From: Terry Reilly

Sent: Saturday, August 04, 2018 4:58:56 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 08/03/18

PDF attached

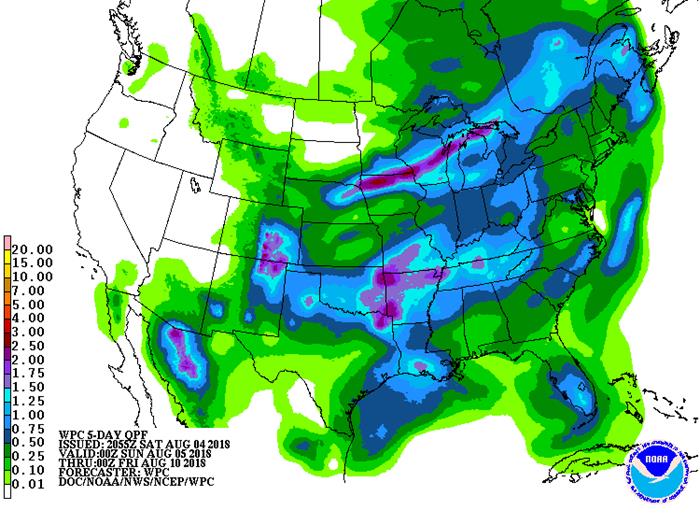

· The near-term weather model appears to be drier for the central WCB through early next week.

· Crop stress will increase this weekend with rising temperatures.

· The ridge of high pressure building up over the Great Plains and a part of western Corn Belt during the coming weekend and next week is still slated to happen, accelerating net drying and limiting rainfall across the Plains, Midwest and Delta from August 5th through August 14.

· Rainfall between now and August 5 for the Midwest will be very important.

· Some of the Midwest northern growing areas will pick up on rain. The northwestern growing areas will see rain this weekend. The Delta will see rain in the southeastern areas on Saturday. All other areas of the Delta will see net drying through the weekend.

· Canada’s southern Prairies will still see stress this week for the summer crops. Southeastern Canada is in good shape.

SIGNIFICANT CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST CORN BELT EAST CORN BELT

Tdy-Sat 45% cvg of up to 0.65”

and local amts to 1.20”

most often with some

1.20-3.0” amts in Mn.

and a few nearby areas;

driest south

Tdy-Sun 15-35% daily cvg of

up to 0.30” and locally

more each day

Sun-Mon 55% cvg of up to 0.75”

and local amts over 2.0”;

east-central and NE Neb.

to south Wisc. wettest;

driest NW and south

Mon-Tue 80% cvg of up to 0.75”

and local amts to 2.0”;

west-central and SW

Illinois driest

Tue-Aug 10 10-25% daily cvg of

up to 0.30” and locally

more each day

Wed-Aug 10 10-25% daily cvg of

up to 0.30” and locally

more each day

Aug 11-13 Up to 20% daily cvg of

up to 0.25” and locally

more each day; some

days may be dry

Aug 11-14 5-20% daily cvg of up

to 0.30” and locally

more each day

Aug 14-16 40% cvg of up to 0.50”

and locally more;

wettest north

Aug 15-17 55% cvg of up to 0.40”

and locally more

U.S. DELTA/SOUTHEAST SIGNIFICANT PRECIPITATION EVENTS

DELTA SOUTHEAST

Sat-Mon 5-20% daily cvg of

up to 0.30” and locally

more each day

Sat-Tue 15-35% daily cvg of

up to 0.50” and locally

more each day

Tue-Wed 80% cvg of up to 0.75”

and local amts to 1.70”;

driest south

Wed-Aug 10 80% cvg of up to 0.75”

and local amts to 2.0”;

wettest west

Thu-Aug 10 75% cvg of up to 0.75”

and local amts to 1.75”;

driest north

Aug 11-17 10-25% daily cvg of 10-25% daily cvg of

up to 0.30” and locally up to 0.30” and locally

more each day more each day

Source: World Weather Inc. and FI

Weekly Bloomberg Bull/Bear Survey

· Wheat survey results: Bullish: 9 Bearish: 2 Neutral: 3

· Corn: Bullish: 8 Bearish: 2 Neutral: 5

· Soybeans: Bullish: 6 Bearish: 5 Neutral: 4

· Raw sugar: Bullish: 5 Bearish: 3 Neutral: 1

· White sugar: Bullish: 5 Bearish: 1 Neutral: 3 White-sugar

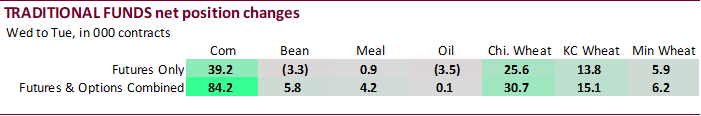

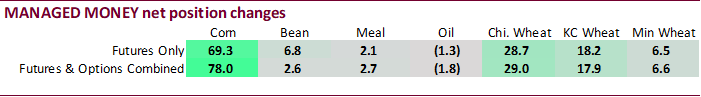

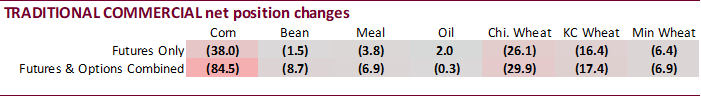

CFTC Commitment of Traders Report

· Chicago wheat, futures only position for traditional funds was a record net long 75,028 contracts as of 7/31, taking out 8/21/12.

· For the week ending July 31, traditional funds were buyers of corn, Chicago wheat, KC wheat and MN wheat. Futures only for soybeans traditional funds sold a little and bought a small amount in the futures and options positions.

· For managed money, funds were large buyers of corn, bought a good amount of Chicago wheat and added longs to KC wheat.

· Traditional funds were about 16k less long in corn that trade expectations, 22k more short in soybeans were the traditional funds posted a short position of 14,100, heavier buyers in Chicago wheat than anticipated and didn’t sell as much meal as the daily estimate of funds suggested.

· We estimate the funds futures only for traditional funds going home on Friday at net long 118k corn, net short 24k soybeans, net long 88k meal, net short 56k soybean oil, and net long 84k wheat.

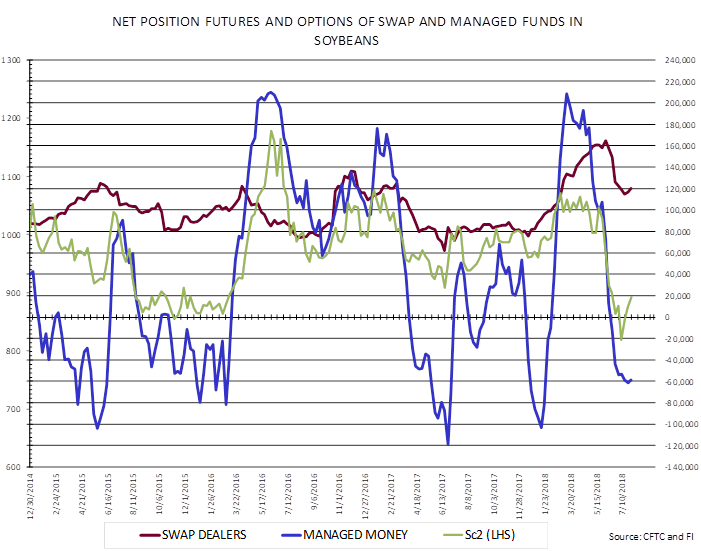

· Traditional funds futures only in soybean oil hold a near record short position. (55.1 short 8/1/13). For options combined the record short was hit three weeks ago. Managed money positions for soybean oil are also near record net short.

· Change In Nonfarm Payrolls (Jul): 157K (est 193K, prevR 248k)

– Unemployment Rate (Jul): (est 3.9%, prev 4.0%)

– Average Hourly Earnings (M/M) (Jul): 0.3% ( est 0.3%, prevR 0.1%)

– Average Hourly Earnings (Y/Y) (Jul): 2.7% (est 2.7%, prev 2.7%)

– Change In Private Payrolls (Jul): 170K (est 190K, prev 234K)

– Change In Manufacturing Payrolls (Jul): 37K (est 25K, prevR 33K)

– Average Weekly Hours All Employees (Jul): 34.5(est 34.5, prevR 34.6)

– Labor Force Participation Rate (Jul): 62.9% (prev 62.9%)

· US Trade Balance (Jun): $-46.3 (est -$46.5Bln, prevR -$43.2Bln)

· China To Levy Differentiated Tariffs On About $60Bln US Goods

· China Govt Says It Will Immediately Impose The Import Tax Measures If The U.S. Starts To Slap Tax On China Imports (livesquak)

· China Central Bank Says Raising Reserve Requirements For Forex Settlements In Order To Fend Off Financial Risks, Promote Stable Operations Of Financial Institutions

Corn.

- Corn prices were higher following soybeans and technical buying.

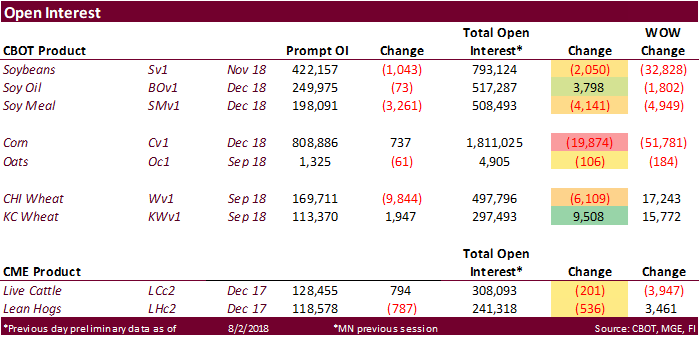

- The funds bought an estimated net 11,000 corn contracts.

· Farm Futures sees the 2018 US corn yield at 175.4 bushels per acre and production at 14.360 billion.

· Informa reportedly left their US corn yield at 176.0 bu/ac from their July outlook, and production also unchanged at 14.392 billion. USDA is at 14.230 billion bushels and 174.0/bu for the yield.

· FI is using 178.0 with 14.543 billion.

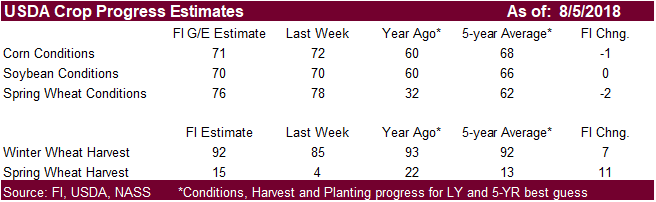

· US crop conditions are expected to decline one in corn.

· A Reuters report mentioned Mexico sees key NAFTA issues resolved with the US next week.

· French corn conditions for the week ending July 29 fell by 5 points from the previous week to 66 percent, below 79 percent at this time last year.

· Vietnam reported an outbreak of H5N6 bird flu in backyard birds.

· Under the 24-hour USDA export system, Vietnam bought 130,000 tons of 2018-19 corn-optional origin.

· China sold 856,885 tons of corn out of reserves at an average price of 1416 yuan per ton ($206.16/ton), 22 percent of total offered. Yesterday they sold 1.1 million tons.

· China sold about 59.4 million tons of corn out of reserves this season.

Soybean complex.

· Soybeans on Friday saw a choppy trade after China said they plan to levy additional tariffs on about $60 billion US products if the US adds more tariffs, so it’s subject to US actions they said.

· Soybeans settled higher after a wide two-sided trade. Soybean meal fell on additional talk Argentina will start exporting meal to China, and soybean oil was higher in part to a higher lead in palm oil. .

· China Gvt’s New Proposed Tariffs On U.S. Goods Include Soybean Oil, Peanut Oil, Corn Oil, Olive Oil, Mutton, Dried, Smoked And Salted Beef, Coffee, Wheat Flour, Spirits (ICE)

· Funds bought an estimated net 6,000 soybeans, sold 2,000 soybean meal and bought 3,000 soybean oil.

· Farm Futures sees the 2018 US soybean yield at 49.8 bushels per acre and production at 4.420 billion.

· Informa reportedly raised their US soybean yield to 50.0 bu/ac and production to 4.445 billion. In July we understand Informa used a 49.1 yield and 4.425 billion bushel crop. USDA is at 4.310 billion bushels and 48.5/bu for the yield.

· FI is using 49.0 with 4.353 billion.

· US crop conditions are expected to be unchanged in soybeans.

· Brazil shipped 1.37 million tons of soybeans last week, down from 1.95 million tons from a year ago. Commitments were thought to be running at 63.7 million tons.

· Safras reported Brazil’s new-crop soybean sales at 18 percent, up from the very slow pace of 8 percent a year ago. Even though producers are reluctant sellers, high Brazil soybean premiums over the US and good China demand enticed forward selling. For the current crop year, 84 percent of the soybean crop had been sold, up from 74 percent from this time last year.

· Yesterday we learned Argentina’s crushing industry was making a big push to get China to agree on importing soybean meal from Argentina crushers. Today the Argentina AgMin said they like to export “major amounts” of soybean meal to China starting May 2019. Apparently officials were in China today finalizing the paperwork. It will be interesting to see if Argentina continues to import US soybeans even after they realize a rebound in their crop. Meanwhile, a shift to China in export soybean meal as a destination raises the question how much of the EU market could be lost. Each Argentina cargo unshipped to the EU could be a an extra cargo shipped from the US.

· China approved the imports of sunflower seeds from Bulgaria.

- No fresh export developments for Friday.

- The CCC 9,000 tons of crude degummed soybean oil for Senegal and Guatemala, on August 8 for September shipment.

- South Korea seeks 12,000 tons of non-GMO soybeans in Aug 7 for Nov/Dec arrival.

- USDA seeks 2,160 tons of refined vegetable oil under the PL480 program on August 7 for shipment in September for Zimbabwe.

- Results awaited: Iran seeks 30,000 tons of soybean oil on August 1.

- Iran seeks 30,000 tons of sunflower oil on September 24.

· China sold 1.054 million tons of soybeans out of reserves so far, this season.

· US wheat futures settled mixed, with Chicago and KC lower on the front end and far back months moderately higher. MN ended higher for most positions on US spring wheat crop concerns.

· Funds sold an estimated net 5,000 SRW wheat contracts.

· We look for a 1-2 point drop in the US spring wheat rating.

· December Paris wheat futures settled 1.50 euros lower at 211.75 euros.

· Informa reportedly lowered their US all wheat crop to 1.825 billion from 1.869 billion last month. This included 1.168 billion bushels of winter wheat, 71 million bushels of durum wheat 586 million bushels of spring wheat. Informa estimated the average U.S. yield for spring wheat at 45.4 bushels per acre, down from its July forecast of 46.8. (Reuters)

· For the August US Crop Production report, we are using 47.5 and 613 million bushels for spring wheat, 41.7 and 77 million for durum, and 47.6 bu/ac and 1.884 billion for the all-wheat crop.

· Northern Europe weather conditions have not changed much.

· Britain’s wheat crop could fall to a five-year low according to AHDB (Agriculture and Horticulture Development Board) of 13.5 million tons, down from 14.8 million last year. Low yields are mainly contributing to the decline.

· India’s weather office noted there is a 47 percent chance of India recording below average rainfall during the second half of the monsoon season which stretches between June to September. The first two months of the season were below normal.

· Egypt said they have enough strategic wheat reserves for 4 months.

Export Developments.

· Jordan issued an import tender for 120,000 tons of feed barley on August 8.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on August 8 for arrival by January 31.

Rice/Other

· Iraq seeks 30,000 tons of rice on August 12, open until Aug 16.

soymeal hulls 13,275,000 14,865,000 12,332,000 13,986,000

of Commerce.

(*)NOTE: Year

TOTAL WHEAT 101,319,031 223,408,463 68,198,138 150,376,894

barley 2,651,387 5,846,308 9,461,222 20,861,995

oats 529,625 1,167,823 973,220 2,145,950

corn 38,696,049 85,324,788 32,647,078 71,986,807

other corn 17,282,479 38,107,866 8,632,822 19,035,373

TOTAL CORN 55,978,528 123,432,654 41,279,900 91,022,180

Write to Rodney Christian at csstat@dowjones.com

(END) Dow Jones Newswires

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.