From: Terry Reilly

Sent: Thursday, August 02, 2018 5:16:46 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 08/02/18

PDF attached

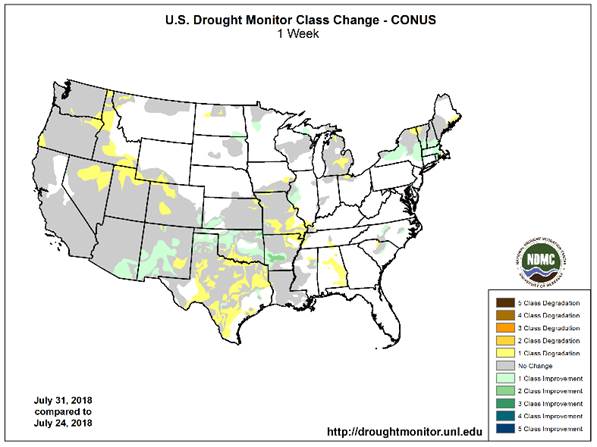

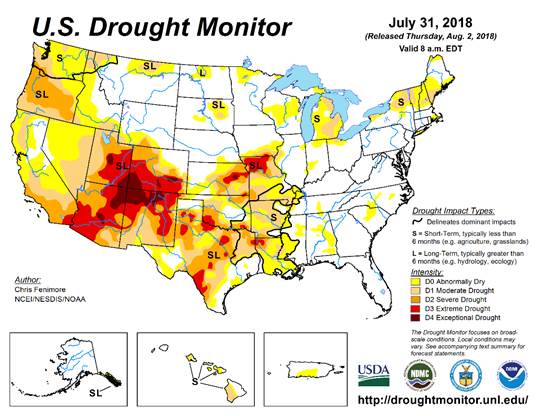

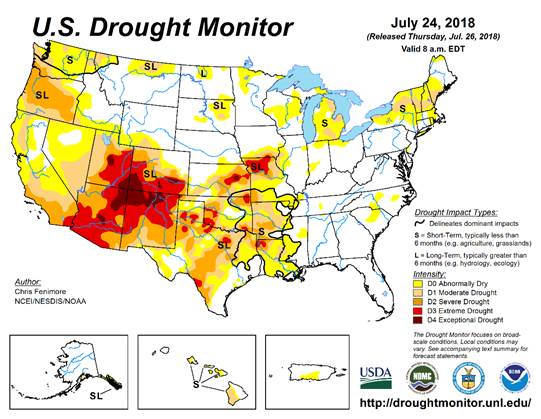

・ The Drought Monitor showed mainland drought conditions at 34.1%, compared to 32.2% last week.

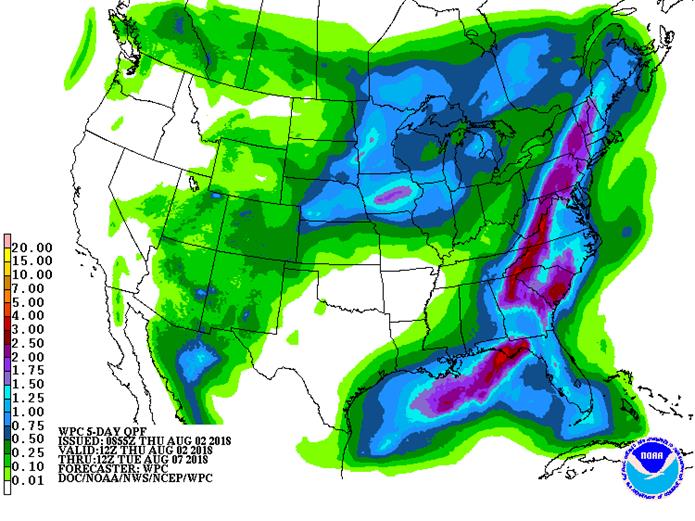

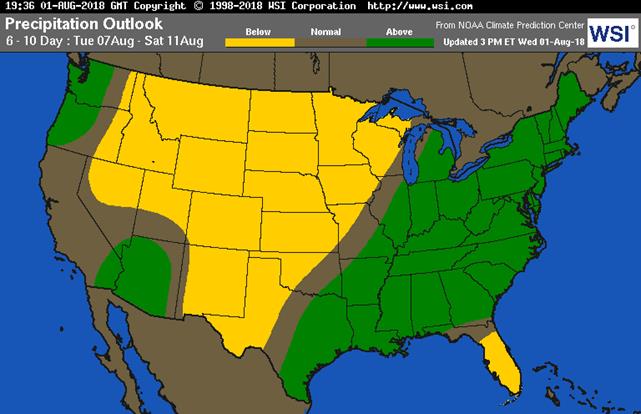

・ The ridge of high pressure building up over the Great Plains and a part of western Corn Belt during the coming weekend and next week is still slated to happen, accelerating net drying and limiting rainfall across the Plains, Midwest and Delta from August 5th through August 14.

・ Temperatures across the northern Midwest will be warm to hot through early next week.

・ Rainfall between now and August 5 for the Midwest will be very important.

・ Some of the Midwest northern growing areas will pick up on rain. The northwestern growing areas will see rain this weekend. The Delta will see rain in the southeastern areas on Saturday. All other areas of the Delta will see net drying through the weekend.

・ Canada’s southern Prairies will still see stress this week for the summer crops. Southeastern Canada is in good shape.

SIGNIFICANT CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST CORN BELT EAST CORN BELT

up to 0.35” and locally

more each day

Fri-Sat 45% cvg of up to 0.75”

and local amts over 2.0”;

S.D. to Mn. wettest;

driest south

Sun-Mon 65% cvg of up to 0.75”

and local amts over 2.0”;

Ia. wettest; far south and

far NW driest

Mon-Tue 80% cvg of up to 0.75”

and local amts to 2.0”;

west-central and SW

Illinois driest

Tue-Wed 60% cvg of up to 0.50”

and local amts to 1.10”;

driest south

Wed-Aug 10 70% cvg of up to 0.55”

and local amts to 1.15”;

wettest south

Aug 9-11 Up to 20% daily cvg of

up to 0.25” and locally

more each day; some

days may be dry

Aug 11-12 5-20% daily cvg of up

to 0.30” and locally

more each day

Aug 12-13 40% cvg of up to 0.50”

and locally more;

wettest north

Aug 13-14 45% cvg of up to 0.40”

and locally more;

north and east wettest

Aug 14-16 5-20% daily cvg of up

to 0.30” and locally

more each day

Aug 15-16 5-20% daily cvg of up

to 0.30” and locally

more each day

U.S. DELTA/SOUTHEAST SIGNIFICANT PRECIPITATION EVENTS

DELTA SOUTHEAST

Tdy-Fri Up to 10% daily cvg of 85% cvg of 0.40-1.50”

up to 0.20” and locally and local amts to 2.50”

more each day; some in most areas from Fl.

days may be dry to Va. and a few bands

of 2.50-3.75” with up

to 0.40” and locally

more elsewhere;

east Ms. driest

Sat-Mon 10-25% daily cvg of

up to 0.30” and locally

more each day

Sat-Tue 15-35% daily cvg of

up to 0.50” and locally

more each day

Tue-Wed 65% cvg of up to 0.75”

and local amts to 1.50”;

driest south

Wed-Aug 10 80% cvg of up to 0.75”

and local amts to 2.0”;

driest NE

Aug 9-10 75% cvg of up to 0.75”

and local amts to 1.50”

Aug 11-16 10-25% daily cvg of 10-25% daily cvg of

up to 0.30” and locally up to 0.30” and locally

more each day more each day

Source: World Weather Inc. and FI

Bloomberg weekly agenda

THURSDAY, AUG. 2:

- Costa Rica public holiday

- FAO food price index, 4am ET (9am London)

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

- Colorado State University provides its final seasonal forecast adjustment before the usual peak of the Atlantic hurricane season in late August

- EARNINGS: Pilgrim’s Pride Corp., Kellogg Co., Asahi Group Holdings

FRIDAY, AUG. 3:

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly updates on French crop conditions

- EARNINGS: Kraft Heinz Co.

Source: Bloomberg and FI

Weekly Bloomberg Bull/Bear Survey

・ Wheat survey results: Bullish: 9 Bearish: 2 Neutral: 3

・ Corn: Bullish: 8 Bearish: 2 Neutral: 5

・ Soybeans: Bullish: 6 Bearish: 5 Neutral: 4

・ Raw sugar: Bullish: 5 Bearish: 3 Neutral: 1

・ White sugar: Bullish: 5 Bearish: 1 Neutral: 3 White-sugar

・ China PMI dropped to 50.8 from 51.0 in June.

・ China Commerce Ministry said China has fully prepared for US threats on escalating trade war, and a pre-requisite for dialogue is equal treatment, keeping promises. China is fully confident to achieve high-quality economic growth target and that the U.S. tactics on China will have no effect. China said yesterday they are ready to retaliate after latest U.S. tariff threat.

・ The US is considering a 25 percent tariff on $200 billion in Chinese imports, higher than the 10 percent previously announced.

・ US Initial Jobless Claims (Jul 27): 218K (est 220K, prev 217K)

-US Continuing Jobless Claims (Jul 20): 1.724M (est 1.750M, prevR 1.747M)

・ Jobs report is due out Friday.

Corn.

- Corn ended higher on US crop concerns and higher wheat.

- Funds bought an estimated net 11,000 corn contracts, even though prices appreciated only 1.75 cents in the nearby contracts.

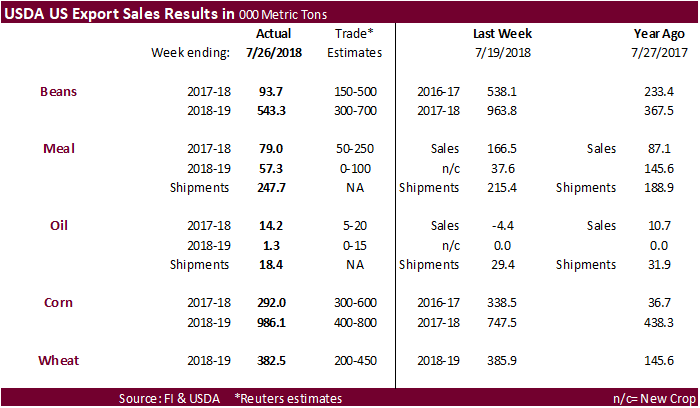

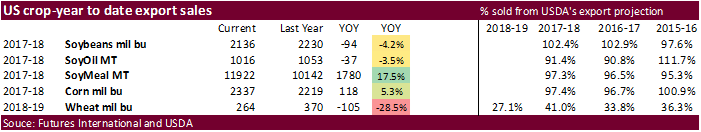

- USDA export sales on a combined crop-year basis were ok.

・ Yesterday INTL FC Stone estimated the 2018 US corn production at 14.562 billion bushels and yield at 178.1 bushels per acre. USDA is at 14.230 billion bushels and 174.0/bu for the yield.

・ Note Informa is due out on Friday. In July we understand Informa used a 176.0 yield and 14.392 billion bushel crop.

・ China sold 1.102 million tons of corn out of reserves at an average price of 1539 yuan per ton ($225.78/ton), 28 percent of total offered.

・ China plans to offer another 4 million tons of corn from state reserves on Friday.

・ China sold about 58.8 million tons of corn out of reserves this season.

USDA Export Sales Highlights

- Corn: Net sales of 292,000 MT for 2017/2018 were down 14 percent from the previous week and 36 percent from the prior 4-week average. Increases were reported for Japan (126,400 MT, including 96,300 MT switched from unknown destinations and decreases of 31,300 MT), Taiwan (78,600 MT, including 66,000 MT switched from unknown destinations and decreases of 900 MT), South Korea (73,800 MT, including decreases of 3,100 MT), Mexico (53,700 MT, including 26,000 MT switched from unknown destinations and decreases of 34,300 MT), and Colombia (52,300 MT, including 50,000 MT switched from unknown destinations and decreases of 2,100 MT). Reductions were primarily for unknown destinations (144,300 MT). For 2018/2019, net sales of 986,100 MT were reported for unknown destinations (372,500 MT), Mexico (286,100 MT), Japan (106,000 MT), Saudi Arabia (70,000 MT), and South Korea (69,000 MT). Exports of 1,624,600 MT were up 27 percent from the previous week and 18 percent from the prior 4-week average. The destinations were primarily to Japan (405,600 MT), Mexico (349,000 MT), South Korea (281,800 MT), Taiwan (160,800 MT), and Colombia (111,100 MT). Optional Origin Sales: For 2017/2018, options were exercised to export 68,000 MT to South Korea from the United States. The current optional origin outstanding balance of 70,000 MT is for South Korea. For 2018/2019, the current outstanding balance of 463,000 MT is for South Korea (343,000 MT), Saudi Arabia (70,000 MT), and unknown destinations (50,000 MT).

- Barley: No net sales were reported for the week. Exports of 1,400 MT were to Japan.

- Sorghum: Net sales of 100 MT for 2017/2018 resulted as increases for Eritrea (30,000 MT, switched from unknown destinations) and Japan (11,000 MT, including 10,900 MT switched from unknown destinations), were partially offset by reductions for unknown destinations (40,900 MT). Exports of 41,400 MT were to Eritrea (30,000 MT), Japan (11,000 MT), and Mexico (400 MT).

- Beef: Net sales of 16,200 MT for 2018 were up noticeably from the previous week and up 36 percent from the prior 4-week average. Increases were primarily for Japan (6,500 MT, including decreases of 700 MT), Hong Kong (2,700 MT, including decreases of 100 MT), South Korea (2,000 MT, including decreases of 500 MT), Mexico (1,700 MT, including decreases of 100 MT), and Canada (1,200 MT, including decreases of 100 MT). For 2019, net sales of 1,400 MT were reported for Mexico. Exports of 18,800 MT were up 5 percent from the previous and from the prior 4-week average. The primary destinations were Japan (7,200 MT), South Korea (4,900 MT), Mexico (1,800 MT), Taiwan (1,400 MT), and Hong Kong (1,200 MT).

- Pork: Net sales of 35,700 MT for 2018 were up 69 percent from the previous week and up noticeably from the prior 4-week average. Increases were reported for Mexico (16,300 MT), Hong Kong (6,600 MT), Australia (3,500 MT), Japan (3,000 MT), and Canada (2,100 MT). Reductions were reported for Chile (100 MT). For 2019, net sales of 500 MT were reported for South Korea. Exports of 21,200 MT were up 17 percent from the previous week and 12 percent from the prior 4-week average. The primary destinations were Mexico (8,200 MT), Japan (4,200 MT), South Korea (1,900 MT), Canada (1,900 MT), and Chile (1,000 MT).

Soybean complex.

・ Soybeans posted a second day of risk off by ending 3.0-4.50 cents lower. High US yield estimates for the US were weighing on prices. Today’s weather forecast was also wetter for IA than that of Wednesday, during the Sunday through Monday period. The outlook next week remains warm and dry.

・ Soybeans meal and oil ended $2.70-$3.70 and 31-34 points lower.

・ Funds were net sellers of 5,000 soybeans, sold 4,000 soymeal, and sold 3,000 soybean oil contracts.

・ Argentina soybean crushers are looking to gain access to China’s soybean meal import market. Argentina’s oilseed group CIARA plans to present China a list of companies wishing to export soybean meal. We think it would be monumental if China decides to open their doors wide open to soybean meal imports, as local crushers have frown down on the idea for many years.

・ USDA export sales for old crop fell short of expectations, but a pickup in sales to the EU could justify an offset by large reductions by unknown and China. The unknown sales cancellations could have been rolled into new-crop (+543,300 tons). Product sales showed meal backing off from the previous week and soybean oil improving.

・ Yesterday INTL FC Stone estimated the 2018 US soybean production at 4.574 billion bushels and yield at 51.5 bushels per acre. USDA is at 4.310 billion bushels and 48.5/bu for the yield.

・ We think the soybean yield is too high issued by FC Stone. Several field reports across IL and IA would beg to differ on the state yields they released of 60 and 59/bu, respectively. If they are correct on their national yield, prices could retest contract lows.

・ Note Informa is due out on Friday. In July we understand Informa used a 49.1 yield and 4.425 billion bushel crop.

・ JCI reported China’s soybean crush margins held near the lowest in about a month. (Bloomberg)

- South Korea seeks 12,000 tons of non-GMO soybeans in Aug 7 for Nov/Dec arrival.

- USDA seeks 2,160 tons of refined vegetable oil under the PL480 program on August 7 for shipment in September for Zimbabwe.

- Results awaited: Iran seeks 30,000 tons of soybean oil on August 1.

- Iran seeks 30,000 tons of sunflower oil on September 24.

・ China sold 1.054 million tons of soybeans out of reserves so far, this season.

USDA Export Sales Highlights

- Soybeans: Net sales of 93,700 MT for 2017/2018 were down 76 percent from the previous week and 71 percent from the prior 4-week average. Increases were reported for Germany (143,300 MT), Pakistan (68,500 MT, including 65,000 MT switched from unknown destinations), the Netherlands (66,600 MT, including 66,000 MT switched from unknown destinations), South Korea (60,000 MT, including 56,000 MT switched from unknown destinations), and Tunisia (33,000 MT, including 30,000 MT switched from unknown destinations). Reductions were for unknown destinations (316,200 MT) and China (120,000 MT). For 2018/2019, net sales of 543,300 MT were reported for unknown destinations (411,600 MT), Switzerland (60,000 MT), and Japan (30,000 MT). Exports of 856,400 MT were up 26 percent from the previous week and 18 percent from the prior 4-week average. The destinations included Germany (143,300 MT), Taiwan (86,400 MT), Japan (72,100 MT), Mexico (71,600 MT), and Pakistan (68,500 MT). Optional Origin Sales: For 2017/2018, the current optional origin outstanding balance of 66,000 MT is for unknown destinations. For 2018/2019, the current outstanding balance of 63,000 MT is for unknown destinations. Export for Own Account: The current exports for own account outstanding balance is 130,900 MT, all Canada. Export Adjustment: Accumulated exports of soybeans to the Netherlands were adjusted down 143,308 MT for week ending July 19th. The correct destination for this shipment is Germany and is included in this week’s report.

- Soybean Cake and Meal: Net sales of 79,000 MT for 2017/2018 were down 53 percent from the previous week and 32 percent from the prior 4-week average. Increases were reported for Mexico (25,500 MT), Morocco (21,200 MT), the Dominican Republic (8,100 MT), Nicaragua (6,000 MT, including 3,500 MT switched from Honduras, 1,500 MT switched from Costa Rica, and 300 MT switched from El Salvador), and Canada (5,500 MT, including decreases of 3,400 MT). Reductions were reported for Guatemala (6,500 MT), El Salvador (2,100 MT), and Costa Rica (1,800 MT). For 2018/2019, net sales of 57,300 MT were primarily for Mexico (50,900 MT), Honduras (5,000 MT), and Guatemala (1,000 MT). Exports of 247,700 MT were up 15 percent from the previous week and 3 percent from the prior 4-week average. The primary destinations were the Philippines (90,700 MT), Colombia (24,400 MT), Mexico (24,300 MT), the Dominican Republic (19,500 MT), and Panama (17,600 MT).

- Soybean Oil: Net sales of 14,200 MT for 2017/2018 were up noticeably from the previous week, but down 20 percent from the prior 4-week average. Increases were primarily for South Korea (12,300 MT, switched from unknown destinations), Peru (9,200 MT), and Mexico (3,700 MT). For 2018/2019, net sales of 1,300 MT were reported for Mexico. Exports of 18,400 MT were down 37 percent from the previous week and 18 percent from the prior 4-week average. The primary destinations were South Korea (14,000 MT), Colombia (2,200 MT), and Mexico (1,600 MT).

・ US wheat futures rallied early, backed off, then rallied again on a bullish headline before selling off when the headline was found to be false. For intraday highs, Chicago wheat on a nearby contract rolling basis surged to its highest level since June 2015. KC hit its highest level since January 2015, while MN remained at a about a 10-month high. Prices settled well off their respected highs with September Chicago up 2.25 cents, September KC up 5.50 cents, and September MN up 2.50 cents. It was extraordinary day of trading, in our opinion. But unwanted.

・ Funds today bought an estimated net 8,000 SRW wheat contracts.

・ During the trade a Bloomberg headline read that the Ukraine AgMin will limit wheat exports in “mid-term”, via a Facebook statement (could not be verified), but shortly later the official AgMin said there were no talks about limiting wheat exports.

・ In our opinion, Ukraine will not need to limit exports, even with using our current 25.1-million-ton production (updated revised this afternoon after getting feedback), down from 27.0 million tons in 2017. Ukraine is expected to harvest a record or near record corn crop, which should alleviate the need for wheat used for feed during the 2018-19 marketing year. In addition, the carryin stocks are projected by USDA at 1.4 million tons, and using estimates near USDA’s 3.2 and 6.2MMT feed and FSI consumption, exports could dip to 15.9 million tons, down from 17.5 million tons in 2017-18 but large enough to satisfy importers needs for at least three-fourths of the crop-year. At 15.9 million tons, exports could average 1.33 million tons a month. In 2017-18, they averaged about 1.46 million tons. In 2016-17 wheat exports averaged 1.5 million per month. See our balance sheet attached.

・ Another headline said Russia has no plans to limit wheat exports this crop-year.

・ Russia’s Economic Minister expects grain harvest to total 113-115 million tons in 2018, above 100 million tons by the AgMin. The Economic Minister noted that would be against the 135MMT record last year.

・ EU wheat was screaming higher early this morning and ended 5.50 euros higher basis December to 213.75 euros.

・ USDA all-wheat US export sales were within expectations and included the usual suspects.

・ Egypt and Algeria bought wheat.

・ Agritel estimated the EU will thresh 136.6 million tons of all-wheat, down 15 million tons compared with 2017. Northern Europe took a hit from drought. If realized the production would be second-lowest crop this decade after 2012.

・ The EU awarded 72,048 tons of wheat imports under quotas. No barley was granted.

・ The FAO reported a decrease in the food price index for the month of July to 168.8 from 173.7, or 3.7 percent, largest monthly percentage decrease since December. Dairy was down 6.6% from last month.

Black Sea wheat Platts C August

Source: Reuters and FI

Export Developments.

・ Egypt bought 240,000 tons of Russian and Roman wheat for September 11-20 shipment. Lowest paid was $251.96/ton c&f.

・ Algeria bought at least 360,000 tons of milling wheat at around $263/ton c&f & $272/ton c&f, for October shipment.

・ Jordan bought 60,000 tons of hard milling wheat at $237.15/ton c&f for shipment in the second half of September. They were in for 120k.

・ Iraq’s bought about 50,000 tons of Australian wheat at $335 a ton CIF free out. Interesting since US wheat was previously the lowest offered.

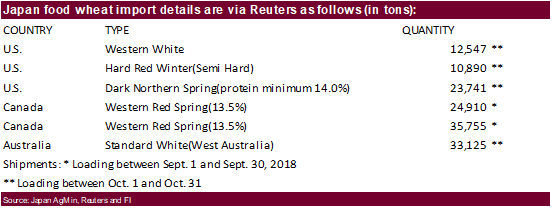

・ Japan bought 140,968 tons of food wheat.

・ China sold 1,800 tons of 2013 imported wheat at auction from state reserves at 2370 yuan/ton ($347.21/ton), 0.10 percent of wheat was offered.

・ Jordan issued an import tender for 120,000 tons of feed barley on August 8.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on August 8 for arrival by January 31.

Rice/Other

・ Iraq seeks 30,000 tons of rice on August 12, open until Aug 16.

USDA Export Sales Highlights

- Wheat: Net sales of 382,500 MT for 2018/2019 were down 1 percent from the previous week, but up 21 percent from the prior 4-week average. Increases were reported for Taiwan (104,900 MT), the Philippines (104,500 MT, including 31,500 MT switched from unknown destinations and decreases of 16,700 MT), Indonesia (70,000 MT), Sri Lanka (60,000 MT), and Mexico (30,700 MT, including decreases of 2,800 MT). Reductions were reported for unknown destinations (32,900 MT) and Algeria (22,800 MT). Exports of 386,600 MT were down 6 percent from the previous week, but up 2 percent from the prior 4-week average. The destinations were primarily to the Philippines (121,300 MT), Thailand (56,400 MT), Nigeria (45,000 MT), Taiwan (44,900 MT), and Mexico (32,900 MT).

- Rice: Net sales of 7,300 MT for 2017/2018 were up 18 percent from the previous week, but down 69 percent from the prior 4-week average. Increases were reported for Canada (3,000 MT), Mexico (1,900 MT), Colombia (700 MT), Turkey (500 MT), and Honduras (300 MT, including decreases of 200 MT). For 2018/2019, net sales of 12,200 MT were reported for Honduras (10,200 MT), El Salvador (1,700 MT), and Liberia (300 MT). Exports of 32,000 MT were up 38 percent from the previous week, but down 4 percent from the prior 4-week average. The destinations were primarily to Mexico (22,400 MT), Honduras (2,800 MT), Canada (2,500 MT), Japan (1,700 MT), and Jordan (900 MT). Export for Own Account: The current exports for own account outstanding balance is 100 MT, all Canada.

- Cotton: Net sales of 19,600 running bales for 2017/2018 were up noticeably from the previous week, but down 49 percent from the prior 4-week average. Increases reported for China (6,500 RB), South Korea (5,000 RB), Taiwan (3,400 RB), Pakistan (2,300 RB, including decreases of 100 RB), and India (1,300 RB, including decreases of 600 RB). For 2018/2019, net sales of 261,200 RB reported for Vietnam (128,500 RB), Pakistan (25,300 RB), South Korea (23,800 RB), Colombia (22,700 RB), and Mexico (16,700 RB), were partially offset by reductions for India (1,600 RB) and China (1,300 RB). Exports of 259,100 RB were down 12 percent from the previous week and 13 percent from the prior 4-week average. The primary destinations were Vietnam (59,500 RB), Indonesia (42,200 RB), Turkey (38,500 RB), China (28,100 RB), and Thailand (15,400 RB). Net sales of Pima totaling 2,600 RB for 2017/2018 were down 56 percent from the previous week, but up 9 percent the prior 4-week average. Increases were reported for Turkey (1,300 RB) and Pakistan (1,000 RB). Reductions were reported for South Korea (300 RB) and Honduras (200 RB). For 2018/2019, net sales of 900 RB were reported for Pakistan (400 RB), India (200 RB), and Italy (200 RB). Exports of 6,200 RB were down 66 percent from the previous week and 59 percent from the prior 4-week average. The primary destinations were India (2,100 RB), China (2,000 RB), Vietnam (1,300 RB). Optional Origin Sales: For 2017/2018, options were exercised to export 100 RB to Indonesia from the United States. The current optional origin outstanding balance is 4,400 RB, all Indonesia. Exports for Own Account: The current exports for own account total of 13,000 RB is for Vietnam (6,300 RB), China (6,200 RB), and Bangladesh (500 RB).

Terry Reilly

Senior Commodity Analyst C Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.