From: Terry Reilly

Sent: Wednesday, August 08, 2018 5:13:40 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 08/08/18

PDF attached

WORLD

WEATHER AREAS OF GREATEST INTEREST

Texas

cotton, sorghum and corn production areas from the Blacklands into West Texas are still advertised to receive significant rain in the coming week and World Weather, Inc. believes the forecast will verify to some degree

All

cotton areas will be impacted in the described region will be impacted

Rainfall

of 0.25 to 0.75 and locally more will occur in far northwestern parts of West Texas and in a part of the Panhandle while 1.00 to 3.00 inches results in most other areas in West Texas with locally more possible

The situation needs to be closely monitored for changes

Rolling

plains rainfall may occur in multiple inches resulting in substantial drought relief

Blacklands

rainfall may range from 1.00 to 3.00 inches with locally more

Eastern

Australia’s forecast remains drier biased for the next ten days

Some

rain may fall in New South Wales on days 9 or 10, but confidence is low and resulting rainfall is not likely to be very great

Other

Australia crop areas will remain in favorable condition

Rain

fell in some of northern China’s dry region again overnight and more rain is expected periodically during the next two weeks

Sufficient

relief should occur to reduce concern over the region, but some pockets of dryness will continue in Jilin and Liaoning

East-central

China is expected to dry out significantly in the next week to ten days

The

area includes southern Henan, Anhui and Jiangsu south through lower Yangtze River Valley

These areas should become short to very short of topsoil moisture by the second half of next week, although subsoil moisture will be a little better

India’s

monsoon is advertised to perform better in August 16-22

Western

and southern India have already been drying out for a while

Western and northern Rajasthan and northwestern Gujarat are already too dry along with unirrigated areas in Pakistan

Some

showers are expected on a daily basis, but warm temperatures and the light intensity of resulting rainfall will lead to net drying

Rainfall

will be concentrated on eastern parts of the nation during the coming week while net drying occurs in the west and south

Greater

rain in the second week of the outlook will bring some relief to parts of Gujarat, Rajasthan, western Madhya Pradesh and parts of Maharashtra

Canada’s

Prairies will continue to suffer from heat and dryness

Most

of the Prairies are still advertised to be hot in the latter half of this week with little to no rain

Extreme highs in the 80s and lower 90s Fahrenheit will occur in the north while 90s to 104 occur in the south

A

cool front is expected this weekend and early next week that will restore more seasonable temperatures, but rainfall accompanying the frontal system will not be very great

Some

cooling is expected Sunday into Tuesday and then warmer conditions will occur again later next week while rainfall remains minimal

Western

and northern Alberta is the only region that gets significant rain in the next week to ten days and that region is already favorably moist

U.S.

western Corn Belt will dry down over the next several days

Warm

temperatures and limited rainfall will lead to the net drying bias

Some

dryness relief is possible parts of Missouri, Kansas and southern Iowa during the middle to latter part of next week, but confidence is low

Southern

and eastern Midwest crop areas are expected to remain in good shape during the next ten days, but some net drying is possible in the northeast including Michigan

Rain

frequency will be greatest in the lower and eastern Midwest

Temperatures

in the U.S. Midwest will be seasonable warm over the next couple of weeks with a warmer than usual bias in the northwest

U.S.

rainfall overnight was lightly scattered across the Midwest with areas from southern Kansas and northern Oklahoma to the Ohio River Valley getting the most significant rainfall

Locally

heavy rain occurred in southeastern Missouri and southwestern Illinois, northeastern Illinois, southwestern Michigan and from eastern Kentucky into North Carolina where amounts of 1.00 to more than 2.00 inches resulted

U.S.

temperatures trended hotter in the northwestern Plains Tuesday and remained very warm to hot in the southern and western states

Northern

U.S. Plains will receive very little rain and experience periods of hot weather during the next ten days

Western

areas will be hottest with multiple days with extreme highs over 100 in Montana and western Dakotas

Brazil’s

weather will be inclusive of mild temperatures and scattered showers during the next week few days with warming this weekend and early next week followed by some additional mild conditions with a few more showers

None

of the rain will be great as that reported this past weekend

The

moisture will continue good for wheat and sugarcane while mildly disruptive to Safrinha corn harvesting

Coffee

trees are flowering in many areas from southern Zona de Mata through Sul de Minas to Parana as a result of weekend rainfall and that makes the need for follow up rain very high for successful pollination

Tropical

Storm Debby formed in the central Atlantic Ocean and will remain a minimal threat to land and shipping as it drifts over open water

Dissipation

is expected by Friday

Hurricane

Hector will pass to the south of Hawaii in the Pacific Ocean later this week

Hurricane

John will stay well off the west coast of Mexico restricting rain in crop areas.

Tropical

Storm Kristy is no threat to land in the eastern Pacific Ocean

Europe

is still expected to trend cooler over the balance of this week with two frontal systems expected during the coming week

Temperatures

will become more seasonable in the north and west

Rain

is expected to fall erratically, but between the two frontal systems many areas will get “some” rain

More will be needed to bring soil moisture closer to normal

Pockets of improved soil moisture are expected

Western

Europe was still very warm to hot Tuesday and rainfall was minimal

Southeastern

Europe will trend dry and warm to hot over the next ten days

The

area includes the Balkan Countries and Ukraine where steady drying and developing late season crop stress is expected to evolve

This will impact soybeans, sunseed and late season corn

SIGNIFICANT

CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST

CORN BELT EAST CORN BELT

Tdy

55% cvg of up to 0.30”

and local amts to 0.65”;

driest west

Tdy-Sun

5-20% daily cvg of up

to 0.30” and locally

more each day

Thu-Sat

20-40% daily cvg of

up

to 0.40” and locally

more each day

Sun-Mon

10-25% daily cvg of

up

to 0.25” and locally

more each day

Mon-Tue

25% cvg of up to 0.60”

and

local amts to 1.30”;

far south wettest

Tue-Aug

15 50% cvg of up to 0.60”

and

local amts to 1.30”;

wettest south

Aug

15-17 60% cvg of up to 0.70”

and

local amts to 1.40”;

far

NW driest

Aug

16-18 75% cvg of up to 0.75”

and local amts to 1.50”

Aug

18-20 5-20% daily cvg of up

to 0.30” and locally

more each day

Aug

19-21 10-25% daily cvg of

up

to 0.25” and locally

more each day

Aug

21-22 60% cvg of up to 0.65”

and locally more

Aug

22-23 65% cvg of up to 0.65”

and locally more

U.S.

DELTA/SOUTHEAST SIGNIFICANT PRECIPITATION EVENTS

DELTA

SOUTHEAST

Tdy

65% cvg of up to 0.50”

and local amts to 1.0”;

driest south

Tdy-Fri

50% cvg of up to 0.75”

and local amts to 2.0”;

east Ms. and Ala.

wettest

Thu-Fri

85% cvg of up to 0.75”

and local amts to 1.50”

Sat-Mon

80% cvg of up to 0.75”

and local amts to 2.0”;

driest west

Sat-Sun

20-40% daily cvg of

up

to 0.50” and locally

more

each day

Mon-Aug

16 5-20% daily cvg of up

to

0.25” and locally

more

each day

Tue-Aug

16 10-25% daily cvg of

up

to 0.30” and locally

more each day

Aug

17-20 10-25% daily cvg of 10-25% daily cvg of

up

to 0.35” and locally up to 0.35” and locally

more

each day more each day

Aug

21-22 5-20% daily cvg of up 5-20% daily cvg of up

to 0.30” and locally to 0.30” and locally

more

each day more each day

Source:

World Weather and FI

Bloomberg

weekly agenda

WEDNESDAY,

AUG. 8:

- China’s

General Administration of Customs releases preliminary agricultural commodity trade data for July, 11pm ET Tuesday (11am Beijing Wednesday) - EIA

U.S. weekly ethanol inventories, output, 10:30am - French

Agriculture Ministry publishes crop areas, production forecasts

THURSDAY,

AUG. 9:

- USDA

weekly net-export sales for corn, wheat, soy, cotton, 8:30am - Brazil’s

crop agency Conab updates its forecast on 2017-18 grain and oilseed crop, 8am ET (9am Sao Paulo)

- Strategie

Grains monthly report on European market outlook - Port

of Rouen data on French grain exports - Buenos

Aires Grain Exchange weekly crop report - Bloomberg

weekly survey of analysts’ expectations on grain, sugar prices - EARNINGS:

BayWa

FRIDAY,

AUG. 10:

- USDA’s

monthly World Agricultural Supply and Demand Estimates (WASDE) report for August, noon

- China’s

Ministry of Agriculture publishes China Agricultural Supply & Demand Estimates (CASDE) report

- Malaysian

Palm Oil Board (MPOB) releases data on palm oil stockpiles, exports, production as of end-July, 12:30am ET (12:30pm Kuala Lumpur)

- Cargo

surveyors Intertek, AmSpec release respective data on Malaysia’s Aug. 1-10 palm oil exports, 11pm ET Thursday (11am Kuala Lumpur Friday)

- SGS

data during same period, 3am ET Friday (3pm Kuala Lumpur Friday)

- SGS

- Unica’s

bi- weekly Brazil Center-South sugar output, 9am ET - FranceAgriMer

weekly updates on French crop conditions - ICE

Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - EARNINGS:

BRF

Source:

Bloomberg and FI

Bloomberg

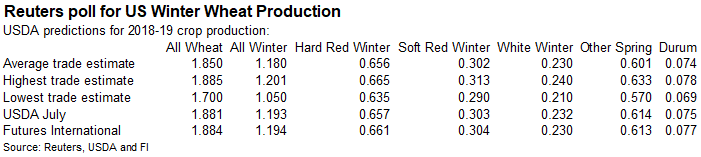

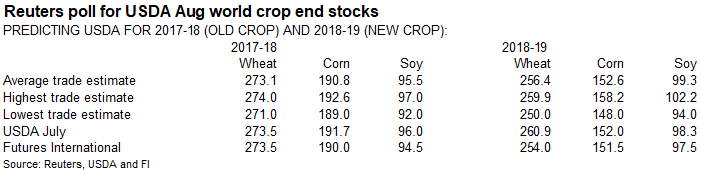

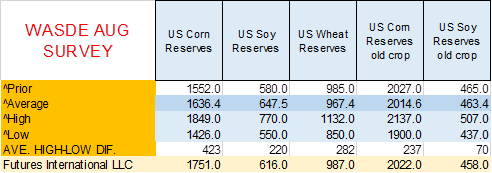

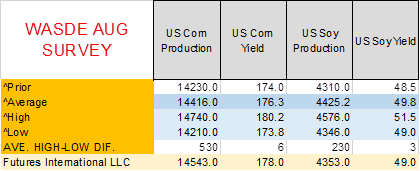

estimates for USDA August S&D and Crop Production

Source:

Bloomberg, USDA and FI

Corn.

·

Rising concerns over US corn crop conditions and near record US weekly ethanol production underpinned the market but prices ended only a half cent higher. A $2.00-$2.39 decline in US WTI crude oil limited

gains in corn. Over the short-term, we are neutral corn while bullish soybeans and wheat. Large US corn stocks and steady US exports are seen limiting upside potential for the market, but that view could change on Friday after USDA releases an update on US

and world S&D’s. If

we are correct on our US corn supply and ending stocks estimates for US corn, and are right on our soybean estimates, we look for soybean/corn spreading post USDA report on Friday.

·

September WTI crude oil was down $2.38/barrel to 66.78 on slowing China demand and higher than expected national stocks as indicated in the weekly EIA report. Note US crude oil is not included in the list

of products for the August 23 China import tariffs of $16 billion.

-

The

funds bought an estimated net 6,000 corn contracts. -

The

US WCB will trend drier over the next 10 days while much of the ECB will be wetter than normal.

-

Today

was day 2 of the Goldman Roll.

·

JBS is importing more corn from Argentina. Purchases now total 120,000 tons. Southern Brazilian end users found Argentina corn was about 5 percent less than corn coming out of Mato Grosso.

·

Argentina may not have any corn to offer after October.

·

A large grain company estimated Brazil corn exports could decline to 20 in 2018, lower side of many other projections, and 10 million below Brazil’s AgMin forecast earlier this year. If realized, USDA 2018-19

US corn exports could expand at least another 5 million tons from current forecast to 61.5MMT, or 200 million bushels to 2.425 billion.

·

Anthrax was discovered in a pig in Romania.

·

Note 5 days ago China’s AgMin issued a warning after African Swine Fever was detected in Shenyang, which led to the culling of about 1000 pigs.

·

The USDA Broiler report showed eggs set up 1 percent and chicks placed up slightly. Cumulative placements from the week ending January 6, 2018 through August 4, 2018 for the United States were 5.70 billion.

Cumulative placements were up 2 percent from the same period a year earlier.

·

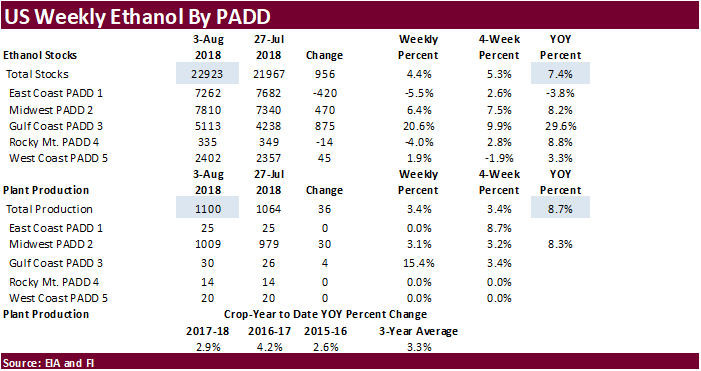

US ethanol production was up 36,000 barrels per day to 1.100 million barrels, second largest in our weekly history, behind 1.108 million for the week ending 12/1/17. Traders were looking for a slight increase.

·

US ethanol stocks increased 956,000 barrels to 22.923 million, highest since 3/16/18. Traders were looking for a small increase in stocks.

·

September 2017 through August 3, 2018 US ethanol production is running 2.9% above the same period a year ago.

·

We are using 5.635 billion bushels for corn for ethanol usage, above USDA’s 5.600 current estimate for 2017-18, and for 2018-19 we are at 5.750 billion, 125 million above USDA.

CME

lean hogs continuation

Source:

CME, Reuters and FI

·

Taiwan’s MFIG seeks 65,000 tons of optional origin corn on August 9 for shipment between October 21 and November 9, later if from the US PNW.

·

China sold about 59.4 million tons of corn out of reserves this season.

Soybean

complex.

-

The

soybean complex traded choppy Wednesday, with soybeans and meal ending higher and soybean oil lower. The lower trade in soybean oil could have been influenced by a large drop in US WTI crude oil. Soybean meal ended more than $4.00 higher, which support nearby

crush. Soybeans finished 4.50-5.00 cents higher. There is speculation China may have to take US soybeans to satisfy consumption. Meanwhile analysts are increasing their estimates for Chinese corn for feed demand as end users are adjusting formulas to make

up for a possible shortfall in Chinese soybean meal.

·

Funds bought an estimated net 3,000 soybeans, bought 5,000 soybean meal and sold 2,000 soybean oil.

·

USDA’s August US Crop Production and S&D’s are due out on Friday.

If

we are correct on our US ending stocks estimates for soybeans and corn, soybeans could be friendly after the release of the report and gain on corn.

·

Germany’s Farm Cooperatives estimated the German rapeseed crop at 3.47 million tons, down from 4.26MMT in 2017.

·

Hot temperatures and dry conditions in Canada are starting to threaten canola production prospects.

·

China’s soybean complex traded higher led by a 1.6% increase in soybeans and 1.2% increase in meal.

·

China customs data reported July China soybean imports declined to 8.01MMT from 8.70MMT in June and below 10MMT in July 2017.

·

China imported 52.88MMT of soybeans during the Jan-July period, 3.7 percent below 54.89MMT year ago. Some analysts look for Aug and Sep imports to total 8MMT each. (Reuters)

·

China bought 32.9 million tons from the United States in 2017, 34 percent of its total purchases. (Reuters)

·

China imports of vegetable oils in July were 506,000 tons, down 2.7 percent from the previous month but up 87.4 percent from a year ago. (Reuters)

·

Oil World in their weekly update suggested China may have to start importing soybeans again from the United States as SA will run out of supplies. 15 million tons during the Oct-Mar period was noted.

·

The July soybean import figures were viewed on the lower side by at least one analyst, and August China soybean imports could end up higher than 9 million tons due to delayed arrivals of soybeans in late July.

Time will tell. Brazil exports of soybeans on the other hand could slow in August and September to between 6.5-8.0MMT and 6.0-7.0MMT, respectively.

·

Low water levels in Argentina are starting to reduce the amount of commodities loaded onto ships.

·

India’s oilmeal exports in July increased 18.3 percent from a year earlier to 148,983 tons. July rapeseed meal exports were a large 46,364 tones while soymeal exports decreased 63,748 tons from 87,797 tons

in July 2017.

·

China sold 37,428 tons of 2013 soybeans at auction at an average price of 2983 yuan/ton ($436.88/ton), 12.5% of what was offered.

China

sold 1.091 million tons of soybeans out of reserves so far, this season.

·

China sold 25,755 tons of 2011 soybean oil at auction at an average price of 5,000 yuan/ton ($734.01/ton), 59.6% of what was offered.

·

China sold 600 tons of rapeseed oil at auction at an average price of 6,000 yuan/ton ($878.73/ton), 1% of what was offered.

-

Egypt

bought 21,500 tons of sunflower oil at $760.93/ton and 20,000 tons of soybean oil at $689.85/ton.

-

Iran

seeks 30,000 tons of sunflower oil on September 24. -

Results

awaited: South Korea seeks 12,000 tons of non-GMO soybeans in Aug 7 for Nov/Dec arrival.

-

Results

awaited: USDA seeks 2,160 tons of refined vegetable oil under the PL480 program on August 7 for shipment in September for Zimbabwe.

-

Results

awaited: Iran seeks 30,000 tons of soybean oil on August 1.

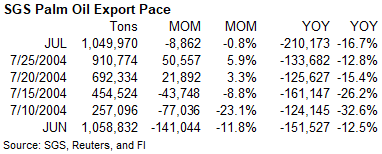

July

SGS palm exports were finally released

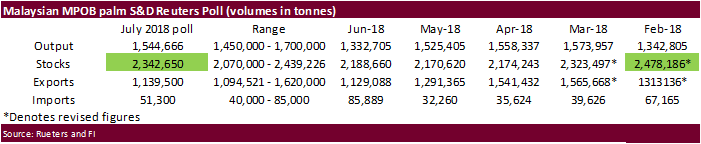

Traders

look for Malaysian palm oil stocks to hit a 5-month high. We expect a gradual draw over the next several months. MPOB Malaysian July S&D estimates by Reuters:

-

US

wheat futures ended higher after a mixed start. September

MN ended up for the 11th consecutive session.

·

Funds bought an estimated net 4,000 SRW wheat contracts.

·

The US wheat/corn ratio is trading at its highest level since December 2014.

·

Ukraine harvested 30.7 million tons of grain with an average yield of 3.43 tons/hectare.

·

Germany’s Farm Cooperatives estimated the German grain crop at 36.3 million tons, including 19.2 million tons of wheat, down from 45.5MMT and 24.0MMT, respectively, in 2017. The grain harvested would be the

lowest in 24 years, if realized.

·

German feed wheat end users have been busy buying the commodity from EU block members (Romania and Bulgaria) in the Black Sea region. At least 700,000 tons have been bought this summer. German end users have

also bought 500,000 tons of Argentina corn.

·

Reuters noted “feed wheat in Germany’s South Oldenburg market for September/December was offered for sale well over milling wheat at around 229 euros ($265) a ton, about 10 euros more expensive than milling

wheat.”

·

The weekly crop report for Manitoba, Canada, indicated dry conditions continued across much of the province, and crop stress is rising.

Export

Developments.

·

Thailand passed on 39,000 tons of feed wheat, optional origin, for September shipment. Offered were around $240/ton, $5-10 above what they wanted.

-

Japan

in a SBS import tender bought 2,900 tons of feed wheat and 200 tons of barley for arrival by January 31.

-

Japan

in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on August 22 for arrival by January 31.

·

Results awaited: Jordan issued an import tender for 120,000 tons of feed barley on August 8.

·

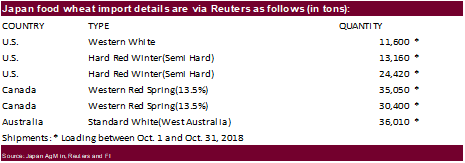

Japan seeks 150,640 tons of milling wheat on August 9.

·

Jordan issued an import tender for 120,000 tons of hard milling wheat on August 9.

Rice/Other

·

Iraq seeks 30,000 tons of rice on August 12, open until Aug 16.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.