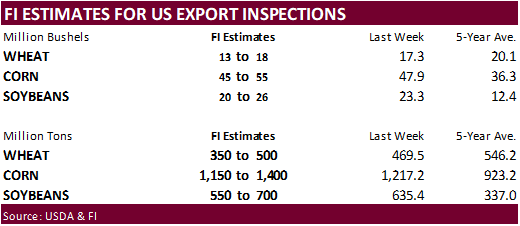

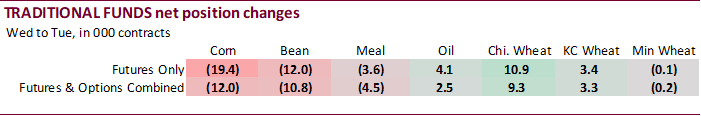

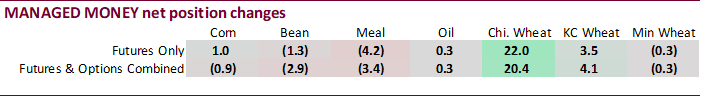

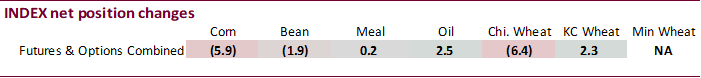

Traditional funds sold corn, soybeans and meal while they bought wheat and soybean oil.

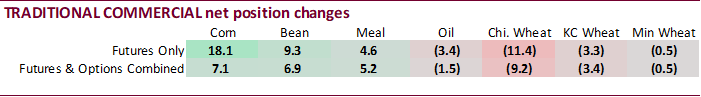

·

Commercials were active on the other side. Producers bought corn and soybeans, and were good sellers of KC wheat. Index funds reduced positions in corn and soybeans.

·

The daily estimate of funds position was way off for corn and soybeans.

·

As of last Tuesday, funds futures only were net long 71,400 corn, and net short 10,800 soybeans. The trade estimate the funds net long 121,800 corn and net long 15,200 soybeans. So the buying for the week

ending July 24 was much, much less than expected for soybeans and corn.

·

Note the funds futures only net position in corn were net long 71,400 contracts, while futures and options combined in corn are net short 53,400 contracts.

·

Commercials in corn for the futures and options combined really turned around their positions since late May when they were net short 245k to current net long 59.7k.

·

US GDP Annualised (Q2): 4.1% (est 4.2%, prevR 2.2%)

US

GDP Index (Q2): 3.0% (est 2.3%, prevR 2.0%)

·

Personal Consumption Expenditures Prices (Q2): 4.0% (est 3.0%, prevR 0.5%)

Core

Personal Consumption Expenditures (QoQ): 2.0% (est 2.2%, prevR 2.2%)

Corn.

-

Corn

is

followed wheat by trading lower but eventually traded two-sided, ending modernly higher. The 24-hour sale announcement to unknown was supportive.

-

Funds

bought an estimated net 7,000 corn contracts. -

The

US and Mexico are closer in reaching a NAFTA deal. An agreement could be in place as early as August.

-

French

crop conditions for corn were unchanged from the previous week at 71 percent.

-

Shipping

delays along the Miss River are underpinning freight rates, which lowers the amount producers are paid for cash crops.

·

Private exporters reported to the U.S. Department of Agriculture the following activity:

–Export

sales of 154,100 metric tons of soybeans for delivery to unknown destinations during the 2018/2019 marketing year.

·

China sold 968,796 tons of 2014 corn of corn out of auction at an average price of 1,418 yuan per ton ($208.54/ton), 24 percent of what was offered. Yesterday they sold 1.169 million tons.

·

China also sold 4,561 tons of 2013 corn out of reserves at 1490 yuan per ton.

·

China sold about 57.7 million tons of corn out of reserves this season.

·

China plans to offer another 8 million tons of corn from state reserves in early August.

Soybean

complex.

·

The soybean complex

traded higher on technical rebound and steady US export business. Soybean oil rallied in afternoon trading on unwinding of meal/oil spreads. Soybean meal finished mixed.

·

September soybeans ended higher in the last eight out of ten sessions. Nearby soybeans are at a three-week high.

·

Producer selling increased across the WCB on Friday.

·

Funds were net buyers of 4,000 soybeans, sold 1,000 soymeal, and bought 4,000 soybean oil contracts.

·

GAPKI reported Indonesia exports of palm and palm kernel oils up 7.5 percent from a year earlier to 2.29 million tons. Domestic stocks of palm oil rose to 4.85 million tons by the end of June from 4.76 million

a month earlier.

·

Argentina crushed 3.268 million tons of soybeans in June, down from 3.918 million a year ago and down from 3.672 million in May 2018. January through June Argentina soybean crush was about 18.5 million tons,

down from 21.4 million during the same period a year ago. Argentina imported 2.95 million tons of soybeans during first half 2018, up from 1.1 million year earlier. Argentina soybean meal exports during the same period in 2018 fell to 13.1 million tons from

15.7 million during first half 2017. Soybean oil exports are also down from a year ago. Brazil has picked up the majority of shortfall in Argentina soybean meal exports by shipping 8.57 million tons in 1H 2017, up from 7.6 million year earlier.

·

Note Brazil is seeking a 5-million-ton soybean meal export quota from China.

·

Australia’s canola production was estimated at 3.64 million tons by the Australian Oilseeds Federation. USDA is using 3.2 million tons for 2018-19 and 3.67 million for 2017-18.

Selected

EU Soybean Import figures

France

·

January through May 2018 = 315.3

·

January through May 2017 = 267.4 thousand tons

Spain

·

January through May 2018 = 1.524

·

January through May 2017 = 1.497 million tons

Portugal

·

January through May 2018 = 436.8

·

January through May 2017 = 382.8 thousand tons

·

January through April 2018 = 1.189

·

January through April 2017 = 1.358 million tons

Netherlands

·

January through March 2018 = 970.4

·

January through March 2017 = 831.8 thousand tons

SA

soybean export figures

Brazil

soybean exports to China

·

January through June 2018 = 35.944 million tons (46.3MMT to all countries)

·

January through June 2017 = 34.108 million tons (44.0MMT to all countries)

·

January through June 2016 = 29.458 million tons

Argentina

soybean exports to China

·

January through June 2018 = 1.115 million tons (1.25MMT to all countries)

·

January through June 2017 = 3.830 million tons (4.18MMT to all countries)

·

January through June 2016 = 4.375 million tons

-

Private

exporters reported to the U.S. Department of Agriculture the following activity:

–Export

sales of 270,000 metric tons of corn for delivery to unknown destinations during the 2018/2019 marketing year; and

-

South

Korea seeks 12,000 tons of non-GMO soybeans in Aug 7 for Nov/Dec arrival.

-

Iran

seeks 30,000 tons of soybean oil on August 1. -

Iran

seeks 30,000 tons of sunflower oil on September 24.

·

China sold 1.031 million tons of soybeans out of reserves so far, this season.

·

Chicago and KC wheat futures opened and traded much of the day surprisingly lower this morning on follow through profit taking from the recent rally. Paris wheat was lower. Yields from the US SW crop tour

were disappointing, and this created a two-sided trade in Minneapolis, which ended higher.

·

Funds today sold an estimated net 6,000 SRW wheat contracts.

·

Black Sea wheat prices increased to $240/ton C&F, up from $235/ton from the previous week. Some trades occurred around $220-$225/ton. US wheat into Asia was quoted at $265 for soft white and $282 for HRW,

and $288 for spring.

·

French crop conditions for soft wheat were unchanged from the previous week at 71 percent. 88 percent of the crop had been harvested as of July 22, up from 64 percent previous week.

·

Germany’s river levels are low, affecting grain transport.

·

December Paris wheat futures

settled at 199.75 euros, 1.00 euro lower. The September and December charts look short term technically bearish.

Export

Developments.

·

Jordan seeks 120,000 tons of barley on July 31.

-

Japan in a SBS import

tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on August 1 for arrival by January 31.

·

Iraq seeks 50,000 tons of US, Canadian, and/or Australian wheat on July 29, valid until August 2.

-

Results awaited:

Bahrain Flour Mills seeks 17,000 tons of semi-hard wheat and 8,000 tons of hard wheat, on July 24, valid until July 25, for shipment in late Aug/early Sept. Origins include Australia, Baltics, & Canada.

Rice/Other

-

Results awaited:

Thailand seeks to sell 120,000 tons of raw sugar on July 18.

·

Results awaited: Mauritius

seeks 6,000 tons of white rice for Sep 1-Nov 30 shipment.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.