From: Terry Reilly

Sent: Wednesday, August 01, 2018 4:34:55 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 08/01/18

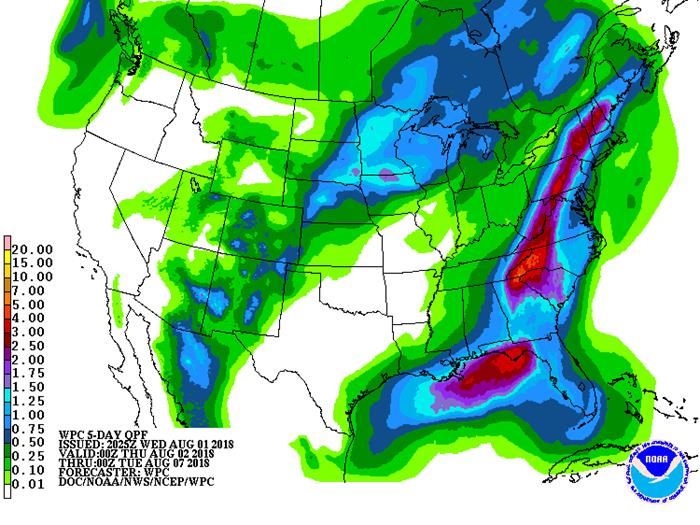

・ An independent weather forecaster (Skymet) lowered the India monsoon rainfall outlook for 2018. August rainfall was seen at 88 percent of average, and 93 percent in September.

・ Australia’s July was the driest since 2002.

・ One US main feature to keep an eye on is a ridge of high pressure building up over the Great Plains and a part of western Corn Belt during the coming weekend and next week, accelerating net drying and limiting rainfall across the Plains, Midwest and Delta from August 5th through August 14.

・ Rainfall between now and August 5 for the Midwest will be very important.

・ Before temperatures warm during the second week of August, the US weather outlook is all not that bad. There will be some ongoing dry pockets across the western US and temperatures warn across the WBC this week. Rest of the Midwestern growing areas will see cool temperatures, which should slow evaporation rates.

・ Europe’s weather will improve this week but much of the damage is done.

・ Southern Russia and parts of Ukraine improved over the past week. Some areas will return to net drying.

・ Australia’s canola crop will continue to see crop stress across New South Wales. There is an opportunity for rain across northern New South Wales this week but it will not be widespread enough to ease drought conditions.

・ China’s weather improved late last week and conditions will overall be favorable.

・ Canada’s southern Prairies will still see stress this week for the summer crops. Southeastern Canada is in good shape.

・ Net drying in the US PNW will add stress to the spring wheat crop.

SIGNIFICANT CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST CORN BELT EAST CORN BELT

and locally more;

far NW wettest

Thu-Sat 15-35% daily cvg of

up to 0.35” and locally

more each day

Fri-Sun 70% cvg of up to 0.75”

and local amts over 2.0”;

far south driest

Sun-Tue 80% cvg of up to 0.75”

and local amts to 1.50”;

driest west

Mon 30% cvg of up to 0.35”

and local amts to 0.65”;

south and east wettest

Tue 15% cvg of up to 0.60”

and locally more;

wettest SE

Aug 8-11 5-20% daily cvg of up

to 0.30” and locally

more each day;

driest SW

Aug 8-12 5-20% daily cvg of up

to 0.30” and locally

more each day

Aug 12-14 50% cvg of up to 0.60”

and locally more;

wettest north

Aug 13-15 50% cvg of up to 0.50”

and locally more

U.S. DELTA/SOUTHEAST SIGNIFICANT PRECIPITATION EVENTS

DELTA SOUTHEAST

Tdy-Fri Up to 15% daily cvg of 90% cvg of 0.35-1.50”

up to 0.25” and locally and local amts to 2.50”

more each day; some with lighter rain in a few

days may be dry locations and some

bands of 2.50-3.75”;

east Ms. driest

Sat-Mon 15-35% daily cvg of

up to 0.30” and locally

more each day

Sat-Tue 15-35% daily cvg of

up to 0.50” and locally

more each day

Tue-Aug 8 60% cvg of up to 0.75”

and local amts to 1.50”;

driest south

Aug 8-9 80% cvg of up to 0.75”

and local amts to 2.0”

Aug 9-10 15-35% daily cvg of

up to 0.35” and locally

more each day

Aug 10-13 10-25% daily cvg of

up to 0.30” and locally

more each day

Aug 11-13 5-20% daily cvg of up

to 0.30” and locally

more each day

Aug 14-15 10-25% daily cvg of 15-35% daily cvg of

up to 0.25” and locally up to 0.50” and locally

more each day more each day

Source: World Weather Inc. and FI

- Switzerland public holiday

- EIA U.S. weekly ethanol inventories, output, 10:30am

- USDA soybean crush for June, 3pm

- NOTE: Starting this day, the U.S. Agriculture Department ends its decades-long policy of giving crop data to news organizations under embargo in favor of posting reports directly on the web. This could benefit businesses with ability to quickly scan and trade on the figures

THURSDAY, AUG. 2:

- Costa Rica public holiday

- FAO food price index, 4am ET (9am London)

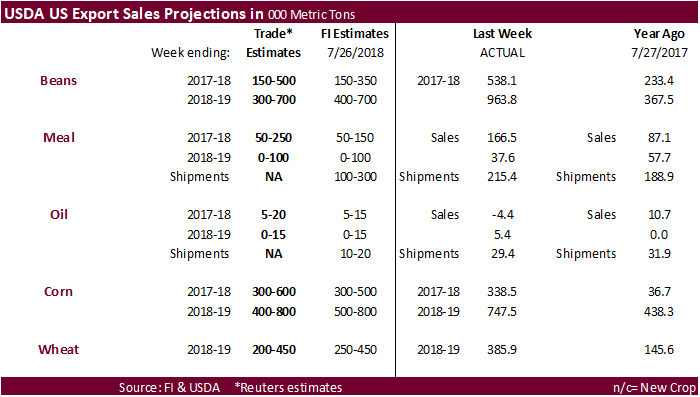

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

- Colorado State University provides its final seasonal forecast adjustment before the usual peak of the Atlantic hurricane season in late August

- EARNINGS: Pilgrim’s Pride Corp., Kellogg Co., Asahi Group Holdings

FRIDAY, AUG. 3:

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly updates on French crop conditions

- EARNINGS: Kraft Heinz Co.

Source: Bloomberg and FI

Brazil’s Trade Ministry selected commodity exports

Commodity July 2018 June 2018 July 2017

COFFEE(60 KG BAG) 1,242,462 2,157,363 1,599,948

CRUDE OIL (TNS) 8,098,498 2,858,774 5,382,273

ETHANOL (LTR) 180,685,275 131,873,480 156,097,318

SOYBEANS (TNS) 10,195,879 10,420,130 6,954,980

IRON ORE 35,999,441 35,314,719 31,308,784

FROZEN ORANGE JUICE (TNS) 22,431 48,022 32,102

NON-FROZEN ORANGE JUICE (TNS) 179,491 156,958 132,041

SUGAR RAW (TNS) 1,709,222 1,705,553 2,184,558

Source:

・ FOMC Benchmark Interest Rate Unchanged, Target Range Stands At 1.75%-2.00%

・ China said they will retaliate, again, if the US increased tariffs on additional products from China. The White House said they are going to forward in adding tariffs. This got the trade, once again, very nervous. Yesterday people thought there may be progress and today the trade dispute escalated. The US is considering a 25 percent tariff on $200 billion in Chinese imports, higher than the 10 percent previously announced.

・ ADP Employment Change (Jul): 219K (est 186K, prev 177K)

・ ADP Employment Change (Jul): 219K (est 186K, prevR 181K)

・ Jobs report is due out Friday.

Corn.

- Corn ended lower following weakness in soybeans amid ongoing US/China trade tensions. September was unable to close above the 50-day MA. Technically the charts appear slightly bearish.

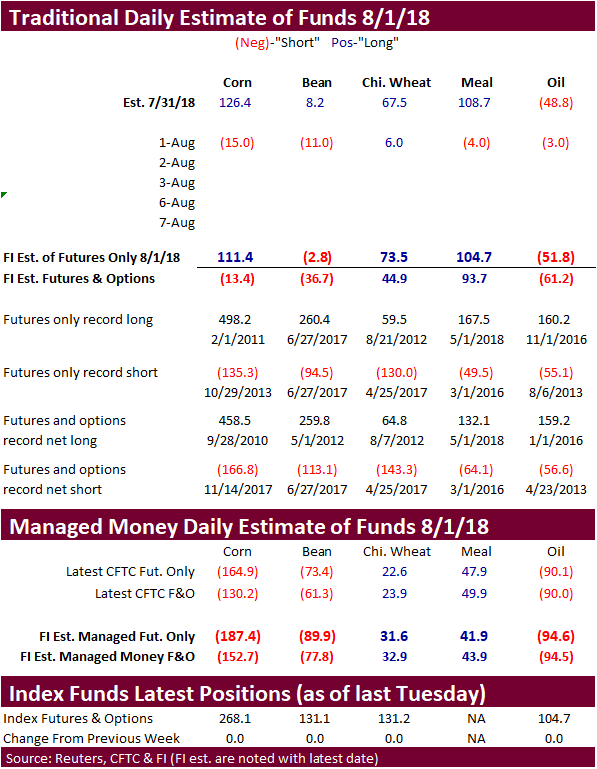

- Funds sold an estimated net 15,000 corn contracts.

- Ukraine seeks to secure 500,000 tons of corn from local producers.

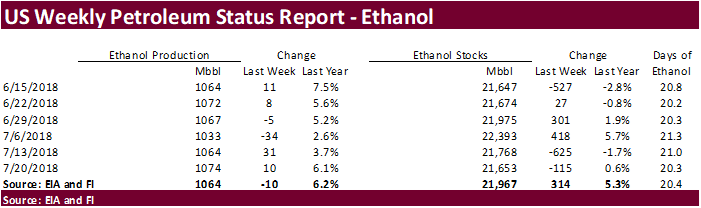

- EIA reported a slowdown in US ethanol production and increase in stocks.

- EIA reported the total listed capacity of (operable) ethanol plants in the United States increased by 5 percent-more than 700 million gallons (about 2.6 billion liters) per year-between January 2017 and January 2018, the U.S. Energy Information Administration reported on Wednesday.

- The USDA Broiler report showed broiler-type eggs set up 1 percent and chicks placed up 2 percent. Cumulative placements from the week ending January 6, 2018 through July 28, 2018 for the United States were 5.52 billion. Cumulative placements were up 2 percent from the same period a year earlier.

・ South Korea’s MFG bought 69,000 tons of corn, optional origin, at $212.90/ton, c&f, for arrival around January 3, 2019.

・ China sold about 57.7 million tons of corn out of reserves this season.

・ China plans to offer another 8 million tons of corn from state reserves in early August.

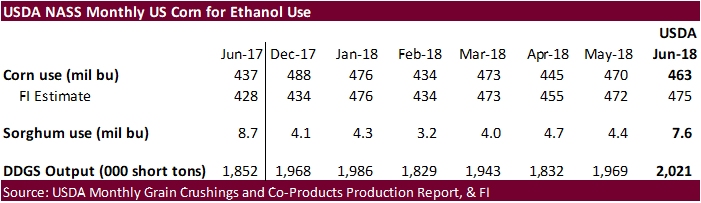

The USDA US monthly grain grind report showed corn used for ethanol in June totaled 463 million bushels, 13 milling below our working estimate, lower 470 million in May and compares to 437 million in June 2017. Sorghum used for ethanol was 7.6 million, above 4.4 million in May and below 8.7 million in June 2017. DDGS production in June at 2.021 million short tons were highest since August 2017.

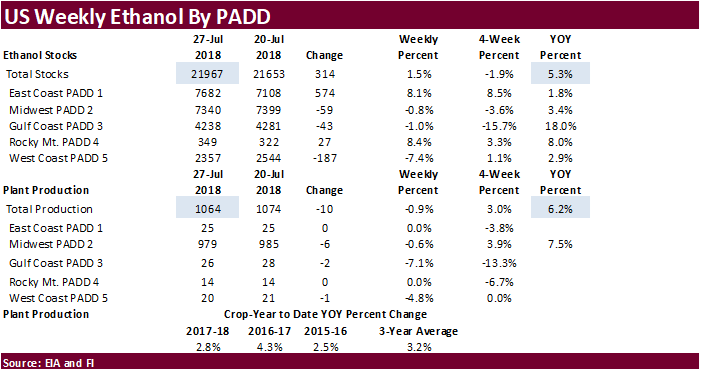

Weekly US ethanol update

- EIA reported weekly US ethanol production decreased 10,000 barrels per day and stocks up 314,000 barrels. A Bloomberg survey called for weekly US ethanol production to decrease 8,000 barrels per day and stocks to increase 132,000 barrels, so estimates were somewhat inline.

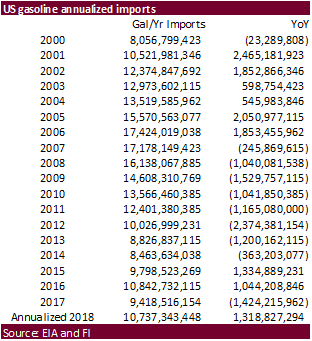

- US gasoline stocks decreased for the fifth week in a row.

- US ethanol blend rate into finished motor gasoline fell to 90.8% from 91.4% last week.

- The US ethanol-RBOB spread is narrowing.

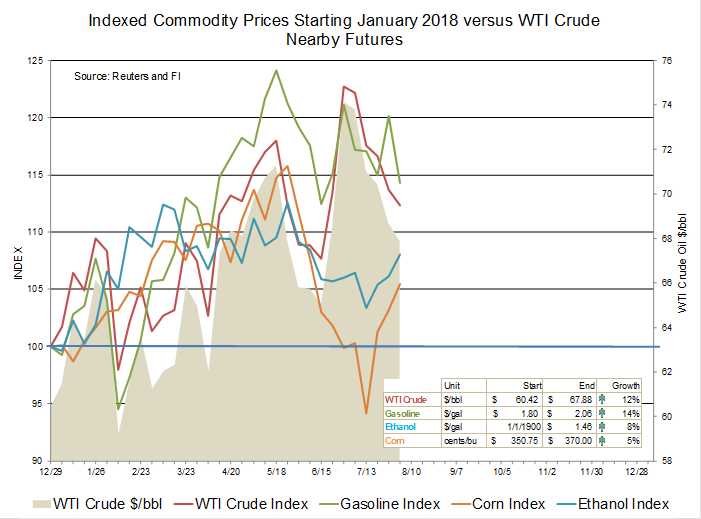

Ethanol prices turning higher while WTI Crude & Gasoline prices are slipping

Soybean complex.

・ The soybeans complex ended sharply lower in a risk off day after China threatened to retaliate if the US adds on additional import tariffs.

・ Funds were net sellers of 11,000 soybeans, sold 4,000 soymeal, and sold 3,000 soybean oil contracts.

・ China said they will retaliate, again, if the US increased tariffs on additional products from China. The White House said they are going to forward in adding tariffs. This got the trade, once again, very nervous. Yesterday people thought there may be progress and today the trade dispute escalated. The US is considering a 25 percent tariff on $200 billion in Chinese imports, higher than the 10 percent previously announced.

・ NTL FC Stone estimated the 2018 US soybean production at 4.574 billion bushels and yield at 51.5 bushels per acre. USDA is at 4.310 billion bushels and 48.5/bu for the yield.

・ Brazil exported 10.2 million tons of soybeans in July, 200,000 more than our working estimate and compares to 10.42 million in June and 6.95 million tons a year ago. 1.73 million tons were exported in July compared to 1.56 million a month earlier and 1.16 million in June 2017. 210,904 tons of soybean oil were exported versus 126,068 tons in June and 137,307 year ago.

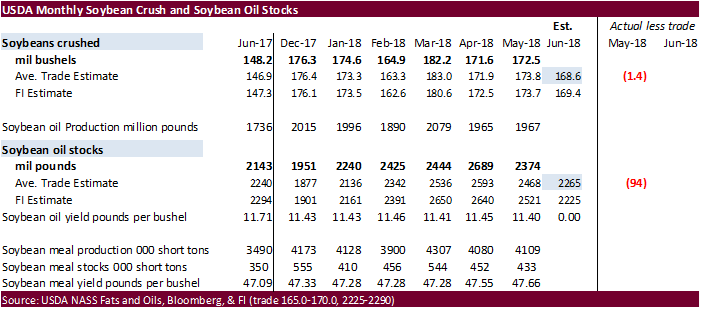

・ USDA reported the June US crush at 169.5 million bushels, 1 million above a Bloomberg average trade guess, below 172.5 in May and above 148.2 million in June 2017. US soybean oil stocks at the end of June were 2.305 billion, 40 million above the average trade guess and down from 2.468 billion last month but well up from 2.143 billion at the end of June 2017.

・ China sold 1.054 million tons of soybeans out of reserves so far, this season.

・ China failed to sell any soybean oil out of auction. 56,611 tons were offered.

・ China sold 4,250 tons of rapeseed oil out of auction from state reserves at an average price of 6,000 yuan per ton, 5.5% of the 76,932 tons offered.

- Results awaited: Iran seeks 30,000 tons of soybean oil on August 1.

- South Korea seeks 12,000 tons of non-GMO soybeans in Aug 7 for Nov/Dec arrival.

- USDA seeks 2,160 tons of refined vegetable oil under the PL480 program on August 7 for shipment in September for Zimbabwe.

- Iran seeks 30,000 tons of sunflower oil on September 24.

・ US wheat ended higher on ongoing global crop concerns.

・ Funds today bought an estimated net 6,000 SRW wheat contracts.

・ After the close Egypt announced they were in for wheat.

・ December Paris wheat futures settled at 208.25 euros, up 4.00 euros higher. The contract traded to a 3-1/2 year high. On a rolling basis, Paris wheat is the highest since July 2015.

・ German farm cooperative DBV estimated the winter-wheat crop down 25% 18MMT tons from the previous season.

・ Australia’s July was the driest since 2002.

・ The USDA Attaché estimated 2018-19 Argentina’s wheat production at 19.5 million tons, same as USDA official.

・ The USDA Attaché estimated Kazakhstan’s wheat production at 14 million tons, 0.8MMT below 2017. USDA’s official is at 14 million tons.

・ The USDA Flour Milling report for Q2 showed flour milling at 227 million bushels, down slightly from the first quarter 2018 grind of 227 million bushels but up 1 percent from the second quarter 2017 grind of 224 million bushels. Second quarter 2018 total flour production was 105 million hundredweight, down slightly from the first quarter 2018 but up 1 percent from the second quarter 2017.

Export Developments.

・ Egypt seeks wheat for September 11-20 shipment.

・ Results awaited: Algeria seeks at least 50,000 tons of milling wheat on August 1 for October shipment.

- Japan in a SBS import tender bought 18,465 tons of feed wheat and 46,060 tons of barley for arrival by January 31.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on August 8 for arrival by January 31.

・ China sold 3,739 tons of 2013 imported wheat at auction from state reserves at 2370 yuan/ton ($348.60/ton), 0.22 percent of wheat was offered.

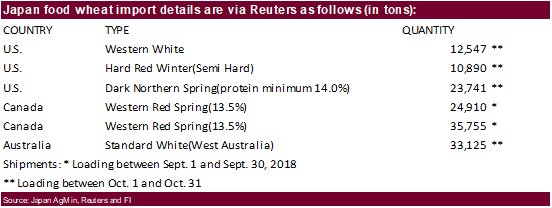

・ Japan seeks 140,968 tons of food wheat on Thursday.

・ Jordan seeks 120,000 tons of hard milling wheat on August 2.

- Results awaited: Bahrain Flour Mills seeks 17,000 tons of semi-hard wheat and 8,000 tons of hard wheat, on July 24, valid until July 25, for shipment in late Aug/early Sept. Origins include Australia, Baltics, & Canada.

Rice/Other

・ Vietnam sees July rice exports at 382,000 tons.

・ Iraq seeks 30,000 tons of rice on August 12, open until Aug 16.

Terry Reilly

Senior Commodity Analyst C Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.