From: Terry Reilly

Sent: Tuesday, August 07, 2018 3:34:10 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 08/07/18

PDF attached

·

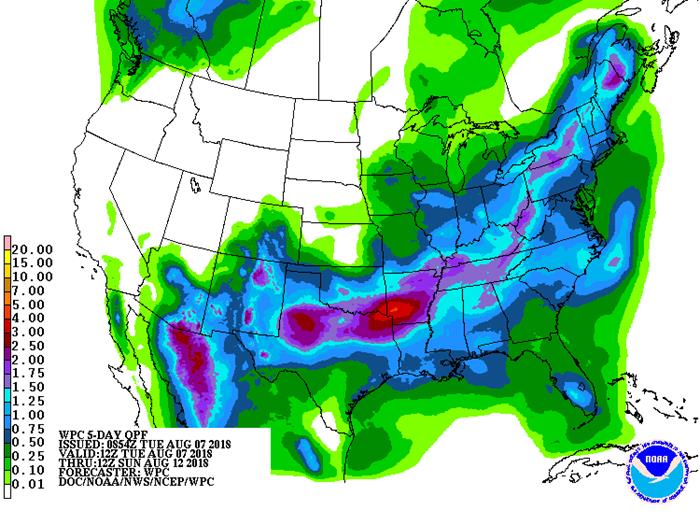

Rain continued to fall across IA and surrounding areas through Tuesday. Other areas saw increasing crop stress.

·

Note critical rain will fall through Tuesday across southern IA before a week of dry weather sets in. Next critical rain even will be during the August 15-17 period.

AREAS

OF GREATEST CHANGE OVERNIGHT

o

Texas cotton, sorghum and corn production areas from the Blacklands into West Texas are still advertised to receive significant rain in the coming week and World Weather, Inc. believes the forecast will verify to some degree

·

All cotton areas will be impacted

·

Rainfall of 0.25 to 0.75 and locally more will occur in the northwestern parts of West Texas while 1.00 to 2.00 inches results in most other areas with locally more possible

·

The situation needs to be closely monitored for changes

o

Eastern Australia’s forecast remains dry for the next ten days

o

Rain fell in some of northern China’s dry region overnight and more rain is expected there during the next two weeks

o

East-central China is expected to dry out significantly in the next week to ten days

·

The area includes southern Shandong, southern Henan and areas south through eastern Hubei, Anhui and Jiangsu to the lower Yangtze River Valley

·

These areas should become short to very short of topsoil moisture by the second half of next week, although subsoil moisture will be a little better

o

India’s monsoon is looking drier today

·

Rainfall was reduced from the forecast in much of the nation

·

Western and southern India have already been drying out for a while

·

Western and northern Rajasthan and northwestern Gujarat are already too dry along with unirrigated areas in Pakistan

·

Some showers are expected on a daily basis, but warm temperatures and the light intensity of resulting rainfall will lead to net drying

·

Indian Meteorological Department already suggests rainfall for the season to date in India has been 90% of normal and they consider anything less than 90% to be potentially problematic for some parts of the nation

·

El Nino is still expected to evolve later this year and dryness now may leave India’s western crop areas in a precarious situation that might threaten corn, sorghum, soybean, cotton, rice and peanut production

·

There is still plenty of time for improved weather, but the situation needs to be closely monitored

o

Canada’s Prairies are advertised drier in the second week of the outlook today

·

Most of the Prairies are still advertised to be hot in the latter half of this week with little to no rain

·

A cool front is expected this weekend and early next week that will restore more seasonable temperatures, but rainfall accompanying the frontal system will not be very great

·

Follow up rainfall is restricted, according to the latest model data

o

U.S. western Corn Belt weather may dry down gradually over the next ten days, but rain will fall in parts of Missouri and Neighboring areas today and early Wednesday

·

Southern and eastern Midwest crop areas expected to remain in good shape, but net drying is likely in the upper Midwest and in southern Iowa

o

Temperatures in the U.S. Midwest will be seasonably warm over the next couple of weeks

o

Brazil’s weather will be inclusive of mild temperatures and scattered showers during the next week to ten days from Center south into the far south

·

None of the rain will be great as that reported this past weekend

·

The moisture will continue good for wheat and sugarcane while mildly disruptive to Safrinha corn harvesting

·

Coffee trees are expected to flower in many areas from southern Zona de Mata through Sul de Minas to Parana as a result of weekend rainfall and that makes the need for follow up rain very high for successful pollination

o

A disturbance in the central Atlantic Ocean may acquire tropical characteristics this week, but the system is so far from land it will have a minimal impact.

o

Hurricane Hector should pass to the south of Hawaii in the Pacific Ocean later this week

o

Tropical Storm John and Tropical Storm Ileana will stay off the coast of Mexico restricting rain in crop areas.

o

Tropical Storm Kristy formed Monday in the eastern Pacific Ocean and was also expected to stay far from land

o

Europe is still expected to trend cooler over the balance of this week with two frontal systems expected

·

Temperatures will become more seasonable

·

Rain is expected to fall erratically, but between the two frontal systems many areas will get “some” rain

·

More will be needed to bring soil moisture closer to normal

·

Pockets of improved soil moisture are expected

·

Western Europe was still very warm to hot Monday and rainfall was minimal

REST

OF THE WORLD

o

U.S. rainfall overnight was greatest from Kansas and southeastern Nebraska through northern Missouri to parts of western Ohio and southern Michigan

·

Southern Iowa did not receive much rain of significance

·

Rain totals of 0.50 to 1.50 inches occurred in many areas, according to Doppler radar

·

Some lighter showers occurred in the upper Midwest and in the southeastern states

·

Most of Texas, Oklahoma and the Delta were dry along with the northwestern Plains and the far western United States

o

U.S. temperatures Monday were in seasonably in the northern Midwest and quite warm in the far western states and in the lower Midwest

·

Seasonably warm conditions occurred din much of the south

·

Many highs in the 90s occurred in the west and south while upper 70s and 80s occurred in the northern half of the Plains and northern Midwest

o

Today’s U.S. outlook favors net drying in the western Corn Belt after Wednesday morning

·

Scattered showers will impact the eastern Midwest periodically over the next ten days

·

Showers will continue frequent in the Delta and southeastern states

·

The Northern Plains and most of the far western states will stay dry during the next ten days

o

Canada’s Prairies will become excessively hot later this week with restricted rainfall for the next ten days

·

Stress to most crops and livestock are expected later this week and into the weekend, but “some” cooling is expected late in the weekend and next week that will bring “some” relief, but rainfall is not likely to be very significant

o

Southeastern Canada’s corn, soybean and wheat production areas will see a favorable mix of weather during the next two weeks.

o

Pakistan continues to suffer from excessive heat and dry weather

·

Highest temperatures during the weekend were in the range of 100 to 111 degrees Fahrenheit similar to that reported last week

·

Monsoonal rainfall has failed to reach southern Pakistan this year stressing some crops

·

Water supply in northern parts of the nation was already below average this year and limited summer rainfall and persistent heat has not helped the situation

·

Crop yields may be down, although irrigation has continued to be applied

o

Russia’s Southern Region, middle and lower Volga River Valley and central and eastern Ukraine will experience net drying over the next ten days

·

Temperatures will be warmer than usual, but not excessively hot

·

Highs in the 80s and 90s Fahrenheit are most likely

·

Net drying will raise crop moisture stress and return a more serious level of drought in southern portions of the described region

o

A favorable mix of rain and sunshine is likely in the western parts of Russia, Ukraine, Belarus and Baltic States during the next two weeks

·

Seasonably warm temperatures are expected

o

Northeastern and east-central Mexico crop areas will continue dealing with drought for at least the next ten days along with South Texas

·

Western and southern Mexico will receive periods of rain favoring most crop needs

·

Corn, sorghum, dry beans, sugarcane, and coffee in west and southern parts of the nation will either stay in good condition or see some improvement

·

Far southern parts of the nation had been drier biased in the most recent 30 days and a boost in rainfall is needed

o

Eastern Europe and western CIS weather will dry down for a while this week and then get some rain late in the week or during the weekend

·

A favorable mix of rain and sunshine this week will be good for many crops

·

The drier periods will be ideal for late season winter crop maturation and harvesting in western Russia, Belarus, the Baltic States and parts of western and northern Ukraine

·

The environment will also be good for early 2019 small grain planting that is under way in northern Russia now

·

Eastern Russia New Lands will be mild to cool and a little rainy during the coming week

·

Some drying is going to be needed later in August to support spring wheat maturation and harvest progress

·

Too much moisture might threaten sunseed and unharvested spring cereal quality

·

Mild to warm weather is expected west of the Ural Mountain region with the warmest weather expected during mid- to late-week

o

Xinjiang, China will experience warm temperatures and much less potential for rain through the end of this week

·

A new frontal system may reach the area next weekend bringing a new wave of the thunderstorms followed by brief cooling

·

A few strong thunderstorms and locally heavy rain will be possible

·

Temperatures will be plenty warm through Friday and then cooler during the weekend

·

Highs in the 90s to near 100 degrees Fahrenheit will occur through Friday and then cool to the 80s and lower 90s briefly

o

Southeast Canada corn, soybean and wheat conditions should be good in the coming week

·

A little too much rain has recently impacted some wheat production areas

·

Alternating periods of rain and sunshine are expected this week and some crop areas might benefit from a few more days of net dry

o

Argentina precipitation will be minimal until Tuesday when rain evolves briefly

·

Rain totals of 0.15 to 0.75 inch are expected with local amounts over 1.00 inch in southern Buenos Aires

·

Dry weather will occur early and late this week with more rain early to mid-week next week

·

Rain totals should be sufficient in key wheat production areas to maintain a good outlook for the start of spring growth

·

Cordoba and Santiago del Estero will not receive much rain of significance

·

Temperatures will be mild with a slight cooler than usual bias in the east and a warmer than usual bias in the west

Source:

World Weather INC

SIGNIFICANT

CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST

CORN BELT EAST CORN BELT

Tdy-Wed

85% cvg of 0.15-0.75”

and local amts over 2.0”

with lighter rain in a

few

areas; driest NW

Wed-Mon

5-20% daily cvg of up

to 0.30” and locally

more each day

Thu-Aug

14 20-40% daily cvg of

up

to 0.40” and locally

more each day

Aug

14-15 65% cvg of up to 0.70”

and

local amts to 1.40”

Aug

15-16 75% cvg of up to 0.60”

and local amts to 1.30”

Aug

16-17 5-20% daily cvg of up

to 0.30” and locally

more each day

Aug

17-18 5-20% daily cvg of up

to 0.30” and locally

more each day

Aug

18-20 70% cvg of up to 0.65”

and locally more

Aug

19-21 75% cvg of up to 0.65”

and locally more

U.S.

DELTA/SOUTHEAST SIGNIFICANT PRECIPITATION EVENTS

DELTA

SOUTHEAST

Tdy-Wed

70% cvg of 0.25-0.75”

and local amts to 1.70”

north with up to 0.30”

and locally more south

Wed-Fri

60% cvg of up to 0.75”

and local amts to 2.0”;

east Ga. and S.C. driest

Thu-Fri

75% cvg of up to 0.75”

and local amts to 1.50”;

driest north

Sat-Mon

20-40% daily cvg of 80% cvg of up to 0.75”

up to 0.50” and locally and local amts to 2.0”;

more

each day driest west

Aug

14-15 5-20% daily cvg of up 5-20% daily cvg of up

to 0.30” and locally to 0.30” and locally

more

each day more each day

Aug

16-18 65% cvg of up to 0.60” 75% cvg of up to 0.75”

and locally more and locally more

Aug

19-21 10-25% daily cvg of 10-25% daily cvg of

up to 0.30” and locally up to 0.30” and locally

more

each day more each day

Source:

World Weather INC and FI

Bloomberg

weekly agenda

TUESDAY,

AUG. 7:

- New

Zealand dairy auction on Global Dairy Trade online market starts ~7am ET (~noon London, ~11pm Wellington) - China

National Grain and Oils Information Center (CNGOIC) publishes forecast on country’s grains output

- EARNINGS:

Dean Foods, Mosaic

WEDNESDAY,

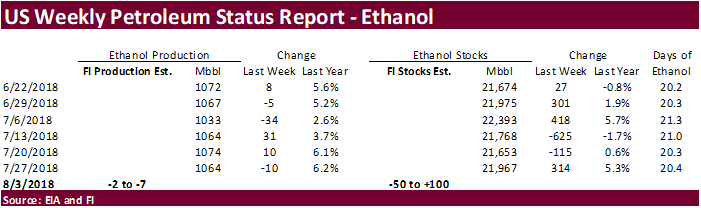

AUG. 8:

- China’s

General Administration of Customs releases preliminary agricultural commodity trade data for July, 11pm ET Tuesday (11am Beijing Wednesday) - EIA

U.S. weekly ethanol inventories, output, 10:30am - French

Agriculture Ministry publishes crop areas, production forecasts

THURSDAY,

AUG. 9:

- USDA

weekly net-export sales for corn, wheat, soy, cotton, 8:30am - Brazil’s

crop agency Conab updates its forecast on 2017-18 grain and oilseed crop, 8am ET (9am Sao Paulo)

- Strategie

Grains monthly report on European market outlook - Port

of Rouen data on French grain exports - Buenos

Aires Grain Exchange weekly crop report - Bloomberg

weekly survey of analysts’ expectations on grain, sugar prices - EARNINGS:

BayWa

FRIDAY,

AUG. 10:

- USDA’s

monthly World Agricultural Supply and Demand Estimates (WASDE) report for August, noon

- China’s

Ministry of Agriculture publishes China Agricultural Supply & Demand Estimates (CASDE) report

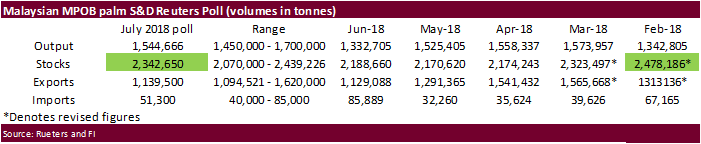

- Malaysian

Palm Oil Board (MPOB) releases data on palm oil stockpiles, exports, production as of end-July, 12:30am ET (12:30pm Kuala Lumpur)

- Cargo

surveyors Intertek, AmSpec release respective data on Malaysia’s Aug. 1-10 palm oil exports, 11pm ET Thursday (11am Kuala Lumpur Friday)

- SGS

data during same period, 3am ET Friday (3pm Kuala Lumpur Friday)

- SGS

- Unica’s

bi- weekly Brazil Center-South sugar output, 9am ET - FranceAgriMer

weekly updates on French crop conditions - ICE

Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - EARNINGS:

BRF

Source:

Bloomberg and FI

Bloomberg

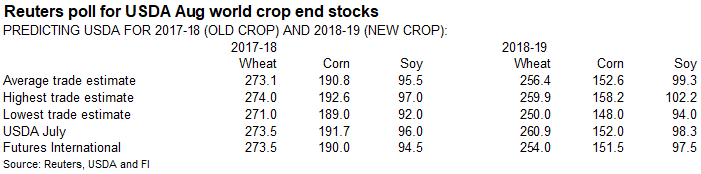

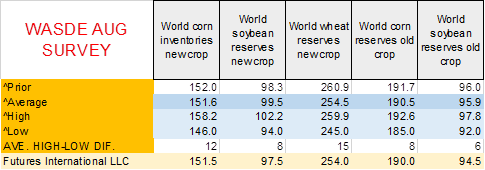

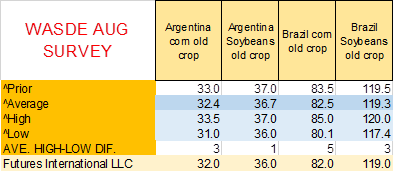

estimates for USDA August S&D and Crop Production

Source:

Bloomberg, USDA and FI

Corn.

-

Corn

futures ended 0.25-0.75 in the front months after wheat prices were unable to sustain early gains. Some said the lower trade was in part to showers forecast for dry areas of the US, but the weather forecast also calls for net drying for other areas that may

miss out on rain for at least a week. Limiting losses could have been the 24-hour reporting system sale of new-crop corn to unknown.

-

The

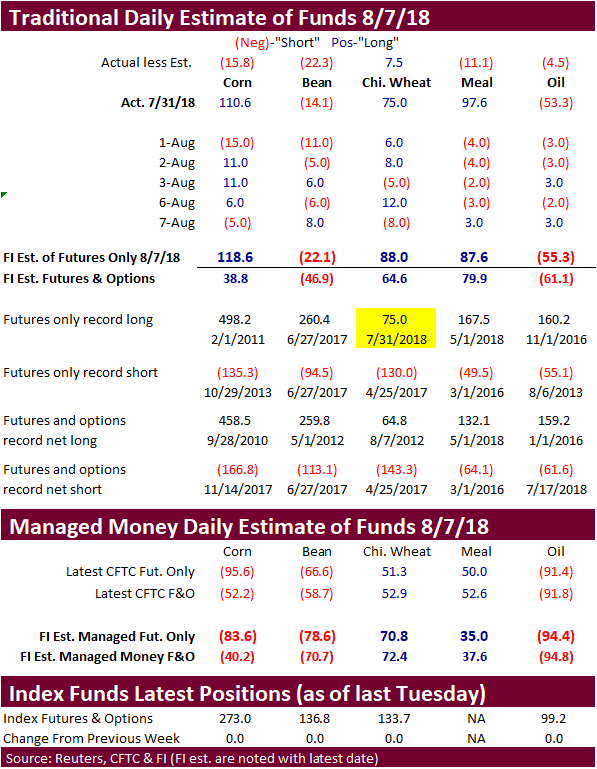

funds sold an estimated net 5,000 corn contracts. -

The

CBOT oats market traded lower after 5 days of gains. Recall US oats conditions in the G/E categories were unchanged on Monday.

·

A large grain company estimated Brazil corn exports could decline to 20 in 2018, lower side of many other projections, and 10 million below Brazil’s AgMin forecast earlier this year. If realized, USDA 2018-19

US corn exports could expand at least another 5 million tons from current forecast to 61.5MMT, or 200 million bushels to 2.425 billion.

-

Producers

are harvesting corn earlier than normal across northeast of France, eastern areas, in the far north and near the center of the country, according to Arvalis.

-

We

are hearing the corn crop in Ukraine may end up better than expected.

·

Morocco opened its door to US poultry imports.

·

Anthrax was discovered in a pig in Romania.

·

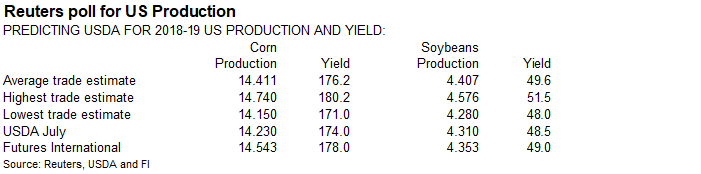

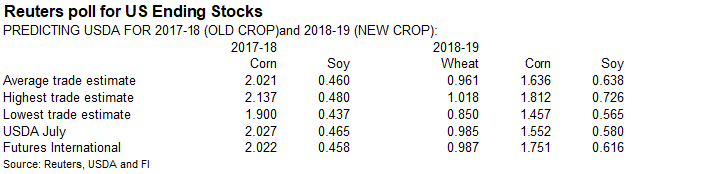

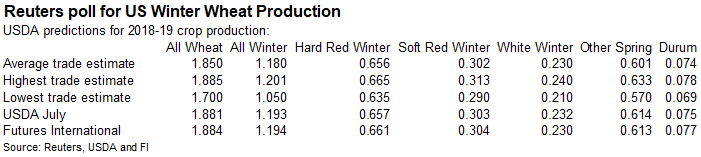

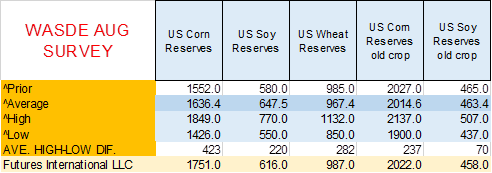

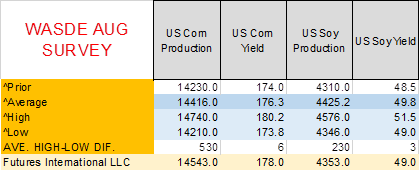

A Bloomberg poll calls for U.S. corn ending stocks to come in at about

1.636 billion bushels versus USDA’s estimate of 1.552 billion in July, and the corn yield to be initially surveyed by NASS at

176.3 bu/ac versus their working estimate of 174.0 bu/ac. FI is looking for 178.0 and stocks to increase 199 million to 1.751 billion.

·

The Bloomberg poll shows a US corn production low/high of 14.210-14.740 billion, or 530 million bushel spread, with an average of 14.416 billion, 186 million above USDA. FI is using 14.543 billion, 127 million

above the Bloomberg corn production average. If we are correct on our corn supply and ending stocks estimates for US corn, and are right on our soybean estimates, we look for soybean/corn spreading post USDA report on Friday.

-

USDA

reported the following under the 24-hour reporting system:

–Optional

origin sales of 179,000 metric tons of corn for delivery to unknown destinations during the 2018/2019 marketing year. An optional origin contract provides that the origin of the commodity may be the U.S. or one or more other exporting countries.

·

China sold about 59.4 million tons of corn out of reserves this season.

Soybean

complex.

-

The

soybean complex rallied on Tuesday after USDA showed a decline in the weekly US soybean crop rating. Net drying for the rest of this week into next week for some of the US soybean growing areas also is raising concern as the crop is in the critical pod setting

phase.

·

Funds bought an estimated net 8,000 soybeans, bought 3,000 soybean meal and bought 3,000 soybean oil.

·

USDA reported new-crop soybeans sold to unknown destinations.

·

Oil World in their weekly update suggested China may have to start importing soybeans again from the United States as SA will run out of supplies. 15 million tons during the Oct-Mar period was noted.

·

The CNGOIC lowered its outlook for 2018-19 China soybean imports to 94 million tons from 95 million, and sees 2017-18 imports at 95 million tons, also down 1MMT from previous. They see July-Sept. soybean arrivals

at 26MMT and noted Chinese soybean crushers are intentionally delaying inbound shipments as supplies of the oilseed from state reserves are ample. China 2018-19 soybean meal consumption est. at 74.48MMT. (Bloomberg)

·

Malaysian Palm Oil Council estimates the 2018 palm oil price at 2,410 ringgit/ton, down 9 percent from their January forecast. Prices seen stabilizing in 2,179-2,611 ringgit range. (Bloomberg)

·

The Malaysian Palm Oil Board lowered its 2018 palm oil production to 19.9MMT, 2.9% lower than their January prediction. Production in 2H seen at 11MMT vs 11.2MMT in 2H 2017. Below normal rainfall was noted.

·

USDA’s August Crop Production and S&D’s are due out on Friday.

·

A Bloomberg poll calls for U.S. soybean ending stocks to come in at about

648 million bushels versus USDA’s estimate of 580 million in July, and the soybean yield to be initially surveyed by NASS at

49.8 bu/ac versus their working estimate of 48.5 bu/ac. FI is looking for 49.0 yield and US ending stocks to increase to 616 million bushels. If we are correct, soybeans could be friendly after the release of the report on Friday.

·

The Bloomberg poll shows a US soybean production low/high of 4.346-4.576 billion, or 230 million bushel spread, with an average of 4.425 billion, 115 million above USDA July. FI is using 4.353 billion, 72

million below the average trade guess.

-

USDA

reported the following under the 24-hour reporting system:

–Export

sales of 145,000 metric tons of soybeans for delivery to unknown destinations during the 2018/2019 marketing year.

-

Egypt

seeks 30k SBO and 10k Sunflower oil for LH September. -

Results

awaited: South Korea seeks 12,000 tons of non-GMO soybeans in Aug 7 for Nov/Dec arrival.

-

Results

awaited: USDA seeks 2,160 tons of refined vegetable oil under the PL480 program on August 7 for shipment in September for Zimbabwe.

-

The

CCC seeks 9,000 tons of crude degummed soybean oil for Senegal and Guatemala, on August 8 for September shipment.

-

Results

awaited: Iran seeks 30,000 tons of soybean oil on August 1. -

Iran

seeks 30,000 tons of sunflower oil on September 24.

·

China sold 1.054 million tons of soybeans out of reserves so far, this season.

Traders

look for Malaysian palm oil stocks to hit a 5-month high. We expect a gradual draw over the next several months. MPOB Malaysian July S&D estimates by Reuters:

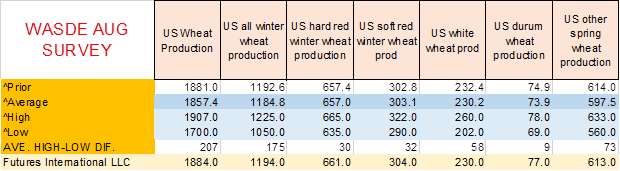

-

US

wheat futures opened mostly higher but selling eventually dragged contracts lower even after USDA reported a large decline in the US spring wheat crop rating. Profit taking was likely after contracts hit three-year highs.

·

Funds sold an estimated net 8,000 SRW wheat contracts.

·

Earlier the US wheat/corn ratio hit a three-year high and should continue to climb higher over the coming weeks.

·

Saudi Arabia said they will no longer buy wheat or barley from Canada amid a diplomatic dispute.

·

The French AgMin lowered its soft wheat estimate to 35.1 tons from 36.1MMT in July, and down 4% from 2017. Average yields are seen at 7.11 tons/ha versus 7.37 tons/ha in 2017. The durum crop is seen 13.4%

lower from 2017 to 1.84MMT.

·

Ukraine may propose limiting milling wheat exports to 8 million tons, down from 10 million tons set in 2017-18.

·

The CNGOIC estimated China could import 4 million tons of wheat in 2018-19, up about 315,000 tons from the previous season. China’s wheat production seen at 122.5 million tons in 2018, down 7.27MMT from 2017.

Export

Developments.

·

China sold 2983 tons of 2013 imported wheat at auction at an average price of 2370 yuan/ton ($347.01/ton), 0.2% of what was offered.

·

Thailand seeks 39,000 tons of feed wheat, optional origin, for September shipment.

·

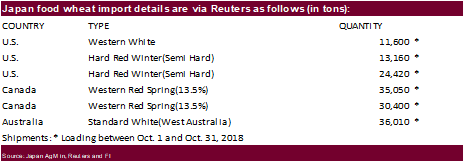

Japan seeks 150,640 tons of milling wheat on August 9.

·

Jordan issued an import tender for 120,000 tons of feed barley on August 8.

·

Jordan issued an import tender for 120,000 tons of hard milling wheat on August 9.

-

Japan

in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on August 8 for arrival by January 31.

Rice/Other

·

China sold 228,251 tons of rice out of auction at 2361 yuan per ton ($344.54/ton), 13 percent of what was offered.

·

Iraq seeks 30,000 tons of rice on August 12, open until Aug 16.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.